Ontario’s Action Plan: Protect, Support, Recover provides $15 billion in new supports, building on the $30 billion in total supports to date from the first phases of Ontario’s response to COVID‑19, for a total of $45 billion in total supports over a three-year period.

Protect

Builds on the government’s urgent response to COVID‑19 and provides $15.2 billion in supports, including $7.5 billion in new funding.

Highlights of the $7.5 billion in new funding include:

- Increasing average daily direct care from a nurse or personal support worker (PSW) per long‑term care resident to four hours a day over a four-year period, making Ontario the leader among Canadian provinces in protecting our seniors;

- Making available $4 billion in 2021–22 and a further $2 billion in 2022–23 in dedicated support to protect people’s health and to support the fight against the COVID‑19 pandemic; and

- Opening the new Cortellucci Vaughan Hospital site with a new emergency room, state-of-the-art diagnostic imaging and operating rooms. This is the first newly built hospital to open in Ontario in 30 years that adds net new capacity to the system.

These investments build on supports announced as part of the first phases of Ontario’s response to COVID‑19, including:

- Investing $2.8 billion in a Fall Preparedness Plan to support response efforts to the second wave of

COVID‑19. Key investments include over $1.4 billion to continue to ramp up COVID‑19 testing, case and contact management, $351 million to support 2,250 hospital beds, $284 million to address the surgical backlog and $70 million to purchase influenza vaccines; - Investing $1.75 billion to increase long-term care capacity and access for residents by building 30,000 long‑term care beds. The government is also introducing a new and innovative Accelerated Build Pilot Program that will enable the faster construction of four new long-term care homes and add up to 1,280 beds to the sector, with a targeted completion of early 2022;

- Investing an additional $572 million in hospitals for costs incurred during the pandemic;

- Providing $270 million for public health, home and community care supports and virtual care and Telehealth initiatives;

- Providing over $1.5 billion for pandemic pay — a temporary pay increase of $4 per hour for more than 375,000 frontline workers for work performed from April 24 to August 13, 2020 — in partnership with the federal government;

- Purchasing nearly $1.1 billion in personal protective equipment (PPE) and other critical supplies to protect our health care workers, patients and people across the province;

- Launching a recruitment campaign to hire 98 more occupational health and safety inspectors, so that Ontario will have more active inspectors than at any time in its history. Since March 11, over 20,000 field visits were conducted by ministry inspectors;

- Providing $461 million in temporary wage increases, effective October 1, 2020, for over 147,000 personal support workers (PSWs) and direct support workers who deliver publicly funded personal support services, helping the province attract and retain the workforce needed to care for patients, clients and residents in response to the COVID‑19 pandemic; and

- Building on the $3.8 billion investment over 10 years for the Mental Health and Addictions (MHA) Roadmap to Wellness, the government is providing additional funding to help expand access for critical mental health and addictions support and reduce wait times for critical services. This includes $176 million in 2020–21, for important initiatives such as expanded community supports in both French and English as well as investing $19.25 million for mental health supports for postsecondary students.

Support

Builds on assistance already made available to families, workers and employers and provides $13.5 billion in supports for people and jobs, including $2.4 billion in new funding.

Highlights of the $2.4 billion in new funding include:

- Providing $380 million to parents through another round of payments, following the $378 million of funding in March of $200 per child up to age 12 and $250 per child and youth with special needs up to age 21, through the Support for Learners initiative. This will assist with added costs of COVID‑19, such as technology for online learning. This means a family with three young children, one of whom has special needs, would receive $1,300 in 2020 to support costs related to educational supplies and technology.

- Proposing the new Seniors’ Home Safety Tax Credit for the 2021 taxation year — a 25 per cent credit on eligible renovations of up to $10,000 — to help seniors stay in their homes longer by making their homes safer and more accessible. Seniors would be eligible regardless of their incomes and whether they owe income tax for 2021. Family members who live with them and support them would also be eligible;

- Investing an additional $60 million over three years starting in 2020–21 in the Black Youth Action Plan, doubling its base funding to extend the current program and create a new economic empowerment stream that will support Black youth in achieving social and economic success;

- Investing $100 million over two years for the Community Building Fund to support community tourism, cultural and sport organizations, which are experiencing significant financial pressures due to the pandemic;

- Providing one-time emergency funding of $25 million for Ontario’s arts institutions to help cover operating losses incurred as a result of COVID‑19; and

- Providing an additional $1.8 billion in the Support for People and Jobs Fund over the next two years,

2021–22 and 2022–23, to remain responsive to emerging needs and continue providing supports for the people of Ontario.

These investments build on supports announced as part of the first phases of Ontario’s response to COVID‑19, including:

- Making available $1.3 billion in 2020–21 for the education sector to keep students, teachers and staff safe as schools reopen;

- Making $300 million available to assist eligible businesses pay the costs associated with property taxes and energy bills, in any region in Ontario where the Province determines recently modified Stage 2 public health restrictions are necessary, or going forward, in areas categorized as Control or Lockdown;

- Investing up to $4 billion for municipalities and transit systems to provide one-time assistance, in partnership with the federal government, to help local governments address budget shortfalls related to COVID‑19 and maintain the critical services people rely on every day;

- Providing $176 million in 2020–21 in relief through off-peak electricity pricing 24 hours a day for residential, farm and small business time-of-use customers from March 24, 2020 to May 31, 2020;

- Suspending time-of-use electricity rates and introducing a new fixed COVID‑19 Recovery Rate of 12.8 cents per kilowatt hour to be charged 24 hours a day, 7 days a week from June 1, 2020 to October 31, 2020;

- Investing $241 million to deliver over $900 million in urgent relief to roughly 64,000 small businesses and their landlords, through the Canada Emergency Commercial Rent Assistance program, in partnership with the federal government;

- Providing $60 million in one-time grants of up to $1,000 for eligible main street small businesses — in retail, food and accommodations, and other service sectors with fewer than 10 employees, to help offset the unexpected costs of personal protective equipment (PPE);

- Investing $510 million through the Social Services Relief Fund to help municipal service managers and Indigenous housing partners protect homeless shelter staff and residents, expand rent support programming and create longer-term housing solutions;

- Launching the $50 million Ontario Together Fund to help businesses provide innovative solutions or retool their operations in order to manufacture essential medical supplies and equipment; and

- Helping small businesses create and enhance their online presence to reach more customers through the $57 million Digital Main Street program.

Recover

While Ontario remains focused on getting through COVID‑19, the government and people must begin to build the foundation for a strong recovery fuelled by economic growth. This pillar includes $4.8 billion in new supports for recovery efforts that will be built on over time.

Highlights of the $4.8 billion in funding include:

- Making additional investments of over $680 million over the next four years in broadband infrastructure, which, combined with its prior commitments, increases Ontario's investment to an historic nearly $1 billion to ensure communities across the province are connected;

- Bringing more jobs to Ontario with a comprehensive plan to address the job-killing high costs of electricity, saving medium-size and larger industrial and commercial employers about 14 and 16 per cent respectively, on average, on their electricity bills (at an additional expense of $1.3 billion over three years);

- Reducing property taxes on job creators and levelling the playing field by lowering high Business Education Tax (BET) rates for over 200,000 employers, or 94 per cent of all business properties in Ontario, to a rate of 0.88 per cent. This is creating $450 million in immediate annual savings and representing a reduction of 30 per cent for many businesses currently subject to the highest BET rate in the province;

- Responding to requests from local governments by proposing to provide municipalities with the ability to cut property tax for small businesses and a provincial commitment to consider matching these reductions. This would provide small businesses as much as $385 million in total municipal and provincial property tax relief by 2022–23, depending on municipal adoption;

- Ending a tax on jobs for an additional 30,000 employers by proposing to make permanent the Employer Health Tax (EHT) exemption increase from $490,000 to $1 million. With this additional relief about 90 per cent of employers would pay no EHT, saving them $360 million in 2021–22 that could be reinvested in jobs and growth;

- Committing to provide Ontario residents with support of up to 20 per cent for eligible Ontario tourism expenses to encourage them to safely discover Ontario in 2021, the year of the Ontario staycation;

- Connecting workers in the tourism and hospitality sector and others most affected by the pandemic to training and jobs with an investment of $180.5 million over 3 years, including a skilled trades strategy, an additional $100 million of dedicated investments through Employment Ontario for skills training, a redesigned Second Career program, and $59.5 million to acquire in‑demand skills; and

- Providing $500 million over four years to make government services more reliable, convenient and accessible through the Ontario Onwards Acceleration Fund.

Cash flow supports

In 2020, Ontario made $11.3 billion available to improve cash flow for people and businesses through tax and other deferrals, to provide relief during this challenging economic time. This included:

- Providing a six-month interest and penalty-free period to make payments for most provincially administered taxes, providing $7.5 billion in relief to help 100,000 Ontario businesses;

- Deferring the June 30 remittance of education property tax to school boards by 90 days, which provided municipalities with flexibility to provide property tax deferrals of over $1.8 billion to residents and businesses; and

- The Workplace Safety and Insurance Board allowing a six-month deferral of premium payments, providing up to $1.9 billion in financial relief to employers.

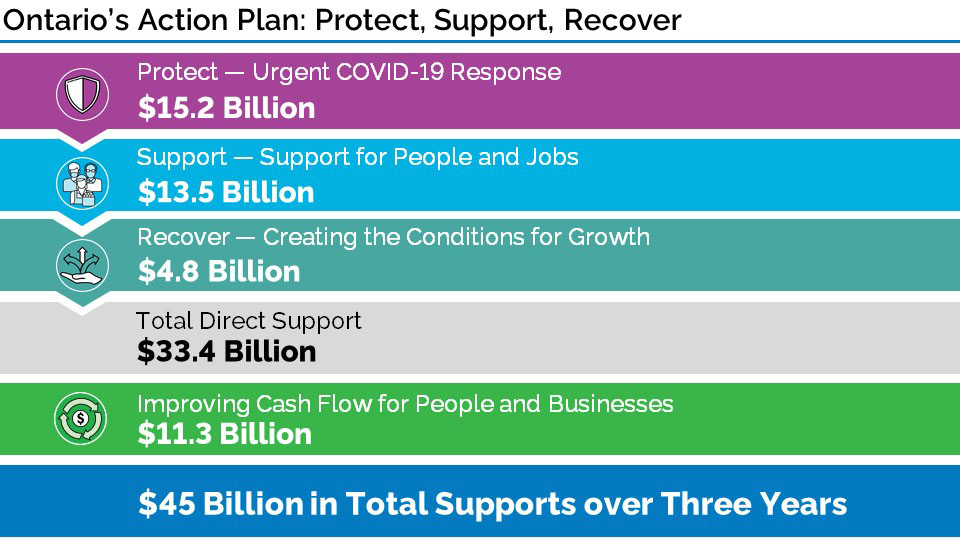

Chart Description

Chart: Ontario’s Action Plan: Protect, Support, Recover

Protect – Urgent COVID-19 Response

$15.2 Billion

Support – Support for People and Jobs

$13.5 Billion

Recover – Creating the Conditions for Growth

$4.8 Billion

Total Director Support

$33.4 Billion

Improving Cash Flow for People and Businesses

$11.3 Billion

$45 Billion in Total Supports over Three Years