On this page Skip this page navigation

- Introduction

- Helping Families with their Child Care Expenses

- Supporting Children and Families

- Providing Tax Relief for Families When They Need It the Most

- Providing Tax Relief to Low-income Workers

- Providing Dental Care for Low-income Seniors

- Eliminating Co-Pays for Pharmacy Payments in Long-Term Care

- Helping to Reduce the Cost of Living in the North

- Making Tuition More Affordable

- Making GO Transit Service Free for Kids

- Providing Free Museum Admission for Young People

- Reducing Electricity Bills

- Ending the Cap-and-Trade Carbon Tax

- Increasing Ontario’s Housing Supply

- Eliminating Drive Clean

- Making Auto Insurance Affordable: Fixing the Broken System

- Providing Other Relief for Families and Individuals

Introduction

The government has a balanced and prudent plan to put more money into the pockets of families and individuals in every corner of the province. The government is reducing taxes, tackling the rising costs of housing and energy, lowering fees and improving services, so parents can spend more on their children, young people can save more for the future, and everyone can stretch their household budgets further. Putting more money in people’s pockets will help families and individuals to live the lives they deserve.

The government heard loud and clear that people from all walks of life are tired of paying more and getting less. The carbon tax, increasing child care costs, and the rise in electricity costs due to the previous government’s initiatives, have made it harder for families to make ends meet.

That is why the government is taking concrete steps to help parents afford child care that works best for their family, why the government is bringing tax relief to low-income workers, and why the government is providing publicly funded dental care to low-income seniors.

The government will continue to respect taxpayer dollars and deliver on its commitment to make life more affordable.

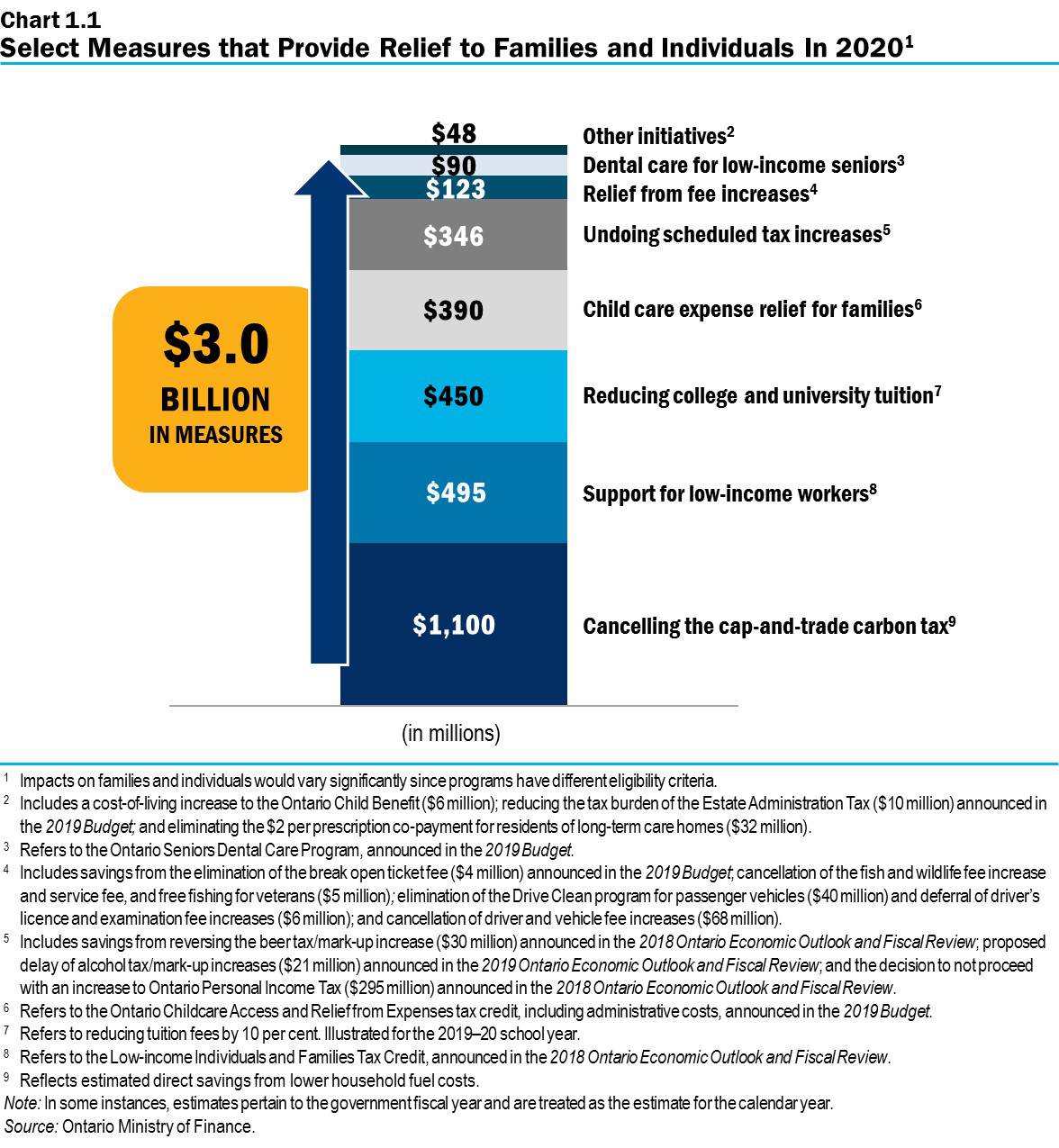

Actions taken to date, described in this chapter, would total $3.0 billion in relief for families and individuals in 2020.

Helping Families with their Child Care Expenses

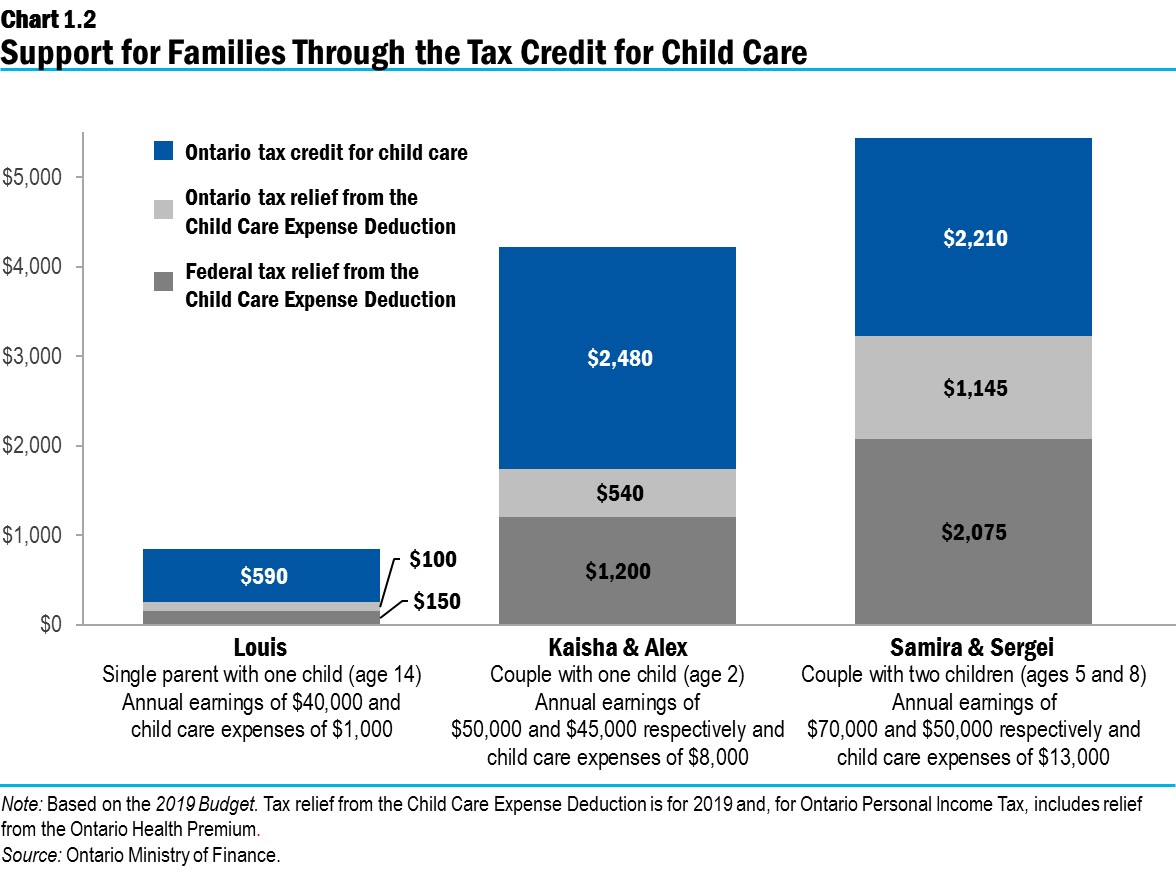

Giving parents more financial support and choice for child care is the right and responsible thing to do. The government is providing families with a tax credit for child care, starting with the 2019 tax year. The Ontario Childcare Access and Relief from Expenses (CARE) tax credit gives parents the flexibility to access a broad range of child care choices, including care in centres, homes and camps.

The tax credit will provide $1,250 per family, on average, in child care support to about 300,000 families, in addition to the Child Care Expense Deduction, and will target tax relief to low- and middle-income families.

Child care expenses can be a financial burden on parents and many cannot afford to wait until they file their tax returns to receive relief. As indicated in the 2019 Budget, the government is exploring options to give families the choice to apply for and receive regular advance payments during the year. This would allow families to receive support closer to when they incur expenses rather than waiting until they claim the credit on their Personal Income Tax returns.

The government also provides funding to municipalities to support licensed child care, and child and family programs in the province. In 2019–20, the government will invest $1.7 billion to support child care subsidies and child care operations. Last year, families received a fee subsidy for more than 100,000 children.

The government has also committed $1.0 billion over the next five years to create more child care spaces in schools.

Supporting Children and Families

Low- to moderate-income families in Ontario are struggling with the cost of raising their children. To support families, the government is also providing a cost-of-living increase to the Ontario Child Benefit, which provides direct financial supports to about one million children in more than 500,000 families. Starting on July 1, 2019, the maximum annual benefit per child increased to $1,434 from $1,403.

Providing Tax Relief for Families When They Need It the Most

The government has reduced the tax and compliance burden of the Estate Administration Tax. Effective January 1, 2020, there will be no Estate Administration Tax on the first $50,000 of the value of the estate. The tax will be calculated as $15 for every $1,000, or part thereof, of the value of the estate over $50,000.

Estate representatives are required to file an Estate Information Return after receiving an estate certificate. Starting January 1, 2020, the deadlines for filing information returns will be extended to 180 days for initial filings, and 60 days for filing an amended return to report new information.

Providing Tax Relief to Low-income Workers

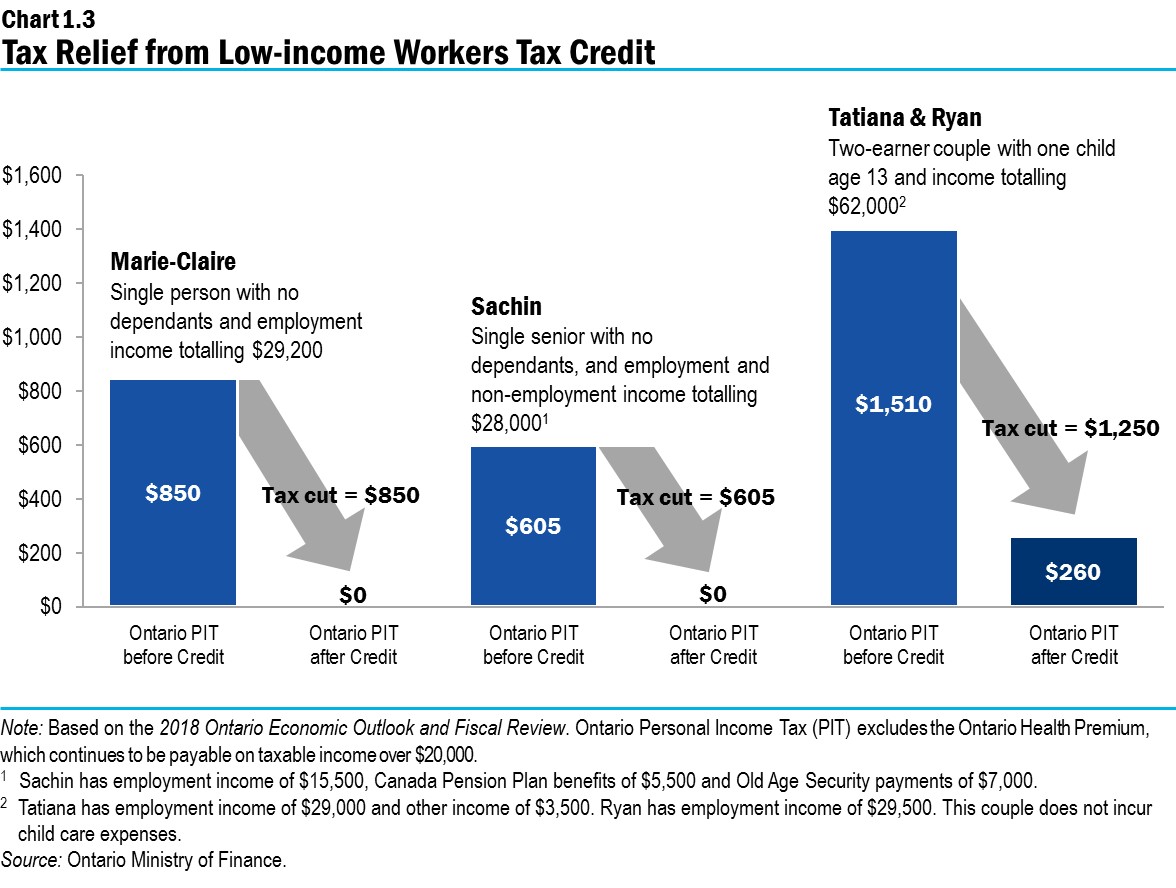

The government is helping people keep more of their hard‐earned money with the Low‐income Individuals and Families Tax (LIFT) Credit. This credit supports low-income taxpayers who have employment income, including those earning minimum wage, and was effective January 1, 2019.

As announced in the 2018 Ontario Economic Outlook and Fiscal Review, this credit will provide Ontario Personal Income Tax relief to about 1.1 million taxpayers who have employment income. Ontario Personal Income Tax will be eliminated for about 580,000 taxpayers, while tax will be reduced for another 520,000.

A single person who works full time at minimum wage (earning nearly $30,000) with no other income will receive the maximum $850 in Ontario tax relief and therefore pay no Ontario Personal Income Tax. Taxpayers with individual incomes greater than $30,000 or family incomes greater than $60,000 could also benefit from the credit as it is phased out gradually.

Providing Dental Care for Low-income Seniors

Starting this fall, the government is investing approximately $90 million a year to provide low-income seniors access to high-quality dental care. Ontario’s low-income seniors, age 65 and older, with an income of $19,300 or less, or couples with a combined annual income of $32,300 or less, who do not have dental benefits, will qualify for the publicly funded Ontario Seniors Dental Care Program. Services will be accessed through public health units, community health centres and Aboriginal Health Access Centres across the province.

Without timely treatment, oral health issues can create a significant burden on the health care system and contribute to hospital overcrowding. In 2015, there were almost 61,000 hospital emergency visits for dental problems, at a cost to Ontario’s health care system of approximately $31 million. This is another step that the government is taking to end hallway health care.

Eliminating Co-Pays for Pharmacy Payments in Long-Term Care

The government is committed to making program enhancements that help and protect seniors. As part of the proposal to change long-term care pharmacy payments to a per-bed-fee model from a per-prescription-fee model, the $2 per prescription co-payment for residents of long-term care homes would be removed. The introduction of this funding model can help support effective long-term care medication management. This change would result in real and significant savings for residents living in long-term care homes who would each save about $150 every year.

Helping to Reduce the Cost of Living in the North

People living in Northern Ontario can have a higher cost of living due, in part, to greater reliance on air travel and air freight. This is why the government is proposing legislation that would reduce the aviation fuel tax rate in the North to 2.7 cents per litre from 6.7 cents per litre. This change would take effect on January 1, 2020 and would return the aviation fuel tax rate in the North to that which was in effect in 2014.

The North would be defined as the districts of Algoma, Cochrane, Kenora, Manitoulin, Nipissing, Parry Sound, Rainy River, Sudbury, Thunder Bay and Timiskaming. This is the same geographic area used for the Northern Ontario Energy Credit and the Growth Plan for Northern Ontario.

See the Annex: Details of Tax Measures for more information.

The Government is Reducing Costs for Northern Families

Buying groceries for a family of four in the North could cost about $980 per month or more. This proposed tax rate reduction could save this family about $230 per year.

The Government is Making Air Travel in Northern Ontario More Affordable

Minh, who lives in Thunder Bay, travels to Red Lake every month to visit his mother. This proposed tax rate reduction could save Minh about $135 on his travel per year.

Source: Ontario Ministry of Finance.

Making Tuition More Affordable

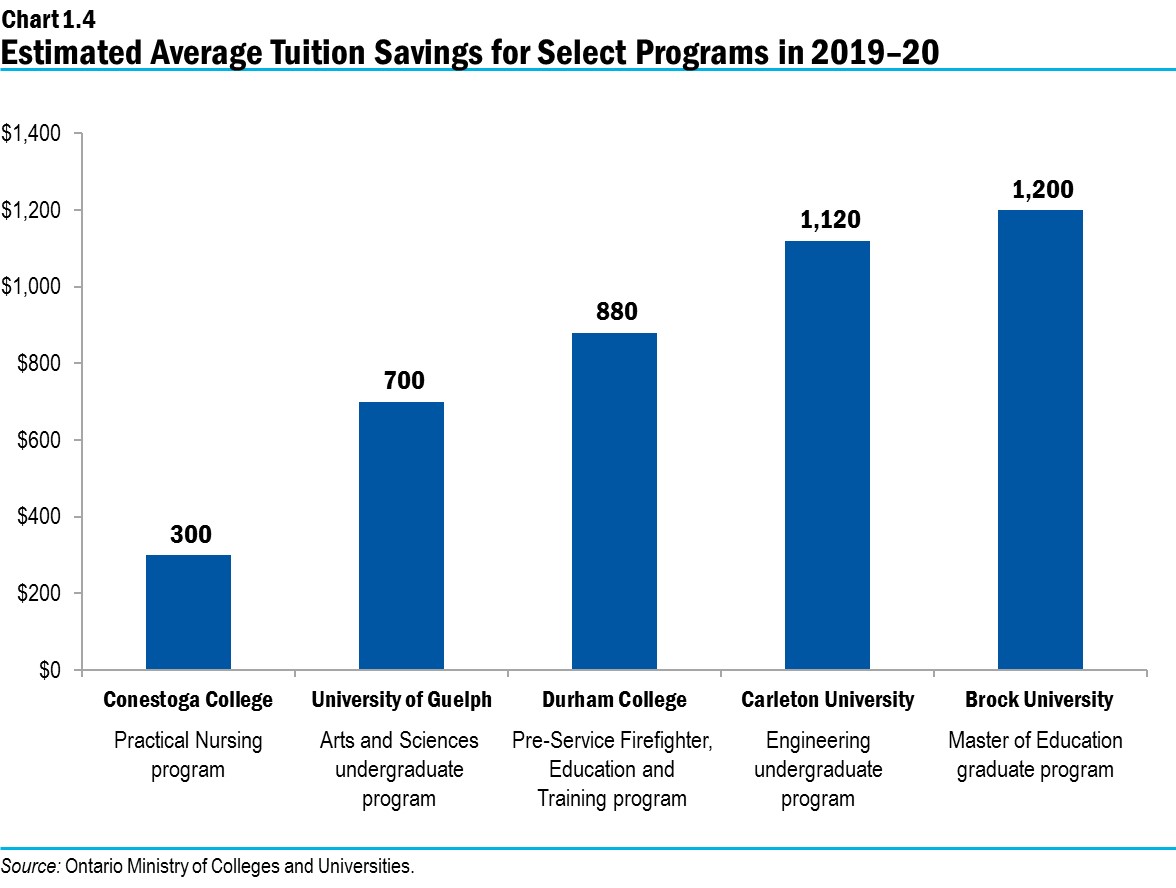

Ensuring that postsecondary education is affordable is part of the government’s plan to keep more money in the pockets of Ontario students and families. The government has implemented a historic tuition reduction of 10 per cent across all funding-eligible programs in the 2019–20 academic year and will freeze tuition fees in the 2020–21 academic year. In comparison to the 2018–19 academic year, domestic students will see an average tuition reduction of approximately $340 for those attending college and $660 for those enrolled in an undergraduate arts and science degree, resulting in approximately $450 million in tuition relief for Ontario students.

The government has also introduced the Student Choice Initiative to ensure students have the transparency and freedom to choose which non-essential ancillary student fees they pay. Fees that fund major campus-wide services and facilities, such as those that support essential campus health and safety initiatives, will continue to be mandatory.

Making GO Transit Service Free for Kids

The Province made taking transit easier and more affordable by introducing free travel for children 12 and under on all GO Transit trains and buses in March 2019. The introduction of the Kids GO Free initiative increases ridership, helps families save money and offers parents a low-stress alternative to driving in the Greater Toronto and Hamilton Area (GTHA).

Providing Free Museum Admission for Young People

Ontario has a vibrant history and culture, and the government wants to ensure that children across the province have increased access to learning and cultural opportunities. In 2006, the Province created the Fun Pass program. Using this as a model, the government is proposing to allow free access for children and will extend to attractions, museums, galleries and historic sites across the province. The details of the new program will be announced in the near future.

Reducing Electricity Bills

The government is committed to an electricity system that delivers cost-effective energy solutions to the people of Ontario. This includes transparency when it comes to residential electricity bills so people know exactly what they are paying for. The government is also committed to transparently reporting to the public how much costs are subsidized on their electricity bills because of past decisions.

The previous government left in place a system that was burdened with high costs and a lack of accountability. In addition, high-priced, long-term contracts resulted in electricity that Ontario did not need at prices consumers could not afford. But the true and escalating cost of electricity was hidden by a needlessly complex and non-transparent refinancing mechanism as part of the previous government’s “Fair Hydro Plan.”

To subsidize this problem of their own making, the previous government chose to set up a program to keep costs off-book that relied on borrowed money, which would be paid back by future ratepayers, entrenching a system of rising costs for years to come.

In order to restore transparency to the electricity system in Ontario, the current government ended this program by implementing the Fixing the Hydro Mess Act, 2019, which transparently accounts for the cost of rebates on the Province’s books.

Effective November 1, 2019, the refinancing and rebate programs put in place by the previous government have been replaced by the Ontario Electricity Rebate (OER) to provide direct relief on consumers’ bills. It also shows the people of Ontario just how much taxpayers continue to pay for the electricity decisions of the past government.

This year, the Province is expecting to subsidize residential, farm and small business electricity bills to the tune of at least $4 billion, in order to help ensure the bills of Ontario residents, farms and small businesses are more affordable.

The government remains committed to fixing the mess left behind by the previous government and building a system that the people of Ontario can rely on for future generations.

As part of this, the Province is also committed to reducing electricity system costs. The government’s actions towards this include the following:

Terminating more than 750 renewable energy contracts, which is estimated to reduce costs to electricity customers by $790 million.

Refocusing and centralizing electricity conservation programs to the Independent Electricity System Operator, which is estimated to achieve savings of up to $442 million over three years.

Ensuring that compensation paid to Hydro One executives is not funded from electricity rates and includes performance targets such as the CEO’s contribution to reducing electricity system costs.

Ending the Cap-and-Trade Carbon Tax

The government is delivering on its commitment to address the challenges of a changing climate and to mitigate against further environmental damage. The government is doing so without imposing the burden of a provincial carbon tax on the people of Ontario. By cancelling the cap-and-trade carbon tax, the government has improved affordability and enabled Ontario households to save $275, on average, in fuel and other costs in 2020.

The people of Ontario now face the federal government’s carbon tax, which was imposed on April 1, 2019 and has added 4.4 cents per litre to the price of gasoline. This will rise to 6.6 cents in 2020, 8.8 cents in 2021, and 11.1 cents per litre in April 2022. The tax was also imposed in New Brunswick, Manitoba and Saskatchewan and will apply in Alberta effective January 1, 2020. The Province has ensured that Ontarians know how much more they are paying for gas because of the federal carbon tax. Under the Federal Carbon Tax Transparency Act, 2019, as of August 30, 2019, gasoline retailers must display one sticker highlighting the price increase, in English or French, on the front of each gasoline pump.

Increasing Ontario’s Housing Supply

Ontario faces a housing affordability challenge, especially in the Greater Toronto Area (GTA). On average, home prices continue to put the dream of home ownership out of reach for too many.

Ontario has experienced strong population growth in recent years, leading to growing household formation and demand for housing. The corresponding growth in the stock of housing per household has declined relative to the past, contributing to higher home prices and rents. The long-term average annual growth of the housing stock per household in Ontario was 0.9 per cent between 1974 and 2018 but has declined to 0.6 per cent between 2006 and 2018.

In the More Homes, More Choice: Ontario’s Housing Supply Action Plan, the government committed to making it easier to build more homes faster, and to building the right types of homes in the right places so everyone can find a place to live that meets their needs and their budget. The Province has been talking to Ontarians, and meeting with stakeholders from across the province, to work out the details that will turn this bold vision into reality through a wide range of measures, including:

- Improving the efficiency and transparency of the planning system to help bring housing to market more quickly while still maintaining strong environmental protection;

- Harmonizing the Ontario Building Code and encouraging the development of different types of housing; and

- Reducing costs and other barriers to development.

The government recognizes that there is more work to do in order to make it easier to build homes across the province, and it continues to look for additional improvements in the development approvals process, working with municipal and federal partners to gather the data needed to drive informed decisions. For homeowners, the government has provided a user-friendly checklist to help build legal second units, and is considering ways to make it easier to pursue innovative forms of building design.

Eliminating Drive Clean

The Ontario government eliminated the Drive Clean program for passenger vehicles, effective April 1, 2019, saving more than $40 million every year for the people of Ontario and reducing the regulatory burden on Ontario families. When it was first introduced, Drive Clean was intended to be time-limited and as the years passed, so did its usefulness — providing less value for taxpayer dollars. Air emissions from passenger vehicles have declined steeply and they are no longer the biggest contributors to smog. That is why the government is taking action to improve and protect Ontario’s air and reduce smog-causing pollutants by proposing a new enhanced emissions testing program for heavy diesel commercial motor vehicles. This would target the biggest polluters on Ontario’s roads.

Making Auto Insurance Affordable: Fixing the Broken System

The government is committed to making auto insurance more affordable by cutting system costs in a sustainable way and fixing the broken system for the nearly 10 million drivers in Ontario.

Drivers deserve better than the patchwork of reforms implemented by previous governments. This has led to an unaffordable auto insurance system that is vulnerable to fraud and abuse, with unnecessary burdens for businesses and consumers.

That is why the government is taking action on a plan that will sustainably reduce system costs that drive up auto insurance premiums for drivers. This plan includes:

- Increasing consumer choice in auto insurance products by allowing drivers to decide for themselves and their families what coverage they need;

- Enhancing competition in the auto insurance market by supporting innovation and reducing barriers for new and existing companies to compete in Ontario; and

- Fighting fraud and taking costs out of the system by working with the Financial Services Regulatory Authority of Ontario (FSRA) to prevent bad actors in the system, replace inefficient processes and reduce fees.

Since April 2019, the government has been hard at work putting this plan into action, including:

- Launching FSRA, a new, modern regulator that will provide industry oversight that ensures consumer safety, fairness and choice;

- Enabling electronic communications that saves time and money for consumers and businesses; and

- Permitting electronic proof of auto insurance on mobile devices to give drivers more choice and convenience.

On October 9, 2019, FSRA released a new, modern and simplified rate approval process for auto insurance companies. The new Standard Rate Filing process will reduce unnecessary red tape and delays, while saving costs that would otherwise be passed on to consumers. Specifically, the process will significantly reduce the time and burden associated with rate filing applications and will enable insurers to be more responsive to current market conditions, compete more vigorously for customers, and make auto insurance pricing more fair and accurate.

This is the first phase of the government’s plan to fix the broken auto insurance system, reduce costs in a sustainable manner, and make life more affordable. As the government moves forward with this plan, it will continue to listen to the people of Ontario on how to improve the drivers’ experience.

Providing Other Relief for Families and Individuals

In addition to the measures described previously in this chapter, the government has taken many other actions to save money for families and individuals, including relief from fee increases and undoing previously scheduled tax increases.

The government has delivered more relief from fee increases, including:

- Elimination of the break open ticket fee to benefit charities;

- Cancellation of the fishing and hunting licence fee increase and service fee, and free fishing for veterans;

- Deferral of driver’s licence and examination fee increases; and

- Cancellation of driver and vehicle fee increases.

The government is also helping people keep more of their hard-earned money by undoing scheduled tax increases, including:

- Reversing the scheduled alcohol tax increases and mark-ups; and

- Not proceeding with an increase to Ontario Personal Income Tax.

Chart Descriptions

Chart 1.1: Selected Measures that Provide Relief to Families and Individuals in 2020

This chart illustrates selected measures that provide relief for Ontario’s families and individuals in 2020. Government actions would total $3.0 billion for families and individuals in 2020. This includes other initiatives ($48 million), dental care for low-income seniors ($90 million), relief from fee increases ($123 million), undoing scheduled tax increases ($346 million), child care expense relief for families ($390 million), reducing college and university tuition ($450 million), support for low-income workers ($495 million), and cancelling the cap-and-trade carbon tax ($1,100 million).

Impacts on families and individuals would vary significantly since programs have different eligibility criteria.

Other initiatives include a cost-of-living increase to the Ontario Child Benefit ($6 million) announced in the 2019 Ontario Economic Outlook and Fiscal Review; reducing the tax burden of the Estate Administration Tax ($10 million) announced in the 2019 Budget; and eliminating the $2 per prescription co-payment for residents of long-term care homes ($32 million).

The dental care for low-income seniors refers to the Ontario Seniors Dental Care Program, announced in the 2019 Budget.

Relief from fee increases includes savings from the elimination of the break open ticket fee for charities ($4 million) announced in the 2019 Budget; cancellation of the fish and wildlife fee increase and service fee, and free fishing for veterans ($5 million); elimination of the Drive Clean program for passenger vehicles ($40 million) and deferral of driver’s licence and examination fee increases ($6 million); and cancellation of driver and vehicle fee increases ($68 million).

Undoing scheduled tax increases includes savings from reversing the beer tax/mark-up increase ($30 million), announced in the 2018 Ontario Economic Outlook and Fiscal Review; proposed delay of alcohol tax/mark-up increases ($21 million), announced in the 2019 Ontario Economic Outlook and Fiscal Review; and the decision to not proceed with an increase to Ontario Personal Income Tax ($295 million), announced in the 2018 Ontario Economic Outlook and Fiscal Review.

Child care expense relief for families refers to the Ontario Childcare Access and Relief from Expenses tax credit, including administrative costs, announced in the 2019 Budget.

Reducing college and university tuition refers to reducing tuition fees by 10 per cent. Illustrated for the 2019–20 school year.

Support for low-income workers refers to the Low-income Individuals and Families Tax Credit, announced in the 2018 Ontario Economic Outlook and Fiscal Review.

Cancelling the cap-and-trade carbon tax reflects estimated direct savings from lower household fuel costs.

Note: In some instances, estimates pertain to the government fiscal year and are treated as the estimate for the calendar year.

Source: Ontario Ministry of Finance.

Chart 1.2: Support for Families Through the Tax Credit for Child Care

This bar chart shows three examples of the additional support families will get in 2019 from the new Ontario child care tax credit on top of the federal and Ontario Personal Income Tax relief they receive from the Child Care Expense Deduction.

Left section: A single parent (Louis) with a 14-year-old child, annual earnings of $40,000, and eligible child care expenses of $1,000 for the year will get $150 in federal tax relief and $100 in Ontario tax relief from the deduction and an extra $590 from the Ontario child care tax credit.

Middle section: A couple (Kaisha and Alex) with a two-year-old child, annual earnings of $50,000 and $45,000 respectively, and eligible child care expenses of $8,000 will get $1,200 in federal tax relief and $540 in Ontario tax relief from the deduction and an extra $2,480 from the Ontario child care tax credit.

Right section: A couple (Samira and Sergei) with two children (ages five and eight), annual earnings of $70,000 and $50,000 respectively, and eligible child care expenses of $13,000 will get $2,075 in federal tax relief and $1,145 in Ontario tax relief from the deduction and an extra $2,210 from the Ontario child care tax credit.

Note: Based on the 2019 Budget Tax relief from the Child Care Deduction is for 2019 and, for Ontario Personal Income Tax, includes relief from the Ontario Health Premium.

Source: Ontario Ministry of Finance.

Chart 1.3: Tax Relief from Low-income Workers Tax Credit

This chart provides three examples of the amount of Ontario Personal Income Tax (PIT), excluding the Ontario Health Premium, payable before and after the low-income workers tax credit.

Leftmost section: Marie-Claire is a single person with no dependants and $29,200 of employment income, only. In 2019, without the credit, Marie-Claire would have paid about $850 in Ontario PIT. The new credit, however, will reduce the amount of Ontario PIT payable by $850 to zero.

Middle section: Sachin is a single senior who has both employment and non-employment income. Sachin earns employment income of $15,500, and receives $5,500 as a Canada Pension Plan benefit and $7,000 in Old Age Security payments, resulting in a total income of $28,000. In 2019, without the credit, Sachin would have paid about $605 in Ontario PIT. The new credit, however, will reduce the amount of Ontario PIT payable by $605 to zero.

Rightmost section: Tatiana and Ryan are a two-earner couple with one child age 13 (for whom child care expenses are not incurred). In 2019, Tatiana has employment income of $29,000 and other income of $3,500, while Ryan has $29,500 in employment income only. In 2019, without the credit, the family would have paid $1,510 in Ontario PIT in total. The new credit, however, will reduce the family’s Ontario PIT payable by $1,250, reducing their combined Ontario PIT to $260.

Note: Based on the 2018 Economic Outlook and Fiscal Review. Ontario Personal Income Tax (PIT) excludes the Ontario Health Premium, which continues to be payable on taxable income over $20,000.

Source: Ontario Ministry of Finance.

Chart 1.4: Estimated Average Tuition Savings for Select Programs in 2019–20

This bar chart illustrates the estimated average tuition savings for select programs in the 2019–20 academic year. A student attending Conestoga College enrolled in a Practical Nursing program will see a $300 reduction in their tuition. A student enrolled in an Arts and Sciences undergraduate program at the University of Guelph will see a savings of $700. A student enrolled in a Pre-Service Firefighter, Education and Training program at Durham College will see a reduction of $880 in their tuition. A student enrolled in an Engineering undergraduate program at Carleton University will see a tuition reduction of $1,120. A student attending Brock University enrolled in a Master of Education graduate program will see a savings of $1,200.

Source: Ontario Ministry of Colleges and Universities.