Introduction

Housing. Transportation. Groceries. Child Care. Electricity. These are some of the most important items in any household budget. And when costs go up, it has a direct impact on families, seniors, workers and the economy. A higher cost province is a less competitive province, when workers decide to take their skills elsewhere if the cost of living in Ontario is too high.

This is why the government is helping to keep costs down with a plan to build more homes, reduce the cost of driving or taking transit, and provide relief on everything from child care costs to taxes.

The most important economic decisions are not made around the boardroom table, they are made around the kitchen table. Money saved at the pumps or at the grocery store is money that the people of Ontario can re-invest in themselves and the economy.

More Homes for Everyone

Everyone in Ontario deserves to find housing that is right for them. The government is taking action to increase housing supply and make sure that everyone in Ontario can find a home that meets their needs and their budget.

Ontario is helping to create the conditions to get more homes built faster, with 2021 seeing the highest level of housing starts in over 30 years. But too many people in Ontario still struggle to find a home.

In March 2022, the government introduced More Homes for Everyone, the next step in the government’s long-term plan to address the housing crisis and deliver on the Housing Affordability Task Force’s recommendations in partnership with municipalities. The government’s plan to get more homes built faster would:

- Reduce red tape to create more homes;

- Make it easier to build community housing; and

- Protect homebuyers, homeowners and renters.

To support long-term solutions to address the housing crisis, the government will deliver a housing supply action plan every year for the next four years, with policies and tools that support multigenerational homes and missing middle housing.

Reducing Red Tape to Build More Homes

Accelerating Community Infrastructure and Housing

The government is planning to introduce a new tool to help municipalities accelerate planning processes. The Community Infrastructure and Housing Accelerator would streamline approvals that regulate the use of land and the location, use, height, size and spacing of buildings and structures to permit certain types of development. This would help municipalities speed up approvals for housing and community infrastructure, like hospitals and community centres, while increasing transparency and accountability. The Community Infrastructure and Housing Accelerator would not be used in the Greenbelt, maintaining the government’s steadfast commitment to protecting this valued area.

Streamlining Development Approvals

The government is working with municipalities to ensure they have the tools they need to unlock housing supply. This is why the government is investing more than $45 million for a new Streamline Development Approval Fund to help Ontario’s 39 largest municipalities modernize, streamline and accelerate processes for managing and approving housing applications.

Speeding Up Approvals for New Housing

Ontario needs more housing built, faster. Removing red tape and duplication is key to increasing the supply of housing across the province. This is why Ontario is committed to working with the municipal sector on developing a data standard for planning and development applications to help reduce approval timelines.

Creating the Development Approvals Data Standards for the province is a critical step in facilitating the digitization of land approval processes, helping to reduce timelines and allowing for data to be collected consistently over time. This would make the housing development approvals process faster and less costly for government.

Modernizing Municipal Services

Municipal partners provide important public services and the government is committed to helping them improve these services to ensure taxpayers get good value for their money. The government has invested more than $23 million through the Audit and Accountability Fund to help large municipalities find better, more efficient ways to operate and to support initiatives that increase digital services, modernize operations and integrate and streamline services.

Providing Additional Resources to Reduce Backlogs at the Ontario Land Tribunal

The Ontario Land Tribunal (OLT) plays an important role in Ontario’s housing sector as an impartial adjudicator resolving proposed development disputes and breaking the cycle of appeals and delays.

This is why Ontario is investing $19.2 million over three years to help reduce backlogs at the OLT, as well as the Landlord and Tenant Board. This funding will increase the number of full-time adjudicators, increase resources for mediation, and resolve land use planning and tenant and landlord disputes more quickly. This will also allow the OLT to expand their digital offerings to further enhance efficiency and provide more e-services.

Building Strong Rural Communities

The government is committed to building strong rural communities with investments to support the creation of new housing and modern, efficient public infrastructure and to boost economic development. The government has provided over $68 million since 2020 in the Municipal Modernization Program to help small and rural municipalities find better, more efficient ways to deliver local services for residents and businesses. This funding has helped municipalities identify more than $100 million in efficiencies, accelerate the creation of new housing through streamlined development approvals and develop a one window permit service to speed up approvals.

Investing in and Supporting Community Housing

The government is working with local service managers and Indigenous program administrators to sustain, repair and grow the community housing system. This is why the government is making significant investments in community housing and homelessness programs. Through the Community Housing Renewal Strategy and the government’s response to COVID-19, Ontario has invested more than $3 billion between 2020 and 2022 to support community housing and help to prevent homelessness. This includes nearly $1.2 billion through the Social Services Relief Fund to municipal and Indigenous partners.

The government has also introduced a new regulatory framework under the Community Housing Renewal Strategy to make the system more sustainable over the long term, improve access based on those with the greater need and provide greater flexibility to service managers to meet local needs.

Protecting Homebuyers, Homeowners and Renters

Prioritizing Ontario Homebuyers

Priority for Ontario housing should be given to Ontario homebuyers and families, not foreign speculators. This is why the government has increased the Non-Resident Speculation Tax rate to 20 per cent, expanded the tax beyond the Greater Golden Horseshoe Region to apply provincewide, and closed loopholes to fight tax avoidance, effective March 30, 2022. The tax applies to homes purchased anywhere in Ontario by foreign nationals, foreign corporations or taxable trustees. See Annex: Details of Tax Measures and Other Legislative Initiatives for further information about the changes to the Non-Resident Speculation Tax.

Supporting the Use of Municipal Vacant Home Taxes

To increase housing supply in Ontario, municipalities are exploring the use of vacant home taxes, which the government is prepared to facilitate.

Ontario will work with its municipal partners over the summer to establish a working group to facilitate the sharing of information and best practices, as well as to explore opportunities to enhance the existing legislative framework. Based on feedback from this working group, the government may also consider potential refinements to provisions in the Municipal Act, 2001.

This provincial and municipal collaboration will help maximize the impacts of vacant home taxes on the supply of housing and ensure that the people of Ontario benefit from a coordinated, consistent approach to the implementation of these municipal taxes.

The government will also work with municipalities to identify potential measures to discourage land speculation involving projects that are approved by the municipality but remain unbuilt by the developer.

Cracking Down on Unethical Developers

The government’s plan will better protect consumers when they buy a new home by holding new home builders and vendors to professional standards; increasing fines to address unethical behaviour; and enabling Tarion to extend the warranties on unfinished items in a new home.

Proposed legislative amendments would increase fines imposed by the Discipline Committee, increase administrative penalties, enable the consideration of monetary benefit in determining a fine or penalty, as well as give the Home Construction Regulatory Authority, the regulator of the new homebuilding industry, clearer authority to address unethical builder and vendor conduct.

In addition, the government is consulting on proposals to better inform and protect purchasers of new condominium homes by:

- Requiring key information to be provided, through a mandatory Condominium Information Sheet, to buyers of pre-construction condominium units as part of a purchase agreement;

- Increasing the amount of interest payable on deposits for the purchase of a new or pre-construction unit from a developer in certain circumstances, such as in case a project is cancelled; and

- Providing additional information about condo projects and cancellations to the Home Construction Regulatory Authority to post on the Ontario Builder Directory.

These protections will help ensure that penalties for cancelling projects or moving the goal posts are aligned with the impact on homebuyers.

Keeping Transportation Costs Down

Making it more affordable to travel and transport goods is essential for the province’s economy and quality of life. This is why the government’s plan includes measures that would deliver relief, from taxes on gas to the cost of auto insurance.

Providing Tax Relief at the Pumps

Supply chain challenges, the Russian invasion of Ukraine and other cost pressures are increasing the cost of living, from gas to groceries. In this period of economic uncertainty, families and businesses need relief. This is why the Ontario government is stepping up with the Tax Relief at the Pumps Act, 2022 that will temporarily cut the gas tax by 5.7 cents per litre and the fuel tax by 5.3 cents per litre for six months beginning July 1, 2022. See Annex: Details of Tax Measures and Other Legislative Initiatives for further information about these changes. This measure builds on the elimination of the cap-and-trade program, providing a total of 10 cents per litre in relief from provincial charges and taxes at the pumps for Ontario drivers and Ontario families.

The government will ensure municipalities that receive funding through the provincial Gas Tax program would not be impacted by this temporary cut to the gas tax rate.

Eliminating Licence Plate Renewal Fees and Stickers

For many families, driving is an absolute necessity. As the cost of living continues to go up, the government is cutting costs for nearly eight million vehicle owners by eliminating licence plate renewal fees and the requirement to have a licence plate sticker for passenger vehicles, light-duty trucks, motorcycles and mopeds.

In March 2022, Ontario passed legislation to enable the government to refund eligible individual owners of vehicles for any licence plate renewal fees paid since March 2020. Eligible vehicle owners began receiving cheques in the mail at the end of March and throughout the month of April. Eliminating renewal fees will save vehicle owners $120 a year in Southern Ontario and $60 a year in Northern Ontario for each passenger and light commercial vehicle.

Renewal fees are also being eliminated for passenger, light-duty commercial vehicles, motorcycles and mopeds that are owned by a company or business. This is just one of the many ways the government is supporting small businesses across the province.

Vehicle owners will still be required to renew their licence plate every one or two years at no cost to confirm their automobile insurance is valid and pay any outstanding fines, fees and tolls. The government is working with partners to develop a new, more user-friendly process that will continue to validate automobile insurance requirements and support law enforcement efforts.

Removing Tolls on Highways 412 and 418

The government is providing the people and businesses of Durham Region with more travel options, while helping them keep their hard-earned money in their pockets, by permanently removing tolls on Highways 412 and 418. Highways 412 and 418 were the only tolled north-south highways in Ontario. Removing tolls will save the average commuter $7.50 per trip on Highway 418 and $3.74 per trip on Highway 412. This will provide more travel options for local residents, relieve gridlock on local roads across Durham Region, and help improve economic competitiveness for local businesses. The removal of tolls shows the government’s commitment to help Durham Region grow and thrive.

Reducing the Cost of Auto Insurance

Ontario is acting on its plan to reduce the cost of auto insurance. The government recognizes the COVID-19 pandemic has put significant financial pressures on people. This is why in April 2020, the government took quick and decisive action to enable financial relief for drivers, resulting in over $1.3 billion in consumer savings. Data from the Financial Services Regulatory Authority of Ontario (FSRA) indicate that 99 per cent of the market received some form of consumer relief.

Since announcing the multi-year strategy, Putting Drivers First: A Blueprint for Ontario’s Auto Insurance System (Blueprint) in 2019, the government and FSRA have made significant progress on their commitments, including:

- Increasing competition, by making it easier for insurers to offer more discounts and options to consumers such as enabling insurers to offer incentive and rebate programs.

- Increasing innovation, by enabling insurers to develop usage-based insurance programs. As a result, for the first time since 2016, FSRA has reported that two large insurers have launched new usage-based insurance programs. Furthermore, FSRA has been enabled to operate an auto insurance regulatory sandbox that will allow insurers to pilot other innovative initiatives.

- Increasing consumer convenience, by enabling electronic communications for customers, including offering electronic proof of auto insurance.

- Increasing consumer choice, by making it optional to purchase not-at-fault property damage coverage (also known as Direct Compensation – Property Damage). This is an important change the government is making to give drivers more options. For example, for those who own older cars that are worth less than the cost to insure them. The government remains committed to ensuring all drivers have as much choice as possible when it comes to auto insurance.

- Making the supervision of insurance more transparent, dynamic and flexible through a new FSRA rule that defines unfair or deceptive acts or practices.

Helping with the Cost of Groceries and other Essentials

When prices go up, seniors, low-income families and workers are the first to feel the impact in their household budgets. This is why the government is helping with the costs for everyday essentials by providing targeted tax relief to the working people of Ontario, keeping energy costs down and lowering the cost of child care while maintaining flexibility for working parents.

Tax Relief to Workers and Families Since 2018

Since 2018, the government has introduced significant tax relief to families across the province, including:

- The Low-income Individuals and Families Tax (LIFT) Credit to reduce or eliminate personal income tax for low- and moderate-income workers. The government is also proposing an enhancement to the credit starting in 2022 that would provide even more tax savings for many Ontario workers. With this enhancement, claimants of this credit would receive an estimated $430 in tax relief, on average, in 2022;

- The Childcare Access and Relief from Expenses (CARE) tax credit to provide families with the flexibility they need to choose the child care options that work best for them. In 2022, claimants of this credit will receive an estimated $1,250 in support, on average, before accounting for the impact of the recent Canada-Ontario Early Learning and Child Care Agreement;

- The Jobs Training Tax Credit to help interested workers looking to make a change to get the training they need to sharpen their skills. In 2022, claimants of this credit will receive an estimated $1,150 in support, on average;

- The Staycation Tax Credit to help encourage Ontario families to support the local economy by vacationing in Ontario. In 2022, claimants of this credit will receive an estimated $145 in support, on average;

- The Seniors’ Home Safety Tax Credit to help seniors make their homes safer and more accessible. In 2022, claimants of this credit will receive an estimated $1,100 in support, on average;

- The proposed Ontario Seniors Care at Home Tax Credit to help low- to moderate-income senior families with eligible medical expenses. In 2022, claimants of this new credit would receive an estimated $550 in support, on average; and

- The cut to the gas tax by 5.7 cents per litre and the fuel tax by 5.3 cents per litre for six months beginning July 1, 2022, to provide relief to Ontario families and businesses.

Lifting Up Workers and Families

With minimum wage workers and low-income families seeing the cost of groceries and other essentials rising every day due to external factors, it has never been more important to provide tax relief.

This is why, starting with the 2022 tax year, the government is proposing to enhance the Low-income Individuals and Families Tax (LIFT) Credit, increasing and expanding the benefit to provide $320 million in additional tax relief to more workers.

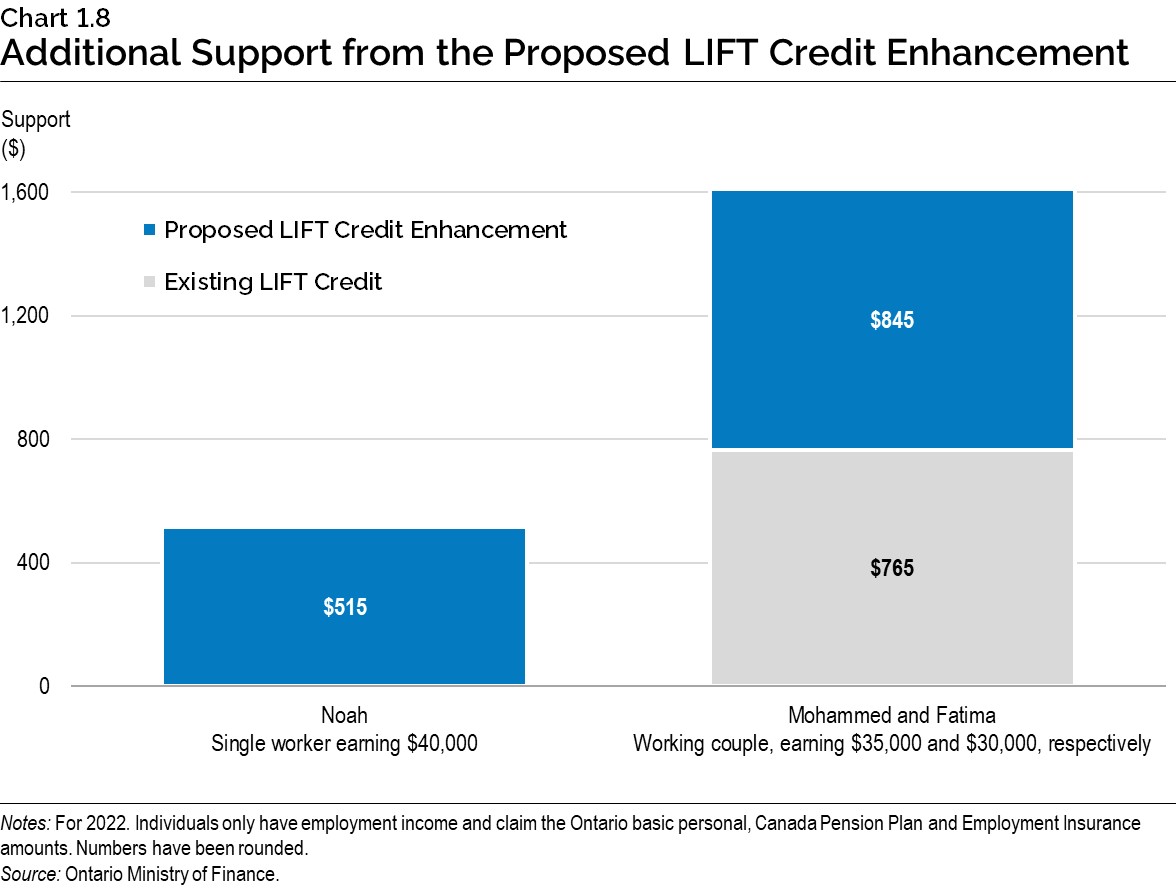

As shown in the examples in Chart 1.8, Noah is a single worker who earns $40,000 in 2022 and would not be eligible under the current LIFT Credit. Under the proposed enhancement to the LIFT Credit, Noah would receive $515.

Mohammed and Fatima are a married couple who earn $35,000 and $30,000 respectively. Under the current LIFT Credit, they would be entitled to $765 in tax relief. Under the proposed enhancement to the LIFT Credit, they would see a combined $845 in additional tax relief, more than doubling their current entitlement

See Annex: Details of Tax Measures and Other Legislative Initiatives for further information.

Lowering Child Care Fees for Parents

On March 28, 2022, Ontario and the federal government announced an agreement for a new Canada-wide Early Learning and Child Care System, which will provide Ontario with $13.2 billion in new federal investments by 2026–27. Over and above this amount, Ontario is investing an additional $395 million to cover the costs of inflation.

The benefits of this funding will begin immediately, reducing fees in participating licensed child care for children five years old and younger by up to 25 per cent beginning in April 2022, through retroactive rebates to parents between May and December. In December 2022, parents will see another reduction. In total, by the end of 2022, fees for families will be reduced by 50 per cent, on average. Ontario will achieve an average of $10-a-day child care by September 2025. To ensure a sustainable future that protects Ontario taxpayers and puts parents first, the Canada–Ontario agreement also ensures that the cost of implementing the agreement will continue to be monitored by Canada and Ontario with an automatic financial review process in 2024–25.

Ontario will address increasing demand for child care by creating 86,000 new, high-quality child care spaces. This includes more than 15,000 new spaces already created since 2019. This agreement also includes startup grants for geographic areas of highest need. Ontario’s licensed child care spaces will include a mix of not-for-profit and for-profit settings to provide families with choice and flexibility.

To expand the child care system in Ontario to meet demand, Ontario will also improve compensation for Registered Early Childhood Educators (RECEs) working in participating licensed child care, including RECEs providing child care for children six to 12 years old. Ontario will also continue to support the expansion and recruitment of new early childhood educators.

| Region | Community | School |

|---|---|---|

| North | Ignace | Ignace Public School |

| North | Keewatin | St. Louis School |

| North | Vermilion Bay | Lillian Berg Public School |

| East | Gloucester | École élémentaire catholique Sainte-Marie |

| East | Ottawa | W.E. Gowling Public School |

| East | Russell | Mother Teresa Catholic School |

| West | Brantford | Banbury Heights |

| West | Brantford | École élémentaire catholique Sainte-Marguerite-Bourgeoys |

| West | Guelph | St. Patrick Catholic School |

| West | London | Northeast Elementary School |

| West | London | École élémentaire Marie-Curie |

| West | Milverton | Milverton Public School |

| West | Paris | Cobblestone Elementary School |

| West | Tobermory | St. Edmunds Public School |

| West | Waterloo | École élémentaire L’Harmonie |

| West | West Lorne | St. Mary’s Catholic School, West Lorne |

| Central | Beeton | Tecumseth Beeton Elementary School |

| Central | Brampton | Agnes Taylor Public School |

| Central | Burlington | École élémentaire Renaissance |

| Central | Etobicoke | Elmlea Junior School |

| Central | Grimsby | Lakeview Public School |

| Central | Hamilton | École élémentaire Pavillon de la jeunesse |

| Central | Mississauga | Our Lady of Mercy Elementary School |

| Central | Mississauga | San Lorenzo Ruiz Elementary School |

| Central | Mississauga | Cashmere Avenue Public School |

| Central | North York | École élémentaire catholique Sainte-Madeleine |

| Central | Pickering | Rosebank Road Public School |

| Central | Scarborough | St. Florence Catholic School |

| Central | Scarborough | St. Malachy Catholic School |

| Central | Scarborough | St. Marguerite Bourgeoys Catholic School |

| Central | Sunderland | Sunderland Public School |

| Central | Toronto | École élémentaire catholique du Sacré-Coeur |

Source: Ontario Ministry of Education.

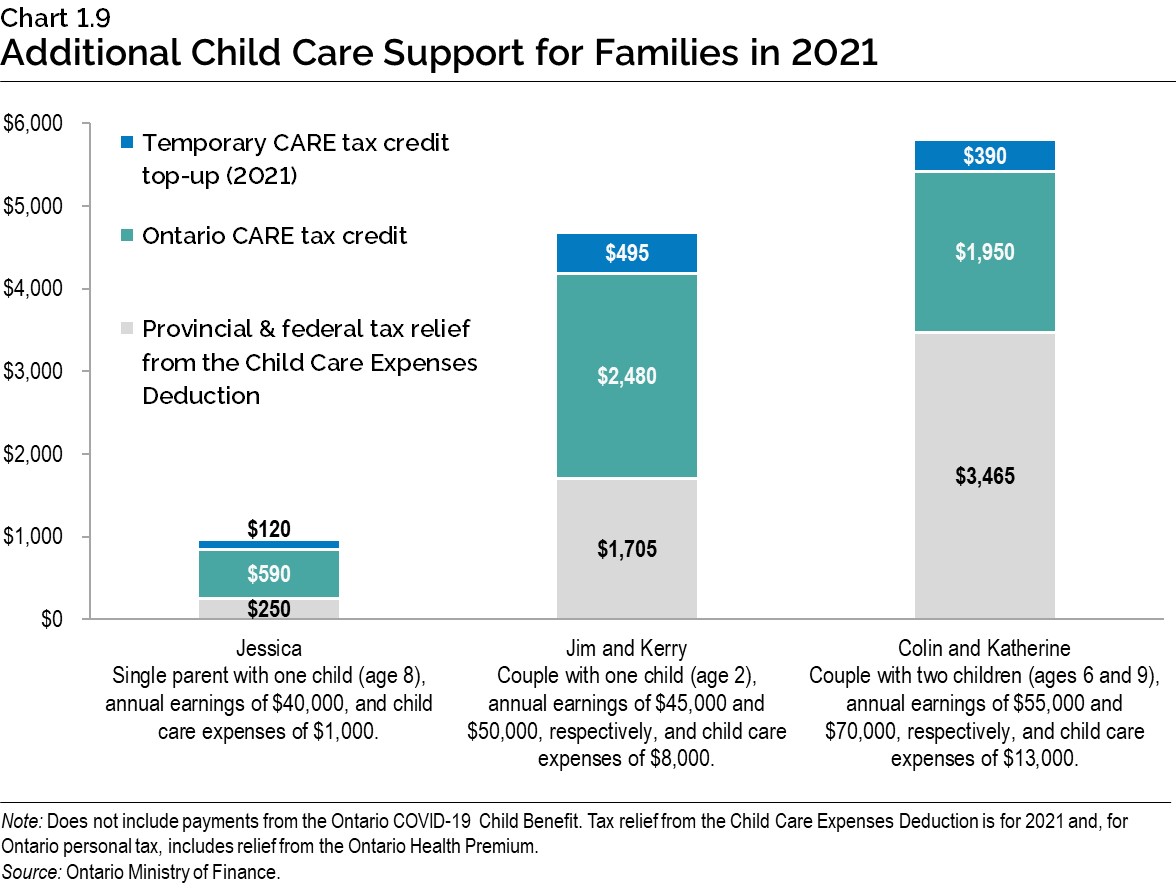

Providing Parents Flexibility and Relief

Some parents work 9 to 5. Some parents work the night shift. Some parents work from home. Different families have different child care needs and are looking for flexibility. This is why the government introduced the Ontario Childcare Access and Relief from Expenses (CARE) tax credit in the 2019 tax year. This credit provides eligible families with flexible support of up to 75 per cent of their eligible child care expenses. In 2021, the government introduced a one-time top-up equal to 20 per cent of the 2021 credit entitlements for eligible families.

The following chart provides three examples of the support provided by the CARE tax credit and the temporary 20 per cent top-up for 2021.

Supporting a Strong and Stable Food Supply Chain

Supply chain disruptions are affecting the productivity and growth of the agri-food sector. To help strengthen the province’s food supply, the government is investing $10 million in 2022–23 to establish a Food Security and Supply Chain Fund. In addition, $5 million is being allocated in 2022–23 for emergency support initiatives to help livestock producers if emergency processing disruptions occur. The government is also developing an Ontario Food Security and Supply Chain Stability Strategy to boost domestic agri-food production capacity and strengthen the food supply into the future.

See Chapter 1, Section A: Rebuilding Ontario’s Economy, Securing the Agri-Food Supply Chain for more details.

Delivering Meals, Medicine and Other Essential Items in Communities

To ensure low-income seniors, people with disabilities and other vulnerable people have access to the essential items they need, the government is investing an additional $5.5 million in the Ontario Community Support Program, bringing the government’s total investment to approximately $22 million. Since April 2020, this critical community support has made approximately 1.6 million deliveries of meals, medicine and other essential items to more than 70,000 low-income seniors and people with disabilities.

Keeping Electricity Bills Down

The Ontario government’s Comprehensive Electricity Plan continues to provide electricity price relief for people and businesses. The plan moves a portion of the cost of non-hydroelectric, renewable energy contracts from ratepayers to the government, lowering the electricity costs on their bills. In addition, the Ontario Electricity Rebate (OER) provides a 17 per centrebate on the total electricity bill of eligible households, small businesses and farms.

The government provides additional targeted electricity bill relief, including for eligible low-income households, rural or remote customers and on-reserve First Nations consumers. For example, the Ontario Electricity Support Program (OESP) provides monthly on-bill credits to eligible low-income customers, and the Low-Income Energy Assistance Program (LEAP) provides a one-time grant towards electricity or natural gas bills to eligible consumers who are behind on payments. The Rural or Remote Rate Protection (RRRP) and Distribution Rate Protection (DRP) programs provide a rate subsidy to eligible rural or remote residential customers and specified residential customers who are served by eight Local Distribution Companies with higher distribution costs, respectively. The On-Reserve First Nations Delivery Credit provides a credit equivalent to the delivery charge on customers’ electricity bills. The Energy Affordability Program (EAP) provides support to income-eligible electricity consumers by helping them to lower their monthly electricity costs and to increase their home comfort.

Extending the Tuition Freeze for Postsecondary Students

To ensure Ontario students have access to affordable, high-quality postsecondary education, the government is maintaining the current tuition freeze for Ontario’s publicly assisted colleges and universities for an additional academic year in 2022–23. The one-year tuition freeze builds on Ontario’s historic 10 per centreduction in tuition for the 2019–20 academic year, and the subsequent two-year tuition freeze from 2020–22. These actions have provided students and families with about $450 million in annual tuition relief when compared to tuition costs in 2018–19.

Expanding the Home and Vehicle Modification Program

The government continues to help individuals with long-term disabilities to remain in their homes and participate in their communities through the Home and Vehicle Modifications Program. An additional investment of $15 million over the next three years will support more than 1,200 individuals and families each year in making their homes safer and more accessible. Eligible individuals may receive a grant of up to $15,000 to modify their home and/or vehicle so they can live safely and comfortably in their homes, avoid job loss and participate in their communities.

Chart Descriptions

Chart 1.8: Additional Support from the Proposed LIFT Credit Enhancement

This bar chart shows the existing and enhanced support an individual and one couple would get from the proposed Low-income Individuals and Families Tax (LIFT) Credit enhancement. The enhanced credit is shown on top of the existing LIFT Credit (if any).

Left section: Noah is a single worker who earns $40,000 in 2022. Noah would receive $0 from the existing LIFT Credit and $515 from the proposed enhancement to the LIFT Credit.

Right section: Mohammed and Fatima are a working couple, earning $35,000 and $30,000, respectively. They would get about $765 in tax relief from the existing LIFT Credit, and about $845 in additional tax relief from the proposed enhancement to the LIFT Credit.

Notes: For 2022. Individuals only have employment income and claim the Ontario basic personal, Canada Pension Plan and Employment Insurance amounts. Numbers have been rounded.

Source: Ontario Ministry of Finance.

Chart 1.9: Additional Child Care Support for Families in 2021

This bar chart shows the existing and enhanced support three representative families would get in 2021. The temporary Ontario CARE tax credit top-up is shown on top of the current Ontario CARE tax credit and federal and Ontario Personal Income Tax relief these families receive from the existing Child Care Expenses Deduction.

Left section: Jessica is a single parent with an eight-year-old child. With annual earnings of $40,000, and eligible child care expenses of $1,000 for the year, she would get $250 in total federal and provincial Personal Income Tax relief from the deduction, $590 from the Ontario CARE tax credit, and an additional $120 from the temporary CARE tax credit top-up. In total, this would bring total support to 96 per cent of eligible expenses.

Middle section: Jim and Kerry are a couple with a two-year-old child, and annual earnings of $45,000 and $50,000, respectively. With eligible child care expenses of $8,000, they would get $1,705 in total federal and provincial Personal Income Tax relief from the deduction, $2,480 from the Ontario CARE tax credit, and an additional $495 from the temporary CARE tax credit top-up. In total, this would bring total support to 59 per cent of eligible expenses.

Right section: Colin and Katherine are a couple with two children ages six and nine. With annual earnings of $55,000 and $70,000, respectively, and eligible child care expenses of $13,000, they would get $3,465 in total federal and provincial Personal Income Tax relief from the deduction, $1,950 from the Ontario CARE tax credit, and an additional $390 from the temporary CARE tax credit top-up. In total, this would bring total support to 45 per cent of eligible expenses.

Note: Does not include payments from the Ontario COVID-19 Child Benefit. Tax relief from the Child Care Expenses Deduction is for 2021 and, for Ontario Personal Income Tax, includes relief from the Ontario Health Premium.

Source: Ontario Ministry of Finance.