Introduction

The impacts of the novel coronavirus (COVID‑19) global outbreak are being felt by Ontario families, businesses and communities.

The COVID‑19 outbreak has emerged not only as a serious international health concern, but as a threat to economies worldwide. While the situation continues to unfold, the Province is working with its partners to act urgently to protect the people of Ontario.

The government’s first steps, outlined today, will provide $7 billion in additional resources for the health care system and to provide direct support for people and jobs. It also will make available $10 billion in support for people and businesses through tax credits and deferrals to improve their cash flow, protecting jobs and household budgets, while providing the resources necessary to protect their health.

Given the global uncertainty and an unprecedented public health crisis, economic outlooks are changing at a rapid pace. The government of Ontario is committed to providing a financial update that is as current as possible. So instead of a full Budget, the government is releasing a one-year economic and fiscal update that is based on the best information available, as well as the first steps in its plan to tackle the COVID‑19 outbreak.

The update includes a one-year outlook based on available economic projections and provides certainty to hospitals, schools, municipalities and other partners for the year to come. It also includes increased resources for the health care system, direct support for people and jobs, and prompt action to help employers respond to the challenges ahead. This is an immediate, responsible course that helps create confidence and stability.

Ontario’s Action Plan: Responding to COVID‑19 includes resources for health professionals on the front lines to fight the COVID‑19 outbreak, and new measures to support businesses, seniors, parents, students, workers, Indigenous communities and vulnerable populations.

Ontario’s plan includes historic levels of prudence, including a dedicated $1.0 billion COVID‑19 contingency fund as part of the additional health care investments, an increased contingency fund of $1.3 billion and an unprecedented reserve of $2.5 billion — the largest in Ontario’s history — to provide continued flexibility to respond to changing global circumstances.

The government will build on its record of transparency with regular financial updates as the situation evolves. This will ensure the people of Ontario have the most current information available.

The Province will continue to closely collaborate with its partners, including the federal government and Ontario’s municipalities, to protect the economy. Experience has shown this is most effective when governments work together. And this is exactly what the province has done.

Ontario’s Action Plan: Responding to COVID‑19 outlines the Province’s first steps to tackle the COVID‑19 outbreak head on.

Highlights of Ontario’s Action Plan: Responding to COVID‑19

- $3.3 billion of additional resources for health care, including:

- $2.1 billion in new measures to support the COVID‑19 response including:

- A dedicated $1.0 billion COVID‑19 contingency fund;

- $341 million for hospital capacity to increase assessments and treatment;

- $243 million for long-term care home emergency capacity and new virus containment measures;

- $100 million more for public health;

- $170 million for community capacity, homecare and Telehealth Ontario;

- $62 million for health care workers in assessment centres, hospitals and the community;

- $75 million for new personal protective equipment and critical medical supplies;

- Approximately $80 million for ambulance and paramedic services; and

- Approximately $70 million for new infection control measures in retirement homes, residential facilities and emergency shelters

- An additional $1.2 billion to improve services in the health and long-term care sector.

- $2.1 billion in new measures to support the COVID‑19 response including:

- $3.7 billion to support people and jobs, including:

- $75 million in urgent additional support for 194,000 low-income seniors by proposing to double the Guaranteed Annual Income System (GAINS) maximum payment to $166 per month for individuals and $332 per month for couples, for six months starting in April 2020;

- Helping families pay for extra costs associated with school and daycare closures during the COVID‑19 outbreak by providing a one-time $200 payment per child up to 12 years of age, and $250 for those with special needs including kids enrolled in private schools;

- Providing six months of Ontario Student Assistance Program (OSAP) loan and interest accrual relief, in coordination with the federal government’s measures, leaving more money in the pockets of student borrowers;

- Providing new, additional support of $26 million to Indigenous peoples and communities, including emergency assistance for urban Indigenous people in financial need, costs for health care professionals and critical supplies to reach remote First Nations, as well as funding to address emergency planning and self‑isolation needs for people in First Nation communities;

- $200 million in new funding to provide temporary emergency supports for people in financial need as well as funding to municipalities and other service providers to respond to local needs; for example, food banks, homeless shelters, churches and emergency services;

- Making electricity bills more affordable for eligible residential, farm and small business consumers through a $1.5 billion increase in electricity cost relief compared to the 2019 Budget. The government is also setting electricity prices for time-of-use customers at the lowest rate, known as the off-peak price, 24 hours a day for 45 days, to support ratepayers in their increased daytime electricity usage as a result of measures to contain the COVID‑19 outbreak;

- $9 million in direct support to families for their energy bills by expanding eligibility for the Low‑income Energy Assistance Program (LEAP) and ensuring that their electricity and natural gas services are not disconnected for nonpayment during the COVID‑19 outbreak;

- Cutting taxes by $355 million for about 57,000 employers through a proposed temporary increase to the Employer Health Tax (EHT) exemption;

- Helping to support regions lagging in employment growth with a proposed new Corporate Income Tax credit — the Regional Opportunities Investment Tax Credit; and

- Supporting the timely delivery of critical food and supplies by amending a regulation that restricted delivery trucks from operating during off-peak hours.

- $10 billion in support for people and businesses to improve cash flows by:

- Providing a five-month interest and penalty-free period to make payments for the majority of provincially administered taxes, providing $6 billion in relief to help support Ontario businesses when they need it the most;

- Deferring the upcoming quarterly (June 30) remittance of education property tax to school boards by 90 days. This will provide municipalities with the flexibility to, in turn, provide property tax deferrals of over $1.8 billion to local residents and businesses; and

- Providing $1.9 billion in new financial relief by the Workplace Safety and Insurance Board (WSIB) allowing employers to defer payments for a period of six months.

- Fiscal prudence at historical levels, including:

- A dedicated $1.0 billion COVID‑19 contingency fund as part of the additional health care investments;

- An increased contingency fund of $1.3 billion; and

- An unprecedented reserve of $2.5 billion — the largest in Ontario’s history — to provide continued flexibility to respond to changing global circumstances.

Supporting Health Care

Ontario’s Action Plan: Responding to COVID‑19 includes $3.3 billion in additional health care investments, relative to the 2019 Budget. This includes $2.1 billion in new initiatives to respond to the COVID‑19 outbreak, as well as $1.2 billion to continue the government’s long-term plan to build a health care system that is there for patients when they need it.

Hospitals

The plan includes new investments to equip hospitals to immediately tackle COVID‑19 and continue building a sustainable and connected health care system, with initiatives including:

- $935 million for the hospital sector, including $594 million to accelerate progress on the government’s commitment to address capacity issues, as well as $341 million for an additional 1,000 acute care and 500 critical care beds and more assessment centres; and

- $124 million to support the delivery of more than 90 transitional care projects, creating approximately 1,000 spaces where more than 20,000 patients can move from a hospital bed to a more appropriate transitional care setting. Examples include Southlake Regional Health Centre and Health Sciences North, which help patients gain access to specialized care in the most appropriate setting and ensure hospital beds are available for those who need them.

Long-Term Care

The Province is increasing quality and access at long-term care homes with initiatives including:

- $243 million for surge capacity in the long-term care sector, as well as funding for 24/7 screening, more staffing to support infection control, and supplies and equipment to help tackle the COVID‑19 outbreak;

- Approximately $80 million to improve and maintain the quality of care and overall resident experience in long-term care homes, as well as continued funding to increase long-term care capacity and access for residents; and

- Approximately $23 million for a minor capital program that will support the ongoing repair of homes and allow operators to maintain safe and modern facilities for their residents.

Public Health

The government is investing in additional public health resources, with initiatives including:

- $160 million in increased funding for public health to support COVID‑19 monitoring, surveillance and laboratory and home testing, while also investing in virtual care and Telehealth Ontario; and

- $61 million for publicly funded vaccines to support the province’s immunization program to maintain high immunization rates and help prevent disease outbreaks.

Additional Investments

Other investments in 2020–21 to tackle COVID‑19 and build a better health care system that is there for patients when they need it include:

- $75 million to supply personal protective equipment and critical medical supplies to front-line staff;

- $120 million to increase home and community care capacity to allow hospitals to direct more resources to complex COVID‑19 patients;

- $62 million to provide more physicians, particularly in rural and remote communities, nurses in hospitals and personal support workers in communities;

- $23.8 million to enable more physicians to conduct video, email or phone visits for patients to see their doctor from the comfort and convenience of their own homes;

- $20 million in research and innovation funding to develop tools and resources to combat COVID‑19 and related diseases by leveraging the strengths of Ontario’s world-class research institutions, industry and non-profit scientific partners;

- Approximately $35 million to ensure patients have access to vital blood products, particularly plasma, and support Canadian Blood Services with the establishment of a new plasma site in Sudbury;

- Approximately $70 million for infection control and personal protective equipment in residential facilities for children and youth in care, children with complex needs and people with developmental disabilities, retirement homes, youth justice facilities, and emergency shelters for women and families fleeing domestic violence; and

- A new website, Ontario Together, to help the government partner with Ontario’s manufacturing sector to meet the challenges of the COVID‑19 outbreak and redirect resources towards the production of essential equipment such as ventilators, masks and swabs.

The government is also committing a dedicated $1.0 billion COVID‑19 contingency fund.

Supporting People and Jobs

People across Ontario are responding to the evolving COVID‑19 outbreak by taking additional precautions to keep themselves, their families and their communities safe.

They should not be penalized for acting responsibly and doing the right thing by following the advice of public health officials. Building on coordinated actions with the federal government, Ontario is taking immediate steps to support people and families by planning to invest $3.7 billion in supports for people and jobs in response to the COVID‑19 outbreak.

Seniors

The Province is providing immediate financial support of an additional $75 million to 194,000 vulnerable seniors, who may need more help to cover essential expenses during the COVID‑19 outbreak, by proposing to double the Guaranteed Annual Income System (GAINS) maximum payment for low-income seniors, for six months starting in April 2020. This would increase the maximum payment to $166 per month for individuals and $332 per month for couples.

The government is also helping seniors by providing $5 million to support the coordination of subsidized deliveries of meals, medicines and other essentials, by working with local businesses and charities as well as existing health services.

Parents

To help parents pay for the extra costs associated with the closure of schools and daycares during the COVID‑19 outbreak, the government is providing a one-time payment of $200 per child up to 12 years of age, and $250 for those with special needs, including kids enrolled in private schools.

As part of the government’s efforts to contain the COVID‑19 outbreak, Ontario is also providing emergency child care options to enable parents who are front-line workers to report for work, such as health care workers, police officers, fire fighters and correctional officers.

Students

The government is temporarily suspending Ontario Student Assistance Program (OSAP) loan repayments between March 30, 2020 and September 30, 2020, during which time borrowers will not be required to make any loan or interest payments. In coordination with the federal government’s measures, this will immediately leave more money in the pockets of student borrowers during these challenging economic times.

Workers

The government is taking further measures to support Ontario workers, with initiatives including:

- Quickly passing legislation to provide job-protected leave to employees in isolation or quarantine, or those who need to be away from work to care for children because of school or daycare closures due to the COVID‑19 outbreak;

- Committing $100 million in funding through Employment Ontario for skills training programs for workers affected by the COVID‑19 outbreak; and

- Working with the federal government to find ways to support apprentices and enable businesses to continue to retain these skilled trades workers during the COVID‑19 outbreak.

Indigenous Peoples and Communities

The government is providing supports of $26 million for Indigenous peoples and communities, including emergency assistance for urban Indigenous people in financial need and costs for health care professionals and critical supplies to reach remote First Nations.

Vulnerable People

During the COVID‑19 crisis, it is particularly important to support vulnerable people, including those who are homeless, unemployed or living in poverty. That is why the government is:

- Investing $52 million to expand access to the emergency assistance program administered by Ontario Works to provide financial support to people facing economic hardship and help them with basic needs, such as food and rent during this public health emergency;

- Enhancing funding for charitable and non-profit social services organizations, for example food banks, homeless shelters, churches and emergency services such as the Red Cross, to improve their ability to respond to the COVID‑19 outbreak. The government is doing this by providing $148 million directly to Consolidated Municipal Service Managers and District Social Service Administration Boards who would allocate this funding based on local needs; and

- Equipping essential first responders and front-line staff in the justice sector with the necessary personal protective equipment and other critical supplies required to ensure the safety and security of all people in Ontario during the COVID‑19 outbreak.

Electricity Relief

The government is supporting people and businesses with the costs of electricity during the COVID‑19 outbreak. That is why the government is:

- Providing $9 million in direct support to families for their energy bills by expanding eligibility for the Low‑income Energy Assistance Program (LEAP) and by ensuring that their electricity and natural gas services are not disconnected for nonpayment during the COVID‑19 outbreak; and

- Supporting more affordable electricity bills for eligible residential, farm and small business consumers, by providing approximately $5.6 billion for electricity cost relief programs in

2020–21. This is an increase of approximately $1.5 billion compared to the 2019 Budget plan. The Province is also setting electricity prices for residential, farm and small business time-of-use customers at the lowest rate, known as the off-peak price, 24 hours a day for 45 days to support ratepayers in their increased daytime electricity usage as they respond to the COVID‑19 outbreak, addressing concerns about time-of-use metering.

Employer Health Tax

The government is cutting taxes by $355 million for about 57,000 employers by proposing a temporary increase to the Employer Health Tax (EHT) exemption from $490,000 to $1 million for 2020. With this plan, more than 90 per cent of private-sector employers would not pay EHT in 2020.

Eligible private-sector employers with annual payrolls up to $5 million would be exempt from EHT on the first $1 million of total Ontario remuneration in 2020. The maximum EHT relief from the exemption would increase by $9,945 to $19,500 for 2020 for eligible employers. About 57,000 private-sector employers would pay less EHT, including about 30,000 who would not pay any EHT for 2020, effectively eliminating EHT for these employers for one year. The exemption would return to its current level of $490,000 on January 1, 2021.

Regional Opportunities Investment Tax Credit

To support business investment in regions of the province where employment growth has been significantly below the provincial average, Ontario is proposing a new 10 per cent refundable Corporate Income Tax credit.

The Regional Opportunities Investment Tax Credit would be available to eligible businesses that construct, renovate or acquire qualifying commercial and industrial buildings in designated regions of the province, saving them up to $45,000 in the year.

Support for People and Businesses to Improve Cash Flow

Ontario is making $10 billion available to improve cash flows for people and businesses through tax and other deferrals over the coming months to provide relief during this challenging economic time, in coordination with the federal government.

$6 Billion in Tax Deferrals

To help support Ontario businesses when they need it most, the government is providing a five-month interest and penalty-free period for businesses to make payments for the majority of provincially administered taxes.

Beginning April 1, 2020, the Province is providing flexibility to about 100,000 businesses in Ontario to help manage their cash flows during this challenging time. This will continue for a period of five months, up until August 31, 2020, and is expected to make available $6 billion to improve the cash flows of Ontario businesses.

For this period, the Province will not apply any penalty or interest on any late-filed returns or incomplete or late tax payments under select provincially administered taxes, such as the Employer Health Tax, Tobacco Tax and Gas Tax.

The initiative and relief period complement the relief from interest and penalties from not remitting Corporate Income Tax owing that was announced by the federal government on March 18, 2020.

$1.8 Billion in Education Property Tax Deferrals

The Province recognizes that many residents and businesses are facing challenges in making their scheduled property tax payments. The government is working closely with municipalities as they introduce measures to provide property tax relief, for example, by allowing taxpayers to defer property tax payments.

To encourage these actions, the government is deferring the property tax payments municipalities make to school boards by 90 days.

In addition to collecting municipal property taxes, municipalities collect and remit education property taxes to school boards on a quarterly basis. Deferring the June 30 quarterly remittance to school boards by 90 days will provide municipalities with the flexibility to, in turn, provide over $1.8 billion in property tax deferrals to residents and businesses.

To ensure this does not have a financial impact on school boards, the Province will adjust payments to school boards to offset the deferral.

$1.9 Billion in Workplace Safety Expenses

Working in conjunction with the government of Ontario, the Workplace Safety and Insurance Board (WSIB) will allow employers to defer payments for a period of six months. This will provide employers with $1.9 billion in financial relief.

All employers covered by the WSIB’s workplace insurance are automatically eligible for the financial relief package. Schedule 1 employers with premiums owed to the WSIB will be allowed to defer reporting and payments until August 31, 2020. The deferral will also apply to Schedule 2 businesses that pay WSIB for the cost related to their workplace injury and illness claims. In addition, no interest will be accrued on outstanding premium payments and no penalties will be charged during this six-month deferral period.

Responsibly Managing the Province’s Finances

Events like the COVID‑19 outbreak underscore why governments must be positioned to act in a time of crisis. Through its action plan, Ontario is immediately allocating the necessary resources to tackle the COVID‑19 outbreak, while continuing to invest in people. As a result, the 2020–21 deficit is projected to be $20.5 billion.

This plan builds on the government’s responsible approach to managing Ontario’s finances with measures to provide further flexibility to respond to this rapidly changing global outbreak. This includes historic levels of prudence, including a dedicated $1.0 billion COVID‑19 contingency fund, an increased contingency fund of $1.3 billion and an unprecedented reserve of $2.5 billion, the largest in Ontario’s history.

Ontario’s strong economic fundamentals have positioned the government to respond decisively to this outbreak. The Province will continue to actively monitor and mitigate risks, coordinating with partners and other levels of government, while continuing to retain flexibility to respond as conditions evolve.

Conclusion

Ontario’s Action Plan: Responding to COVID‑19 outlines the government’s first steps to protect public health, and support people and jobs.

Ontario will continue to work diligently with health experts, business leaders, financial institutions, economists and municipal and federal partners to respond swiftly and effectively to this outbreak, so that the people of Ontario are supported and protected during the COVID‑19 outbreak.

The people and businesses of Ontario have shown immense cooperation, resilience and determination to tackle this crisis by helping one another. To every family, person, business and community — the Ontario government is right there beside you.

Chart Description

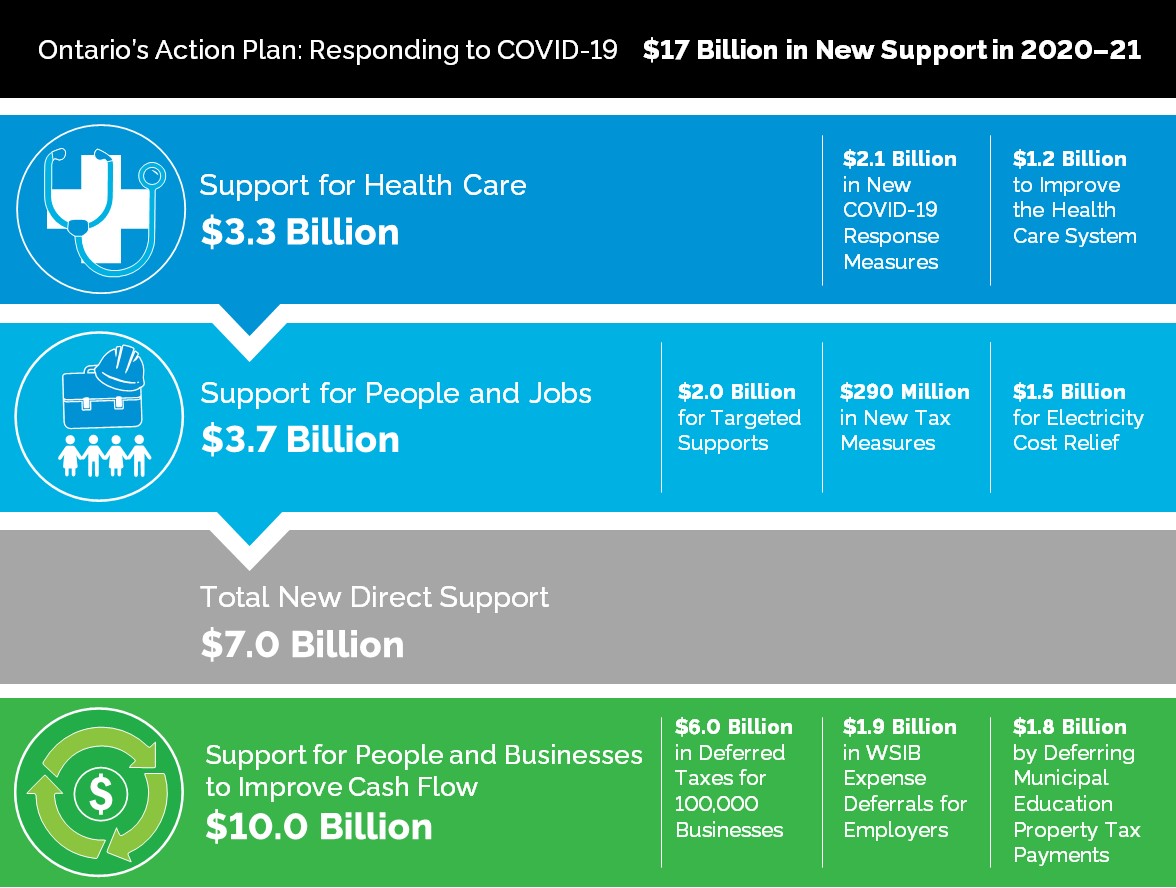

Chart: Highlights of Ontario’s Action Plan: Responding to COVID‑19

This chart demonstrates Ontario’s $17 billion investment in 2021–21, in new support as part of its action plan in response to the outbreak of novel coronavirus (COVID‑19).

Top section: The chart shows Ontario is investing $3.3 billion in support for health care with $2.1 billion in new COVID‑19 response measures and $1.2 billion in measures to improve the health care system.

Middle section: The chart shows Ontario is investing $3.7 billion in support for people and jobs with $2.0 billion in targeted supports, $290 million in new tax measures and $1.5 billion for electricity cost relief.

The chart shows that in total these measures represent $7.0 billion in direct support for people and jobs.

Bottom section: The chart shows Ontario is investing $10.0 billion in support for people and businesses to improve cash flow with $6.0 billion in deferred taxes for $100,000 businesses, $1.9 billion in Workplace Safety and Insurance Board (WSIB) expense deferrals for employers and $1.8 billion by deferring municipal education property tax payments.