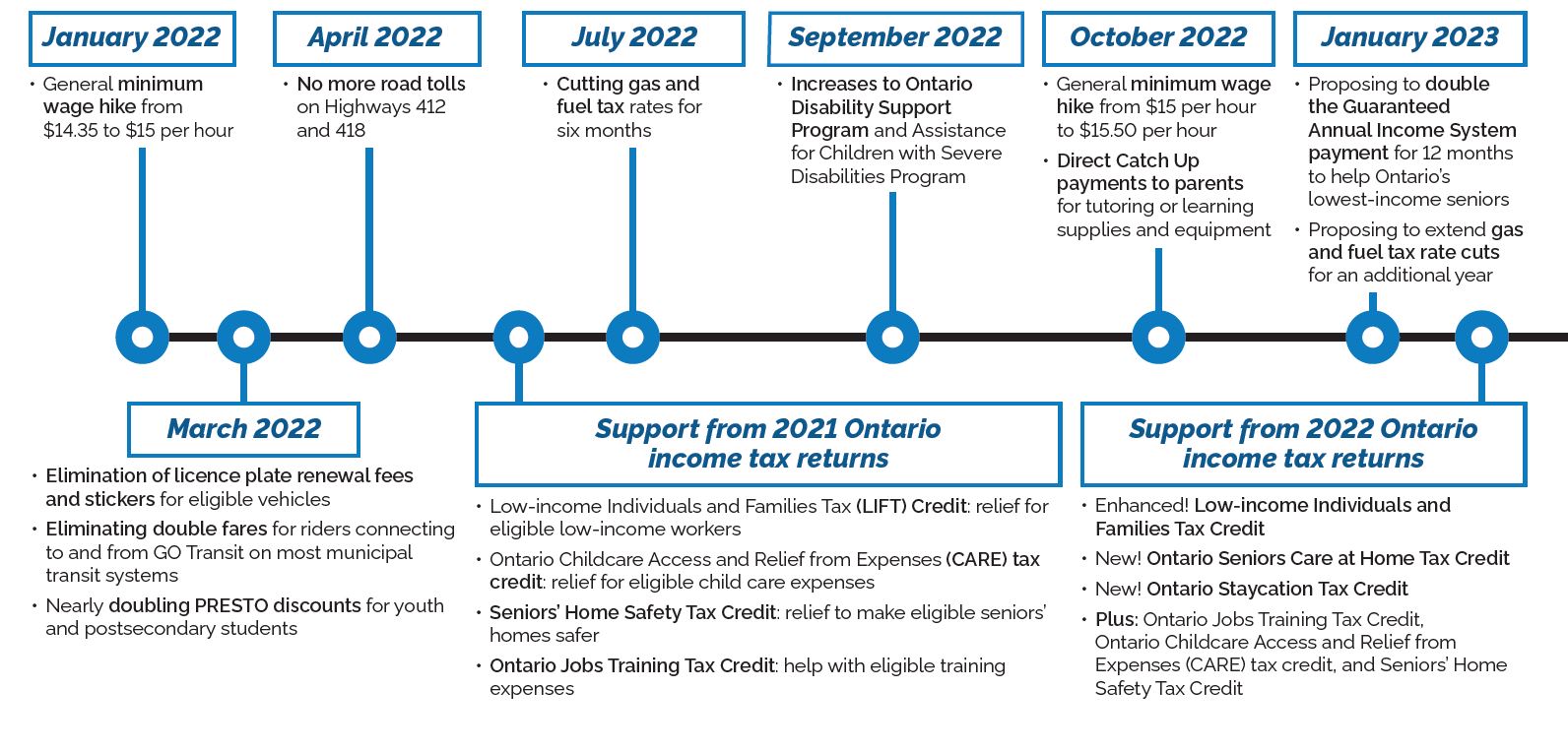

See below for accessible description of the timeline.

January 2022

- General minimum wage hike from $14.35 to $15 per hour

March 2022

- Elimination of licence plate renewal fees and stickers for eligible vehicles

- Eliminating double fares for riders connecting to and from GO Transit on most municipal transit systems

- Nearly doubling PRESTO discounts for youth and postsecondary students

April 2022

- No more road tolls on Highways 412 and 418

Support from 2021 Ontario income tax returns

- Low‐income Individuals and Families Tax (LIFT) Credit: relief for eligible low-income workers

- Ontario Childcare Access and Relief from Expenses (CARE) tax credit: relief for eligible child care expenses

- Seniors’ Home Safety Tax Credit: relief to make eligible seniors’ homes safer

- Ontario Jobs Training Tax Credit: help with eligible training expenses

July 2022

- Cutting gas and fuel tax rates for six months

September 2022

- Increases to Ontario Disability Support Program and Assistance for Children with Severe Disabilities Program

October 2022

- General minimum wage hike from $15 per hour to $15.50 per hour

- Direct Catch Up Payments to parents for tutoring or learning supplies and equipment

January 2023

- Proposing to double the Guaranteed Annual Income System payment for 12 months to help Ontario’s lowest-income seniors

- Proposing to extend gas and fuel tax rate cuts for an additional year

Support from 2022 Ontario income tax returns

- Enhanced! Low-income Individuals and Families Tax Credit

- New! Ontario Seniors Care at Home Tax Credit

- New! Ontario Staycation Tax Credit

- Plus: Ontario Jobs Training Tax Credit, Ontario Childcare Access and Relief from Expenses (CARE) tax credit, and Seniors’ Home Safety Tax Credit

Updated: November 14, 2022

Published: November 14, 2022