Introduction

The government has a plan to attract investment, encourage entrepreneurs and risk-takers, and grow small businesses. The goal of the plan is to create high-paying, quality jobs across the province.

High taxes and energy costs, burdensome red tape, excessive compliance requirements and outdated regulations are costing businesses time and money, which in turn is driving away investment and job creation in the province.

That is why the government is creating a business-friendly environment by reducing taxes, encouraging regional and innovative investments, and eliminating outdated and duplicative regulations, while making sure that important health, safety and environmental protections are maintained or enhanced. This plan will build the foundation to create a more prosperous and competitive Ontario.

Businesses in Ontario are already benefiting from the progress the government has made towards its goal to reduce red tape — which is expected to generate savings of $400 million annually for businesses by 2020. The government is also focused on reducing the cost of energy and enabling critical investments in projects that will help Ontario industries grow. The Ontario Job Creation Investment Incentive, which allows businesses to accelerate writeoffs of capital investments, is also encouraging new investment in Ontario.

The government’s plan is creating a culture that celebrates and rewards entrepreneurs and encourages investment and growth in every region of the province. It is rebuilding the essential link between a growing economy and Ontario’s ability to invest in world-class government services and supports for the most vulnerable.

Supporting Small Businesses

Today, there are more than 470,000 small businesses in Ontario representing almost 98 per cent of all businesses in the province. Small businesses provide about one-third of private-sector employment — just over two million jobs — and play a large role in the economy by providing goods and services to larger companies, consumers and government. The Province is committed to helping small businesses grow and succeed across all industries and communities in the province. Key initiatives that support small businesses are summarized below, including the government’s proposal, in this document, to cut the small business Corporate Income Tax rate to 3.2 per cent from 3.5 per cent.

Lowering Costs by Cutting Taxes for Small Businesses

As promised, the government is proposing to lower costs for small businesses by reducing taxes. The Province has a preferential small business Corporate Income Tax (CIT) rate of 3.5 per cent. The small business CIT rate provides $2.4 billion annually in tax relief to Ontario’s small businesses compared to what they would pay if they were charged the general CIT rate of 11.5 per cent.

The government is proposing to reduce the small business CIT rate to 3.2 per cent from 3.5 per cent starting January 1, 2020, fulfilling its promise to cut Ontario’s small business tax rate by 8.7 per cent. This measure would provide tax relief of up to $1,500 annually to over 275,000 businesses that benefit from the small business CIT rate, from family-owned businesses to innovative start-ups.

See the Annex: Details of Tax Measures for more details.

Small businesses already benefit from accelerated writeoffs of capital investments as well as the government’s decision to not parallel a federal measure that would have increased taxes on some small businesses earning passive investment income. These tax measures, along with the proposed small business CIT rate cut, would deliver a total of $255 million in Ontario income tax relief to small businesses in 2020.

Lowering Costs for Small Businesses

In addition to providing tax relief, the government has taken actions such as cancelling the cap-and-trade carbon tax, keeping the minimum wage at $14 per hour and supporting a reduction in Workplace Safety and Insurance Board (WSIB) premiums. These measures, together with Ontario income tax relief, would save small businesses $2.3 billion in 2020.1

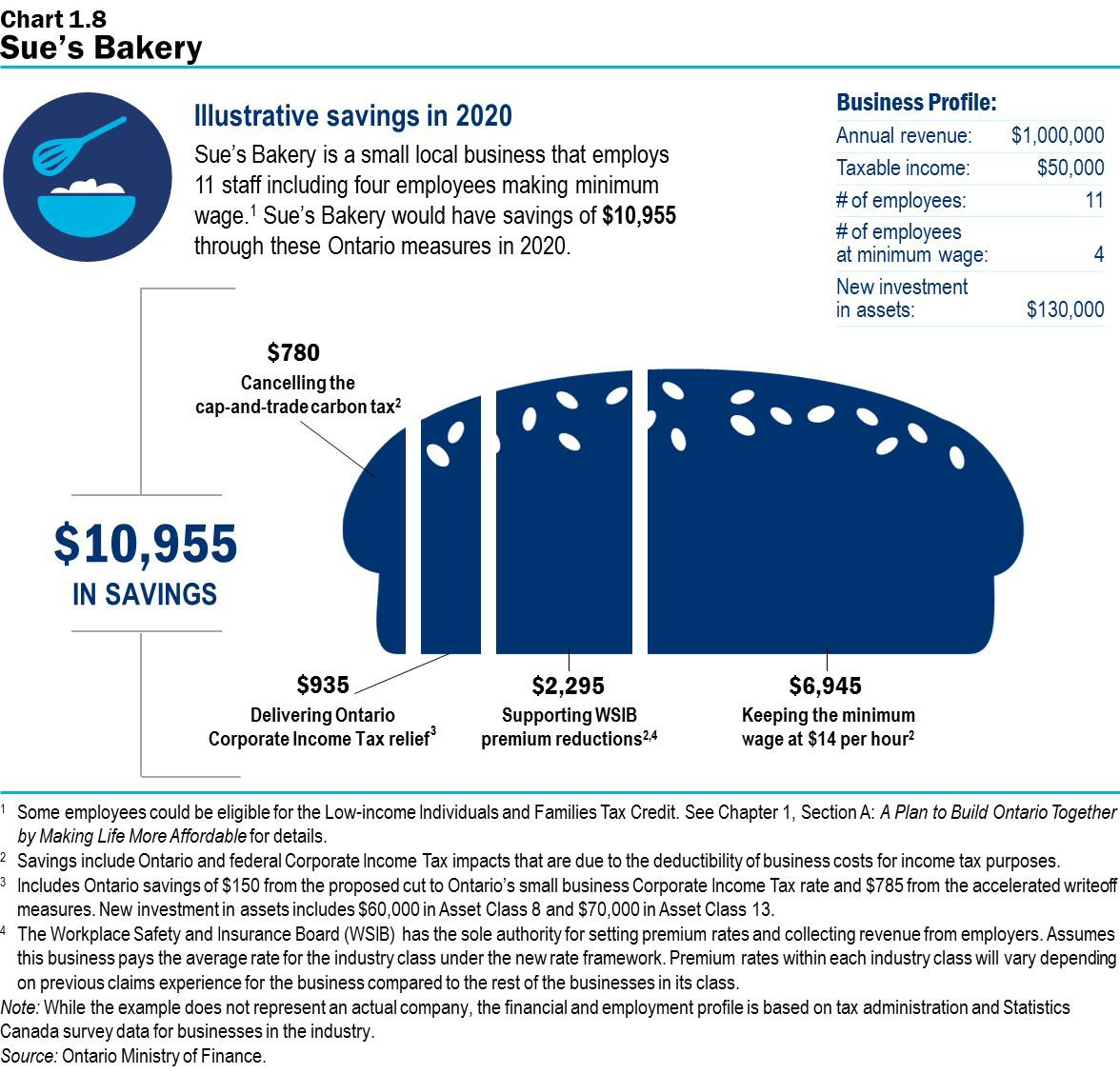

Lowering Costs for Small Businesses — Illustrative Savings for a Local Business

To illustrate these savings, consider Sue’s Bakery, a small local business that employs 11 staff including four that earn minimum wage.

In 2020, Sue’s Bakery would save $935 in Ontario Corporate Income Tax from the proposed cut to Ontario’s small business Corporate Income Tax rate and measures to accelerate writeoffs of capital investments. This is in addition to $780 in savings from the cancellation of the cap-and-trade carbon tax, $2,295 from reduced WSIB premiums, and $6,945 from keeping the minimum wage at $14 per hour.

In total, Sue’s Bakery would see savings of $10,955 in 2020 from these Ontario measures.

Reducing Red Tape for Small Businesses

The government’s plan to reduce regulatory barriers to growth will continue to support small businesses. The fall burden reduction bill, the Better for People, Smarter for Business Act, 2019, contains several proposed amendments that will support small businesses, including:

- Reducing data collection requirements for barbers and hairdressers because their services are non-invasive by amending the Health Protection and Promotion Act;

- Removing duplicative training requirements for dry cleaning establishments by revoking Ontario Regulation 323/94 (Dry Cleaners) under the Environmental Protection Act; and

- Simplifying and shortening insurance contracts for agricultural producers and allowing for more online and simplified processes for low-value claims by amending the Agricultural Products Insurance Act.

Supporting Small Business Growth

The government recognizes that small and medium-sized enterprises (SMEs) often do not have the time or resources to access the Province’s business support programs. The new Regional Development Program2 will help overcome these barriers by prioritizing SMEs for support, and making it simpler and faster for businesses to navigate government programs. The Regional Development Program will provide access to financial and non-financial tools to support investment and help SMEs grow and create good jobs.

Developing a Small Business Success Strategy

To inform the development and implementation of an Ontario Small Business Success Strategy, the Province will host consultations with industry and business leaders in the coming months to better identify the needs of small businesses. As small businesses are located across industries and communities in Ontario, these consultations will provide business owners the opportunity to directly tell the government about what matters most to them, and what additional steps the government can take to help their businesses flourish and grow.

Creating a Competitive Business Environment

The government is committed to creating an environment that attracts investment and encourages entrepreneurs to start and grow a business.

For the economy to be competitive, governments must focus on all factors that influence business investment decisions. As outlined later in this chapter, creating a more competitive business environment includes lowering costs and reducing regulatory burdens. In addition, the Province is acting on a broad range of measures that will support Ontario’s economic competitiveness:

- The government’s balanced approach to managing the Province’s finances increases business confidence and sends a positive signal to investors. See Ontario’s Economic and Fiscal Outlook in Brief for more details.

- As outlined in Chapter 1, Section A: A Plan to Build Ontario Together by Making Life More Affordable, the government is putting more money back into people’s pockets. This will improve the lives of people and encourage workers to stay in or move to Ontario.

- Ensuring that today’s students and tomorrow’s innovators and workers have the necessary skills to reach their full potential will help businesses find the employees they need to succeed in a changing economy. See Chapter 1, Section B: A Plan to Build Ontario Together by Preparing People for Jobs for more details.

- Investment in infrastructure, such as building highways, new subways, rapid transit projects, and expanding natural gas and broadband access will improve productivity and help businesses get goods to markets. See Chapter 1, Section D: A Plan to Build Ontario Together by Connecting People to Places and the Enabling Natural Gas Expansion section later in this chapter, for more details.

- Making government processes and services more innovative and efficient, as described in Chapter 1, Section F: A Plan to Build Ontario Together by Making Government Smarter, to be responsive to the needs of companies and help them invest, grow and attract talent.

Establishing a Premier’s Advisory Council on Competitiveness

The government is committed to ensuring Ontario continues to be the economic engine of the federation by creating the conditions for long-term economic growth and prosperity.

Since coming to office, the government has taken swift action to improve Ontario’s competitiveness through various initiatives. At the same time, the government recognizes that the world continues to change and shift to an ever more digital and technology-centric, globally connected economy. Ontario must and will adapt to ensure that its people and businesses can compete in the new economy.

This is why the government is proposing to form the Premier’s Advisory Council on Competitiveness, which will be supported by the Ministry of Finance and the Ministry of Economic Development, Job Creation and Trade. The Council will consult with Ontario’s business leaders, speak directly with private-sector workers, and leverage lessons from peer jurisdictions to understand how to improve Ontario’s competitiveness.

The Council will report back with actionable recommendations that will improve competitiveness in a practical way that ensures all people of Ontario, no matter which region they live in or their background, can share in economic prosperity.

Encouraging Investment and Regional Prosperity

There are some areas of the province that have not fully recovered from the global economic downturn over a decade ago. In order for Ontario to be a global leader in job growth and the premier destination to start a new business, all regions of the province should share in prosperity. Over the coming months, the government will be consulting on ways to encourage investment into rural and undercapitalized areas of the province with the goal of restoring Ontario’s competitiveness and allowing the private sector to create jobs and growth. The outcome could include exploring potential changes to the tax system that may benefit overlooked areas of the province and new, upcoming industries.

Lowering Costs for Businesses

As referenced earlier, a number of significant government actions are lowering costs for businesses in Ontario, allowing them to grow and create jobs, and creating a competitive environment to attract new investment, including:

- Cancelling the cap-and-trade carbon tax;

- Keeping the provincial minimum wage at $14 per hour until October 1, 2020, after which it will increase based on inflation;

- Supporting a 17 per cent cut to the average WSIB premium rate for 2020, which is on top of a nearly 30 per cent reduction in the average premium rate in 2019;

- Providing accelerated writeoffs of capital investments;

- Not paralleling a federal measure that would have increased Ontario Corporate Income Tax on about 7,900 small businesses earning passive investment income; and

- Proposing to cut the small business Corporate Income Tax rate to 3.2 per cent, which would provide tax relief of up to $1,500 annually to over 275,000 small businesses.

It is estimated that Ontario businesses would save $5.4 billion in 2020 through these actions.

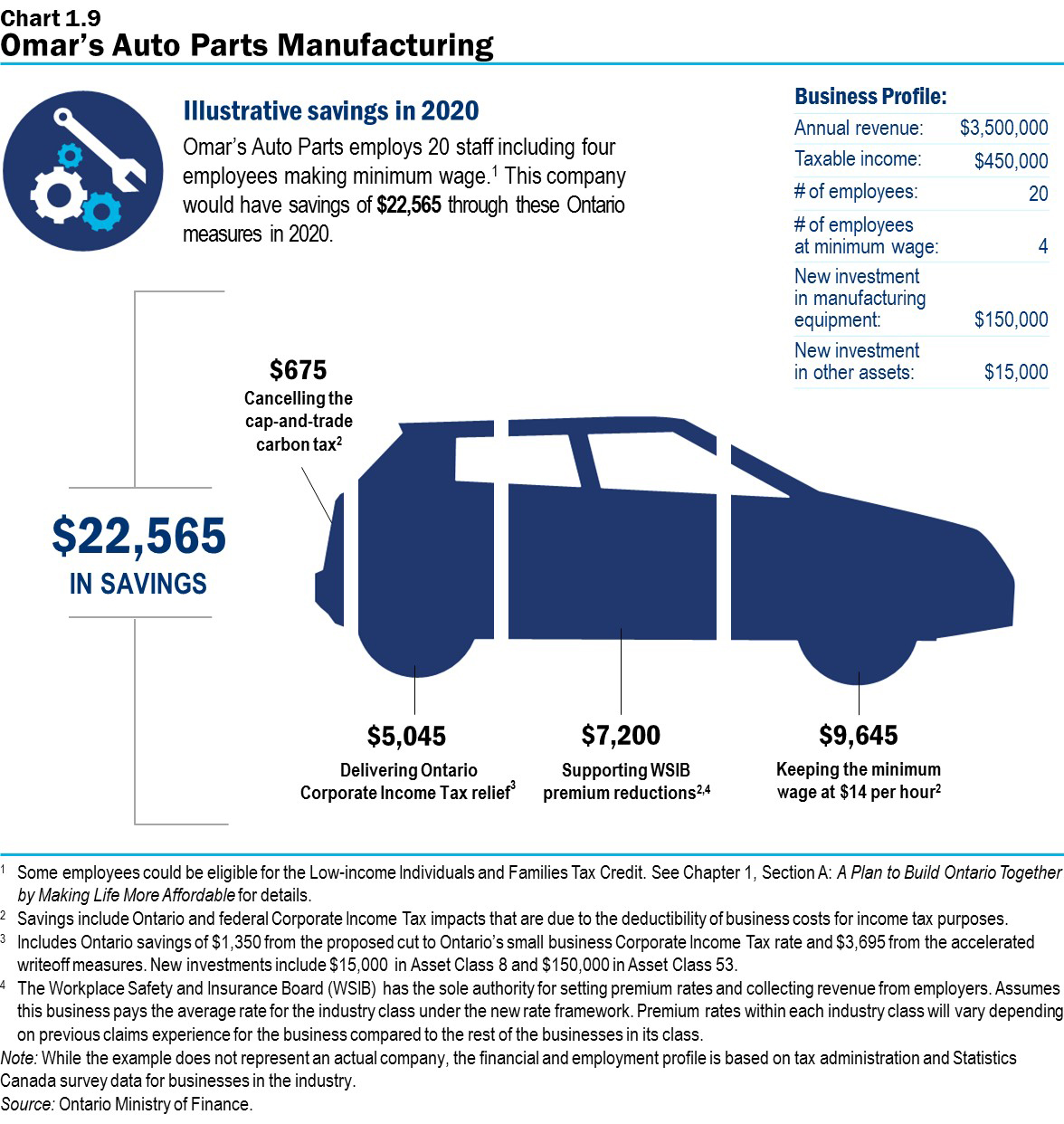

Lowering Costs for Businesses — Illustrative Savings for a Small Manufacturer

To illustrate these savings for a small manufacturer, consider Omar’s Auto Parts Manufacturing, which employs 20 staff including four employees making minimum wage. As illustrated in Chart 1.9, Omar’s Auto Parts Manufacturing would have savings of $22,565 in 2020 from these Ontario measures.

Lowering Employer Payroll Costs

As part of the government’s strategy to make Ontario a more attractive place to invest, the government has acted to lower costs directly linked to employing workers. The Province introduced the Making Ontario Open for Business Act, 2018 that cancelled the planned minimum wage increase to $15 per hour in January 2019 and a further inflation-based increase in October. This is estimated to save employers $1.4 billion in 2020. The Act also repealed many of the other employment standards and labour relations changes introduced by the previous government in Bill 148. A report cited by the Ontario Chamber of Commerce3 estimated that the reforms in Bill 148 were going to create a $23 billion challenge for businesses over 2018 and 2019.

In addition, the WSIB announced a 17 per cent cut to the average WSIB premium rate and a new premium rate framework starting January 1, 2020. This is estimated to save employers $607 million in 2020 and reduce red tape. This is in addition to the nearly 30 per cent average premium rate cut in 2019 that is estimated to save employers $1.45 billion.

Providing Corporate Income Tax Relief

Creating an open for business environment in Ontario requires a business tax system that is competitive with other jurisdictions. The government has delivered income tax relief measures that are strengthening Ontario’s tax competitiveness for business investment and are helping businesses grow and create jobs.

The Province is paralleling federal measures that allow businesses to accelerate writeoffs of capital investments. These measures apply to assets acquired after November 20, 2018 and will deliver $3.8 billion in Ontario Corporate Income Tax relief over six years. By providing a faster writeoff of capital investments, these measures encourage businesses across the province to make investments, such as machinery upgrades or expansions.

The government has also delivered income tax relief for small businesses by not paralleling a federal measure that would have increased Ontario Corporate Income Tax on some small businesses earning passive investment income.

In addition, the government is proposing to cut Ontario’s small business Corporate Income Tax rate to 3.2 per cent from 3.5 per cent, starting January 1, 2020 as outlined previously in this chapter.

Ensuring a Competitive Property Tax System

A well-functioning property tax and assessment system is critical to ensuring that Ontario remains competitive while supporting local services and public education.

As announced in the 2019 Budget, the government will be seeking input over the coming months on measures to support a competitive business environment and enhance the accuracy and stability of property assessments. This review will also look at measures to strengthen the governance and accountability of the Municipal Property Assessment Corporation.

Reducing Red Tape

The Province is committed to reducing red tape to save businesses $400 million annually by 2020. This will provide businesses with ongoing savings on their compliance costs. The government is applying four key principles for reducing regulatory burden:

- Protecting Health, Safety and the Environment: Maintaining regulations that are in place for good reasons and addressing those that are not, including regulations that are dragging businesses and people down;

- Simpler: Simplifying the regulatory landscape to enhance the business experience, making rules easy to follow and comply with;

- Faster: Evolving the compliance and enforcement approach to make it more modern and risk-focused; and

- Cost-effective: Harnessing the power of disruptive technologies to lower the costs of delivering high-quality public services.

Following these principles, this fall the Province introduced the Better for People, Smarter for Business Act, 2019. This Act, along with regulatory changes, contain over 80 proposed actions, which would create efficiencies and reduce red tape across many sectors. These include:

- Streamlining the approvals process for drainage maintenance and improvements, reducing flood risk, enhancing environmental benefits and promoting agriculture productivity through amendments to the Drainage Act;

- Updating the Agricultural and Horticultural Organizations Act to revoke unnecessary, redundant and unenforceable provisions to reduce confusion and compliance costs for organizations;

- Modifying the integrated vehicle safety and emissions inspection program to increase on-road enforcement presence while reducing burden by combining two mandatory inspections into one and making it more convenient for small trucking businesses;

- Reducing drug submission requirements for generic line extensions by amending regulations under the Ontario Drug Benefit Act and the Drug Interchangeability and Dispensing Fee Act;

- Supporting businesses in the forestry sector by permitting the deployment of wood biomass as a fuel for combined heat and power systems by amending regulations under the Environmental Protection Act; and

- Enabling food service operators to allow dogs into outdoor eating areas of the premises (i.e., patios) through changes to the Health Protection and Promotion Act.

The cumulative impact of these measures will help restore Ontario’s competitiveness, retain high‑quality jobs and create an attractive investment climate. In addition, these changes are expected to reduce the compliance costs to key economic sectors and the wider business community, and would result in an overall reduction in the regulatory burden. These proposed measures also build off of more than 100 actions the government has already taken to reduce red tape.

In April 2019, the Province took a major step towards reducing the regulatory burden facing job creators by passing the Restoring Ontario's Competitiveness Act, 2019 which reduced regulatory burdens in 12 sectors. In addition, the Making Ontario Open for Business Act, 2018 made changes to employment standards and labour relations legislation. The government also reduced the regulatory burden for employers of apprentices by lowering journeyperson-to-apprentice ratios to 1:1, established a moratorium on the reclassification of trades, and enabled the winding down of the Ontario College of Trades. See Chapter 1, Section B: A Plan to Build Ontario Together by Preparing People for Jobs for more details.

Supporting Business Growth

In addition to creating a competitive business environment, the government can do its part by strategically partnering with businesses, industries and communities to maximize economic benefits for the people of Ontario.

Modernizing Business Support Programs

Earlier this year, the government introduced the Open for Jobs Blueprint, a plan for modernizing Ontario’s business support programs and ensuring that they help create good jobs and grow the economy. Going forward, business support programs will be transformed based on four key principles under the plan:

- Accessibility;

- Fiscal responsibility;

- Coordination and scalability; and

- Effectiveness.

The Blueprint also ensures that programs focus on regions and sectors that require support to remain competitive, and on transparency to ensure programs are accountable and delivering on their goals.

The government is using these principles to re-examine and transform existing business support programs. At the same time, it is announcing the first business support programs that have been transformed using the Open for Jobs Blueprint.

Supporting Regional Economic Development

The government is committed to increase economic prosperity in all parts of the province. This means ensuring all regions of Ontario can attract investment, grow their economies and create good jobs.

Despite all regions of Ontario experiencing employment growth since 2009, not all regions have fared as well as others. Between 2009 and 2018, the Greater Toronto Area experienced the strongest employment growth (19 per cent), followed by Central Ontario (11 per cent); Southwestern Ontario (6 per cent); Eastern Ontario (4 per cent); and Northern Ontario (1 per cent).

To reduce regional disparities in economic growth, the government is taking the first step to transform business support programs by moving forward with the new Regional Development Program. This program includes the Eastern Ontario Development Fund and Southwestern Ontario Development Fund, which are being redesigned using the principles of the Open for Jobs Blueprint. Going forward, the funds will focus on providing performance-based loans to eligible small and medium-sized businesses operating, or seeking to expand, in Eastern and Southwestern Ontario. A new competitive process that assesses project applications to ensure the greatest return on investment for taxpayer dollars will create a more flexible, accessible and accountable program. The program will offer a 60-day service commitment for applicants to be notified of a decision. The funds will also support municipalities and economic development organizations so they can help advance economic development strategies and invest in infrastructure.

In addition to the funds, a new government-wide service delivery model will facilitate access to complementary supports. These include advisory services to help navigate Provincial regulatory requirements; expedited environmental approvals; streamlined approvals for land-use planning; and reduced red tape for accessing skills and talent. Companies will have one point of contact who will help them navigate and access the services and supports available through the Regional Development Program. This will help simplify and improve access to tools and services and ensure businesses can focus on growth and creating good jobs.

The Open for Jobs Blueprint is also being used to redesign the Forestry Growth Fund that will support economic growth in Northern Ontario. See the Promoting Ontario’s Forestry Industry section later in this chapter for more details.

Supporting Francophone Business, Cultural and Community Initiatives

Ontario is helping Francophone communities across the province to promote their culture, grow their businesses and encourage greater community engagement.

Franco-Ontarians are the largest French-speaking community in Canada outside of Quebec. According to the 2016 Census, there are about 622,000 Francophones in the province. Research on Franco-Ontarians has identified obstacles to accessing education and skilled employment, as well as insufficient French-language resources.

To create meaningful employment opportunities and strengthen the capacity of Francophone organizations, the government launched a redesigned version of the Francophone Community Grants Program. The program aims to improve Francophone front-line services for small businesses to better serve their French-speaking clients and partners. The government has added an economic development and job creation component to the program, inviting Francophone entrepreneurs to submit applications for projects. The program will also help train and retain skilled Francophone workers. In addition, the program will continue to invest in local cultural and community initiatives, demonstrating the government’s ongoing support for the Francophone non-profit sector, as well as Ontario's commitment to protecting and promoting the French language and culture.

The government also recently signed a memorandum of understanding with the federal government to move forward with the implementation of the Université de l’Ontario français. See Chapter 1, Section B: A Plan to Build Ontario Together by Preparing People for Jobs for more details.

Supporting and Strengthening Ontario International Exports

Trade with other countries plays a central role in supporting jobs and growth across Ontario. Since the beginning of 2018, international trade tensions and rising tariffs have led to a slowdown in merchandise trade and global economic growth — see Chapter 2: Economic Outlook for more details. However, Ontario remains a leader in global trade with its value of exports increasing by three per cent in the first half of 2019 as compared to the same period last year.

In October 2019, Ontario’s Minister of Economic Development, Job Creation and Trade; Minister of Agriculture, Food and Rural Affairs; and Minister for Seniors and Accessibility concluded a successful trade mission to South Korea and Japan. The trade mission focused on promoting Ontario as an attractive destination for business and investment in automotive, aerospace and other key sectors. The Minister of Agriculture, Food and Rural Affairs facilitated meetings with importers, retailers, distributors and government representatives in Seoul, Osaka and Tokyo. The Minister promoted Ontario’s agri-food products that have been impacted by ongoing trade disputes as well as the quality and availability of Canadian pork, beef, soybean and other agri-food products.

As part of this mission, the government announced two new agreements that will further Ontario’s trade relationship with South Korea. The agreements include a US$20 million venture fund, which will support artificial intelligence, digital health and medical science companies in Ontario and an MOU between Ontario and the Korea Importers Association to promote co-operation between Ontario and South Korean businesses.

Breaking Down Trade Barriers within Canada

Ontario is leading efforts to accelerate the removal of internal trade barriers across Canada to help businesses create jobs, attract investment and bring prosperity to every corner of the country. According to a recent report by the International Monetary Fund, removing all of Canada’s internal trade barriers for goods would add 2.9 per cent to Ontario’s real GDP per capita.4 An earlier study estimated that internal trade liberalization could add $50 to $130 billion to Canada’s real GDP.5

In July 2019, Premier Ford took a leadership role among Canada’s provincial and territorial leaders at the Council of the Federation summer meeting in Saskatoon by advocating for the removal of barriers to internal trade, and promoting job creation, investment and economic growth.

In September 2019, the government followed through on Premier Ford’s pledge to accelerate the removal of internal trade barriers by formally signalling its support to modify the Canadian Free Trade Agreement (CFTA) with an amendment that allows federal, provincial and territorial governments to independently remove unnecessary restrictions to internal trade. In addition, the government is moving forward on its commitment in the 2019 Budget to modify an exception under the CFTA that was negotiated by the previous government in order to allow a pipeline project that transports oil within Ontario’s borders.

Protecting Intellectual Property

Intellectual property in the form of patents, trademarks, copyrights, industrial designs and trade secrets, is one of the ways innovators and creators help secure their breakthroughs and inventions. In an increasingly globalized marketplace, it is critical that innovators understand not only why they need to protect their hard work, but also how they can commercialize their intellectual property.

In May 2019, the government announced the creation of an expert panel and online consultation to maximize commercialization opportunities for intellectual property generated by the postsecondary education sector. The panel includes leaders from business, intellectual property law and postsecondary institutions, led by the former Chairman and co-CEO of Research In Motion (BlackBerry), Jim Balsillie.

A report and action plan on the commercialization of intellectual property to support the government in achieving its priorities for creating sustainable, competitive and long-term economic activity in Ontario is expected in December 2019.

Helping Ontario’s Industries Grow

The government is committed to strengthening and growing Ontario’s diverse economic sectors in an increasingly competitive and challenging global economy.

Strengthening the Competitiveness of Ontario’s Automotive Sector

The auto sector supports about 105,000 direct jobs in communities across the province. Ontario is the only subnational jurisdiction in North America with five global automotive assemblers, and has been the top vehicle producer in 12 of the past 15 years. However, the sector’s growth prospects are facing a number of challenges, including low investment over the past decade, an uncertain trade environment and disruptive global industry trends.

The government is committed to addressing each of these challenges and strengthening Ontario’s North American leadership in automotive production through its Driving Prosperity strategy, which is supported by three strategic pillars: a competitive business environment, innovation and talent. The government has been working in collaboration with industry, the research and education sector, and other levels of government to fulfil its promise of making Ontario a top destination for auto sector investment, including being a leader in the next generation of automotive technology.

Attracting Automotive Investment

The Driving Prosperity strategy identified a Job Site Challenge as an opportunity to help create a competitive business environment. Over the past decade, Ontario has only received seven per cent of announced automaker investment in North America, despite accounting for 14 per cent of production. Ontario does not currently have any marketed shovel-ready and internationally certified mega sites available for investors and the Challenge will help attract new greenfield investments.

The Challenge is designed to put the province back on the short-list of candidate jurisdictions for major upcoming automotive and advanced manufacturing investments. It will identify large tracts of shovel-ready land and allow for plant construction to begin in an expedited manner through streamlined, accelerated, one-window land development approvals.

The benefits of a major new investment could be widespread, from generating upwards of $1 billion in investment, to creating thousands of jobs, anchoring the supply chain and providing benefits to surrounding communities.

Promoting Ontario’s Forestry Industry

Forestry is an important sector in Ontario, especially in the province’s Northern and rural communities. In 2018, the sector directly supported more than 50,000 jobs. Ontario’s forestry sector is currently experiencing challenges in the face of increasing global competition and uncertain U.S. trade policy.

The government is investing $10 million annually to support the sector through the renewed Forestry Growth Fund (FGF). Consistent with the Open for Jobs Blueprint, the redesigned FGF will use an open and competitive rounds-based application process that predominantly uses loans and loan guarantees to support business. These changes will make the program more sustainable and transparent. As well, the redesigned program will help businesses access capital, address business requirements and support Ontario’s sustainable forestry model.

The program will be part of the Province’s upcoming Forestry Strategy. It will help businesses become more productive, invest in innovation, and move up the value-chain which ultimately will make Ontario’s forestry sector more competitive and better positioned to face global economic challenges.

On September 5, 2019, a NAFTA Chapter 19 dispute panel determined that there is no evidence that Canada’s softwood lumber industry has harmed United States softwood producers and has given the U.S. International Trade Commission 90 days to reassess their complaint. The government will continue to strongly defend its softwood lumber industry, communities and workers, and will continue to work closely with the federal government and other Canadian provinces on this unwarranted dispute.

Training Forestry Workers

The government is helping people across Northwestern Ontario prepare for successful careers in the forestry sector by partnering with employers and investing in publicly funded access to skills training. The government is providing more than $2.4 million in provincial funding for two innovative Skills Advance Ontario training projects, creating opportunities for 200 people to put their skills to work.

Standing up for Ontario Farmers

Ontario farmers play an important role in boosting the province’s economy and producing some of the safest, highest-quality food products in the world. Ontario’s agriculture and agri‑food sector supports more than 837,000 jobs across the province. The government is helping the agri-food sector to grow while safeguarding public confidence in Ontario’s food system and ensuring environmental sustainability.

The government is acting to address the trade disruptions that have hurt Ontario farmers and affected all Ontario exports, particularly pork, beef, grains and oilseeds. Ontario’s trade mission to South Korea and Japan in October 2019 connected Ontario farmers and food processors with key importers and buyers. The Province has also sought the federal government’s support in securing new export markets for the meat sector through the Canadian Agricultural Partnership (CAP).

To ensure the competitiveness of Ontario’s farmers, the Province has introduced the following initiatives by leveraging the CAP, which is a $3 billion, five-year commitment by the federal, provincial and territorial governments. The government has committed to investing up to $6.45 million over three years to support new trade opportunities for Ontario farmers, which include:

- The Market Access Initiative, launched in September 2019, to assist food and agri-food product exporters in diversifying to new international markets for Ontario food products; and

- Allocating up to $1.2 million to support in-market trade representatives, export marketing support and foreign direct investment attraction.

Supporting the Ontario Food Terminal’s Long-Term Success

The government has been conducting a review on modernizing and enhancing the Ontario Food Terminal. It is the largest wholesale produce market in Canada, selling over two billion pounds of produce annually. As the review of the Ontario Food Terminal continues, the government will look to promote modern food distribution systems, infrastructure enhancements for Ontario farmers and local food. In October 2019, the government named the Ontario Food Terminal lands as a Provincially Significant Employment Zone — an identification that will protect the terminal for its importance to employment and economic growth, as well as ensure its long-term viability and certainty.

Supporting Young Farmers

The government has launched the 2019 Excellence in Agriculture program, which now includes a new category to recognize outstanding young farmers. The program recognizes agri-food innovations that demonstrate leadership, product development and technology advancement that will benefit the agri-food sector. The 2019 Excellence in Agriculture program includes a new category to recognize outstanding youth leaders in the agri-food sector. There is also a new category focused on innovation. The innovations recognized will help move the sector forward so it is better positioned to thrive here at home and on the global stage.

Growing Ontario’s Meat Industry

Ontario supports its local food industry and is making it easier for the entire agri-food sector to do business, grow and create jobs in the province. Currently, a lack of provincially licensed abattoirs forces farmers to incur the expense and burden of travelling long distances with their animals to access custom services at such abattoirs. Unlike federally licensed abattoirs that process higher animal volumes, provincially licensed abattoirs allow farmers to process a smaller number of animals and sell the meat cuts at local farmers’ markets. The government is committed to supporting the growth of such abattoirs and is working with meat processors to ensure continued delivery of safe, high-quality food. Ontario is also reducing unnecessary and costly regulatory burden for provincially licensed meat plants.

The Canadian Agricultural Partnership’s Provincially-Licensed Abattoir Cost-Share Program has allocated $1.25 million for provincially licensed meat processors. To date, Ontario has committed to 35 projects, focusing on food safety improvements, which will receive over $592,000. In October 2019, the Minister of Agriculture, Food and Rural Affairs hosted the inaugural meeting of the Meat Industry Engagement Panel, which will advise the Minister on how Ontario can support and grow the meat sector across the province, including in the North.

Listening to Rural Ontario

The government recognizes the importance and uniqueness of rural communities that form the backbone of Ontario and wants to hear from rural Ontario on how to leverage its potential for economic growth.

Starting at the January 2020 Rural Ontario Municipal Association (ROMA) conference, the Province will begin conducting a series of roundtable discussions with rural stakeholders on economic development challenges and opportunities in their regions.

The Province is already working to better help rural and Indigenous communities through a revitalized Rural Economic Development (RED) program. The first intake of applications under the redesigned program was held in July 2019. The program offers two new project categories:

- Economic Diversification and Competitiveness — projects that remove barriers to job growth and attract investment; and

- Strategic Economic Infrastructure — projects that advance economic development and investment opportunities.

The government is also supporting rural Ontario by investing in broadband, transportation and natural gas expansion. See Chapter 1, Section D: A Plan to Build Ontario Together by Connecting People to Places and the Enabling Natural Gas Expansion sectionlater in this chapter, for more details.

Developing Mining and Exploration Industries

The government has established a mining working group, composed of leaders in the mining and exploration sector, including financial institutions, prospectors and Indigenous business organizations, as a consultative body chaired by the Minister of Energy, Northern Development and Mines. The group held its inaugural meeting in March 2019 and met again in September 2019. In its discussions, the working group has raised concerns that Ontario is lagging behind other jurisdictions in its ability to attract new investment in exploration in the junior mining sector. Recognizing that this sector drives the discovery of new mineral resources, attracts capital investment and contributes to job creation, the government will explore options to improve access to capital for industries such as exploration and mining.

Opening Up the Ring of Fire

Ontario’s Ring of Fire represents a promising mineral development opportunity. The government is taking a new approach to develop the area. It will focus on working directly with willing First Nation partners to develop all season roads that will enable access to communities as well as resources in the Ring of Fire.

A transformative project of this nature with nationally significant jobs and economic benefits also requires the federal government to take action to invest and expedite its development. Ontario expects the federal government to take a cost-sharing approach with the Province on road construction and invest in supporting First Nations. This is critical to unlock economic development opportunities in the Ring of Fire to create jobs, generate revenue and bring prosperity to First Nations and communities across the North.

Noront Resources, the major claim holder in the Ring of Fire region, is planning to develop its Eagle’s Nest nickel mine first, followed by chromite mining in the future. The company is partnering directly with First Nations to encourage further economic development. Earlier this year, the company announced Sault Ste. Marie as the future home of its new plant that would process chromite into ferrochrome, a key ingredient in stainless steel.

Reforming Electricity Pricing and Increasing Access in the North

Streamlining Industrial Electricity Pricing

The government is committed to improving trust and transparency in the electricity sector and to bolster the ability of Ontario’s businesses to compete, invest and grow. The government understands the challenges to Ontario businesses caused by the high cost of electricity, affecting the ability of industrial businesses to compete globally. The Province held consultations across the province, hearing from businesses firsthand and receiving a total of 140 written submissions. The consultations highlighted that stakeholders felt burdened by the regulatory processes and raised the need for improvements to cost transparency and certainty, and rate stability.

The government is proposing to take near-term action to reduce the red tape burden in the electricity system by working with the Independent Electricity System Operator (IESO) to simplify and streamline industrial electricity billing and the Global Adjustment settlement process. The government is also introducing advisory services to assist businesses in navigating regulatory approvals and connection issues.

The government is also directing the IESO to retain an independent third party to undertake a targeted review of existing generation contracts for opportunities to reduce electricity system costs, benefiting all consumers. The IESO is to report back on the review’s findings in the first part of 2020.

The government is also considering additional options and will be following up on the consultations.

Supporting Competitiveness of Large Industrial Companies in the North

The government recognizes the importance of helping large industrial companies in Northern Ontario remain competitive. The Northern Industrial Electricity Rate (NIER) program provides electricity price mitigation and greater cost-competitiveness for qualified, large northern industrial electricity users. The NIER program provides total funding of up to $120 million per year, with participating companies receiving a rebate of up to $20 million per year.

Enhancing the Transmission Grid: Connecting Northern Remote Communities and Building the East‑West Tie

Twenty-five remote First Nation communities in Northwestern Ontario have been historically reliant on local diesel generation for electricity.

Wataynikaneyap Power LP (Wataynikaneyap Power), a licensed transmission company, is a partnership between the First Nation Limited Partnership (FNLP), comprising 24 First Nations with majority ownership, and Fortis (WP) LP. The Province designated Wataynikaneyap Power to connect 16 remote First Nation communities to the provincial grid, which would increase electricity reliability and support economic growth. As announced in July, the Province, Wataynikaneyap Power and the federal government signed agreements under which the federal government is to provide about $1.6 billion in funding for the project as it is completed. Interim financing of about $1.3 billion is to be provided by the Province.

NextBridge Infrastructure held the ground breaking for the East-West Tie (EWT) Transmission Project in Northern Ontario on October 2, 2019. The 450 kilometre transmission line will support job creation, enhance reliability, improve the flow of cheaper and lower-emission energy, and add the capacity needed for major regional development projects like the Wataynikaneyap Power grid connection project and the Ring of Fire.

Promoting Transparency and Accountability at Hydro One

The government committed to restoring public confidence in Hydro One while promoting greater transparency and accountability. The Hydro One Accountability Act, 2018 was enacted and a new, highly qualified board was appointed. In March 2019, the government approved Hydro One’s revised compensation framework.

Hydro One’s new compensation framework sets a cap of $1.5 million per year in compensation for the CEO of Hydro One, including a maximum $500,000 base salary, with performance‐based incentives. The new framework also sets compensation of $80,000 for board members and $120,000 for the board chair for 2019. Other new executive hires are capped at 75 per cent of the CEO’s compensation. The new framework includes performance targets that require the CEO to contribute to reducing electricity system costs.

Promoting Efficient Electricity Distribution

Consolidation in the electricity distribution sector can help reduce electricity rates and improve services for electricity customers through innovation and efficiency gains. Private-sector expertise can play an important role in achieving these objectives. As announced in the 2018 Ontario Economic Outlook and Fiscal Review, time-limited tax relief measures were extended until December 31, 2022.

The government is continuing to review sector activity and is considering additional ways to promote efficiency and modernization of the electricity distribution sector in consultation with consumers and other stakeholders.

Enabling Natural Gas Expansion

The government is delivering on its commitment to make life more affordable for individuals, families and businesses by lowering heating costs, creating jobs and making businesses more competitive by expanding access to natural gas. The new natural gas program is supporting the private sector in its expansion of natural gas access for communities in Ontario, making sure homes and businesses across the province have access to clean and affordable fuel sources.

As a leading example, the government is enabling natural gas expansion in the community of Chatham-Kent through the private construction of two new transmission pipelines and supporting distribution mains. Switching from electrical heat or oil to natural gas can result in significant savings for the people of Ontario. For the average residential customer, switching to natural gas can save between $800 and $2,500 a year.

Modernizing Financial Services

This government is committed to creating a regulatory landscape for the financial services and pension sectors that is transformative — including delivering regulatory services more effectively, reducing regulatory burden, fostering a strong and competitive financial services sector and ensuring high standards of business conduct while also protecting the rights and interests of consumers, investors and pension plan beneficiaries. The government has announced several reform initiatives to support this commitment, including:

- Implementing the Putting Drivers First blueprint for Ontario’s auto insurance system;

- Introducing the Capital Markets Plan;

- Implementing a new framework as part of the Financial Professionals Title Protection Act, 2019;

- Conducting legislative reviews of the Credit Unions and Caisses Populaires Act, 1994, the Mortgage Brokerages, Lenders and Administrators Act, 2006, and the Co-operative Corporations Act; and

- Modernizing the administration of pension plans under the Pension Benefits Act.

In addition, on June 8, 2019, the government of Ontario launched the Financial Services Regulatory Authority of Ontario (FSRA) to regulate the province’s non-securities financial services and pension sector. FSRA will play an important role in implementing the government’s vision for the financial services sector. FSRA’s commitment to regulatory efficiency includes streamlining existing regulatory requirements, such as guidance, data and filing requirements, to improve the regulatory framework and to focus on efficiency and effectiveness.

Supporting More Efficient Capital Markets

As announced in the 2019 Budget, the government continues to work with the Ontario Securities Commission (OSC) to support the Capital Markets Plan. This plan focuses on strengthening investment in Ontario, promoting competition and facilitating innovation in order to position Ontario as a leading capital markets jurisdiction.

The Ontario government is introducing legislative changes related to securities and capital markets. These changes would enable streamlined and more efficient regulation and include:

- Repealing the Toronto Stock Exchange Act; and

- Amending the Securities Act, in line with the Capital Markets Plan, to allow the OSC to issue blanket orders supporting greater efficiency in capital markets.

Following the OSC’s public consultation to reduce regulatory burden, the OSC’s Burden Reduction Task Force will soon deliver its final report outlining the recommendations received and the short, medium, and longer term initiatives it will undertake to reduce regulatory burden for businesses, resulting in greater investment in Ontario’s capital markets.

Reviewing the Securities Act

The Securities Act has not been reviewed in over 15 years, is outdated, and should support modern capital markets. Ontario will undertake measures to create a modernized securities regulatory framework that is responsive to innovation and changes in a rapidly evolving marketplace. Accordingly, the government will establish a securities modernization task force. The task force will solicit input from stakeholders and help inform the government’s vision of creating a 21st century securities regulatory framework. The task force will provide policy recommendations on critical areas such as driving competitiveness, regulatory structure, efficient regulation and investor protection.

Ontario continues to work collaboratively with other participating jurisdictions on the Cooperative Capital Markets Regulatory System (CCMR).

Modernizing the Way Co-ops Do Business

A modern and competitive co‐operative corporation sector contributes to the economy, creates jobs and provides valuable services for the communities it serves. Co-ops provide people in Ontario with access to valuable goods and services, including those that might otherwise be out of reach. This includes agricultural processing and housing. They also provide job opportunities across the province, including jobs in rural and Northern regions, fostering inclusive economic growth for newcomers, women, and low-income individuals. Outdated and burdensome legislation creates barriers for co-ops, costing them time and money which prevents them from growing.

Following a legislative review and consultations on the Co-operative Corporations Act (CCA) the government is introducing changes that would modernize the legislation. As part of this, the government is levelling the playing field for some co-ops by removing the current “50 per cent rule,” which restricts co-ops from doing more than 50 per cent of their business with non-members. In addition, audit exemptions are proposed to be expanded to help smaller co-ops avoid needless compliance costs. These changes would reduce red tape, allow co-ops to grow and expand, and better enable the sector to serve their members and customers effectively.

The government also plans to transfer full authority and responsibility for the CCA from the Minister of Finance to the Minister of Government and Consumer Services in early 2020.

Updating the Credit Unions and Mortgage Brokers Regulatory Framework

Like the general co-operative sector, credit unions and caisses populaires are enormous contributors to Ontario’s economic prosperity. Credit unions play a key role in communities across Ontario by providing financial products and services to their 1.6 million members. However, while the credit union sector is fast-growing and innovative, its competitiveness has been undermined by the aging and outdated Credit Unions and Caisses Populaires Act, 1994 (CUCPA).

The government consulted with the sector to receive feedback on modernizing the CUCPA. Based on this feedback, the government is working to develop new principles-based legislation to replace the outdated CUCPA. This new legislation will aim to reduce regulatory burden for Ontario’s credit unions, enabling them to be more agile and competitive while continuing to meet the needs of their members.

The government is also committed to reducing burden in the mortgage brokering sector. The government recently received and released a report on the legislated review of the Mortgage Brokerages, Lenders and Administrators Act, 2006, led by Minister Doug Downey, Attorney General and Stan Cho, Parliamentary Assistant to the Minister of Finance. Their report and its recommendations follow extensive public consultations and input from various financial services stakeholders.

The government is considering the report’s recommendations and will continue to consult with industry and FSRA to determine how to make it easier for brokers and agents to support their clients, while helping grow their business and create jobs.

Modernizing the Pension Sector Framework

The government is enabling efficiencies in the pension regulatory framework, including a proposal to exempt certain individual pension plans (IPPs) and designated plans (DPs) from the application of the Pension Benefits Act (PBA). The Ministry of Finance will soon be consulting on this proposal with potential legislative amendments to follow. The government is also enabling efficiencies in the pension sector by promoting increased electronic communication between administrators and members. Following consultation with stakeholders, the government has brought forward amendments in the Better for People, Smarter for Business Act, 2019 to permit administrators to use electronic communication as the default method, subject to certain conditions, to provide pension plan information to members and former members. This initiative would save pension plans up to $25 million annually across the sector and could allow plans to more effectively engage and communicate with plan members.

The government is improving pension sustainability by enabling conversions to the jointly sponsored pension plan (JSPP) model where plan governance, costs and risks are shared between plan members and employers. Key milestones have been reached for two ongoing initiatives. As part of the new University Pension Plan initiative, the member consent process has been completed for the proposed conversion of the University of Toronto, the University of Guelph and Queen’s University plans, and progress also continues in establishing a Board of Trustees.

Similarly, the WSIB Employees’ Pension Plan has completed the member consent process and has successfully established its Board of Trustees. The government has introduced measures in the Better for People, Smarter for Business Act, 2019 to reduce regulatory burden and streamline the conversion process, and is committed to supporting both initiatives in their efforts to move to the JSPP model.

Protecting Titles for Financial Planners and Financial Advisors

As part of the 2019 Budget, the government introduced legislation to protect titles for financial planners and financial advisors in Ontario. The proposed new framework will require that individuals using the financial planner and financial advisor job titles have the appropriate credentials and are qualified to assist families in meeting their financial goals.

The Financial Services Regulatory Authority of Ontario (FSRA) is currently working with stakeholders to inform the design of the title protection framework. The new framework will strive to protect consumers without adding undue regulatory burden on the financial services industry.

Chart Descriptions

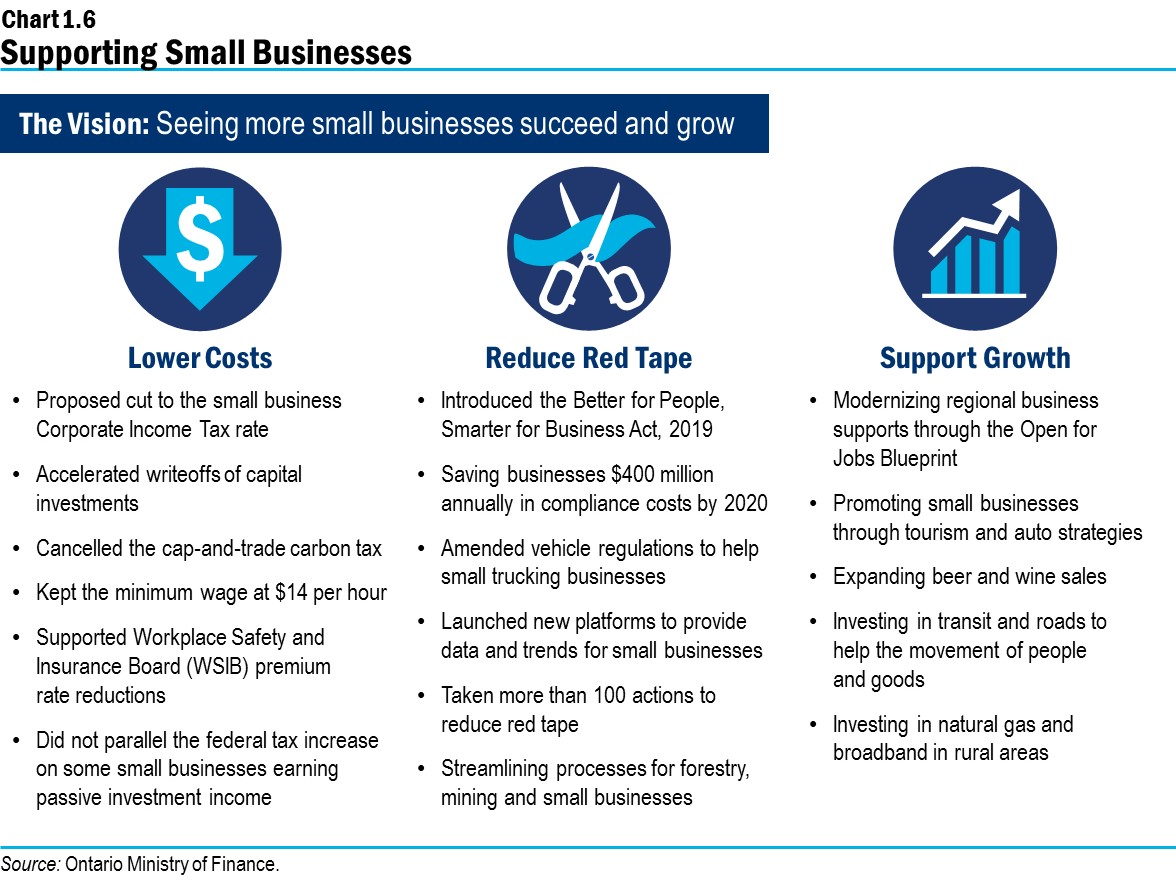

Chart 1.6: Supporting Small Businesses

The chart illustrates the government’s vision to see more small businesses succeed and grow. The supports are organized into three groups.

- Under the first group of lower costs, listed government initiatives include:

- Proposed cut to the small business Corporate Income Tax rate;

- Accelerated writeoffs of capital investments;

- Saving businesses $400 million annually in compliance costs by 2020;

- Cancelled the cap-and-trade carbon tax;

- Kept the minimum wage at $14 per hour;

- Supported Workplace Safety and Insurance Board (WSIB) premium rate reductions; and

- Did not parallel the federal tax increase on some small businesses earning passive investment income.

For the second group to reduce red tape, listed government initiatives include:

- Introduced the Better for People, Smarter for Business Act, 2019;

- Amended vehicle regulations to help small trucking businesses;

- Launched new platforms to provide data and trends for small businesses;

- Took more than 100 actions to reduce red tape; and

- Streamlining processes for forestry, mining and small businesses.

The third group of support growth initiatives include:

- Modernizing regional business supports through the Open for Jobs Blueprint;

- Promoting small businesses through tourism and auto strategies;

- Expanding beer and wine sales;

- Investing in transit and roads to help the movement of people and goods; and

- Investing in natural gas and broadband in rural areas.

Source: Ontario Ministry of Finance.

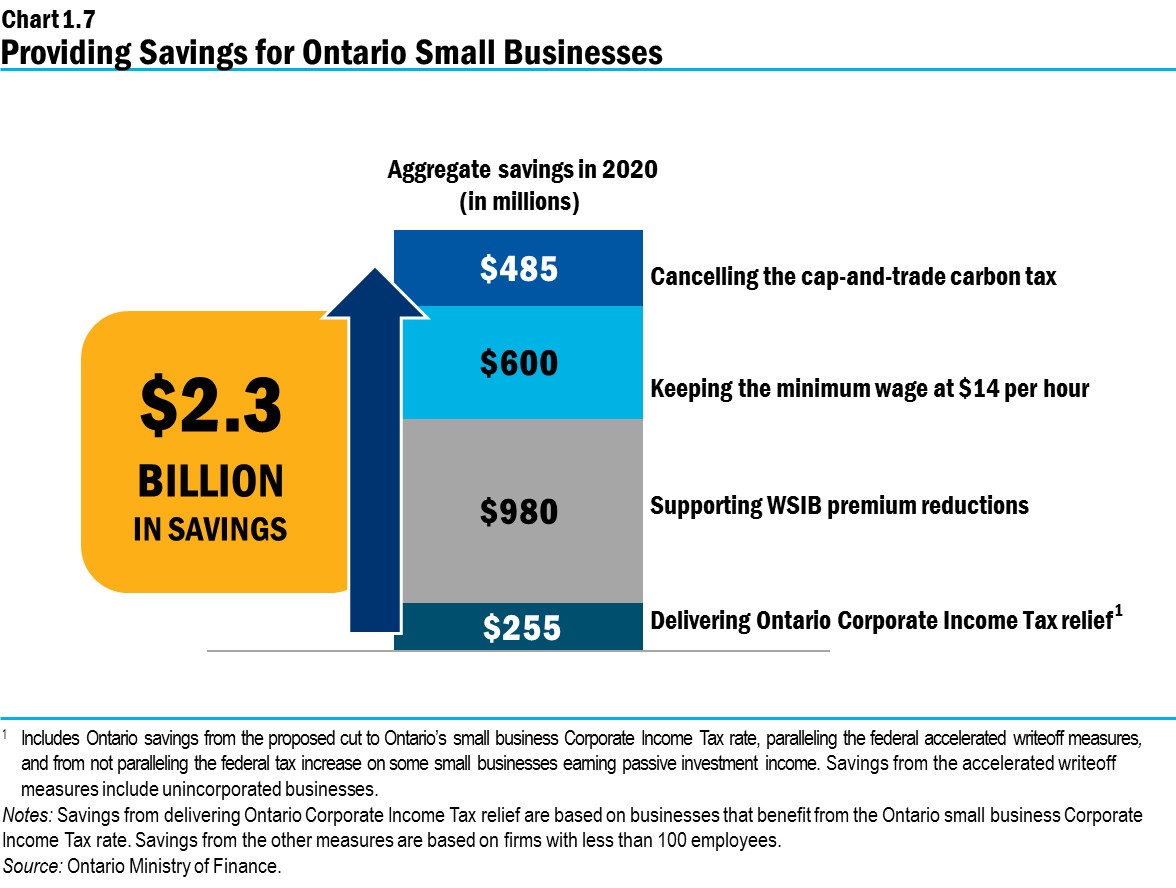

Chart 1.7: Providing Savings for Ontario Small Businesses

This chart illustrates savings for Ontario small businesses. Actions taken by the government would save Ontario small businesses approximately $2.3 billion in 2020. This includes combined savings from cancelling the cap-and-trade carbon tax ($485 million), keeping the minimum wage at $14 per hour ($600 million), supporting WSIB premium reductions ($980 million), and delivering Ontario Corporate Income Tax relief ($255 million).

Notes: Estimated savings from delivering Ontario Corporate Income Tax relief include Ontario savings from the proposed cut to Ontario’s small business Corporate Income Tax rate, paralleling the federal accelerated writeoff measures, and from not paralleling the federal tax increase on some small businesses earning passive investment income. Savings from the accelerated writeoff measures include unincorporated businesses. Savings from delivering Ontario Corporate Income Tax relief are based on businesses that benefit from the Ontario small business Corporate Income Tax rate. Savings from the other measures are based on firms with less than 100 employees.

Source: Ontario Ministry of Finance.

Chart 1.8: Sue’s Bakery

This infographic illustrates savings in 2020 for Sue’s Bakery, a small local business. Sue’s Bakery employs 11 staff including four employees making minimum wage. Sue’s Bakery would have savings of $10,955 in 2020 through the following Ontario measures: savings from cancelling the cap‑and‑trade carbon tax ($780), delivering Ontario Corporate Income Tax relief ($935), supporting WSIB premium reductions ($2,295) and keeping the minimum wage at $14 per hour ($6,945).

This example has the following business profile: annual revenue of $1,000,000, taxable income of $50,000, 11 employees including four at minimum wage and new investment in assets of $130,000.

Some employees could be eligible for the Low-income Individuals and Families Tax Credit. See Chapter 1, Section A: A Plan to Build Ontario Together by Making Life More Affordable for more details.

Delivering Ontario Corporate Income Tax relief includes Ontario savings of $150 from the proposed cut to Ontario’s small business Corporate Income Tax rate and $785 from the accelerated writeoff measures. New investment in assets includes $60,000 in Asset Class 8 and $70,000 in Asset Class 13.

The Workplace Safety and Insurance Board (WSIB) has the sole authority for setting premium rates and collecting revenue from employers. Assumes this business pays the average rate for the industry class under the new rate framework. Premium rates within each industry class will vary depending on previous claims experience for the business compared to the rest of the businesses in its class.

Savings from cancelling the cap-and-trade carbon tax, supporting WSIB premium reductions and keeping the minimum wage at $14 per hour include Ontario and federal Corporate Income Tax impacts that are due to the deductibility of business costs for income tax purposes.

Note: While the example does not represent an actual company, the financial and employment profile is based on tax administration and Statistics Canada survey data for businesses in the industry.

Source: Ontario Ministry of Finance.

Chart 1.9: Omar’s Auto Parts Manufacturing

This infographic illustrates savings in 2020 for Omar’s Auto Parts Manufacturing. Omar’s Auto Parts employs 20 staff including four employees making minimum wage. This company would have savings of $22,565 in 2020 through the following Ontario measures: savings from cancelling the cap-and-trade carbon tax ($675), delivering Ontario Corporate Income Tax relief ($5,045), supporting WSIB premium reductions ($7,200), and keeping the minimum wage at $14 per hour ($9,645).

This example has the following business profile: annual revenue of $3,500,000, taxable income of $450,000, 20 employees including four at minimum wage, new investment in manufacturing equipment of $150,000 and new investment in other assets of $15,000.

Some employees could be eligible for the Low-income Individuals and Families Tax Credit. See Chapter 1, Section A: A Plan to Build Ontario Together by Making Life More Affordable for more details.

Delivering Ontario Corporate Income Tax relief includes Ontario savings of $1,350 from the proposed cut to Ontario’s small business Corporate Income Tax rate and $3,695 from the accelerated writeoff measures. New investments include $15,000 in Asset Class 8 and $150,000 in Asset Class 53.

The Workplace Safety and Insurance Board (WSIB) has the sole authority for setting premium rates and collecting revenue from employers. Assumes this business pays the average rate for the industry class under the new rate framework. Premium rates within each industry class will vary depending on previous claims experience for the business compared to the rest of the businesses in its class.

Savings from cancelling the cap-and-trade carbon tax, supporting WSIB premium reductions and keeping the minimum wage at $14 per hour include Ontario and federal Corporate Income Tax impacts that are due to the deductibility of business costs for income tax purposes.

Note: While the example does not represent an actual company, the financial and employment profile is based on tax administration and Statistics Canada survey data for businesses in the industry.

Source: Ontario Ministry of Finance.

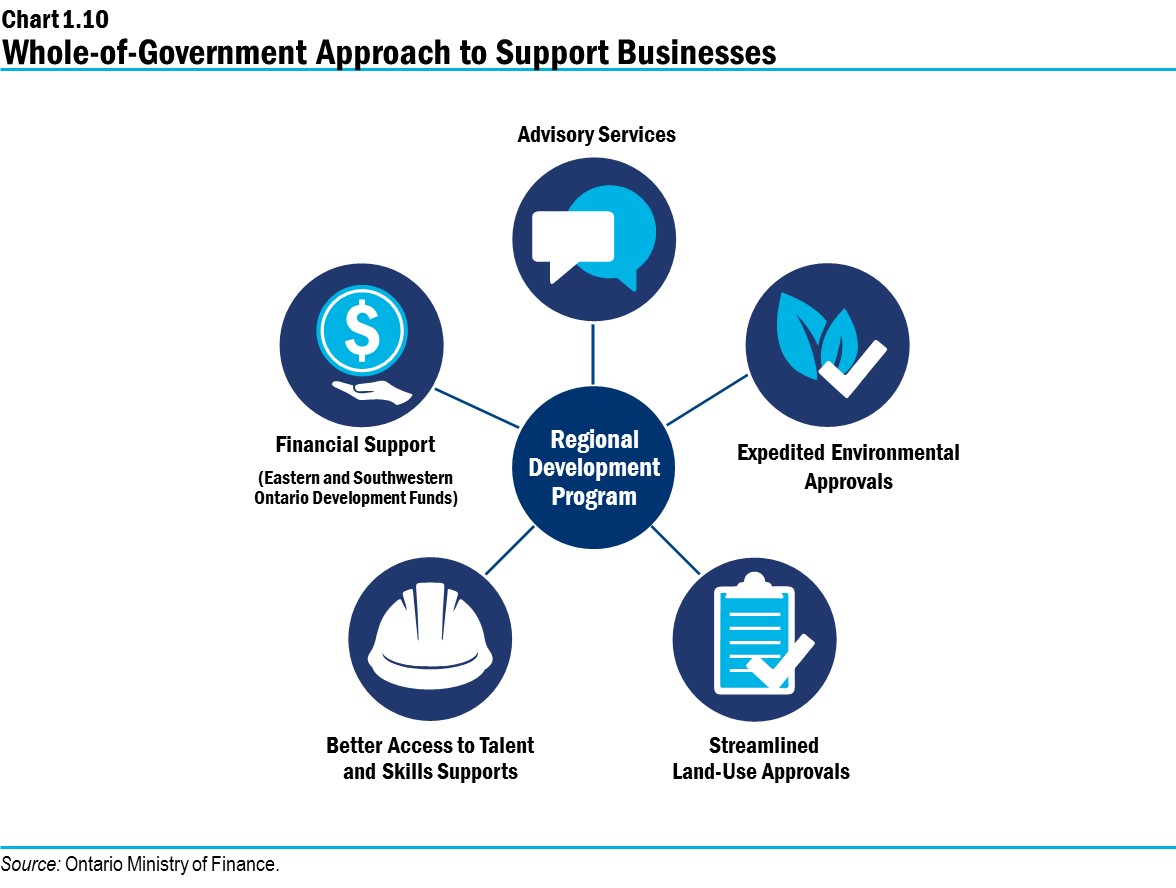

Chart 1.10: Whole-of-Government Approach to Support Businesses

The chart outlines the components of the Province’s “whole of government” approach to support businesses through the Regional Development Program. The components include:

- Advisory Services;

- Expedited Environmental Approvals;

- Streamline Land-Use Approvals;

- Better Access to Talent and Skills Supports; and

- Financial Support through the Eastern and Southwestern Ontario Development Funds.

Source: Ontario Ministry of Finance.

Footnotes

- [1] This is the portion of overall business savings from these measures that will go to small businesses. See the Lowering Costs on Businesses section later in this chapter, for more details.

- [2] See the Supporting Regional Economic Development section later in this chapter, for more details.

- [3] Canadian Centre for Economic Analysis (CANCEA), “Bill 148: Fair Workplaces, Better Jobs Act, 2017 – Assessment of the Risks and Rewards to the Ontario Economy,” (September 2017). https://www.cancea.ca/sites/economic-analysis.ca/files/misc/cancea_bill148_analysis.pdf

- [4] International Monetary Fund, “Canada: Selected Issues,” (June 2019),

https://www.imf.org/en/Publications/CR/Issues/2019/06/24/Canada-Selected-Issues-47022 - [5] Trevor Tombe, Lukas Albrecht. Internal Trade, Productivity, and Interconnected Industries: A Quantitative Analysis. Canadian Journal of Economics, 2016.