Federal–Provincial Collaboration

Ontario: A Forward-Looking Leader and Collaborative Partner

With a plan that is focused on creating opportunity and making care more affordable for the people of Ontario, the Province continues to advocate for a collaborative approach with its federal, provincial and territorial partners. Ontario has led collaborative, forward-looking actions and investments — such as historic funding for public infrastructure, improving access to health care services, tackling climate change and transitioning to a low-carbon economy.

Ontario’s collaborative approach is delivering results and value for all Canadians, including increased and longer term federal funding to support shared priorities in infrastructure, an enhanced Canada Pension Plan, and progress towards expanded and modernized labour market funding and supports. These achievements demonstrate how a partnership between orders of government benefits all Canadians.

A key element of the government’s recovery plan includes working collaboratively with the federal government to ensure that fiscal arrangements are adequate, flexible and sustainable.

Addressing Challenges through a Collaborative Approach

Now more than ever, it is time to embrace collaborative partnerships across Canada to deliver greater prosperity to the people of the province. Ontario and Canada still face complex challenges as well as new uncertainties. These include long-term challenges such as an aging population and the dangers of climate change, but also more immediate challenges like mounting household debt and tax reform, and evolving trade policies in the United States.

Provinces Face Greater Exposure to Uncertainty and Challenges

Many of the challenges that are facing Canada will likely impose significant fiscal pressure on the provinces and territories, which are predominantly responsible for the delivery of programs and services most affected by demographic changes, such as health care, education and social services.

The Parliamentary Budget Officer (PBO) has consistently demonstrated that the federal government’s fiscal position will be better than that of provinces and territories over the longer term. This disparity is partly the result of the federal government having greater ability to raise revenue relative to the services it delivers. In addition, it has limited its financial contribution to key programs, such as health care, without consideration of the demand or need for public services. Meanwhile, provinces and territories will face considerable fiscal pressures, particularly in a time of economic uncertainty, which could impact the costs and demand for public services. In the face of these challenges, the provincial-territorial order of government continues to make the necessary and critical investments needed to provide the high-quality public services Canadians expect and deserve.

Ontario has a plan to invest in key priorities and as a result will be running deficits, similar to the federal government. However, the federal government is insulated from long-term spending pressures. It is vital that the federal government do its fair share to provide adequate, sustainable and flexible support to the provinces and territories, ensuring the ongoing delivery of high-quality public services that all Canadians expect and deserve.

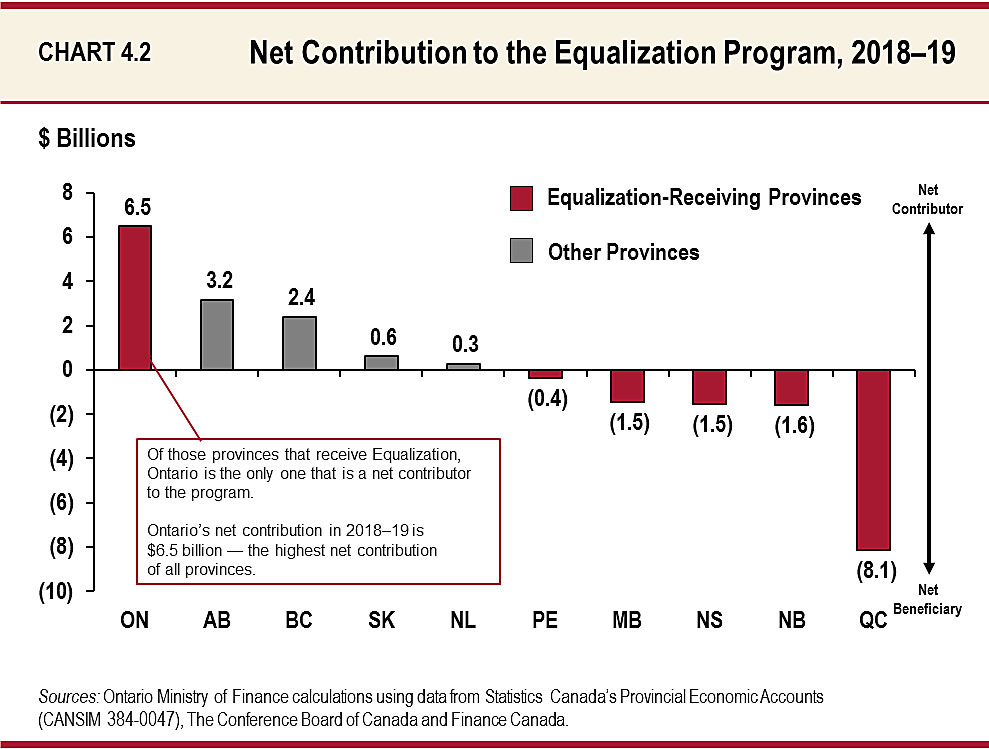

Ontario is a Significant Net Contributor to the Federation

Ontario is proud of its significant and growing contribution to the federation. Research by the Mowat Centre1 has shown that Ontario contributes more to the Canadian federation than it gets back in federal government spending. For Equalization alone, the province’s net contribution is estimated to be $6.5 billion in 2018–19, and has reached a total of approximately $45 billion since Ontario first qualified for the program in 2009–10. The province has recorded stronger economic growth than Canada since 2014, and will soon stop receiving federal Equalization payments, given its strength relative to other provinces.

Equalization is an important part of the Canadian federation, embedded in the Constitution. However, in a climate of uncertainty and rapid economic change across Canada, a responsible and critical assessment of the Equalization program should be taken to ensure that the impacts of any changes are thoroughly understood and fair to the people of Ontario. The Province will continue to press the federal government for fair treatment under the program.

Fiscal Arrangements Need to Keep Pace with Provincial Investments

Fiscal arrangements are a key pillar of support for provinces and territories in delivering public services that Canadians use every day and at every stage of life. This is why it is critical that these funding arrangements keep pace with Provincial investments in public services and do not unduly leverage Provincial spending. To maximize the outcomes and benefits of this funding, fiscal arrangements should be adequate, sustainable and flexible, and take advantage of Provincial expertise in service delivery.

Strengthening Health Care

Increasing access to essential health services is part of Ontario’s plan to create opportunity and make care more affordable. The Province is committed to investing in the health care system so that the people of Ontario can access the health care services they require, when and where they need them. See Chapter I: A Plan for Care for more details.

The provinces’ and territories’ 10-year funding agreement with the federal government for home and community care and mental health and addictions services will support the significant investments and actions that Ontario is already making in these priority areas. This includes providing care at, or close to, home to meet the demand of a growing and aging population, as well as providing access to proven mental health and addictions services supports and services for children, youth and adults. The provision of high-quality health care services to the people of Ontario is a top priority for the Province, and should be for the federal government as well. Compared to the 2017 Budget, Ontario is increasing investments in health care by more than $5 billion between 2018–19 and 2020–21.

As the Province continues to work with the federal government to finalize the details of its agreement, it is critical that the funding partnership with the federal government be adequate and remain flexible enough to respond to the evolving needs of the people of Ontario.

Forming a National Pharmacare Plan

Ensuring that the people of Ontario have access to the medications that will keep them healthy is a priority for the Province — a national pharmacare plan would support this goal. Ontario is pleased that the federal government recognizes the importance of this issue, as evidenced by the recent announcement of the creation of an Advisory Council on the Implementation of National Pharmacare. Ontario has already taken action and is leading the way with OHIP+, which provides young people under the age of 25 with access to over 4,400 prescription products at no cost, regardless of income.

In addition to transforming the public drug programs and benefits, Ontario is taking the next steps to improve the affordability of prescription drugs. As part of this Budget, the Province is eliminating the annual deductible and co-payment for seniors under the Ontario Drug Benefit in August 2019, and introducing a new drug and dental program for people who do not have coverage from an extended health plan, starting in the summer of 2019.

See Chapter I: A Plan for Care for more details.

Ontario, in collaboration with its federal, provincial and territorial partners, has also made progress to improve the affordability, accessibility and appropriate use of prescription drugs for Canadians. In January 2018, after discussions led by Ontario, British Columbia and Saskatchewan, a new joint initiative was announced between the pan-Canadian Pharmaceutical Alliance and the Canadian Generic Pharmaceutical Association. Starting April 1, 2018, the prices for almost 70 of the most commonly prescribed drugs in Canada will be discounted up to 90 per cent off the equivalent cost of their brand-name equivalents. Over 70 per cent of all prescriptions reimbursed under Canada’s public drug plans are generic drugs, including those used by millions of Canadians to treat high blood pressure, high cholesterol and infections.

Over the next five years, this initiative is expected to generate savings of up to $3 billion for public drug plans through a combination of price reductions and the launch of new generic drugs. Ontario plans to reinvest these savings in funding new innovative drug therapies, as well as ensuring the sustainability of its public drug plans, including OHIP+.

This is just one example of how Ontario’s collaborative approach is helping improve the lives of Ontarians. The Province will continue to engage with its provincial, territorial and federal partners to work towards creating a national pharmacare plan so that all Canadians can enjoy a healthier future for themselves and their families.

Implementing Legalization of Cannabis

The federal government’s Cannabis Act, if passed, would permit the legal production, sale and possession of recreational cannabis across Canada later in 2018.

In response to the federal decision to legalize recreational cannabis, Ontario has passed legislation to establish a safe and sensible framework within the province that protects youth and reduces harm.

Ontario’s framework covers the sale, distribution, purchase, possession and consumption of cannabis in the province. Established as a Crown corporation and subsidiary of the LCBO, the Ontario Cannabis Retail Corporation, operating as the Ontario Cannabis Store, will be responsible for new stand-alone cannabis storefronts and an online distribution channel.

In support of a safe and sensible framework, and to protect the health and well-being of everyone in Ontario, the Province will undertake initiatives in public health, road safety, education and law enforcement, such as:

- Increasing the capacity of local law enforcement, including the Ontario Provincial Police, by funding sobriety field test training for police officers to help detect impaired drivers;

- Creating a specialized legal team to support drug-impaired driving prosecutions;

- Increasing capacity at the province’s Centre of Forensic Sciences to support toxicological testing and expert testimony;

- Developing a program to divert youth involved in minor cannabis-related offences away from the criminal justice system;

- Creating a Cannabis Intelligence Coordination Centre to shut down illegal storefronts and help fight the unsafe and illegal supply of cannabis products;

- Providing public health units with support and resources to help address local needs related to cannabis legalization;

- Raising awareness of the new Provincial rules that will take effect when cannabis is legalized federally; and

- Making information and resources on cannabis available to educators, parents, guardians and students.

At the Finance Ministers meeting in December 2017, Ontario and 11 other provinces and territories agreed in principle to join the federal government in a coordinated taxation framework for cannabis. Ontario intends to enter into an agreement with the federal government under which Ontario would receive 75 per cent of the federal excise duty collected on cannabis intended for sale in the province.

An appropriate level of taxation is an important part of eliminating the illicit market. A coordinated approach will help meet Ontario’s objectives for cannabis legalization.

See Chapter V, Section A: Tax Measures for information on how the government intends the Ontario First Nations HST Point-of-Sale Rebate to apply to cannabis.

Working with Municipalities

Ontario has been working with municipalities as critical partners in preparing for the legalization of cannabis. To help address the incremental implementation costs of legalization, Ontario will be providing municipalities with $40 million over the first two years of legalization through the Ontario Cannabis Legalization Implementation Fund. This funding will be provided from Ontario’s portion of the federal excise duty on recreational cannabis. If the Province’s portion of the revenue from the federal excise duty on recreational cannabis for the first two years of legalization exceeds $100 million, the Province will provide municipalities with 50 per cent of the surplus. This funding, in addition to the Provincial initiatives in public health, road safety, education and law enforcement, will help municipal efforts as the date of federal legalization approaches. The Province will continue to work with municipalities to respond to the cost impact of legalization.

Engaging with Indigenous Communities and Organizations

Alongside the federal government, Ontario recognizes the need to engage in a meaningful way with Indigenous communities and organizations on topics related to cannabis legalization. Ontario’s legislative framework includes flexibility to address community-specific, on-reserve approaches. This includes the ability to make agreements with First Nation communities related to cannabis regulation, including minimum age requirements, permitted places of use and enforcement. It also enables a First Nation band council to request the delivery of recreational cannabis to a reserve to be prohibited by regulation, and authorizes the Minister of Finance to enter into agreements with First Nation communities that are interested in on-reserve retailing. Ontario is committed to continuing the dialogue with Indigenous communities and organizations to discuss interests, perspectives, concerns and specific opportunities for collaboration.

Investing in Infrastructure

Ontario is taking the lead in strategic infrastructure investments. This builds on previous budget commitments to invest in infrastructure — resulting in about $230 billion over 14 years, beginning in 2014–15. This is the largest infrastructure investment in schools, colleges, universities, hospitals, public transit, roads and bridges in the province’s history. The next 10 years of investments will help create strong, stable communities across Ontario that improve the lives of Ontarians and will support about 140,000 jobs, on average, each year. See Chapter II: Growing the Economy and Creating Good Jobs for more details.

Infrastructure Updates: Federal–Provincial Negotiations

The government of Ontario continues to work collaboratively with the federal government to make long-term infrastructure investments that will create economic growth, sustain well-paying jobs, build inclusive communities and support a low-carbon, green economy leading to a higher quality of life for all Canadians.

On March 14, 2018, Canada and Ontario announced the signing of a bilateral agreement that will provide more than $11.8 billion over the next decade in federal funding dedicated to infrastructure projects through the Investing in Canada Plan. The projects supported through this agreement will have a total value of over $31 billion, including $10 billion committed by the Ontario government. These projects will be cost-shared with the Ontario government, municipalities and other partners. It will provide municipalities and First Nation communities with stable, long-term funding that will build liveable communities and enhance the quality of life for Ontario families.

This new funding will see the Government of Canada and the Province of Ontario make significant investments in public transit, green infrastructure, and recreational and cultural infrastructure.

For the Community, Culture and Recreation Stream, the Province will work with municipalities and not-for-profits to identify projects that could be nominated for federal funding, such as the Bridletowne Neighbourhood Hub in Scarborough, William Baker Neighbourhood Community Centre in Downsview and Lawrence Heights Community Centre in Toronto.

Increased and longer term federal funding should support shared priorities in infrastructure investments. Ontario continues to work with its federal partner to ensure that the people of Ontario benefit from collaboration in this critical area with a fair share of federal funding.

See Chapter II, Growing the Economy and Creating Good Jobs for more details.

Clean Water and Wastewater Fund

Working alongside the federal government, the Province is continuing to make investments to ensure families have access to clean and safe water through modern, reliable water and wastewater infrastructure. In addition to the $1.1 billion cost shared among provinces, federal, municipal governments and First Nations, Ontario will work with its partners to invest a further $2.8 billion in related projects including water and wastewater. These investments will safeguard the health and well-being of residents, protect waterways and preserve local ecosystems, help Ontario adapt to a changing climate, and lay the foundation for new economic opportunities.

Providing Access to Affordable Housing

The government is committed to ensuring that everyone in Ontario has an affordable and suitable place to call home, advanced by the release of the Fair Housing Plan in 2017 and the Long-Term Affordable Housing Strategy Update in 2016. See Chapter I: A Plan for Care for more details.

Ontario welcomes the federal announcement of a National Housing Strategy (NHS) that will build upon investments that Ontario is already making. The NHS will help with the provision of housing assistance to vulnerable Ontarians, including Indigenous peoples, women and children fleeing family violence, seniors, people with disabilities, people dealing with mental health and addictions issues, veterans and young adults. See Chapter II: Growing the Economy and Creating Good Jobs for more details.

Ontario is investing more than $1 billion each year in housing and welcomes a federal partnership after years of advocating on the national level to build stronger communities and help Ontarians access safe, affordable housing.

Ontario plans to cost-match the Federal-Provincial/Territorial Housing Partnership and the Canada Housing Benefit (previously the Investment in Affordable Housing program) under the NHS. This includes a portable housing benefit and funds for distinct housing priorities, including affordability, repair and construction.

As the Province continues to negotiate and work with the federal government on the NHS, it is important that the new funding be aligned with Ontario’s Long-Term Affordable Housing Strategy Update and be responsive to local needs, while promoting innovation and ensuring public accountability.

A strong and sustainable non-profit and cooperative housing system is essential to supporting social and economic inclusion for low-income Ontarians.

Improving Labour Market Transfers

The Province is already making investments to ensure that the people of Ontario are able to access the high-quality training and labour market supports they require. See Chapter II: Growing the Economy and Creating Good Jobs for more details.

Ontario’s leadership, together with its collaborative approach with federal, provincial and territorial partners, is yielding results. The Province has long called for labour market transfers that are flexible, adequate and responsive. For many years, the majority of unemployed Ontarians have not been eligible for federally funded training.

The new Workforce Development Agreements, along with amendments to the Employment Insurance Act, would help address this issue by expanding the scope of labour market supports and broaden worker eligibility for federally funded training programs and services.

The Province will continue to work with the federal government to ensure that Ontario workers get access to the training and supports they need to earn more money, improve their job security and succeed in a changing economy.

Enhancing the Working Income Tax Benefit

With the changing labour market experienced by many Ontarians, there is a need to strengthen supports for low-income and precariously employed workers. That is why Ontario has long advocated for an enhancement to the Working Income Tax Benefit (WITB).

Ontario welcomes the federal government’s announcement to introduce the new Canada Workers Benefit (CWB) that will replace the WITB, starting in 2019. Compared to the WITB, the CWB will be easier to access and provide higher benefits for low-income workers.

Higher benefits through the CWB are in addition to the increase advocated by Ontario, as part of the Canada Pension Plan (CPP) enhancement negotiations, to protect low-income workers from the additional cost of CPP contributions.

The Province looks forward to working closely with the federal government to ensure that the new CWB best serves the needs of low-income workers and supports Ontario’s plan to reform the income security system.

Tackling Climate Change

Ontario is transitioning to a competitive and low-carbon economy to ensure a healthy environment for generations to come. This shift is encouraging economic growth and job creation by helping business and households reduce their greenhouse gas (GHG) emissions and introducing innovative low-carbon solutions. See Chapter II: Growing the Economy and Creating Good Jobs for more details.

To support the actions Ontario is taking to reduce GHG emissions and build a prosperous low-carbon economy, the Province is working collaboratively with the federal government to identify opportunities for investments of up to $420 million in Ontario under the new federal Low Carbon Economy Fund.

Working in Partnership with Municipalities

All 444 of Ontario’s municipalities work hard to provide high-quality, critical services to their residents. The Province continues to increase financial support to municipalities across Ontario, in recognition of the important role that they play.

In 2018, the Province will provide municipalities with ongoing support of more than $4.2 billion — nearly four times the level of support provided in 2003. This means municipalities will have more financial flexibility to invest in local priorities.

This increased support has helped to place municipalities on a financially sustainable footing. Appreciating that infrastructure investments are critical to ensuring Ontario’s long-term sustainability and prosperity, moving forward, the government will continue to focus on investing in infrastructure that will benefit communities across Ontario.

Provincial support to municipalities includes:

- Making major investments in transit infrastructure, including transforming the GO rail network from a commuter service to a regional transit system through GO Regional Express Rail (RER), as well as investing in other rapid transit projects across the province, including projects in the cities of London, Ottawa and Toronto.

- Providing a predictable source of funding from the Province’s Gasoline Tax for municipalities to improve and expand transit services. The Province has committed to doubling the municipal share of the Gasoline Tax revenue from the current two cents per litre to four cents per litre by 2021–22.

- Providing funding to small, rural and northern communities through the Ontario Community Infrastructure Fund (OCIF). The OCIF funding will increase to $300 million per year by 2018–19 to support the construction and renewal of critical road, bridge, water and wastewater infrastructure.

- Launching a new Community Transportation Grant Program that will provide $40 million over five years to help municipalities, Indigenous communities, Indigenous-led organizations and not-for-profits improve travel options in areas that are not served or are underserved by public transit and intercommunity bus service.

- Providing up to $25 million over five years for tools and supports to help municipalities improve their asset planning capacity and promote infrastructure sustainability.

- Providing unconditional funding under the Ontario Municipal Partnership Fund (OMPF). In 2018, the Province is providing an additional $5 million through the Northern Communities Grant component, increasing the total OMPF envelope to $510 million.

- Investing up to $26 million in the Main Street Revitalization Initiative to help communities attract investment and tourism, create jobs and enhance regional economic growth as part of a $40 million provincial investment in main streets across Ontario.

- Removing more than $2 billion in costs from the municipal property tax base in 2018 by uploading social assistance benefit costs, as well as court security and prisoner transportation costs, for a total benefit to municipalities of $13.5 billion since the uploads began in 2008.

- Extending to municipalities a new authority to levy a hotel tax.

- Providing municipalities with new tools to help increase the supply of housing, including a Vacant Homes Property Tax to encourage property owners to sell unoccupied units or make them available to be rented.

- Increasing municipal flexibility to more effectively manage business property taxes.

- Investing up to $150 million of proceeds from the Provincial carbon market into a new Municipal Greenhouse Gas (GHG) Challenge Fund. The Fund aims to support municipal projects that reduce GHG emissions, including buildings, energy supply, transportation, water and waste. Selected projects will be announced in 2018.

- Working with the federal government to invest in infrastructure programs, such as the Clean Water and Wastewater Fund (CWWF), which will result in over $1.1 billion in cost-shared water, wastewater and storm water projects in municipalities and First Nation communities across Ontario.

- Working with municipalities as critical partners in preparing for the legalization of cannabis, including providing $40 million over the first two years of legalization to help municipalities address incremental implementation costs. See the section Implementing Legalization of Cannabis earlier in this chapter for more details.

- Investing more than $70 million over 10 years to support new priority municipal infrastructure projects such as the Stratford Grand Trunk Community Hub and the Peterborough Arena Complex.

Chart Descriptions

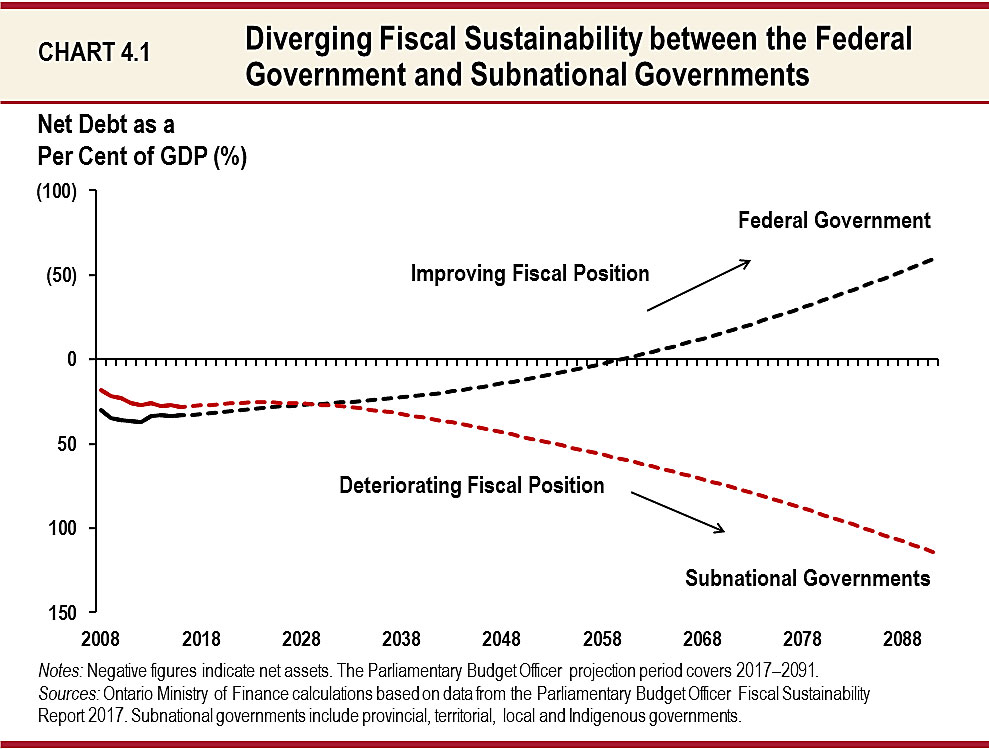

Chart 4.1: Diverging Fiscal Sustainability between Federal Government and Subnational Governments

This line chart illustrates trends of the ratio of net debt as a share of Canada’s gross domestic product (GDP) from 2008 to 2091. The net debt-to-GDP ratio is often used to analyze the fiscal sustainability of the federal government and subnational governments, which include provincial, local and Indigenous governments. Net debt-to-GDP estimates are based on data from the Parliamentary Budget Officer Fiscal Sustainability Report 2017.

The chart shows that the federal government is expected to have a net debt-to-GDP ratio higher than that of other governments combined from 2008 to 2029. This relationship is projected to reverse starting in 2030. From 2030 to 2091 the difference between net debt-to-GDP ratios between the federal government and subnational governments increases, reflecting a progressively stronger fiscal position for the federal government and a deteriorating fiscal position for subnational governments.

Chart 4.2: Net Contribution to the Equalization Program, 2018–19

This chart shows that in 2018–19, Ontario is expected to be the largest net contributor to the Equalization program, with a projected net contribution of $6.5 billion. Ontario is followed by Alberta with a projected net contribution of $3.2 billion, British Columbia with a projected net contribution of $2.4 billion, Saskatchewan with a projected net contribution of $0.6 billion, and Newfoundland and Labrador with a projected net contribution of $0.3 billion. All other provinces receive more in Equalization payments than their taxpayers contribute through federal taxes and include Prince Edward Island with a projected net contribution of negative $0.4 billion, Manitoba with a projected net contribution of negative $1.5 billion, Nova Scotia with a projected net contribution of negative $1.5 billion, New Brunswick with a projected net contribution of negative $1.6 billion, and Quebec with a projected net contribution of negative $8.1 billion.

Footnote

[1] Erich Hartmann and Jordann Thirgood, “Mind the Gap: Ontario’s Persistent Net Contribution to the Federation,” Mowat Centre, School of Public Policy and Governance, University of Toronto, (2017), https://mowatcentre.ca/wp-content/uploads/publications/142_mind_the_gap.pdf