Overview

This Annex: Details of Tax Measures provides specific information on the tax measures the government is proposing in this economic and fiscal update.

Temporary Doubling of the Employer Health Tax Exemption

The Employer Health Tax (EHT) is a payroll tax paid by employers based on their total annual Ontario remuneration, and has a top rate of 1.95 per cent.

Private-sector employers with total annual Ontario remuneration of less than $5 million are currently eligible for an EHT exemption on up to $490,000 of their payroll. As a result of the exemption, about 85 per cent of private-sector employers do not pay EHT.

Private-sector employers (except registered charities) with total annual Ontario remuneration over $5 million, and public-sector employers are not eligible for the exemption.

In order to provide immediate financial relief to employers during this time when their businesses are impacted by the COVID‑19 outbreak, the government proposes to retroactively raise the EHT exemption from $490,000 to $1 million for 2020. The exemption would return to its current level of $490,000 on January 1, 2021.

Increasing the exemption to $1 million would provide additional EHT relief of up to $9,945 per eligible employer. With this additional relief, eligible employers could benefit by up to $19,500 in total EHT relief. About 57,000 private-sector employers would pay less EHT, including about 30,000 who would not pay EHT in 2020.

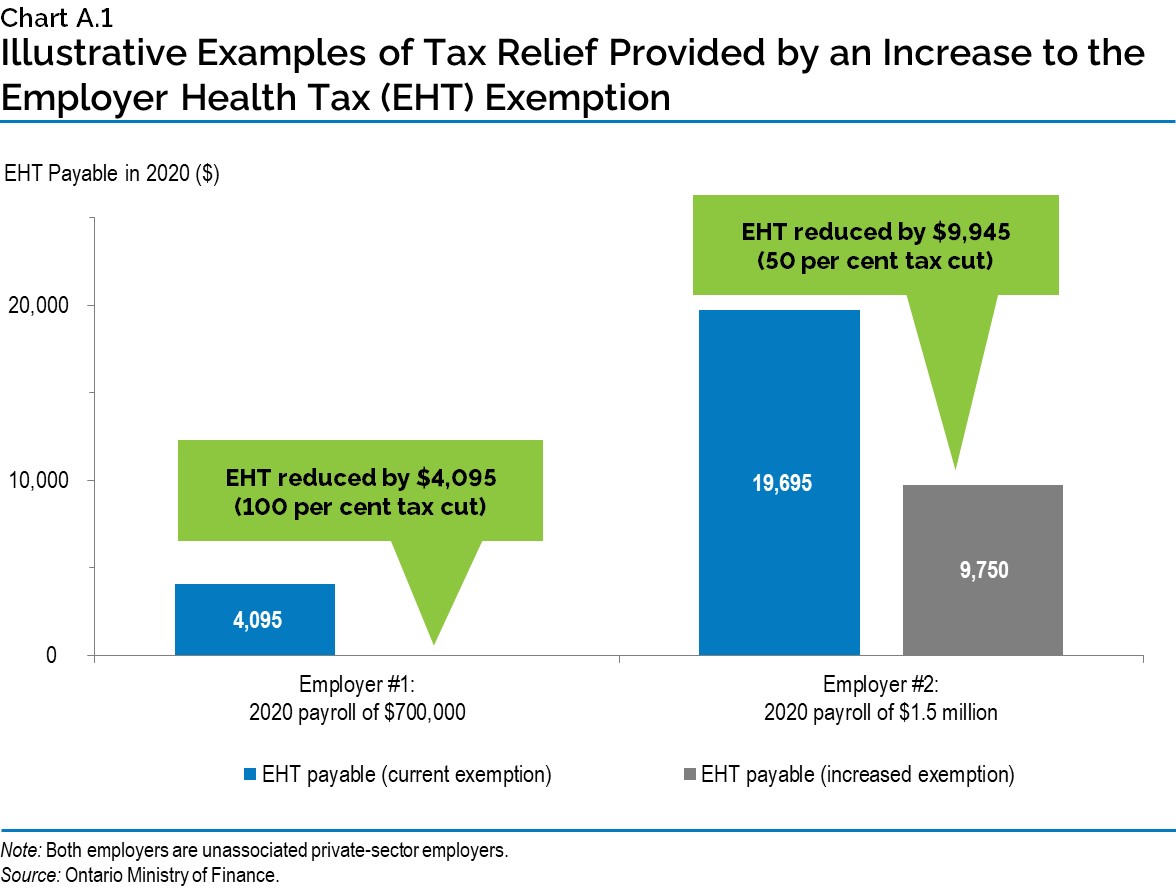

Chart A.1 shows illustrative examples of relief provided by the proposed measure to Ontario private-sector employers.

Providing Interest and Penalty Relief for Ontario Businesses when They Need It Most

The government is helping businesses around the province to focus on the well-being of their employees and their continued operations during this time of uncertainty as a result of the COVID‑19 outbreak.

Beginning April 1, 2020, penalties and interest will not apply to Ontario’s businesses that miss any filing or remittance deadlines under select provincially administered taxes. This will continue for a period of five months, up until August 31, 2020, under the following provincially administered tax programs:

- Employer Health Tax;

- Tobacco Tax;

- Fuel Tax;

- Gas Tax;

- Beer, Wine and Spirits Taxes;

- Mining Tax;

- Insurance Premium Tax;

- International Fuel Tax Agreement;

- Retail Sales Tax on Insurance Contracts and Benefit Plans; and

- Race Tracks Tax.

The interest and penalty relief period is available to all Ontario businesses that are required to file returns and make remittances under these tax programs. During the relief period, penalties and interest will not apply to late returns or remittances made under these tax programs. This initiative complements the relief from interest and penalties from not remitting Corporate Income Tax owing that was announced by the federal government on March 18, 2020.

Businesses will not be required to provide any documentation supporting their reasons for late‑filing or payments and they will not be required to advise the Ontario Ministry of Finance of their inability to meet their deadline(s).

It is estimated that this measure will help provide up to $6 billion to support the liquidity needs of about 100,000 Ontario businesses. In addition, it is also expected to save businesses up to $25 million from interest and penalties waived during the grace period.

Introducing the Regional Opportunities Investment Tax Credit

The government is proposing to introduce a new 10 per cent refundable Corporate Income Tax credit for capital investments — the Regional Opportunities Investment Tax Credit.

Eligible Corporations

A Canadian-controlled private corporation that makes qualifying investments that become available for use on or after March 25, 2020 in specified regions of Ontario would be eligible for the tax credit.

“Available for use” refers to the rules set out in the Income Tax Act (Canada) that determine the taxation year in which a taxpayer can start to claim capital cost allowance for a depreciable property.

Qualifying Investments

Qualifying investments would be eligible expenditures for capital property included in Class 1 and Class 6 for the purposes of calculating capital cost allowance. Qualifying investments would include expenditures for constructing, renovating or acquiring eligible commercial and industrial buildings and other assets.

Spending Requirement

The tax credit would be available for expenditures in excess of $50,000 and up to a limit of $500,000 for qualifying investments that become available for use by a Canadian-controlled private corporation in the taxation year.

Three-Year Reviews

The government proposes to include a mandatory review to be undertaken every three years. The review would evaluate the credit for effectiveness, compliance burden and administrative costs.

Eligible Regions

Areas of the province where investments would be eligible are:

- City of Kawartha Lakes

- County of Bruce

- County of Elgin together with the City of St. Thomas

- County of Essex together with the City of Windsor and Township of Pelee

- County of Frontenac together with the City of Kingston

- County of Grey

- County of Haliburton

- County of Hastings together with the City of Belleville and City of Quinte West

- County of Huron

- County of Lambton

- County of Lanark together with the Town of Smiths Falls

- County of Lennox and Addington

- County of Middlesex together with the City of London

- County of Northumberland

- County of Oxford

- County of Perth together with the City of Stratford and the Town of St. Marys

- County of Peterborough together with the City of Peterborough

- County of Prince Edward

- County of Renfrew together with the City of Pembroke

- District of Algoma

- District of Cochrane

- District of Kenora

- District of Manitoulin

- District of Muskoka

- District of Nipissing

- District of Parry Sound

- District of Rainy River

- District of Sudbury together with the City of Greater Sudbury

- District of Thunder Bay

- District of Timiskaming

- Municipality of Chatham-Kent

- United Counties of Leeds and Grenville together with the City of Brockville, the Town of Gananoque and the Town of Prescott

- United Counties of Prescott and Russell

- United Counties of Stormont, Dundas and Glengarry together with the City of Cornwall

Postponing Planned Property Tax Reassessment

The government is postponing the planned property tax reassessment for 2021.

This will ensure that municipal governments are able to focus their resources on critical public health initiatives and other efforts to manage the local response to the COVID‑19 outbreak. Postponing the reassessment will also provide stability for Ontario’s property taxpayers and municipalities.

Property taxation is based on the assessed value of properties and in Ontario those assessments are updated every four years. The next property valuation update, known as a reassessment, had been scheduled to be completed by the Municipal Property Assessment Corporation (MPAC) in 2020 for the 2021 taxation year. As a result, MPAC would have issued new assessments for more than five million properties beginning this spring.

However, in view of the unique and unforeseen challenges that all municipalities, residents, and businesses are facing during 2020, the government is postponing the reassessment. This means that assessments for the 2021 taxation year will continue to be based on the same valuation date that was in effect for the 2020 taxation year.

This measure will not have a financial impact on municipalities, because MPAC will continue to maintain the assessment roll and ensure that it is updated to reflect changes such as new construction.

This postponement will also provide an opportunity to better reflect the advice received through the Property Assessment and Taxation Review that is currently underway. Through this review, the government is seeking stakeholder input to explore opportunities to support a competitive business environment and enhance the accuracy and stability of property assessments. The feedback received during this review will help to inform the development of policies for the next reassessment.

Summary of Measures

Table A.1 reflects the fiscal impacts of new measures announced in this economic and fiscal update.

| 2019–20 | 2020–21 | |

|---|---|---|

| New Measures — Temporary Doubling of the Employer Health Tax Exemption | 90 | 265 |

| New Measures — Interest and Penalty Relief from Select Provincially Administered Taxes | – | 25 |

| New Measures — Introducing the Regional Opportunities Investment Tax Credit1 | – | 25 |

| New Measures — Postponing Planned Property Tax Reassessment | N/A | N/A |

| Total Fiscal Cost of Measures | 90 | 315 |

Notes: Numbers reflect the fiscal cost of the benefit to individuals, families and businesses.

“–” indicates a nil amount.

[1] As a refundable tax credit, the proposed Regional Opportunities Investment Tax Credit would be an expense in the Ontario Ministry of Economic Development, Job Creation and Trade.

Source: Ontario Ministry of Finance.

Chart Descriptions

Chart A.1: Illustrative Examples of Tax Relief Provided by an Increase to the Employer Health Tax (EHT) Exemption

Chart A.1 shows two illustrative examples of tax relief provided by increasing the Employer Health Tax (EHT) exemption from $490,000 to $1 million.

Left Example: Shows a private-sector employer with a total 2020 payroll of $700,000. This employer currently pays $4,095 of EHT but would see a 100 per cent reduction in EHT paid to $0 under the proposal to increase the exemption to $1 million.

Right Example: Shows a private-sector employer with a total 2020 payroll of $1.5 million. This employer currently pays $19,695 of EHT but would see a 50 per cent reduction in EHT paid to $9,945 under the proposal to increase the exemption to $1 million.

Both employers are unassociated private-sector employers.

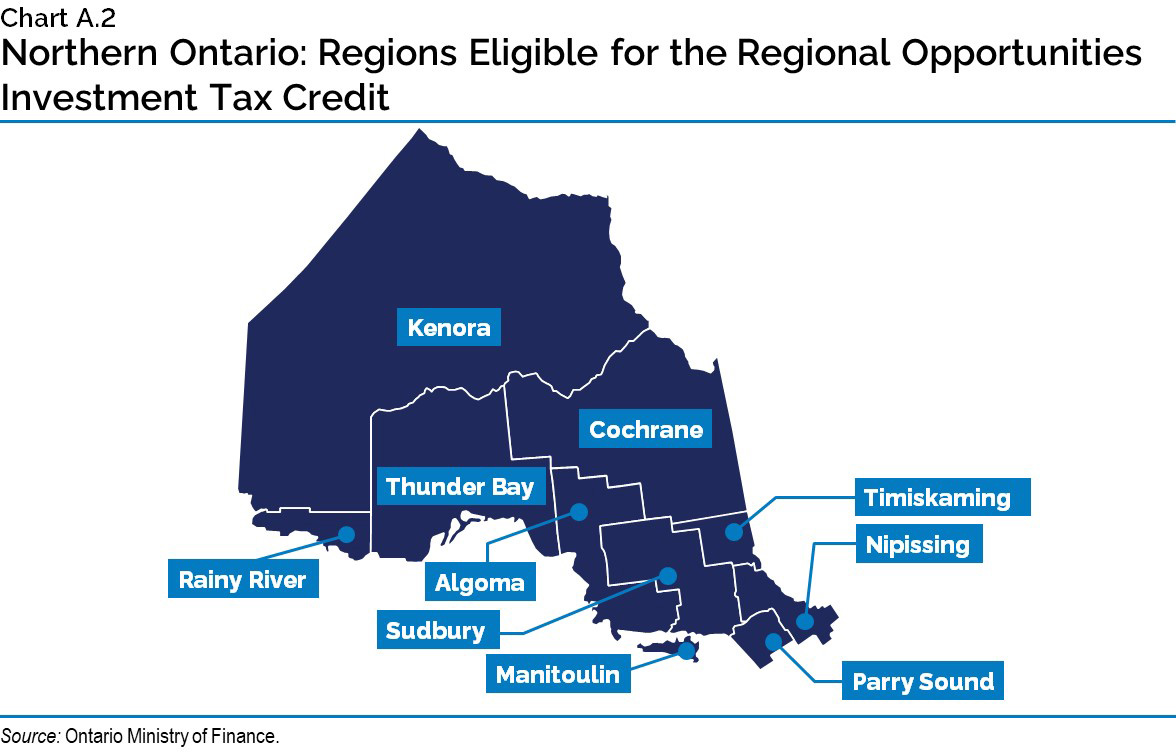

Chart A.2: Northern Ontario: Regions Eligible for the Regional Opportunities Investment Tax Credit

This map shows the regions eligible for the Regional Opportunities Investment Tax Credit in Northern Ontario. The regions noted on the map are as follows: District of Algoma, District of Cochrane, District of Kenora, District of Manitoulin, District of Nipissing, District of Parry Sound, District of Rainy River, District of Sudbury together with the City of Greater Sudbury, District of Thunder Bay, and District of Timiskaming.

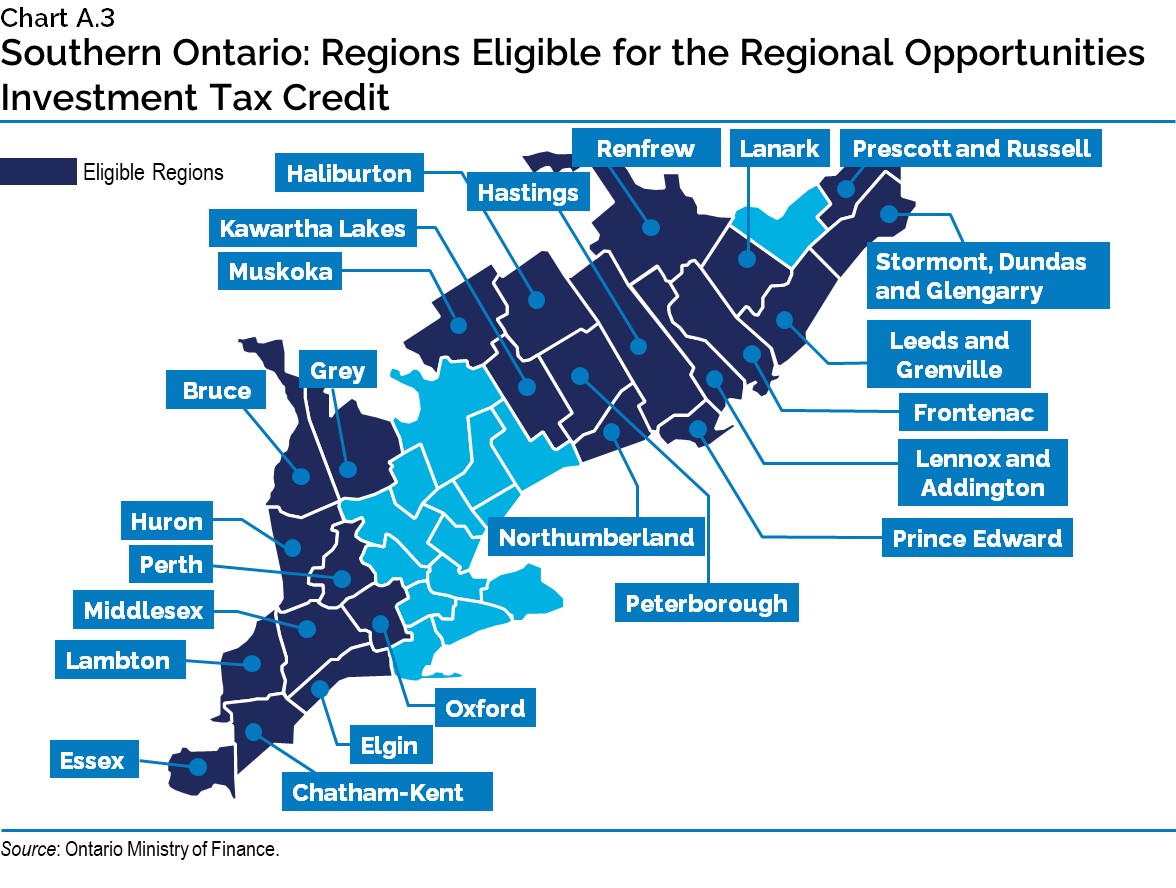

Chart A.3: Southern Ontario: Regions Eligible for the Regional Opportunities Investment Tax Credit

This map shows the regions eligible for the Regional Opportunities Investment Tax Credit in Southern Ontario. The regions noted on the map are as follows: City of Kawartha Lakes; County of Bruce; County of Elgin together with the City of St. Thomas; County of Essex together with the City of Windsor and Township of Pelee; County of Frontenac together with the City of Kingston; County of Grey; County of Haliburton; County of Hastings together with the City of Belleville and City of Quinte West; County of Huron; County of Lambton; County of Lanark together with the Town of Smiths Falls; County of Lennox and Addington; County of Middlesex together with the City of London; County of Northumberland; County of Oxford; County of Perth together with the City of Stratford and the Town of St. Marys; County of Peterborough together with the City of Peterborough; County of Prince Edward; County of Renfrew together with the City of Pembroke; District of Muskoka; Municipality of Chatham-Kent; United Counties of Leeds and Grenville together with the City of Brockville, the Town of Gananoque and the Town of Prescott; United Counties of Prescott and Russell; and United Counties of Stormont, Dundas and Glengarry together with the City of Cornwall.