On this page Skip this page navigation

- Introduction

- Open for Business, Open for Jobs

- Driving Prosperity: The Future of Ontario’s Automotive Sector

- Supporting Small and Medium-Sized Enterprises

- Building an Innovative and Sustainable Postsecondary Sector

- Building a Skilled Workforce

- Reducing Trade Barriers and Protecting Jobs

- Lowering Electricity Bills for Businesses

- Supporting Northern and Rural Communities

- Partnering With Farmers and Agricultural Communities

- Strengthening Ontario Tourism, Culture and Sport

- Creating Confidence in Capital Markets and Financial Services

- Reducing Red Tape in the Pension Sector

Introduction

Ontario is fortunate to rely on a number of powerful strengths that allow it to succeed in a competitive world. The province has a skilled and educated workforce, a diversified economy, abundant natural resources, strong institutions and a privileged location at the crossroads of global and continental trade. Yet, even with these strengths, a 15-year legacy of economic mismanagement from the previous government has left Ontario punching below its weight in the Canadian federation, trailing the national average in real GDP growth over most of the last 16 years. The province’s traditional position as the economic engine of Canada has been eroding due to the high cost of doing business in Ontario, excessive red tape and regulatory burdens, and past governments that did not respect the critical role played by the private sector in the economy. At the same time, the provincial economy is facing increased competition due to U.S. federal tax reform, as well as challenges posed by U.S. protectionism related to the steel, aluminum and softwood lumber sectors and “Buy America” policies. In addition, the federal carbon tax is expected to negatively impact Ontario’s businesses through higher costs.

Ontario’s Government for the People has moved quickly to address challenges to the provincial economy. Swift government actions already taken to reduce costs for businesses will put $5 billion back into the hands of job creators in 2019. As well, the government has taken critical steps to create a pro-jobs environment, whether through efforts to increase the number of skilled workers, or the reduction of red tape and regulatory burdens that used to stand between employers and potential employees.

As a result of government actions taken to date, the provincial economy is on the right track:

- A total of 132,000 net new jobs have been created in the province between June 2018 and February 2019;

- The unemployment rate has declined by 0.2 percentage points, from 5.9 per cent in June 2018 to 5.7 per cent in February 2019; and

- In February 2019, the Ontario Chamber of Commerce (OCC) reported that the proportion of businesses experiencing confidence in the broader economy is up by seven percentage points compared to last year, and the share of businesses lacking confidence in the economy declined by 21 percentage points.

Even with these early successes, much more work remains to overcome the recent years of inaction and indifference. To capitalize on the recent momentum in the economy, the Province is launching the Open for Business, Open for Jobs Strategy. This strategy will build on government actions to date, connecting more workers to good local jobs while encouraging increased job creation, investment and trade.

Open for Business, Open for Jobs

Lowering the Burden on Job Creation

Ontario’s Government for the People has already taken a number of actions to reduce costs for businesses, creating an environment where existing businesses can hire more workers and new businesses can support job creation. These actions include:

- Cancelling the cap-and-trade carbon tax;

- Keeping the minimum wage at $14 per hour;

- Reduced Workplace Safety and Insurance Board (WSIB) premiums;

- Delivering early on the government’s commitment to cut corporate income taxes through the Ontario Job Creation Investment Incentive; and

- Helping small businesses by not paralleling the federal government in phasing out the benefit from the lower small business Corporate Income Tax rate.

Collectively these initiatives are estimated to save Ontario businesses $5 billion in 2019.

Cutting Taxes for Businesses: the Ontario Job Creation Investment Incentive

To compete for business investment and the resulting jobs, Ontario must have a tax system that is internationally competitive. The Province has enhanced Ontario’s tax competitiveness by fulfilling its commitment to cut income taxes for businesses and has done so earlier than promised. The government is providing $3.8 billion in Ontario income tax relief over six years through the Ontario Job Creation Investment Incentive, which parallels capital cost allowance enhancements announced in the federal government’s Fall Economic Statement 2018. By providing faster writeoffs of capital investments, this incentive will encourage businesses to invest in Ontario now and create jobs for the people of Ontario. It is estimated that the Ontario Job Creation Investment Incentive will create between 50,000 and 93,000 net new jobs, and between $7 billion and $10 billion in net new business investment.1

Ontario’s tax advantage over the United States was greatly reduced as a result of U.S. federal tax reform, which included lowering the federal corporate income tax rate from 35 per cent to 21 per cent and allowing businesses to immediately writeoff the full cost of certain depreciable assets.

The Ontario government heard from the business community that U.S. tax reform could negatively affect the province by shifting investment and jobs to the United States. In September 2018, Ontario’s Minister of Finance and Minister of Economic Development, Job Creation and Trade wrote to the federal government to strongly encourage consideration of measures, such as an immediate writeoff of depreciable assets similar to that in the United States.

The federal government’s Fall Economic Statement 2018 announced measures that the Province is paralleling through the Ontario Job Creation Investment Incentive. These measures provide an immediate writeoff for manufacturing and processing machinery and equipment and clean energy equipment, and an Accelerated Investment Incentive for most other assets.

The Ontario Job Creation Investment Incentive lowers Ontario’s average marginal effective tax rate (METR)2 from 16.0 per cent in 2018 to 12.6 per cent in 2019. This reduction in the METR will help Ontario compete for business investment and jobs in the wake of U.S. tax reform. The U.S. average METR has fallen from 29.8 per cent in 2017 to 18.7 per cent in 2019.

By providing faster writeoffs for business investments, the Ontario Job Creation Investment Incentive delivers greater tax savings to Ontario businesses in the first year an asset is put into use.

Chart 1.24 shows that, as a result of this incentive, a company that invests $1 million in manufacturing machinery could save $187,500 in combined federal and Ontario Corporate Income Tax in the first year, while a company that invests $1 million in data network equipment could save $79,500 in combined federal and Ontario Corporate Income Tax in the first year.

For more information, see the Annex: Details of Tax Measures.

content

Lowering Business Costs

The Ontario government’s vision for the economy includes supporting job creation by lowering business costs and making Ontario more competitive. Actions taken to keep the minimum wage at $14 per hour will provide Ontario businesses with direct savings, which they can invest in growing their businesses.

The Making Ontario Open for Business Act, 2018 repealed a scheduled increase in the minimum wage to $15 per hour. Future minimum wage increases will be based on inflation, starting in October 2020. This will lower employer costs by an estimated $1.4 billion in 2019 while preserving the previous minimum wage increase at $14.

Minimum wages are at the highest they have ever been in Ontario after accounting for inflation.3 In 2018, when the minimum wage was increased significantly, Ontario restaurant meal prices increased by 6.5 per cent and part-time employment decreased by 15,900 compared to the previous year. Maintaining the minimum wage at $14 per hour is a balanced approach that will give businesses time to adjust. It will encourage job creation and protect existing jobs and incomes.

Lowering WSIB Premiums

In 2019, the Workplace Safety and Insurance Board (WSIB) premium rates declined from an average of $2.35 on every $100 of insurable payroll to $1.65, effective January 1. This reduction represents a 29.8 per cent cut to the WSIB’s average premium rate and comes after eliminating a long‑standing unfunded liability. It will support Ontario’s competitiveness by delivering cost savings to employers estimated at $1.45 billion in 2019.

Combined with a new WSIB premium rate framework in 2020, this will help safeguard Ontario’s workplace health and safety system, ensuring that it remains accountable, sustainable and able to meet its obligations.

As announced in the 2018 Ontario Economic Outlook and Fiscal Review, Ontario’s Government for the People is conducting an operational review of the WSIB pertaining to the board’s financial oversight, effectiveness and efficiency. Ontario’s workers and their families deserve certainty that the WSIB is being operated effectively, today and for the future. Ontario’s businesses deserve certainty that premiums are being managed prudently.

The review of the WSIB will provide the government with insights regarding the WSIB’s operations and how it compares to best practice. The operational review will focus on the following:

- Financial Oversight: sustainability of the insurance fund and controls;

- Administration: effectiveness of the current WSIB governance and executive management structure; and

- Efficiency: the cost-efficiency and effectiveness of operations, including comparisons with those of competing jurisdictions and private sector insurers.

The review will support the work of the task force reviewing all Provincial agencies. See Chapter 1, Section A: Restoring Fiscal Balance in a Responsible and Sustainable Manner for more details. The review is expected to be delivered to the Minister of Labour by the end of 2019.

Reducing Costs in the Manufacturing Sector

Ontario’s manufacturing sector is a significant contributor to the economy, providing over 760,000 direct jobs and $91 billion in GDP – accounting for 45 per cent of the total Canadian manufacturing sector. However, the sector is not as strong as it once was.

Ontario’s uncompetitive cost structure has been a major factor in the erosion of its industrial base, with over 300,000 manufacturing jobs lost since 2003. The government is working to reverse this erosion by making business costs competitive with those states in the U.S. that are Ontario’s chief competitors for investment. As a result of the government’s initiatives to date, the manufacturing sector is set to realize $1 billion in savings in 2019.

Reducing the Regulatory Burden

Reducing Red Tape

Unnecessarily costly and often outdated regulations are a key driver of Ontario’s high business costs. In October 2018, the University of Toronto’s Munk School of Global Affairs and Public Policy reported that, in 2017, it cost nearly $33,000 per business in Ontario to comply with regulations — the highest of any province. Businesses have also indicated that regulatory costs and delays in Ontario are far worse than what they encounter in the United States, driving investment and job creation south of the border. The government is eliminating red tape and burdensome regulations so that businesses can grow and create good jobs.

In the 2018 Ontario Economic Outlook and Fiscal Review, the Province announced its Open for Business Action Plan. As part of its Plan, the Province set a target to reduce regulatory barriers to business growth by 25 per cent by 2022. The government is moving up the timeframe to achieve this target to 2020 to deliver the competitive advantages of regulatory reduction to businesses sooner. Once fully implemented, these changes are expected to provide Ontario businesses with over $400 million in ongoing savings on their compliance costs. The government will continue its comprehensive review of regulations with a focus on streamlining and eliminating unnecessarily complicated, outdated and duplicative regulations affecting businesses. As part of the review process, the Province will introduce one signature burden reduction bill each fall and spring throughout its mandate as well as multiple other high-impact bills throughout the year that reduce red tape. Last fall, the government introduced two high-impact burden reduction bills.

The government’s actions to reduce red tape have already been recognized as supporting business growth and competitiveness. In January 2019, Premier Ford became Ontario’s first Premier to receive the Golden Scissors Award4 from the Canadian Federation of Independent Business (CFIB). Ontario’s Government for the People was awarded an A- grade by the CFIB, improved from C+ last year. This is a direct result of the significant action it has taken to cut red tape and reduce barriers to business growth.

Restoring Ontario’s Competitiveness

The Legislature recently passed the Restoring Ontario’s Competitiveness Act, 2019. The Act contains over 30 actions to reduce the regulatory burden on businesses by cutting costs, harmonizing regulatory requirements with other jurisdictions, ending duplication and reducing barriers to investment. Examples include:

- Exempting the auto sector from guardrail requirements for vehicle conveyors to more closely align with regulations in U.S. jurisdictions;

- Allowing electronic documentation for International Registration Plans, making it easier for commercial truck drivers to confirm their credentials and to reduce paperwork; and

- Simplifying and updating rules for engineers operating boiler and pressure vessel plants by enabling the government to approve updated and more efficient rules for businesses while protecting public safety.

Amending Employment Regulations to Support Job Creation

The government’s plan for the people eases the burden of regulation on businesses to stimulate job creation and create a pro-growth environment. The Making Ontario Open for Business Act, 2018 removed many labour regulations that were of concern to businesses. This, and other regulation reduction measures, will lower costs and the administrative burden for employers, protect jobs and help ensure Ontario is open for business and open for jobs.

Ontario’s Open for Jobs Blueprint

Modernizing Business Support Programs

In the 2018 Ontario Economic Outlook and Fiscal Review: A Plan for the People, the government committed to undertaking a review of all business support programs to determine their effectiveness, value for money and sustainability. The review was completed and it found that Ontario’s business support programs were not aligned with the priorities of the government, were fragmented across multiple ministries, and lacked sufficient evidence to measure their value, efficiency or effectiveness of programs, thereby seriously limiting the understanding of the return on investment made by taxpayers. The review reinforced the findings from the Auditor General of Ontario, the Financial Accountability Officer, as well as others — these programs were not accountable, transparent, nor an effective use of taxpayer dollars, and did not deliver clear economic outcomes.

Based on the recommendations of the review, the government is introducing the Open for Jobs Blueprint, a plan that will modernize Ontario’s business support programs and make sure that they help create good jobs and grow the economy. The Blueprint for programs is built on four key principles:

- Accessible: programs will be user-friendly and more readily available to make applying for them easier;

- Fiscally Responsible: programs will use competitive rounds and fiscally sustainable tools, with only projects that demonstrate the most value to taxpayers receiving support;

- Coordinated and Scalable: programs will reduce duplication across ministries and ensure that they respond to the needs of business; and,

- Effective: programs will be measured on impact and if they are delivering on their objectives.

Going forward, business support programs will be focused on four economic priorities: talent; research and commercialization; entrepreneurship and growth; and investment attraction. To ensure that no business is excluded from accessing these supports based on their industry or location, each program will include regional, sectoral and transparency lenses. This will ensure that investment proposals are assessed on their ability to address challenges and leverage the opportunities specific to industries and regions, and to ensure that prosperity and growth are spread equitably and transparently.

Details on the first business support program developed using the Open for Jobs Blueprint’s principles will be announced later in fall 2019.

As announced in the 2018 Ontario Economic Outlook and Fiscal Review, the Province is reviewing support provided for research and development (R&D) to ensure that it is effective and efficient. In the coming months, the government will consult with businesses and develop a plan that ensures Ontario entrepreneurs have improved access to the Province’s R&D support.

As part of this review, the Province will examine the Ontario Innovation Tax Credit (OITC), which is an eight per cent tax credit on R&D expenditures for small and medium-sized companies, as well as other R&D tax incentives. Companies that claim the OITC may also receive the 3.5 per cent Ontario Research and Development Tax Credit (ORDTC) and an enhanced 35 per cent federal scientific research and experimental development (SR&ED) investment tax credit for the same expenditures.

The review will consider the appropriate level of R&D tax support for business, taking into account research findings on the cost and benefits of R&D tax credits.5

Exploring Ways to Support Regional Economic Development

Regional imbalances in economic performance persist, with some Ontario regions continuing to experience weaker economic growth than others. The government’s Open for Business, Open for Jobs Strategy will help create an environment that supports economic development and job creation across all areas of the province.

All regions of Ontario experienced employment growth in 2018. Yet, despite these gains, employment levels in Southwestern and Eastern Ontario have remained relatively flat for the past decade. As well, employment in Northern and Southwestern Ontario has yet to reach its pre-recessionary levels. At the same time, the Greater Toronto Area (GTA) has accounted for more than two-thirds of net new jobs between 2003 and 2018, even though it only accounted for an average of 46 per cent of Ontario’s population during the same time period. Also, according to a February 2019 report from The Mowat Centre, sharp declines in employment income have occurred in some cities in Southwestern Ontario and in an arc surrounding the GTA, mainly due to the loss of manufacturing jobs in these areas.6

The range of current regional business support programs are not widely known to businesses. Furthermore, they provide support to a limited number of companies and are sometimes burdensome to access. To provide support more broadly and effectively, the Province is exploring options to improve regional supports, including options available through the tax system. In addition, to ensure that there are opportunities for jobs in all parts of the province, the government is reviewing its current grant programs that support regional economic development.

Supporting Entrepreneurial Businesses through Procurement Reform

Ontario has some of the best innovators and entrepreneurs in the world. But many of these high‑growth, high-potential businesses find it difficult to compete for government contracts. Ontario will explore opportunities to dedicate a portion of ministries’ research and development (R&D) funding to Ontario entrepreneurs so that they can find innovative solutions for technological problems facing the government. The Province will be holding consultations in the coming months to develop a plan that puts Ontario’s R&D dollars to best use.

Expanding the Scope of the Francophone Community Grants Program

To support the government’s efforts to make Ontario open for business, the Province is expanding the scope of the Francophone Community Grants Program to include a focus on economic development opportunities within the Francophone community as well as profiling the role of businesses and entrepreneurs for local and regional economies.

The Program will continue to support community-based projects and, in addition, will provide funding to Francophone businesses, entrepreneurs and relevant not-for-profit organizations to support initiatives that promote the economic and cultural growth of the Francophone community.

Driving Prosperity: The Future of Ontario’s Automotive Sector

The auto sector is a cornerstone of Ontario’s economy that supports hundreds of thousands of direct and spin-off jobs in communities across the province. But since 2003, Ontario has lost more than 300,000 manufacturing jobs, many of which were in the auto sector. Furthermore, vehicle production in the province has fallen by nearly 30 per cent since 2000, and now General Motors (GM) is closing its assembly plant in Oshawa.

The government is helping the auto industry grow and create good jobs. Driving Prosperity is the government’s plan to create the conditions by which the auto sector can thrive and grow in Ontario. The 10-year plan sets out a vision for how industry, the research and education sector and all three levels of government can work together to strengthen the sector’s competitiveness. The plan includes a commitment of more than $40 million over the next three years to strengthen the competitiveness and innovation of the sector.

Driving Prosperity is designed to enhance Ontario’s North American leadership in automotive assembly and parts production, and position the province to be a leader in the development, commercialization and adoption of advanced manufacturing and mobility technologies. This includes leadership for new innovations, such as hydrogen fuel cell technologies. The province’s unique convergence of automotive manufacturing and information and communications technology (ICT) expertise gives it a major advantage in designing and building the next generation of vehicles. Driving Prosperity is supported by three strategic pillars.

Work to support the auto sector is already well underway. The government is creating a competitive business climate for the auto sector by cancelling the cap-and-trade carbon tax, removing onerous provisions of Bill 148, the Fair Workplaces, Better Jobs Act, 2017, reviewing electricity prices, reducing taxes, and reducing unnecessary and costly regulatory burden. The government has also advocated strongly for the removal of tariffs on steel and aluminum — key inputs for the auto sector. Allowing on-the-road testing of autonomous vehicles and implementing the Broadband and Cellular Strategy are supporting innovation in the sector. To ensure that industry has access to the skilled workforce it needs, the government is modernizing the skilled trades and apprenticeship system, and enhancing the pipeline of science, technology, engineering and mathematics (STEM) graduates.

Driving Prosperity will help safeguard jobs and provide support for workers affected by plant closures. When GM announced that it will be closing its Oshawa assembly plant by the end of 2019, Premier Ford authorized Employment Ontario to deploy its Rapid Re-employment and Training Services program to help workers regain employment as quickly as possible. Also, one of the strategy’s immediate actions is to introduce the micro-credentials pilot, which will provide the unemployed and at-risk workers with skills and credentials recognized by employers.

Phase 2, which will be released later this year, will build on the work of Phase 1 and address longer term challenges and opportunities facing the sector.

Supporting Small and Medium-Sized Enterprises

Standing up for small and medium-sized enterprises (SMEs) is a key priority for the government. There are more than 470,000 SMEs in communities across the province employing about one-third of Ontario workers. They are the backbone of communities, providing good jobs for families, which is why the government is committed to their success and growth. The government’s efforts to cut red tape and lower business costs are already supporting these businesses and will continue.

For example, the government offers one-stop services for investors looking to establish or expand their businesses in Ontario. These services include providing information on business opportunities and market insights, offering client-centric solutions and advisory services, and facilitating business linkages and professional connections. These services can be found at www.investinontario.com.

The Province provides the Ontario small business deduction, which reduces Ontario’s general Corporate Income Tax (CIT) rate from 11.5 per cent to 3.5 per cent on eligible small business income. Ontario is helping small businesses by not proceeding with the previous Ontario government’s announcement that would have phased out the benefit of the lower small business tax rate for companies earning over $50,000 of passive investment income in a tax year. This would have increased Ontario Corporate Income Taxes by up to $40,000 per year for about 7,900 of Ontario’s small businesses.

The government remains committed to cutting the small business corporate income tax rate by 8.7 per cent.

Lowering Business Costs — Illustrative Examples

Helping Small Businesses Grow — Illustrative Savings for a Small Restaurant

The government is continuing to deliver immediate savings to small businesses in Ontario and helping them grow and create jobs.

To illustrate the impact, consider the example of a small restaurant owner, Raj, who employs seven staff, including four students making minimum wage. The government’s cancellation of the punishing cap-and-trade carbon tax and the WSIB reduction in premiums will save Raj’s business $855 this year; keeping the minimum wage at $14 per hour saves his business an additional $5,750.

With the new Ontario Job Creation Investment Incentive and the federal government’s accelerated writeoff measures, Raj will save an additional $1,715 and have a total net savings of $8,115 in 2019, even after accounting for the punishing federally imposed carbon tax and the Canada Pension Plan (CPP) contribution increase. This is money Raj can reinvest to grow his business, buy more supplies and hire more people.

Chart 1.28 illustrates the combined small business relief from the Ontario Job Creation Investment Incentive and the federal government’s accelerated writeoff measures, the cancellation of the cap‑and-trade carbon tax, the holding of the minimum wage at $14 per hour, the reduction of WSIB premiums and the federal reduction of Employment Insurance (EI) premiums. The chart also illustrates the negative impact of the federal carbon tax and the CPP contribution increase on Raj’s restaurant.

Boosting Ontario Manufacturing — Illustrative Savings for a Manufacturer

The government is working to make Ontario a leading destination for investment and job creation, and ensuring those job opportunities can be shared across every region of this province.

To illustrate the impact, imagine a company called Prosperity Auto Parts Manufacturing (Prosperity), which employs 210 staff, including 24 employees making minimum wage. Cancelling the previous government’s punishing cap-and-trade carbon tax saves Prosperity about $10,000 this year, while holding the minimum wage to $14 per hour saves the company $39,325. The reduction in WSIB premiums also saves Prosperity over $57,000.

The government’s new Ontario Job Creation Investment Incentive combined with the federal government’s accelerated writeoff measures save Prosperity an additional $173,750. Total net savings in 2019 are $264,700, even after the federally imposed carbon tax and the CPP contribution increase. This is money that Prosperity can reinvest in its business to buy new machinery and hire more people.

Chart 1.29 illustrates the combined business relief from the new Ontario Job Creation Investment Incentive and the federal government’s accelerated writeoff measures, the cancellation of the cap and-trade carbon tax, the keeping of the minimum wage at $14 an hour, the reduced WSIB premiums, and the federal reduction of EI premiums. The chart also illustrates the negative impact of the federally imposed carbon tax and the CPP contribution increase on businesses.

Building an Innovative and Sustainable Postsecondary Sector

Making Tuition More Affordable

Making postsecondary education more affordable is part of the government’s plan to ensure that people have the training and skills they need to get good paying jobs. Recognizing that students in Ontario currently pay the highest average undergraduate tuition fees in Canada,7 the government is lowering tuition rates by 10 per cent starting in the 2019–20 school year for every funding eligible student enrolled in a publicly funded college or university in the province. The new tuition framework will also freeze tuition fees for the 2020–21 school year.

The government’s historic tuition reduction, representing Ontario’s first decrease in student tuition across all funding-eligible programs, will provide students and families in Ontario with roughly $450 million in tuition relief. Students enrolled in a college program will see an average tuition reduction of approximately $340, and students enrolled in an undergraduate arts and science degree will see an average tuition reduction of $660. Many students studying for a university professional or graduate degree will save more than $1,000 annually.

The new tuition framework will provide institutions with multi-year predictability. The government will administer a fund to help smaller Northern institutions adjust to the tuition rate reduction.

Giving Students Choice

Students pay other fees in addition to their tuition. These ancillary fees support a broad range of on-campus groups and services and can add up to as much as $2,000 per academic year. The government is introducing the Student Choice Initiative to empower students to choose which non‑essential ancillary student fees they pay. Institutions will be required to provide an online opt‑out option for all non-essential fees. Fees that fund major campus-wide services and facilities, such as existing transit pass agreements, and those that support essential campus health and safety initiatives will continue to be mandatory.

Restoring Financial Sustainability to OSAP

According to a recent report from the Auditor General of Ontario, the Ontario Student Assistance Program (OSAP) has become financially unsustainable, with projected costs of up to $2 billion annually by the 2020–21 fiscal year.8 This represents a net increase of 50 per cent compared with the 2016–17 fiscal year. The report also notes that, while the number of OSAP grant recipients rose by about 25 per cent, the increase in enrolment was only 1 per cent for universities and 2 per cent for colleges.

The government is taking immediate action to restore financial sustainability to OSAP and to focus student assistance on those who need it the most.

Setting Incentives for Success

Restoring accountability to Ontario’s postsecondary education system involves ensuring that publicly assisted postsecondary institutions are providing the positive economic outcomes the students and people of Ontario need, as well as training people for the jobs of the future.

Strategic Mandate Agreements (SMAs) are bilateral agreements negotiated between the Ministry of Training, Colleges and Universities and the province’s 45 publicly assisted colleges and universities. On March 31, 2020, the current SMAs will expire and new agreements will need to be in place prior to that date. For many years, only a small proportion of funding has been tied to performance (1.4 per cent for universities and 1.2 per cent for colleges) in Ontario’s postsecondary education system.

Through the next round of SMAs, Ontario will become a national leader in outcomes-based funding by tying 60 per cent to performance by the 2024–25 academic year. The first year of these new agreements will tie 25 per cent of funding to performance outcomes, and this proportion will increase annually by increments of 10 per cent for three years and 5 per cent in the last year until it reaches a steady state of 60 per cent in 2024–25.

The overall number of metrics will also be reduced from 38 for colleges and 28 for universities to 10 for each sector. These 10 metrics align with the government’s priorities in skills and job outcomes, and economic and community impact. Institutions will have the flexibility to weigh the metrics that best reflect their differentiated strategic goals and will be measured against their own targets based on historical performance. These changes will reduce the reporting burden for institutions while supporting sustainability through a focus on institutional strengths and differentiation.

The new SMAs will ensure that Ontario’s postsecondary education system is focused on differentiated improvement and offering programming better aligned with labour market demands.

Ensuring a Dynamic University Workforce

The average retirement age of faculty has been increasing,9 suggesting that employees are remaining in their positions longer and limiting turnover that would bring in earlier career professionals with new teaching methods and increase diversity. This has cost implications, as these employees tend to be paid the highest salaries and benefits and, in some cases, are drawing salary and pension payments at the same time.

As such, the government is proposing to introduce amendments to the Ministry of Training, Colleges and Universities Act, that, if passed, could help achieve a more sustainable postsecondary sector and employee renewal. The Ministry of Training, Colleges and Universities will consult with the sector on how best to achieve these outcomes.

Maximizing Commercialization Opportunities

Ontario’s postsecondary institutions conduct high-quality research through campus accelerators and incubators, which contribute to today’s innovation-based economy. However, more needs to be done to strengthen the province’s intellectual property position and maximize commercialization opportunities for economic growth.

That is why the government will create an Expert Panel tasked with delivering an action plan for a provincial intellectual property framework and maximizing commercialization opportunities specifically related to the postsecondary education sector. This panel will potentially include representation from the postsecondary, industry, innovation, venture capital and investment, banking and finance sectors, as well as from medical research and intellectual property legal expertise.

Building a Skilled Workforce

Reforming Apprenticeships and Supporting the Skilled Trades

Ontario’s skilled trades offer careers leading to secure jobs that are also vital to the health and growth of the economy. Apprenticeship opportunities help businesses harness new talent while equipping workers with the practical skills and qualifications that the economy needs now and in the future.

The government’s plan to improve Ontario’s skilled trades and apprenticeship system:

- Reduces the regulatory burdens placed on businesses, apprentices and journeypersons;

- Closes the skills gap by establishing programs that encourage the people of Ontario to enter the skilled trades, get retrained and become aware of the benefits of good paying jobs in the trades; and

- Reviews Ontario’s apprenticeship structure and enacts reforms to increase access to apprenticeship opportunities.

In fall 2018, the government introduced the Making Ontario Open for Business Act, 2018, which reduced journeyperson-to-apprenticeship ratios where they apply, placed a moratorium on trade classifications and reclassifications, and enabled the wind-down of the Ontario College of Trades (OCOT).

The government’s vision for a modernized, client-focused apprenticeship and skilled trades system will be implemented through the following initiatives:

- Establishing a new governance framework through proposed new legislation to replace the Ontario College of Trades and Apprenticeship Act, 2009;

- Encouraging employer participation in the apprenticeship system through a new financial incentive program to support employers to come together and train apprentices;

- Modernizing service delivery in apprenticeship by developing a new client-facing digital system, including a one-window digital portal for apprentices; and

- Promoting apprenticeship and the skilled trades as a pathway choice for all students from kindergarten to Grade 12.

Part of this modernization approach includes a new flexible framework to enable training and certification in a full trade or in a portable skill set, which would allow training and certification within and between trades.

This integrated, multi-phased and sustainable approach highlights the Province’s commitment to equipping more people with the skills needed to get quality jobs through apprenticeships.

Preparing More People for Work

The people of Ontario deserve to have the skills they need to get a good job. Unfortunately, current services are fragmented and do not always provide job seekers with a clear path to employment. A significant proportion of Ontario’s workforce remains underutilized. In fact, last year there were approximately 811,000 underutilized workers across the province.10

That is why the government will undertake a review of its training and employment support programs to increase non-profit and private-sector involvement and implement an outcomes-based funding methodology that better matches unemployed or underemployed people with available jobs.

Redesigning Second Career and Other Skills Training Programs

Skills training can be critical to helping people find work and employers create and fill jobs. However, according to the 2016 Annual Report of the Office of the Auditor General of Ontario, the majority of clients in Employment Ontario’s Second Career program have been unsuccessful in finding full-time employment in their new career.11

This is why, beginning in 2019, the government will make changes to Second Career and other skills training programs to ensure every dollar spent is helping job seekers get the skills they need to find work. This will include a review of financial supports available to laid-off workers, making sure the hard-working people of Ontario get the assistance they need to reskill for new jobs when they lose a job through no fault of their own. This review will also include the supports provided to employers who want to invest in training for their own workforce.

This redesign will also support the development of more short-duration credential programs, which focus on skills that employers are seeking and help people find stable work more efficiently. This spring, the Province will also be launching a micro-credentials pilot, which will create new, responsive training programs to help people develop the kind of in-demand skills that employers are seeking.

Exploring Your Next Career

Ontario’s plan for transforming employment services includes an enhanced labour market information website featuring 500 job profiles to help learners and job seekers explore their first or second career and identify opportunities for relevant education, training and reskilling. The website (found at ontario.ca/jobs) will include improved navigation to the Government of Canada’s Job Bank so that job seekers can find employment opportunities and businesses can find the right workers with the right skills.

Overcoming Barriers to Employment

Ontario’s social assistance system is made up of Ontario Works and the Ontario Disability Support Program (ODSP). While these programs provide critical support to the province’s most vulnerable, the system’s patchwork of benefits and services are not helping people overcome barriers to employment and financial independence.

- Only one per cent of Ontario Works recipients leave the program for a job in any given month.

- Half of those who leave Ontario Works end up returning, with four out of five of them returning within one year.

That is why the government is reforming social assistance — to restore dignity, reduce administrative red tape, and empower social assistance recipients to enter and remain in the labour market. The plan for reform will focus on changes that provide more opportunities for social assistance recipients to achieve better outcomes.

While this work is underway, Ontario Works and ODSP rates were increased by 1.5 per cent in fall 2018.

Improving Employment Outcomes

Over the next year, the government will increase the amount of earnings that recipients can have before their benefits are reduced. This will provide more support as recipients enter the workforce, and improve the incomes of those who are currently working.

- Ontario Works recipients will be able to keep up to $300 in earnings per month, an increase from $200 per month without it impacting their social assistance benefits.

- ODSP recipients will experience greater flexibility through an annual exemption of $6,000 in earnings per year instead of the current $200 per month.

- Benefits will be reduced by 75 cents for each dollar earned above these amounts to encourage recipients to increase their labour force participation and achieve greater financial independence.

Ontario’s employment and training programs also play an important role in helping job seekers, including social assistance recipients, find and keep jobs, and assisting employers in recruiting the skilled workers they need. However, the current system of employment services is fractured and complex, and not sufficiently focused on getting the results needed for success.

The government will transform employment services by:

- Helping job seekers explore their first or next career, and identify opportunities for education, training and reskilling through an enhanced labour market information website;

- Managing employment services more effectively by selecting employment service system managers through a new, competitive process open to not-for-profit organizations, the private sector, as well as Consolidated Municipal Service Managers and District Social Services Administration Boards; and

- Providing wrap-around supports to help vulnerable social assistance recipients address barriers and access employment supports.

Fixing a Patchwork System and Restoring Accountability

Another key aspect of the plan for social assistance reform is fixing the parts of the system that either no longer work or provide unequal support to those in need. Focus will be given to restoring accountability to the system and making it easier to navigate.

The government is planning to make changes to Temporary Care Assistance and the Transition Child Benefit to streamline the system and improve equity between those who receive social assistance and other families with children. Details on these changes will be announced in the coming weeks.

The government will also introduce more options for social assistance recipients to access information about their benefits.

Ontario will strengthen the accountability of both social assistance service managers and the planned employment service system managers to help people achieve employment goals.

Support for Low-income Working Individuals and Families

The government is putting money back into the pockets of low- and moderate-income working families.

Starting with the 2019 tax year, the new Low-income Individuals and Families Tax (LIFT) Credit and the proposed Ontario Childcare Access and Relief from Expenses (CARE) tax credit would provide Personal Income Tax relief to eligible working individuals and families, including those transitioning to employment from social assistance. For more information, see the Annex: Details of Tax Measures.

Low- and moderate-income families with children can also benefit from the Ontario Child Benefit, which will increase with the cost of living on July 1 from a maximum benefit of $1,403 to $1,434 per child per year.

Helping Employers Attract Skilled Workers

The Province is responding to the needs of Ontario’s employers by attracting the skilled workers they need through enhancements to the Ontario Immigrant Nominee Program (OINP). The OINP allows Ontario to nominate for permanent residence people who have the professional and educational skills needed to contribute to the province’s economy. Through the modernization of the OINP, and in tandem with its other initiatives, the government will continue to ensure that Ontario’s workforce remains among the most highly skilled for the modern economy.

- To better reflect employer and labour market needs, the government will seek to expand the occupations eligible for the Employer Job Offer: In-Demand Skills Stream to include transport truck drivers and personal support workers.

- To spread the benefits of immigration to smaller communities, the government will begin a pilot initiative with select communities to explore innovative approaches to bring highly skilled immigrants to smaller communities.

- The government will create a dedicated stream to help Ontario’s technology sector attract highly skilled employees.

- To expand the prospective base of the OINP’s Entrepreneur Stream, the government will recalibrate investment and net worth thresholds to make Ontario competitive with other provinces.

Labour Market Transfers

Ontario is committed to creating and protecting jobs and to building a skilled, competitive workforce. This is why the Province is calling on the federal government to provide adequate funding for skills and training programs. These federal programs need to be developed in consultation with the Province to ensure that they meet the specific needs of Ontario’s labour market.

Reducing Trade Barriers and Protecting Jobs

Trade with other countries and provinces plays a central role in supporting jobs and growth across Ontario and providing opportunities for companies throughout the province in a highly competitive global economy. Ontario’s international exports of goods and services support about one in five provincial jobs and, in 2018, were valued at over one-third of provincial GDP. Trade in services has become more important to the province — over the past 10 years, international exports of services have nearly doubled in number. Ontario is also a leader in interprovincial trade, shipping $152 billion of goods and services to other provinces and territories in 2018, almost double that of Quebec, the next highest province.

The government is connecting more workers with good, local jobs by encouraging trade both inside and outside of Canada.

Addressing the Impacts of the Canada-United States-Mexico Agreement

Ontario exports about $160 billion worth of goods to the United States every year, and Ontario is the top export destination for 19 U.S. states and the second largest for nine others. The signing of the Canada-United States‑Mexico Agreement (CUSMA) on November 30, 2018, will build upon that success for both Ontario and its trading partners south of the border.

The Ontario government supports the core aspects of the North American Free Trade Agreement (NAFTA) that were preserved in CUSMA, including tariff-free trade, an independent trade tribunal, temporary entry provisions and the cultural exemption. These key elements of the agreement will help support the hundreds of thousands of jobs across Ontario that depend on trade with the United States. While the Province welcomes these outcomes, it is disappointed that the signing of CUSMA did not trigger the removal of U.S. steel and aluminum tariffs. Ontario remains concerned about many of the concessions that were made in the agreement.

Specifically, CUSMA will require that Canada extend the period of market protection that it currently provides for biologic drugs (to treat diseases such as cancer, rheumatoid arthritis and diabetes) from 8 years to 10 years. CUSMA will delay and potentially decrease the availability of biosimilar drugs that offer highly comparable therapeutic benefits to biologics at a significantly lower cost, increasing costs for Ontario public and private drug plans, health care providers, and patients.

The government also has significant concerns with the package of concessions the federal government accepted under CUSMA for the supply managed agricultural sectors. These concessions include expanded market access to Canada’s dairy, poultry and egg sectors, the elimination of milk Class 6/7, export constraints for certain dairy products and additional dairy reporting requirements. The Canadian dairy sector will concede an estimated 3.59 per cent of its market access under CUSMA.

Opposing Steel and Aluminum Tariffs

The steel and aluminum sectors employ 20,000 people in Ontario and, in 2017, contributed $2 billion to provincial GDP, a 60 per cent increase since the last recession. Since June 2018, the imposition of United States steel and aluminum tariffs, and Canadian retaliation, have disrupted the highly integrated supply chains of the Canada-United States trade relationship, leading to negative economic impacts on both sides of the border.

Ontario accounts for two-thirds of employment in the steel industry across Canada and continues to be affected by the tariffs imposed by the United States. By December 2018, Ontario’s exports and imports of steel with the United States had decreased by 47 per cent and 57 per cent respectively, since the tariffs were implemented. In addition, the price of Canadian steel used by Canadian businesses had increased 14 per cent year-over-year.

Ontario welcomes the federal government’s Regional Economic Growth through Innovation Steel and Aluminum Initiative, which was announced on March 11, 2019. The $100 million in non-repayable contributions for small and medium-sized enterprise manufacturers operating within Canadian steel and aluminum supply chains will enhance productivity and competitiveness within the province. However, the Province believes more needs to be done.

In a joint letter sent to the federal government on February 4, 2019, the Minister of Economic Development, Job Creation and Trade and the Quebec Minister of Economy and Innovation noted that the U.S. tariffs are adversely and disproportionately impacting the steel and aluminum sectors in Ontario and Quebec. In the letter, the governments assert that it is essential the federal government secure the permanent removal of any and all tariffs on Canadian steel and aluminum. Ontario will continue to call on the federal government to press the United States administration for immediate and permanent removal of its tariffs on Canadian steel and aluminum, and to ensure that no other trade impediments such as quotas are introduced.

Recently, Ontario asked the federal government to seriously review and consider the unintended, adverse impact of Canada’s counter-tariffs on the Canadian boating sector. According to Boating Ontario, the marine industry generates $10 billion in revenue across the country and employs 75,000 Canadians. Ontario makes up more than 40 per cent of the boating industry in Canada and generates $4 billion in revenues each year.

The government of Ontario will continue its engagement with counterparts from the United States to draw attention to the negative impacts of the tariffs, as well as emphasize the mutual benefits of free and open trade. On February 22, 2019, Premier Doug Ford met with United States Trade Representative Robert Lighthizer in Washington, D.C. to discuss the long-lasting and prosperous trade partnership shared by Ontario and the United States. In addition, the Premier met with now former United States Ambassador to Canada Kelly Knight Craft, Canada’s Ambassador to the United States David MacNaughton, Illinois Governor J.B. Pritzker, Indiana Governor Eric Holcomb, Michigan Governor Gretchen Whitmer, Minnesota Governor Tim Walz and Tennessee Governor Bill Lee. The meetings gave the Premier an opportunity to advocate for Ontario’s interests on key issues such as the U.S. steel and aluminum tariffs, which are negatively impacting people and businesses on both sides of the border, as well as the potential for U.S. auto tariffs.

Standing Up against “Buy America” Policies

In recent years, “Buy America” and other discriminatory procurement policies have been pursued at both the federal and state level in the United States. “Buy America” policies promote the use of U.S.-made goods and services in government contracts, negatively impacting opportunities for Ontario businesses and workers and placing a number of the province’s key industries at a distinct disadvantage when bidding on government contracts in the United States.

There was a successful grassroots campaign, which started in Ontario, to reverse the ”Buy America” provision for U.S.-manufactured goods that the United States government introduced in 2009 as part of its bailout package. Ontario will build on this leadership by closely monitoring “Buy America” developments at the sub-national level. The government will engage directly with lawmakers in those states considering “Buy America” legislation to highlight the benefits of open procurement markets and help prevent the enactment of new legislation that would restrict opportunities for Ontario businesses.

The Province is also positioned to anticipate and respond proactively to any new legislation coming from the United States. In the case that one or more U.S. states implement “Buy America” legislation, the Ontario government is able and willing to respond proportionally. Additionally, Ontario has urged the federal government to take immediate action to oppose and call for the removal of these punitive provisions.

Ontario and the United States both benefit from a strong, balanced economic relationship, including through open government procurement. Ontario will work tirelessly to create an environment that protects workers and promotes jobs, opportunity and growth.

Supporting Ontario’s Softwood Lumber Producers

Forestry is an important driver of the province’s economy that employs over 50,000 people, including a significant number of jobs across Northern Ontario. Following the expiration of the 2006 Softwood Lumber Agreement between Canada and the United States in October 2015, the United States imposed final countervailing and anti-dumping duties on Canadian softwood lumber in January 2018, significantly impacting nearly $8 billion of Canadian softwood lumber exports. The Government of Canada is currently pursuing three NAFTA challenges and two World Trade Organization challenges of U.S. softwood lumber duties, with initial results from these challenges expected in 2019.

By the end of January 2019, it is estimated that Ontario’s softwood lumber producers will have paid a total of $168 million in duties to the United States. These unjustified costs imposed by the United States have impacted the competitiveness of Ontario’s lumber producers, potentially leading to job losses and plant closures. Ontario has urged the federal government to consider interim measures to aid domestic producers, such as a commercial loan guarantee program. The Province will continue to work with the federal government to challenge these duties and get a good trade deal for the softwood lumber industry. In addition, the Province is developing a forestry strategy to encourage economic growth within the sector. See the Reviewing the Forestry Sector later in this section for more details.

Breaking Down Interprovincial Trade Barriers

Ontario supports reducing interprovincial trade barriers. This includes the areas of transporting goods between provinces and territories (e.g., trucking requirements), harmonizing food regulations and inspection rules across Canada, harmonizing building codes and facilitating greater trade in alcohol between provinces and territories. According to BMO Capital Markets,12 the net positive impact to Ontario’s GDP from free interprovincial trade would build to a range of between $15 billion to $20 billion over 10 years. Ontario is leading efforts to reduce trade barriers and make the province open for business and open for jobs.

Ontario’s interprovincial exports of goods and services have increased significantly over the past 10 years, with exports rising from $110.5 billion in 2008 to $152.0 billion in 2018. Over the same period, imports of goods and services from other provinces increased from $84.9 billion to $119.6 billion. Ontario’s exports to other provinces exceed its imports from other provinces, resulting in a trade surplus of $32.5 billion in 2018.

On December 7, 2018, Premier Doug Ford met with the First Ministers in Montreal to discuss ways to strengthen economic growth and create jobs by taking steps to diversify Canada’s international trade, promote clean growth and strengthen trade between the provinces and territories. The First Ministers all agreed on the need to resolve the question of softwood lumber and steel and aluminum tariffs, and to ensure that the federal government supports and fully compensates the supply managed sector. The First Ministers also agreed to harmonize standards in the transportation sector, remove unnecessary duplication from the agri-food sector’s food oversight and safety regulations, consult industry and consumers to develop ways to facilitate the sale of alcoholic beverages, and accelerate work to strengthen the Canadian Free Trade Agreement.

Establishing Partnerships with Saskatchewan and Quebec on Trade

On October 29, 2018, Premier Doug Ford hosted Saskatchewan’s Premier Scott Moe at Queen’s Park to discuss ways that their respective governments could cooperate to protect taxpayers and encourage job creation in both provinces. The Premiers discussed their shared commitment to reducing interprovincial trade barriers and announced a memorandum of understanding (MOU) to begin discussions on lowering interprovincial barriers.

On November 19, 2018, Premier Doug Ford and Quebec Premier François Legault held their first official meeting, reaffirming their commitment to interprovincial trade and the need to have more flexibility on regulations governing alcohol sales between the two provinces. They agreed to establish a productive win-win relationship that focuses on wealth creation in both provinces, making life more affordable for families and small businesses in Quebec and Ontario. Ministers holding economic portfolios in their respective Cabinets would also meet twice annually to discuss increased trade between Quebec and Ontario and the diversification of the two provinces’ economies.

Fighting the Federal Government’s Carbon Tax

Standing up for the People of Ontario

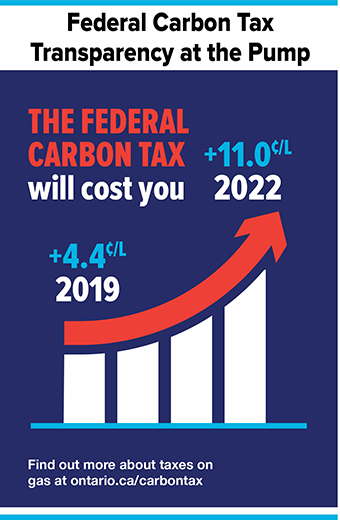

On April 1, 2019 the federal government began imposing its job-killing carbon tax on the people of Ontario and three other Canadian provinces. The federal government has done so despite the overwhelming evidence that a carbon tax is one of the most regressive tax increases in the history of Canada, and one which is expected to increase the typical Ontario household’s cost of living by $258 in 2019, rising to $648 per year by 2022.13 Amongst the hardest hit people will be seniors and lower and middle-income families who will be least able to absorb skyrocketing gas prices and home heating costs. A carbon tax will also make automotive, manufacturing, transportation, mining and forestry activities increasingly unaffordable in Ontario and put thousands of jobs at risk.

The federal government is persisting in its insistence that Ontario families be punished and pay more despite the fact that Ontario already leads Canada in greenhouse gas reduction targets without a carbon tax.

The federal government’s communications on the issue have been clear. When confronted with evidence that Ontario can hit its greenhouse gas reduction targets without a carbon tax, it chooses to move the goalposts, because the federal government’s objective is not to reduce emissions — it is to impose the tax.

As a matter of foundational policy, Ontario considers the federal carbon tax to be a clear and present threat to affordability for low- and middle-income families, as well as to Ontario jobs across multiple sectors. The government intends to use every tool at its disposal to fight the carbon tax. To date, the Ontario government has already legally challenged the federal carbon tax at both the Saskatchewan and Ontario Courts of Appeal.

The government also proposes to introduce urgent transparency measures to counter the federal government’s attempts to hide the true cost of the carbon tax from Ontario families. The government has written to the Ontario Energy Board to encourage it to include the cost of the carbon tax on Ontario home heating bills.

The government will propose legislation to ensure that consumers are aware of the effect of the federal carbon tax on gasoline prices. The Federal Carbon Tax Transparency Act, 2019, if passed, would require gas station operators to display a sticker on gasoline pumps showing the impact of the federal carbon tax.

The government will soon be commencing a public interest information campaign designed to highlight the true cost of the federal carbon tax to Ontario families and businesses, while demonstrating how Ontario’s own environment plan will build on its Canada-leading emissions reductions record in order to hit its target of 30 per cent reductions, without imposing a carbon tax.

Supporting Pipeline Construction

The federal carbon tax will affect Ontario’s — and all of Canada’s — ability to compete globally. As Ontario takes steps to attract and retain good jobs, the Province is also seeking to support economic development in other provinces that could be hindered by the federal carbon tax.

In the 2018 Ontario Economic Outlook and Fiscal Review, the government promised that it would not stand in the way of a pipeline project that transports oil within Ontario’s borders. To that end, Ontario is moving forward with plans to eliminate restrictions on pipeline development in Ontario under the Canadian Free Trade Agreement that were negotiated by the previous government, and is actively working with the parties to the Agreement to implement these changes. Pipelines create good jobs, both in Ontario and across the country, and interprovincial energy infrastructure projects like these are essential for Canada to compete in the global marketplace. In every way possible, Ontario will support its partners looking to expand oil distribution, and at the same time, protect their competitiveness from the federal carbon tax.

On March 6, 2019, Ontario and Saskatchewan took a firm stance against the federal government’s proposed Bill C-69 that will harm miners, communities and businesses. Bill C-69 would potentially politicize the environmental approval process for major natural resource and energy projects, and also impose new, subjective values tests on projects, adding delays and additional hurdles that would hinder projects and put jobs at risk. The Province recognizes the importance of protecting the environment, but also understands that it must be done in a way that supports competitiveness, job creation and economic development.

Lowering Electricity Bills for Businesses

Improving Electricity Programs

Ontario’s Government for the People is taking steps to stabilize costs, drive efficiency, and strengthen trust and transparency in the energy sector. The government believes that electricity bills have been too high and have hindered business investment. The Province is consulting with businesses to improve expensive and confusing electricity programs and is creating an electricity system that works for Ontario families, farms and businesses.

Reforming Industrial Electricity Pricing

The government understands the challenges to Ontario businesses caused by the high cost of electricity, affecting the ability of industrial businesses to compete globally. As part of its Open for Business, Open for Jobs Strategy, the government is launching targeted stakeholder consultations on industrial electricity pricing, including a review of existing pricing programs. This will inform the design and development of new policies to manage electricity costs and help Ontario businesses grow and compete. Stakeholders will have an opportunity to provide input through online submissions and in-person discussions. Helping Ontario businesses with their electricity costs will stimulate economic development, improve fairness, and encourage job creation — sending the clear message that Ontario is open for business.

Modernizing the Ontario Energy Board

The Ontario Energy Board (OEB) is Ontario’s independent regulator of the electricity and natural gas sectors. In recent years, stakeholders have lost confidence in the OEB. Stakeholders believe that the OEB does not operate in a clear and transparent manner; it lacks appropriate governance oversight and does not operate as effectively and efficiently as it could. The OEB Modernization Review Panel’s report has provided recommendations on the governance and operations of the OEB. Informed by the Panel’s recommendations, the government will modernize the OEB and will take steps to reduce costs and regulatory burden, promote regulatory excellence, and improve organizational governance and independence of the OEB. The government’s proposed amendments to the Ontario Energy Board Act, 1998 would, if passed, strengthen the core purpose of the OEB and would allow the OEB to better serve the people of Ontario, operate more effectively and efficiently to protect the rights of consumers, and ensure that Ontario’s energy system remains sustainable and reliable.

Supporting Northern and Rural Communities

The government recognizes the significant contribution that rural and Northern Ontario communities make to the economy. In 2018, about 354,000 workers were employed in Northern Ontario, accounting for 4.9 per cent of all jobs in Ontario. Job gains in Northern Ontario were strong last year, with 5,400 net new jobs created, the largest gain since 2011. Rural communities represented 13 per cent of all Ontario employment, or about 949,000 workers. Rural Ontario also experienced job gains in 2018, with 8,100 net new jobs created.

While rural and Northern Ontario communities both experienced employment growth last year, there is more to be done. These communities face unique economic and demographic challenges to growth, including a lack of economic diversification, aging populations, out-migration, and gaps in infrastructure. Northern and rural areas also have great potential for economic growth and the government is committed to providing rural and Northern Ontario communities with the support they need to create more local jobs.

Reviewing the Far North Act, 2010

The government is committed to reducing red tape and restrictions that are blocking important economic development projects in the Far North of Ontario including the Ring of Fire, all‑season roads and electrical transmission projects for communities. To ensure a collaborative approach to development, the Province will hold consultations on a proposal to repeal the Far North Act, 2010, amend the Public Lands Act to continue approved community based land use plans, and for a time-limited period, enable completion of the planning process for communities that are already at an advanced planning stage.

Developing the Ring of Fire

The Ring of Fire represents a significant opportunity to open up the resources of Northern Ontario and create jobs in the region. The government is working to cut red tape and end the delays that block the development of the Ring of Fire area by working with willing partners to ensure sustainable development in the North.

Earlier this year, Webequie and Marten Falls First Nations initiated environmental assessment studies that will inform the planning and development of all-season access roads in the Ring of Fire region.

Creating a Mining Working Group

The government has announced the creation of a Mining Working Group to focus on reducing red tape and attracting major new investments. The group is chaired by the Minister of Energy, Northern Development and Mines and includes members from mining and exploration companies, prospectors and Indigenous business organizations. Members will provide the Province with input on important issues affecting the minerals sector, while identifying opportunities to ensure future growth, competitiveness and prosperity.

Reviewing the Forestry Sector

In the 2018 Ontario Economic Outlook and Fiscal Review, the government committed to holding consultations to help the Province develop a strategy to encourage economic growth within the forestry sector and promote the sector as open for business. The strategy aspires to increase wood supply and will help unleash the potential of Ontario’s forest industry, creating conditions for the industry to innovate, attract investment, and create jobs and prosperity for the North and for all communities that depend on this sector.

Sharing Resource Revenues

Ontario is one of the most attractive jurisdictions for mineral exploration in the world and accounts for about 25 per cent of Canada’s total exploration expenditures. There are opportunities to increase economic activity from resource exploration and development while ensuring Indigenous communities benefit from the resource sector.

To support opportunities for employment and the financial success of Indigenous communities, the Province will move forward with the agreements signed with the Grand Council Treaty #3, the Wabun Tribal Council and the Mushkegowuk Council to share resource revenues from mining and forestry. At the same time, the Province will continue to explore options to advance resource revenue sharing opportunities with other Indigenous partners and Northern communities, including in the mining, forestry and aggregates sectors.

Expanding the Northern Ontario Internship Program

The government is creating more opportunities for Indigenous peoples and addressing the skilled labour shortage across the North by creating a new Northern Ontario Internship Program. Administered by the Province’s Northern Ontario Heritage Fund Corporation, the new program will remove the requirement that applicants be recent university or college graduates. Program candidates will now include new entrants into the workforce, those transitioning to a new career, the unemployed and underemployed.

The program will have two funding streams:

- The Northern Ontario Indigenous Internship; and

- The Northern Ontario Skilled Labour Internship.

The streams highlight the importance of the North’s Indigenous population to the region’s economy and the issue of skills shortages in areas such as the skilled trades, respectively.

Reviewing the Environmental Assessment Act

Ontario has raised concerns about the federal government’s proposed Bill C-69, which overhauls the Canadian Environmental Assessment Act, 2012. If this legislation is passed without significant adjustments, it would hinder new natural resource and energy projects across Ontario, risking thousands of potential jobs.

The Province is developing its own approaches to modernizing environmental assessments, while creating a more business friendly environment that would encourage development. This includes modernizing Ontario’s Environmental Assessment Act, which mandates an extensive consultation process and consideration of environmental protections and conservation for virtually all public sector projects regardless of environmental impact.

Connecting Northern Remote Communities to the Transmission Grid

Twenty-five remote First Nation communities in Northwestern Ontario currently rely on local diesel generation.

Wataynikaneyap Power LP (Wataynikaneyap Power), a licensed transmission company, is a partnership between the First Nation Limited Partnership, comprising 24 First Nations, with majority ownership, and Fortis (WP) LP (comprised of Fortis Inc. and Algonquin Power & Utilities Corp). In July 2016, the Province designated Wataynikaneyap Power to connect 16 remote First Nation communities to the provincial grid. The project would provide these communities with a reliable supply of electricity and support long-term economic opportunities. In 2018, the federal government announced that it would provide, in two tranches, $1.6 billion in funding for the project, subject to entering into definitive agreements. Under the proposed financing structure, the Province would provide interim financing of over $1.3 billion in order to facilitate the project. In December 2018, Pikangikum First Nation became the first of these communities to be connected to the grid.

The project in Northern Ontario known as the East-West Tie (EWT) Transmission Project has also progressed. In January, as directed by the Province, the OEB designated NextBridge Infrastructure (NextBridge) as the transmitter to build the 450-kilometre transmission line from Thunder Bay to Wawa. The OEB subsequently granted leave to construct the line. The line will support job creation, enhance reliability, improve the flow of cheaper and lower-emission energy, and add the capacity needed for major regional development projects like the Wataynikaneyap Power Project and the Ring of Fire. With the support of the Ontario government, NextBridge has trained over 300 Indigenous community members for project-related jobs. With the support of First Nation and Métis partners, the project is expected to create local employment for over 200 Indigenous people and deliver over $200 million in economic benefits for First Nation communities.

Expanding Access to Natural Gas

Natural gas is the most common heating source in Ontario. In December 2018, the government passed Bill 32, the Access to Natural Gas Act. The new legislation makes it possible for a new program that, once regulations are in force, will help expand access to natural gas in more parts of rural and Northern Ontario, as well as in First Nation communities. The new program will be designed to help the private sector expand natural gas access for up to 78 communities, making connections available for approximately 33,000 households. Switching from propane, electric heat or oil to natural gas can save an average residential customer between $800 and $2,500 a year. This builds on the government’s cancellation of the cap-and-trade carbon tax, which will save families on average $80 per year and small businesses $285 per year, putting more money back in people’s pockets.

Improving Northern Transportation

Through a review of transportation in the North, the government is focusing on identifying opportunities for a modern, sustainable transportation system in Northern Ontario.

Improving Broadband Service to Underserved Areas

Broadband has become essential infrastructure and the people of Ontario are increasingly expecting connectivity. Broadband and cellular access are necessary to attract and retain business in Ontario, increase quality of life for Ontario residents and improve access to government services, including health care and education.

Many rural and remote communities do not have access to viable high-speed connectivity, which limits their ability to grow, innovate, provide important public services, develop a strong workforce and support economic development.

The government is committed to ensuring that communities across Ontario have access to critical broadband and cellular connectivity. In support of this commitment and to expand broadband and cellular infrastructure across Ontario, the Province plans to invest $315 million over the next five years in regional and shovel-ready projects. Ontario’s investment efforts will benefit from investment commitments by other levels of government and leadership from the private sector to maximize the impact of provincial investments. The Province will provide more details as part of its Broadband and Cellular Strategy, which will be released later this year.

Investing in broadband and cellular infrastructure to expand access to reliable, fast and affordable broadband internet connectivity will allow communities and businesses to fully participate and compete in the digital economy. It will also support a digital-first approach to providing government services (e.g., access to data and online services).

Hunting and Monitoring Cormorants

Public consultation to classify the double-crested cormorant as a game bird concluded in January 2019. The government is now evaluating the results of this consultation and plans to introduce legislation that would allow for population management through hunting.

Big Game Management Advisory Committee