The Government of Ontario will protect what matters most. It is starting the province down the path to fiscal sustainability to protect critical services such as health care and education.

Health care

The government is:

- Investing an additional $384 million in hospitals and an additional $267 million in home and community care. This is essential to end hallway health care and direct more health care spending to where it’s needed the most. As well, to improve transitions in care and reduce wait times for services, the government is creating Ontario Health Teams to move toward an integrated health care delivery model.

- Investing $3.8 billion for mental health, addictions and housing supports over 10 years, beginning with the creation of a mental health and addictions system.

- Creating 15,000 new long-term care beds over the next five years and upgrading 15,000 older long-term care beds to provide more appropriate care to patients with complex health conditions.

- Introducing a new dental program for low-income seniors who lack benefits. Individual seniors with annual incomes of $19,300 or less or senior couples with combined annual incomes of less than $32,300, without existing dental benefits will be able to receive dental services in public health units, community health centres and Aboriginal Health Access Centres across the province.

Education

The government is:

- Improving the condition of schools to support better learning and keep children and students safe by investing $1.4 billion in school renewal in the 2019–20 academic year.

- Strengthening Ontario’s education curriculum, with particular emphasis on math and science, as well as job skills such as skilled trades and coding, and life skills such as financial literacy.

- Respecting parents by developing a Parents’ Bill of Rights aimed at improving communication with schools and school boards and allowing them to play a more active role in their children’s education.

- Supporting Indigenous student success by investing additional funds for a revised First Nations, Métis and Inuit studies curriculum and the Indigenous Graduation Coach Program.

Relief for families

The government is:

- Proposing a new Ontario Childcare Access and Relief from Expenses (CARE) tax credit. The CARE tax credit would be one of the most flexible child care initiatives ever introduced in Ontario. It is a plan that would put parents, and not the government, at the centre of the child care decision-making process. The new CARE tax credit would provide about 300,000 families with up to 75 per cent of their eligible child care expenses and allow families to access a broad range of child care options, including care in centres, homes and camps.

- Proposing to provide tax relief for families when they need it most. The death of a loved one is a difficult time for families. Effective January 1, 2020, the Estate Administration Tax would be eliminated for taxable estates with assets of $50,000 or less, and would be reduced by $250 for larger taxable estates.

- Committing up to $1 billion over the next five years to create up to 30,000 child care spaces in schools, including approximately 10,000 spaces in new schools, making life easier for parents and families by helping them find more affordable child care.

- Making home ownership and renting more affordable by helping to increase the supply of housing that people need through the forthcoming Housing Supply Action Plan.

- Making sure hard-working people get assistance to learn new skills when they lose a job through no fault of their own.

- Protecting communities by targeting crime through a Provincial Gun and Gang Support Unit to assist local police officers and prosecutors. In addition, creating a Gun and Gang Specialized Investigations Fund to support joint forces operations.

Chart Description

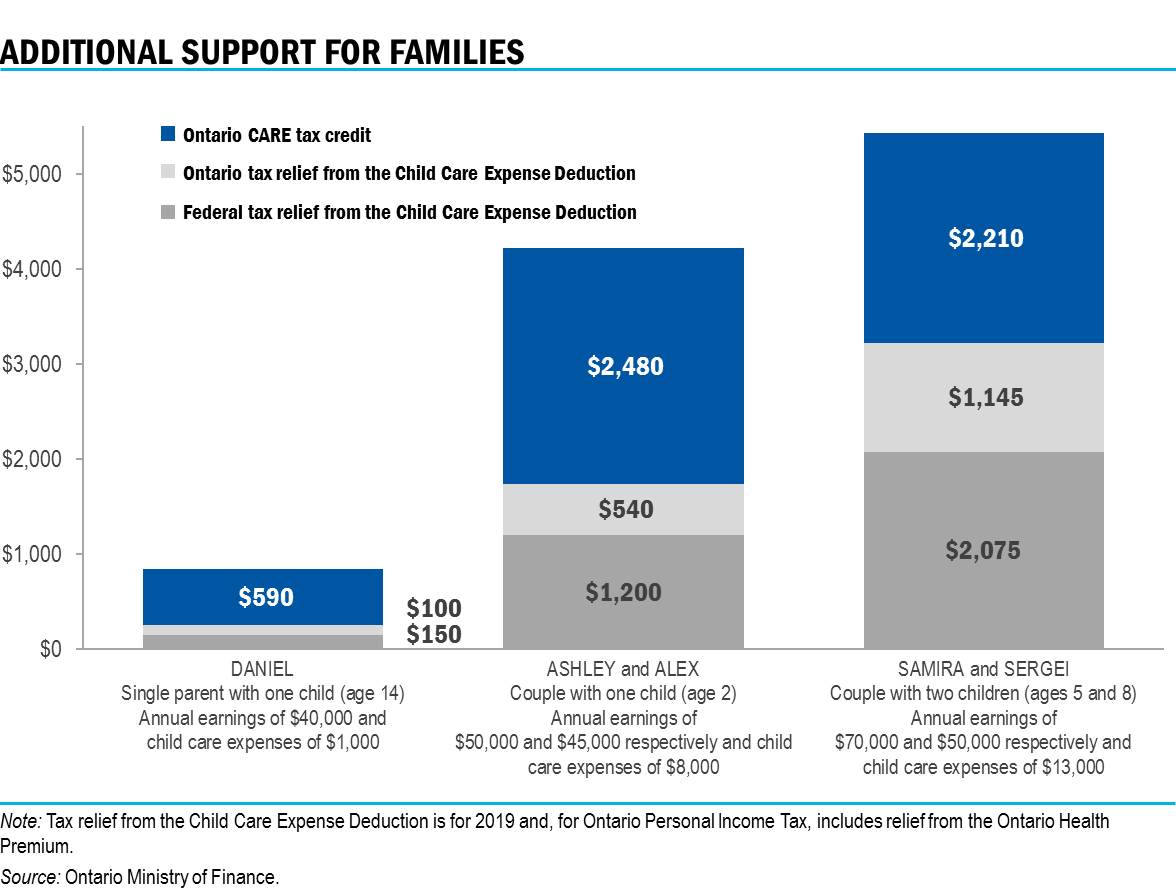

Chart 1: Additional Support for Families

This bar chart shows three examples of the additional support families would get in 2019 from the proposed Ontario CARE tax credit on top of the federal and Ontario Personal Income Tax relief they receive from the existing Child Care Expense Deduction.

Left section: A single parent (Daniel) with a fourteen-year-old child, annual earnings of $40,000, and eligible child care expenses of $1,000 for the year would get $150 in federal tax relief and $100 in Ontario tax relief from the deduction and an extra $590 from the proposed Ontario CARE tax credit.

Middle section: A couple (Ashley and Alex) with a two-year-old child, annual earnings of $50,000 and $45,000 respectively, and eligible child care expenses of $8,000 would get $1,200 in federal tax relief and $540 in Ontario tax relief from the deduction and an extra $2,480 from the proposed Ontario CARE tax credit.

Right section: A couple (Samira and Sergei) with two children (ages five and eight), annual earnings of $70,000 and $50,000 respectively, and eligible child care expenses of $13,000 would get $2,075 in federal tax relief and $1,145 in Ontario tax relief from the deduction and an extra $2,210 from the proposed Ontario CARE tax credit.

Note: Tax relief from the Child Care Expense Deduction is for 2019 and, for Ontario Personal Income Tax, includes relief from the Ontario Health Premium.

Source: Ontario Ministry of Finance.