Backgrounder

A Plan To Create A More Competitive Business Environment

November 6, 2019

Ontario has a plan to create a business environment that attracts investment and encourages entrepreneurs and risk takers to grow their businesses and create high-paying, good quality jobs. Ontario is a province of tremendous opportunity and potential however, high taxes, excessive payroll costs and burdensome red tape have been driving investment and jobs away from the province. That is why the government is creating the conditions for success by reducing taxes and eliminating outdated and duplicative regulations, while making sure important health, safety and environmental protections are maintained or enhanced.

Supporting Small Businesses

Small businesses play an important role in the economy. To help small businesses grow and succeed, the government is proposing to reduce the small business Corporate Income Tax rate to 3.2 per cent from 3.5 per cent, starting January 1, 2020, fulfilling the promise to cut Ontario’s small business tax rate by 8.7 per cent. This measure would provide tax relief of up to $1,500 annually to over 275,000 businesses that benefit from the small business Corporate Income Tax rate — from family-owned shops to innovative start-ups.

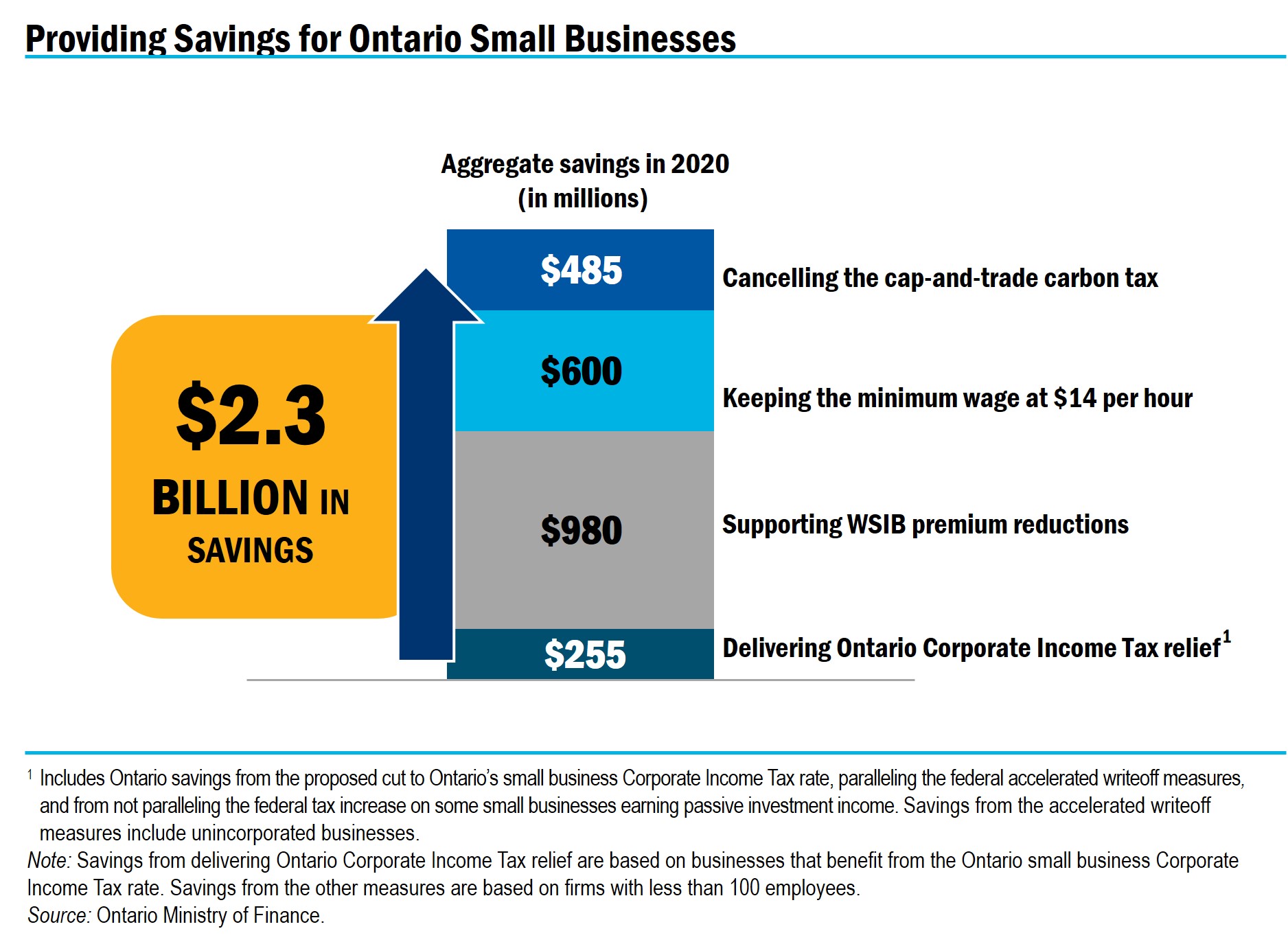

Overall, Ontario’s small businesses would save $2.3 billion in 2020 through actions the government is taking such as cancelling the cap-and-trade carbon tax, keeping the minimum wage at $14 per hour, supporting Workplace Safety & Insurance Board (WSIB) premium reductions and delivering Ontario Corporate Income Tax relief.

In addition to the steps the government has already taken, it will consult with industry and business leaders to better identify the needs of small businesses and to inform its Small Business Success Strategy.

Supporting Small Businesses by Cancelling the Cap-and-Trade Carbon Tax

Ontario is supporting small business by cancelling the cap-and-trade carbon tax. Ontario small businesses will save about $485 million in 2020 from cancellation of the cap-and-trade carbon tax. Businesses now face the federal government’s carbon tax, imposed on April 1, 2019, which among other things has added 4.4 cents per litre to the price of gasoline in Ontario resulting in an additional cost burden on businesses. This will rise to 11.1 cents per litre by April 2022.

Creating a Competitive Business Environment

Ontario is proposing to form the Premier’s Advisory Council on Competitiveness that will consult with business leaders and private sector workers and leverage lessons from other jurisdictions to improve Ontario’s competitiveness.

To encourage businesses across the province to make investments, such as machinery upgrades or expansions, the Province is paralleling federal measures that allow businesses to accelerate writeoffs of capital investments. These measures apply to assets acquired after November 20, 2018 and will deliver $3.8 billion in Ontario Corporate Income Tax relief over six years.

To assist regions in the province that have not fared as well as others, the government is taking the first step to transform business support programs by moving forward with the new Regional Development Program. Under this program, the redesigned Eastern Ontario Development Fund and the Southwestern Ontario Development Fund will focus on providing performance-based loans to eligible businesses operating or seeking to expand in Eastern and Southwestern Ontario. This will help these regions attract investment, create local jobs and diversify their economies.

Reducing Red Tape

The government is eliminating burdensome, outdated and unnecessary regulation to help restore Ontario’s competitiveness, retain high-quality jobs and attract investment. It is committing to reduce red tape to save businesses $400 million annually by 2020 — making it simpler, faster and more cost-effective to do business in Ontario, while making sure important health, safety and environmental protections are maintained or enhanced.

This fall, the Province introduced a package of over 80 proposed actions, including the Better for People, Smarter for Business Act, 2019, which would create efficiencies and reduce red tape across many sectors. These measures will help restore Ontario’s competitiveness, retain high-quality jobs and create an attractive investment climate. In addition, these changes are expected to reduce the compliance costs to key economic sectors and the wider business community and would result in an overall reduction in the regulatory burden. These proposed measures also build off of more than 100 actions the government has already taken to reduce red tape.

Supporting More Efficient Capital Markets

The government continues to work with the Ontario Securities Commission (OSC) to support the Capital Markets Plan. This plan focuses on strengthening investment in Ontario, promoting competition and facilitating innovation in order to position Ontario as a leading capital markets jurisdiction.

The Securities Act has not been reviewed in over 15 years, is outdated, and should support modern capital markets. Ontario is working to modernize the securities regulatory framework to make it responsive to innovation and changes in a rapidly evolving marketplace.

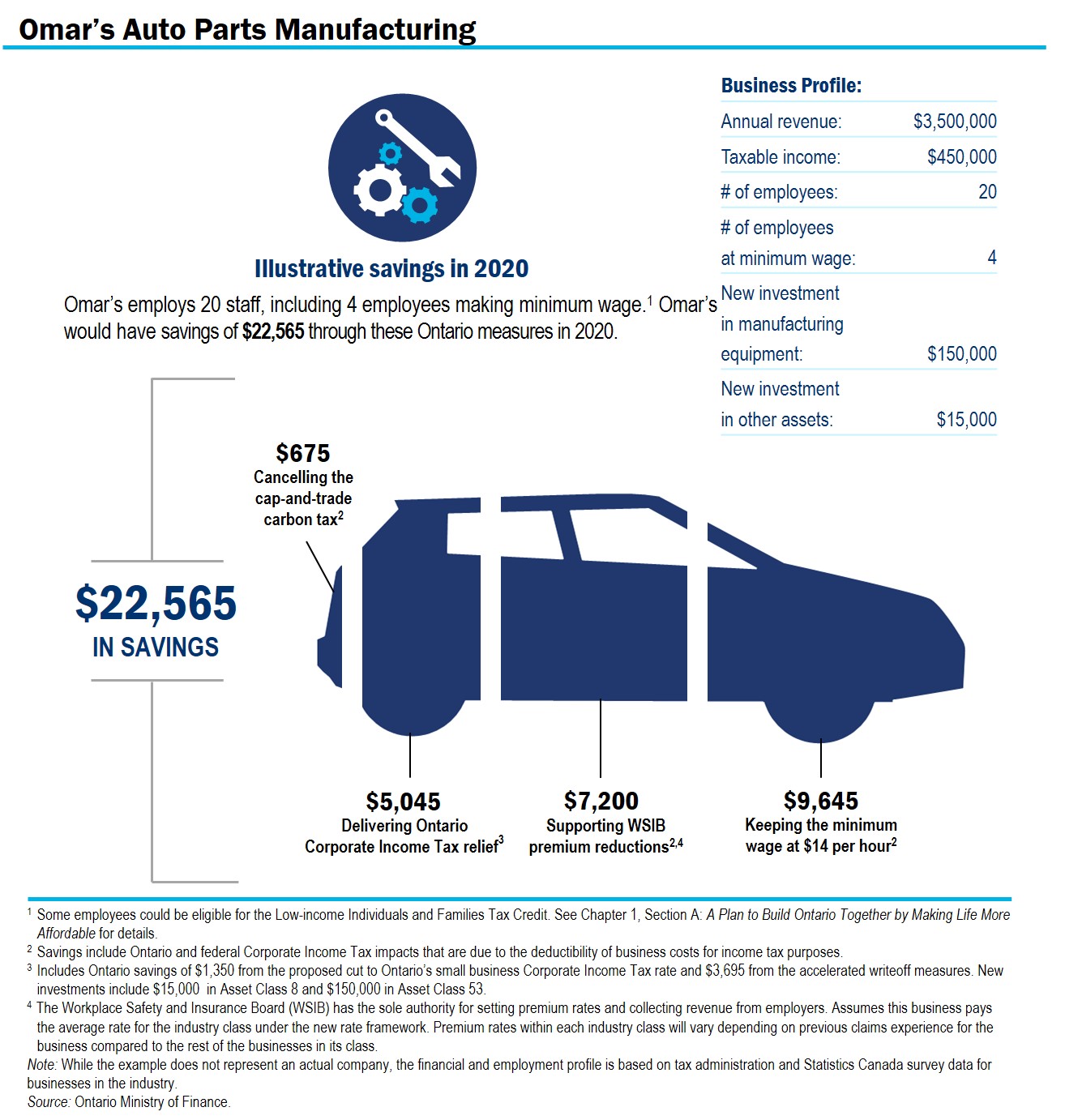

Lowering Costs for Businesses

Actions taken by the government are lowering costs for businesses in Ontario, allowing them to grow and create jobs. The infographic below illustrates savings in 2020 for a small auto parts manufacturer with annual revenue of $3,500,000, and taxable income of $450,000. The company employs 20 staff including four employees making minimum wage. Its savings in 2020 would be $22,565 through the following Ontario measures: savings from cancelling the cap-and-trade carbon tax ($675), delivering Ontario Corporate Income Tax relief ($5,045), supporting WSIB premium reductions ($7,200), and keeping the minimum wage at $14 per hour ($9,645).

Chart Descriptions

Chart 1: Providing Savings for Ontario Small Businesses

This chart illustrates savings for Ontario small businesses. Actions taken by the government would save Ontario small businesses approximately $2.3 billion in 2020.

Chart 2: Omar’s Auto Parts Manufacturing

This infographic illustrates savings in 2020 for Omar’s Auto Parts Manufacturing. Omar’s Auto Parts employs 20 staff including four employees making minimum wage. This company would have savings of $22,565 in 2020 through the following Ontario measures: savings from cancelling the cap-and-trade carbon tax ($675), delivering Ontario Corporate Income Tax relief ($5,045), supporting WSIB premium reductions ($7,200), and keeping the minimum wage at $14 per hour ($9,645).