On this page Skip this page navigation

- Introduction

- Reducing the Employer Health Tax

- Helping Seniors Stay Safely in Their Homes

- Maintaining Cultural Media Tax Credit Eligibility

- Supporting Research and Development

- Reducing Property Taxes for Employers

- Enabling Property Tax Relief for Small Businesses

- Reviewing Ontario’s Property Assessment and Taxation System

- Cancelling the Scheduled Wine Tax Increase and Freezing Beer Tax Rates

- Summary of Measures

- Technical Amendments

Introduction

This Annex contains detailed information on proposed tax measures in this 2020 Budget. These include reducing the Employer Health Tax (EHT), introducing a new temporary Seniors’ Home Safety Tax Credit, helping companies maintain eligibility for cultural media tax credits, reducing property taxes on employers, providing property tax relief for small businesses and retroactively cancelling the increase in wine basic tax rates and freezing beer tax rates.

These proposed measures build on initiatives introduced by the government in the March 2020 Economic and Fiscal Update to help fight the COVID‑19 pandemic — in particular, the increase in the EHT exemption for 2020 from $490,000 to $1 million. The Province also provided six months of relief from penalties and interest for approximately 100,000 businesses that would have otherwise applied for missed filing or remittance deadlines for 10 provincially administered tax programs between April 1 and October 1, 2020. In addition, the government has implemented the new Regional Opportunities Investment Tax Credit for businesses that make eligible capital investments in designated regions of the province where employment growth has lagged the provincial average.

Reducing the Employer Health Tax

The Employer Health Tax (EHT) is a payroll tax paid by employers based on their total annual Ontario remuneration. It has a top rate of 1.95 per cent. Private-sector employers with total annual Ontario remuneration of $5 million or less are eligible for an EHT exemption on part of their payroll ($490,000 in 2019).

As part of Ontario’s Action Plan: Responding to COVID‑19 that wasreleased March 2020, the EHT exemption was increased from $490,000 to $1 million for 2020, providing additional EHT relief of up to $9,945 for a total of up to $19,500 in EHT savings per eligible employer.

To continue to help private-sector employers weather the pandemic and build a stronger foundation for future growth and hiring, the government is proposing to make the EHT payroll exemption increase permanent.

In 2021–22, this proposed exemption increase is estimated to provide $360 million in additional tax relief. In 2021, about 57,000 employers would benefit, including about 30,000 employers who would no longer pay any EHT in the year. This is in addition to about 425,000 smaller payroll employers who would already be exempt with a $490,000 exemption. The EHT would be reduced by about $6,200, on average, in 2021 among those benefiting from the exemption increase.

Currently, employers with annual Ontario payroll over $600,000 are required to pay EHT by way of monthly installments. In 2019, with the exemption set at $490,000, this meant that private-sector employers who claimed the exemption were required to pay EHT monthly installments if they owed more than $2,145 in EHT for the year. Employers not required to make monthly installments pay EHT when they file their annual returns, generally due March 15th of the calendar year following the EHT year.

The government is proposing to double the threshold payroll amount beyond which employers are required to pay EHT installments to $1.2 million, starting in 2021. Private-sector employers who claim the full exemption would be required to remit EHT installments when they owe more than $3,900 in EHT for the year.

The EHT exemption is indexed to inflation every five years, with the next adjustment scheduled for 2024. Given the immediate proposed doubling of the exemption threshold, the government proposes to move the next scheduled adjustment for inflation to January 1, 2029.

Helping Seniors Stay Safely in Their Homes

The government is taking steps to help seniors retain their independence and live in their homes safely and longer by proposing, for the 2021 tax year, the Seniors’ Home Safety Tax Credit.

This temporary personal income tax credit would be refundable to provide support to eligible claimants whether or not they owe income tax for 2021. This credit would support seniors who stay in their homes by assisting with improvements that make their homes safer and more accessible.

The proposed credit would not depend on income and could be claimed for eligible expenses by senior homeowners, renters or people who live with relatives who are seniors.

Expenses would be eligible if they are paid or become payable in 2021 to the extent that they relate to renovations that improve safety and accessibility or help a senior be more functional or mobile at home. Eligible expenses would include:

- Renovations to permit a first-floor occupancy or secondary suite for a senior;

- Grab bars and related reinforcements around the toilet, tub and shower;

- Wheelchair ramps, stair/wheelchair lifts and elevators;

- Non-slip flooring;

- Additional light fixtures throughout the home and exterior entrances;

- Automatic garage door openers; and

- Modular or removable versions of a permanent fixture, such as modular ramps and non-fixed bath lifts.

- Complete rules for eligibility would be set out in legislation.

The Seniors’ Home Safety Tax Credit would be worth 25 per cent of up to $10,000 in eligible expenses for a senior’s principal residence in Ontario. The maximum credit would be $2,500. The $10,000 maximum could be shared by the people who share a home, including spouses and common-law partners.

Individuals would be able to claim the credit for their expenses if the improvement was made to their principal residence or to a residence that they reasonably expect to become their principal residence within the 24 months after the end of 2021. The credit could also be claimed for an individual’s share of improvements done by a condominium corporation, or similar body, to property that includes the individual’s principal residence, provided the improvement meets the eligibility conditions.

If an improvement is paid for in installments, all expenses for that improvement would be considered to have been paid when the final installment becomes payable. To qualify for the credit, the final installment for the improvement must become payable in 2021.

To claim the tax credit, seniors or their family members should get receipts from suppliers and contractors, helping to ensure that vendors report these amounts for tax purposes.

It is expected that the Seniors’ Home Safety Tax Credit would benefit 27,000 people and cost the government about $30 million in 2021.

Ontario would work with the Canada Revenue Agency (CRA) to make the credit available to be claimed through the 2021 personal income tax returns.

Maintaining Cultural Media Tax Credit Eligibility

COVID‑19 has disrupted production activity in the cultural industries, including film and television production, computer animation and special effects, interactive digital media and book publishing. Many productions have been significantly delayed and, in some cases, production schedules may not return to normal in the short term.

Ontario offers a suite of refundable tax credits to encourage production activity and create more jobs in the cultural industries. Due to delays resulting from COVID‑19, companies may be unable to meet tax credit deadlines and may lose eligibility for tax credit support.

To help companies maintain their tax credit eligibility and to help provide some stability and certainty in uncertain times, the Province is proposing to temporarily extend some timelines and amend some requirements for the cultural media tax credits.

The following table summarizes the proposed amendments. For details, see the text that follows the table and refer to the relevant legislation and regulations when available.

| Tax Credit | Current Requirement | Proposal | Would Apply to: |

|---|---|---|---|

| Ontario Film and Television Tax Credit (OFTTC) | Companies must file an application for a certificate of completion within 24 months of the year end in which principal photography begins. | Extend deadline by an additional 24 months. | Productions for which eligible expenditures were incurred prior to March 15, 2020 and which were not completed, certified by Ontario Creates or deemed ineligible for the tax credit by Ontario Creates before March 15, 2020. |

| Ontario Film and Television Tax Credit (OFTTC) | Eligible expenditures can be claimed up to 24 months before principal photography begins. | Extend this claim period by an additional 24 months. | Productions for which eligible expenditures were incurred prior to March 15, 2020 and which were not completed, certified by Ontario Creates or deemed ineligible for the tax credit by Ontario Creates before March 15, 2020. |

| Ontario Film and Television Tax Credit (OFTTC) | Productions must have an agreement in writing to have the production shown in Ontario within two years of the production being complete and becoming commercially exploitable. | Extend this two-year period by an additional 24 months. | Productions for which eligible expenditures were incurred prior to March 15, 2020 and which were not completed, certified by Ontario Creates or deemed ineligible for the tax credit by Ontario Creates before March 15, 2020. |

| Ontario Production Services Tax Credit (OPSTC) | Total expenditures included in the cost of the production during 24 months after principal photography begins must exceed minimum spending requirements. | Allow an additional 24 months to meet the minimum spending requirements. | Productions for which eligible expenditures (or otherwise eligible expenditures) were incurred in Ontario in taxation years ending in 2020 and 2021. |

| Ontario Production Services Tax Credit (OPSTC) | Productions cannot claim the OPSTC until the taxation year in which principal photography begins. | Allow certain companies to claim otherwise eligible expenditures incurred in the two taxation years prior to the year in which principal photography begins. | Productions for which eligible expenditures (or otherwise eligible expenditures) were incurred in Ontario in taxation years ending in 2020 and 2021. |

| Ontario Interactive Digital Media Tax Credit (OIDMTC) | For specified and non-specified products, eligible labour expenditures must be incurred during the 37-month period prior to product completion. | Extend this expenditure window by an additional 24 months. | Products that were not completed before March 15, 2020 and for which eligible labour expenditures were incurred in the 2020 taxation year. |

| Ontario Book Publishing Tax Credit (OBPTC) | Literary works must be published in a bound edition of at least 500 copies. | Temporarily waive this requirement. | 2020 and 2021 taxation years. |

Table A.1 footnotes:

Source: Ontario Ministry of Finance.

Ontario Film and Television Tax Credit

To be eligible for the Ontario Film and Television Tax Credit, companies must file an application with Ontario Creates for a certificate of completion within 24 months of the year end in which principal photography begins. Companies have the option to extend this deadline by 18 months. Productions that have had to temporarily shut down due to COVID‑19 may not be able to complete within these timelines. In response, the Province proposes to introduce regulatory amendments to temporarily allow companies an additional 24 months to file an application for a certificate of completion, resulting in a new application deadline of 48 months. Companies will continue to have the option to extend this 48-month deadline by an additional 18 months.

Companies are also required to have an agreement in writing to have the film or television production shown in Ontario within two years of the production being completed and becoming commercially exploitable. Productions delayed due to COVID‑19 may need a longer timeline to secure distribution. In response, the Province proposes to introduce regulatory amendments to temporarily extend this two-year period by an additional 24 months.

Eligible expenditures can be claimed up to 24 months before principal photography begins. Productions that are delayed in starting principal photography may be facing a shortened expenditure window. In response, the Province proposes to introduce regulatory amendments to temporarily extend this claim period to allow eligible expenditures to be claimed up to 48 months before principal photography begins.

These measures would apply to productions:

- For which eligible expenditures were incurred prior to March 15, 2020; and

- Which were not completed, certified by Ontario Creates or deemed ineligible for the tax credit by Ontario Creates before March 15, 2020.

Ontario Production Services Tax Credit

To be eligible for the Ontario Production Services Tax Credit, total expenditures included in the cost of the production during 24 months after principal photography begins must exceed minimum spending requirements (e.g., $1 million for feature films). Productions that have had to temporarily shut down due to COVID‑19 may take longer than planned to meet these spending requirements. In response, the Province proposes to introduce regulatory amendments to temporarily allow certain companies an additional 24 months to meet these minimum spending requirements. This measure would apply to productions for which eligible expenditures were incurred in Ontario in taxation years ending in 2020 and 2021.

Currently, a production cannot claim the Ontario Production Services Tax Credit until the taxation year in which principal photography commences. Productions that are delayed in starting principal photography may lose tax credit eligibility for expenditures incurred in earlier taxation years. In response, the Province intends to introduce regulatory amendments to temporarily allow certain companies to claim otherwise eligible expenditures incurred in the two taxation years prior to the year in which principal photography begins. This measure would apply to productions that incurred otherwise eligible expenditures in Ontario in taxation years ending in 2020 and 2021.

Ontario Interactive Digital Media Tax Credit

For the Ontario Interactive Digital Media Tax Credit, eligible labour expenditures for specified and non-specified products must be incurred during the 37-month period prior to product completion. Companies may take longer than 37 months to complete a product given development delays due to COVID‑19. In these cases, companies may lose tax credit eligibility for expenditures incurred early in the development process. In response, the Province is proposing amendments to the Taxation Act, 2007, to temporarily extend this 37-month period by an additional 24 months. This measure would apply to products that were not completed before March 15, 2020, and for which eligible labour expenditures were incurred in the 2020 taxation year.

Ontario Book Publishing Tax Credit

To be eligible for the Ontario Book Publishing Tax Credit, a literary work must be published in a bound edition of at least 500 copies. Publishers may not be able to print books given industry shut downs due to COVID‑19. In response, the Province is proposing amendments to the Taxation Act, 2007, to temporarily waive this requirement for the 2020 and 2021 taxation years.

Supporting Research and Development

Ontario proposes to extend the reporting period to claim an Ontario Research and Development Tax Credit (ORDTC). The proposed change would parallel the extension of the reporting deadlines for federal scientific research and experimental development claims. The federal extension was effected by Order of the Minister of National Revenue made on August 31, 2020 under the Time Limits and Other Periods Act (COVID‑19) and deemed effective March 13, 2020.

Corporations with tax year-ends from September 13, 2018 to December 31, 2018 would have an additional six months to file an ORDTC claim and those with tax year-ends from January 1, 2019 to June 29, 2019 would have until December 31, 2020 to file a claim.

Reducing Property Taxes for Employers

The government recognizes that the COVID‑19 pandemic has created significant financial challenges for Ontario businesses. In particular, businesses continue to bear fixed costs, such as property taxes, which are not sensitive to changes in profit and economic cycles.

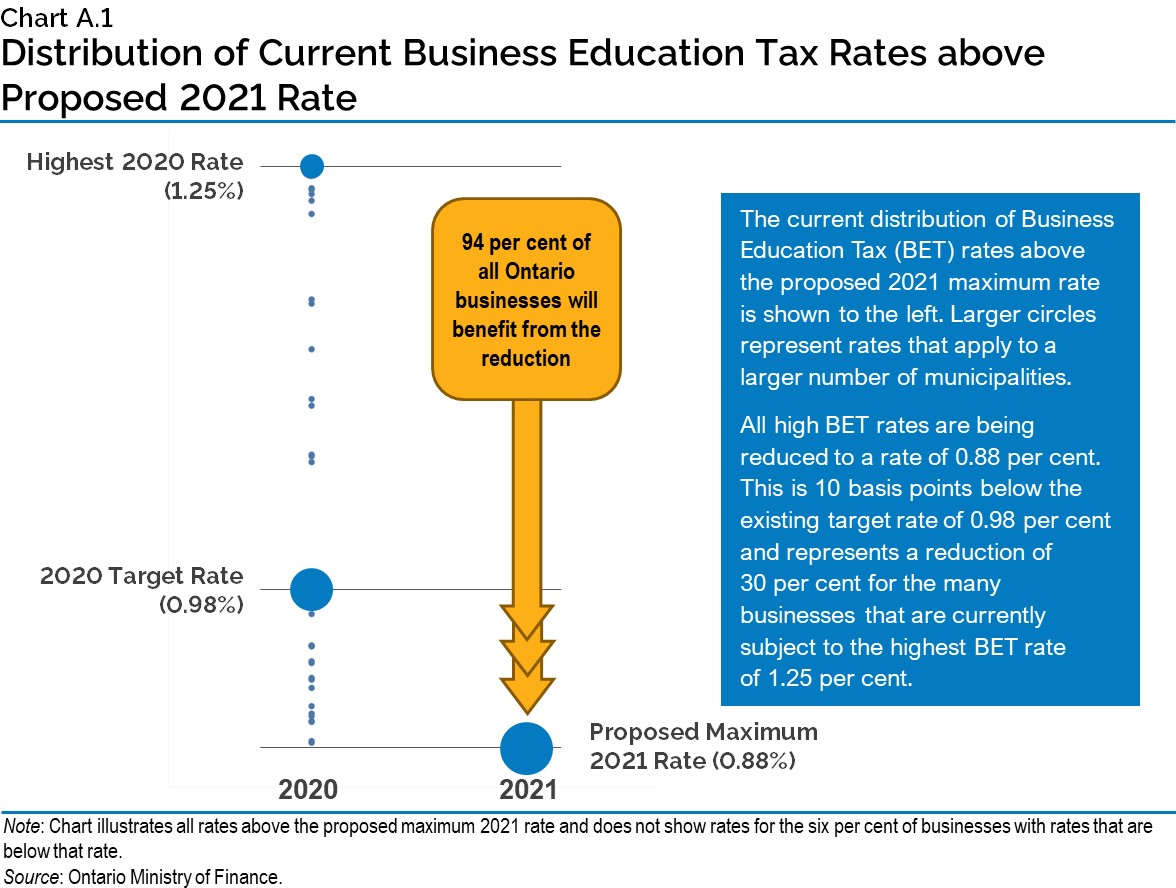

There is currently a wide range of Business Education Tax (BET) rates across the province, reflecting historical assessment and tax inequities. Business and municipal stakeholders have expressed concerns regarding the variation of BET rates and its impact on business competitiveness across the province. The government has heard that, as the province recovers from the COVID‑19 pandemic, addressing this variation in BET rates would reduce regional tax inequities and improve business competitiveness.

That is why the Province is taking immediate action to reduce high BET rates by $450 million in 2021.

Previous plans to reduce BET rates were to be phased in over a number of years but were never fully implemented, leaving a number of key regions of the province with high BET rates. The last BET reduction plan was halted in 2012 after only implementing approximately 40 per cent of promised reductions. Under that plan, high BET rates were to be reduced to a target rate, which was never reached for many businesses.

The BET reductions announced in the 2020 Budget will lower all high BET rates to a rate of 0.88 per cent for both commercial and industrial properties beginning in 2021. This is ten basis points below the existing target rate and represents a reduction of 30 per cent for the many businesses that are currently subject to the highest BET rate. These changes will benefit over 200,000 business properties, or 94 per cent of all business properties in Ontario and provide approximately $450 million in annual savings.

Business education property taxes currently contribute nearly $4 billion in funding to support elementary and secondary school education in Ontario. Education taxes typically make up about 40 per cent of total property taxes levied on business properties. To ensure this measure does not have a financial impact on school boards, the Province will adjust payments to school boards to offset the reduction in education property taxes.

| Region | Municipality (Counts reflect lower- and single-tier municipalities) | Property Class | Annual BET Tax Cut Beginning in 2021 ($) |

BET Tax Cut Percentage |

|---|---|---|---|---|

| Central | Toronto | Commercial | $116,722,000 | 10% |

| Central | Toronto | Industrial | $16,285,000 | 18% |

| Central | Peel Region | Commercial | $26,289,000 | 7% |

| Central | Peel Region | Industrial | $17,330,000 | 17% |

| Central | Waterloo Region | Commercial | $30,582,000 | 30% |

| Central | Waterloo Region | Industrial | $7,225,000 | 30% |

| Central | Durham Region | Commercial | $8,456,000 | 10% |

| Central | Durham Region | Industrial | $5,329,000 | 30% |

| Central | York Region | Commercial | $5,105,000 | 2% |

| Central | York Region | Industrial | $7,308,000 | 10% |

| Central | Hamilton | Commercial | $6,636,000 | 10% |

| Central | Hamilton | Industrial | $3,059,000 | 25% |

| Central | Niagara Region | Commercial | $6,616,000 | 10% |

| Central | Niagara Region | Industrial | $2,767,000 | 30% |

| Central | Simcoe County | Commercial | $2,734,000 | 10% |

| Central | Simcoe County | Industrial | $2,679,000 | 30% |

| Central | Central Region | Commercial | $23,100,000 | 10% |

| Central | 46 Other Benefitting Municipalities | Industrial | $23,053,000 | 23% |

| East | Ottawa | Commercial | $27,931,000 | 17% |

| East | Ottawa | Industrial | $5,336,000 | 30% |

| East | Kingston | Commercial | $7,650,000 | 30% |

| East | Kingston | Industrial | $574,000 | 30% |

| East | Belleville | Commercial | $3,435,000 | 30% |

| East | Belleville | Industrial | $408,000 | 30% |

| East | Renfrew County | Commercial | $1,661,000 | 30% |

| East | Renfrew County | Industrial | $186,000 | 30% |

| East | Cornwall | Commercial | $2,048,000 | 30% |

| East | Cornwall | Industrial | $220,000 | 30% |

| East | East Region | Commercial | $9,175,000 | 26% |

| East | 61 Other Benefitting Municipalities | Industrial | $4,554,000 | 22% |

| Southwest | London | Commercial | $19,288,000 | 30% |

| Southwest | London | Industrial | $1,663,000 | 30% |

| Southwest | Windsor | Commercial | $8,168,000 | 30% |

| Southwest | Windsor | Industrial | $1,905,000 | 30% |

| Southwest | Lambton County | Commercial | $4,623,000 | 30% |

| Southwest | Lambton County | Industrial | $1,419,000 | 30% |

| Southwest | Essex County | Commercial | $4,380,000 | 30% |

| Southwest | Essex County | Industrial | $1,608,000 | 30% |

| Southwest | Oxford County | Commercial | $3,463,000 | 30% |

| Southwest | Oxford County | Industrial | $2,187,000 | 30% |

| Southwest | Grey County | Commercial | $2,788,000 | 30% |

| Southwest | Grey County | Industrial | $282,000 | 30% |

| Southwest | Southwest Region | Commercial | $9,892,000 | 23% |

| Southwest | 44 Other Benefitting Municipalities | Industrial | $6,544,000 | 22% |

| Northeast | Greater Sudbury | Commercial | $1,957,000 | 10% |

| Northeast | Greater Sudbury | Industrial | $420,000 | 10% |

| Northeast | Sault Ste. Marie | Commercial | $728,000 | 10% |

| Northeast | Sault Ste. Marie | Industrial | $101,000 | 10% |

| Northeast | North Bay | Commercial | $668,000 | 10% |

| Northeast | North Bay | Industrial | $70,000 | 10% |

| Northeast | Timmins | Commercial | $405,000 | 10% |

| Northeast | Timmins | Industrial | $54,000 | 10% |

| Northeast | Temiskaming Shores | Commercial | $105,000 | 10% |

| Northeast | Temiskaming Shores | Industrial | $7,000 | 10% |

| Northeast | Northeast Region | Commercial | $753,000 | 10% |

| Northeast | 96 Other Benefitting Municipalities | Industrial | $603,000 | 9% |

| Northwest | Thunder Bay | Commercial | $1,292,000 | 10% |

| Northwest | Thunder Bay | Industrial | $127,000 | 10% |

| Northwest | Kenora | Commercial | $176,000 | 10% |

| Northwest | Kenora | Industrial | $38,000 | 10% |

| Northwest | Dryden | Commercial | $113,000 | 10% |

| Northwest | Dryden | Industrial | $21,000 | 10% |

| Northwest | Greenstone | Commercial | $94,000 | 10% |

| Northwest | Greenstone | Industrial | $6,000 | 10% |

| Northwest | Red Lake | Commercial | $50,000 | 10% |

| Northwest | Red Lake | Industrial | $30,000 | 10% |

| Northwest | Northwest Region | Commercial | $293,000 | 10% |

| Northwest | 27 Other Benefitting Municipalities | Industrial | $280,000 | 10% |

Table A.2 footnotes:

Source: Ontario Ministry of Finance.

Enabling Property Tax Relief for Small Businesses

The government has heard concerns about the property tax burden that small businesses face, and also understands that some municipalities are seeking additional property tax tools that would provide targeted tax relief to small businesses and increase business competitiveness. These tools would be particularly important as the province recovers from the COVID‑19 pandemic.

In response to concerns about the property tax burden on small businesses, the Province plans to provide municipalities with the flexibility to target property tax relief to small businesses, in a way that best reflects their local circumstances. Beginning in 2021, municipalities would be able to adopt a new optional property subclass for small business properties. The small business property subclass will allow municipalities to target tax relief by reducing property taxes to eligible small business properties.

The Province will also consider matching these municipal property tax reductions in order to provide further support to small businesses. This means that small businesses could benefit from both municipal and provincial property tax relief of as much as $385 million by 2022–23, depending on municipal adoption of this new tool.1

To ensure appropriate flexibility, the government is proposing an amendment to the Assessment Act that would allow municipalities to define small business eligibility in a way that best meets local needs and priorities.

Reviewing Ontario’s Property Assessment and Taxation System

A well-functioning property tax and assessment system is critical to ensuring that Ontario remains competitive while supporting local services and elementary and secondary education. As announced in the 2019 Ontario Economic Outlook and Fiscal Review, the government is conducting a review to explore opportunities to:

- Enhance the accuracy and stability of property assessments;

- Support a competitive business environment; and

- Strengthen the governance and accountability of the Municipal Property Assessment Corporation (MPAC).

Input has been sought from taxpayers, municipalities, industry associations and other interested stakeholders. While the consultation process is ongoing, in addition to enabling new property tax relief for small businesses, early action is being taken on the following issues based on the valuable input that has been received to date from stakeholders.

New Assessment Tools for Redevelopment Areas

One of the concerns that has been identified through the property assessment and taxation review is the impact of redevelopment pressure on small businesses. In areas that are experiencing high demand for redevelopment, the Province has heard that there is potential for speculative sales to impact property assessments, which in turn can impact property tax burdens. This issue was highlighted earlier this year by the Member of Provincial Parliament (MPP) for Eglinton-Lawrence, Robin Martin, with the proposed Bill 179, Assessment Amendment Act (Areas in Transition), 2020.

To ensure the government is well-positioned to respond to the input that is being received, amendments to the Assessment Act are being introduced to support the potential creation of optional new assessment tools to address concerns regarding redevelopment and speculative sales.

These amendments, together with the new optional small business property subclass, would provide municipalities with substantial flexibility to address the concerns of small business.

Enhancing Assessment Accuracy and Stability

Another concern that has been expressed through the property assessment and taxation review relates to aspects of the complex methodologies used by MPAC to assess certain types of properties, particularly large industrial facilities. Challenges with these methodologies can lead to costly and protracted assessment appeals. As part of this review, the government is working with stakeholders to identify potential options to enhance the accuracy and transparency of these assessment methodologies, resulting in greater stability and fewer appeals.

In addition, one of the important elements contributing to accurate and transparent assessments is an open and effective exchange of information between property owners and MPAC. Through the consultation and review process, opportunities are being explored to improve the information disclosure and engagement process with the goal of enhancing the accuracy of assessments, reducing appeals, and supporting taxpayer confidence in the integrity of the property tax system.

Cancelling the Scheduled Wine Tax Increase and Freezing Beer Tax Rates

The government has made a number of changes in response to the unique circumstances and economic hardships being faced by the hospitality sector and the beverage alcohol sector. This included measures such as temporarily allowing restaurants and bars to extend outdoor patios, and to include alcohol as part of food take-out and delivery orders. The government is committed to explore options to permanently allowing alcohol to be included in food take-out and delivery orders before the existing regulation expires on December 31, 2020.

The government is freezing beer tax rates until March 1, 2022, and is proposing to retroactively cancel the increase in wine basic tax rates legislated to occur on June 1, 2020. The government issued an order under the Financial Administration Act during the state of emergency that prevents the increase from being applied between June 1, 2020 and December 31, 2020.

Summary of Measures

Table A.3 reflects the fiscal impacts of new measures proposed in this 2020 Budget.

| 2020–21 | 2021–22 | 2022–23 | |

|---|---|---|---|

| Reducing the Employer Health Tax | 90 | 360 | 380 |

| Introducing the Seniors’ Home Safety Tax Credit1 | 10 | 20 | – |

| Maintaining Cultural Media Tax Credit Eligibility2 | – | 45 | 35 |

| Supporting Research and Development | – | – | – |

| Reducing Property Taxes for Employers | 175 | 385 | 450 |

| Property Tax Relief for Small Businesses | 35 | 85 | 110 |

| Cancelling the Scheduled Wine Tax Increase and Freezing Beer Tax Indexation3 | 4 | 20 | 20 |

| Total | 315 | 915 | 995 |

Table A.3 footnotes:

Notes: Positive numbers represent a decrease in government revenue, unless otherwise indicated.

[1], [2] Measure represents an increase in government expenditures.

[3] This impact reflects making regulatory amendments to O. Reg. 257/10 to freeze the beer basic tax rate indexation.

Numbers may not add due to rounding.

Estimates between $1 million and $10 million are rounded to the nearest $1 million. Estimates greater than $10 million are rounded to the nearest $5 million.

“–” indicates a nil amount, or a small amount (less than $1 million).

Source: Ontario Ministry of Finance.

Technical Amendments

Amendments will be proposed to various statutes administered by the Minister of Finance to improve administrative effectiveness or enforcement, maintain the integrity and equity of Ontario’s tax and revenue collections system, or enhance legislative clarity or regulatory flexibility to preserve policy intent.

Taxation

Technical amendments are proposed to the Taxation Act, 2007 that would ensure that:

- Individuals continue to have the right to appeal the amount of Ontario Trillium Benefit, Ontario Sales Tax Credit, Ontario Energy and Property Tax Credit or Northern Ontario Energy Credit that they are entitled to receive;

- The Adoption Expenses tax credit can continue to be used in calculating the amount of tax payable by the spouse or common-law partner, when determining the amount of tax credits that can be transferred to a taxpayer from their spouse or common-law partner;

- The Low-income Individuals and Families Tax Credit continues not to affect the calculation of the Ontario surtax; and

- The Community Food Program Donation Tax Credit for Farmers continues to be the last tax credit to apply in calculating an individual’s Ontario income tax.

A technical amendment to the Municipal Property Assessment Corporation Act, 1997 would ensure continued administrative efficiency in the provision of assessment information.

Other Legislative Initiatives

Additional proposed legislative initiatives include:

- Amendments to the Pension Benefits Act to support the continued development of a target benefit framework and to reintroduce certain unproclaimed provisions of the Pension Benefits Act that are scheduled for automatic repeal later this year.

- Amendments to the Pension Benefits Act to exempt the Pension Plan of Canadian Press Enterprises Inc. and the Canadian Press Enterprises Inc. Pension Plan for Employees Represented by the Canadian Media Guild from the application of the Pension Benefits Guarantee Fund from the date of their establishment to the date of their conversion into a jointly sponsored pension plan.

- Amendments to the Financial Administration Act to allow for any signatures on security certificates or coupons to be electronically reproduced and to allow for the seal of the Minister of Finance to be electronically reproduced on security certificates.

- Amendments to the Financial Administration Act to support reporting of historic liabilities arising from future changes in Public Sector Accounting Standards.

- Amendments to the Municipal Act, 2001 and the City of Toronto Act, 2006 to streamline processes related to implementing certain municipal property tax options, based on input received during the property assessment and taxation review process.

- An amendment to the Assessment Act that would provide regulatory flexibility for the Minister of Finance to make adjustments to the current rules regarding the phase-in of property assessment increases. This would allow the Minister to change the phase-in parameters for subsequent reassessments, which may be necessary as a result of the postponement of the 2021 reassessment.

- Amendments to the Assessment Act to apply the existing property tax exemption for Ontario branches of the Royal Canadian Legion, for 2019 and subsequent tax years, to Ontario units of the Army, Navy and Air Force Veterans in Canada.

- Amendments to the Liquor Licence and Control Act, 2019, which is not yet in force, and the Alcohol, Cannabis and Gaming Regulation and Public Protection Act, 1996 as part of the government’s ongoing efforts to modernize the regulatory framework of alcohol beverages. These amendments would ensure that Ontario has the authority to make needed regulations to implement the new framework, including the power to respond to new emerging product types and to delegate powers and duties to the Liquor Control Board of Ontario (LCBO) or Registrar of the Alcohol and Gaming Commission of Ontario where appropriate. The amendments would also revise the concepts of “retail store” and “permit” to ensure that every existing authorization can be adapted to the new framework with minimal red tape, and would clarify other existing provisions to ensure a smooth transition from the current framework to the new framework.

- An amendment to the Ontario Cannabis Retail Corporation Act, 2017 that would increase the maximum number of members on the Ontario Cannabis Retail Corporation board of directors from seven to nine.

- Introduction of the proposed Interim Appropriation for 2021–2022 Act, 2020. If approved by the Legislature, this would provide the interim legal spending authority for anticipated 2021–22 spending, pending finalization of the 2021–22 supply process.

- Introduction of the proposed Supplementary Interim Appropriation for 2020–2021 Act, 2020. If approved by the Legislature, this would provide supplementary interim legal spending authority for anticipated 2020–21 spending, pending finalization of the

2020–21 supply process. - Amendments to the Ontario College of Teachers Act, 1996 to modernize the governance structure of the Ontario College of Teachers.

- Amendments to the Ontario College of Teachers Act, 1996 and the Early Childhood Educators Act, 2007 to support the safety of students and children in schools and child care settings.

- Housekeeping amendments to the Provincial Offences Act to enable staggered proclamation of amendments that were passed in 2017.

- Amendments to the Conservation Authorities Act to further focus conservation authorities on their core mandate and improve overall governance, oversight and accountability of conservation authorities, reflecting a commitment made in the Made-in-Ontario Environment Plan.

- Amendments to the Provincial Parks and Conservation Reserves Act, 2006 to enhance land management powers and authorities.

- Amendments to the Resource Recovery and Circular Economy Act, 2016 to expand the authority of the Lieutenant Governor in Council to make regulations that provide producers control over the design and establishment of a provincewide collection system for blue box materials.

- Introduction of the proposed Innovation Centre Governance Act, 2020, which is intended to strengthen the Ontario Centres of Excellence Inc. as a central player in Ontario’s innovation ecosystem. If passed, the Act would permit the Minister of Economic Development, Job Creation and Trade to appoint up to six members of the organization’s thirteen-member board of directors.

- Amendments to repeal the Film Classification Act, 2005 and to introduce the proposed Film Content Information Act, 2020. This would provide flexibility to the film industry and replace outdated classification requirements with a requirement to provide information on the film’s content to inform viewing choices. The proposed new statute would also eliminate all licensing requirements.

- Consequential amendments to the Schedule to the Limitations Act, 2002 to provide that the limitation periods set out in subsections 98(3), 187(14), and 187(15) of the unproclaimed Not-for-Profit Corporations Act, 2010 would apply instead of the limitation periods established under the Limitations Act, 2002.

- Amendments to the Crown Forest Sustainability Act, 1994 to enable forestry activities on Crown land to be conducted under the Act without requiring authorizations or being subject to orders under the Endangered Species Act, 2007. This amendment would avoid duplications in approvals. Species at risk, and their habitat, would continue to be protected under the Crown Forest Sustainability Act, 1994 sustainable forest policy framework, and the Lieutenant Governor in Council would be provided a new authority to make regulations to address impacts to species at risk in the forestry context.

- Amendments to the Ontario Northland Transportation Commission Act to enhance ministerial authority and address housekeeping items. A number of oversight and approval functions currently exercised by the Lieutenant Governor in Council would be transferred to the Minister of Transportation. The Minister of Transportation would be given authority to issue binding directives to the Ontario Northland Transportation Commission. Provisions respecting the audit of the Commission would be modernized.

- Amendments to the Highway Traffic Act to grant the Minister of Transportation statutory authority for the Authorized Requester Program established in 1994. The program provides oversight for any disclosure of personally identifiable driver and vehicle licencing information to qualified requesters, under contract.

- Amendments to the Ministry of Agriculture, Food and Rural Affairs Act to enable the Ontario Risk Management Program to carry forward unused funds in good production years to offset losses in future years, in alignment with an insurance-like approach.

- Amendments to the Ontario Energy Board Act, 1998 to modernize Ontario Energy Board (OEB) objectives by making innovation in the electricity sector a legislated objective of the OEB; to strengthen conflict of interest rules for OEB commissioners; and to amend early access to land provisions to streamline approvals to make the process more efficient.

Footnotes

[1] Estimated total municipal and provincial relief reflects assumptions about potential rate of municipal uptake of the small business property subclass, the extent of the rate reduction applied to the subclass and provincial matching of the municipal relief.

Chart Descriptions

Chart A.1: Distribution of Current Business Education Tax Rates above Proposed 2021 Rate

The chart illustrates the distribution of Business Education Tax (BET) rates for the commercial and industrial property classes in 2020. Each blue circle represents a single or upper-tier BET rate above the proposed reduced BET rate of 0.88 per cent. Larger circles represent rates that apply to a larger number of municipalities.

The chart shows the distribution of BET rates that will be impacted by the proposed reduced rate to 0.88 per cent in 2021. The proposed 0.88 per cent target rate is ten basis points below the existing target rate of 0.98 per cent and represents a reduction of 30 per cent for the many businesses that are currently subject to the highest BET rates at 1.25 per cent. As a result, 94 per cent of all Ontario businesses will benefit from the reduction.

Chart illustrates all rates above the proposed maximum 2021 rate and does not show rates for the six per cent of businesses with rates that are below that rate.