Economic and Fiscal Overview

Ontario continues to face economic challenges and elevated uncertainty like the rest of the world. The outcomes of ongoing geopolitical instability, high interest rates and inflation continue to be unclear. But after record investments during a worldwide COVID‑19 pandemic, Ontario is on a path to balance the budget, while continuing to invest responsibly to build a strong province. The government is taking this responsible approach to its finances so Ontario can have a strong fiscal foundation now and in the future.

Economic Outlook

Ontario’s economy has remained resilient and has continued to grow despite ongoing economic uncertainty. Real GDP increased by an estimated 3.7 per cent in 2022 and is projected to increase by 0.2 per cent in 2023, 1.3 per cent in 2024, 2.5 per cent in 2025 and 2.4 per cent in 2026. For the purposes of prudent fiscal planning, these projections are slightly below the average of private-sector forecasts. Ontario’s employment gains were robust in 2022, and the unemployment rate remains near historic lows.

Like the rest of the world, Ontario will be affected by short-term and long-term trends in the global economy, including geopolitical tensions such as Russia’s war in Ukraine, the reopening of China’s economy, the energy transition, and policies such as the United States’ Inflation Reduction Act. To provide more transparency about the province’s economic outlook amid the elevated degree of economic uncertainty, the Ontario Ministry of Finance has developed Faster Growth and Slower Growth scenarios. These alternative scenarios should not be considered the best case or the worst case but reasonable possible outcomes in this period of uncertainty.

Fiscal Outlook

Ontario has a path to balance. The government is on track to balance the budget in 2024–25, three years earlier than forecast in the 2022 Budget. While this is a positive update, significant economic and geopolitical uncertainty persists.

For 2022–23, the government is projecting a deficit of $2.2 billion. Over the medium term, the government is projecting a deficit of $1.3 billion in 2023–24, and surpluses of $0.2 billion in 2024–25 and $4.4 billion in 2025–26. This represents significant improvement compared to the outlook presented in the 2022 Budget.

Since the release of the 2022 Budget, revenues have increased by $20.6 billion, largely driven by higher taxation revenue. The government has made targeted investments throughout the fiscal year to continue to progress on Ontario’s Plan to Build while also investing in critical public services. The 2022–23 total expense outlook is $202.6 billion — $3.9 billion higher than the 2022 Budget. Ontario has shown that it can balance the budget, while making record investments in services the people of Ontario need.

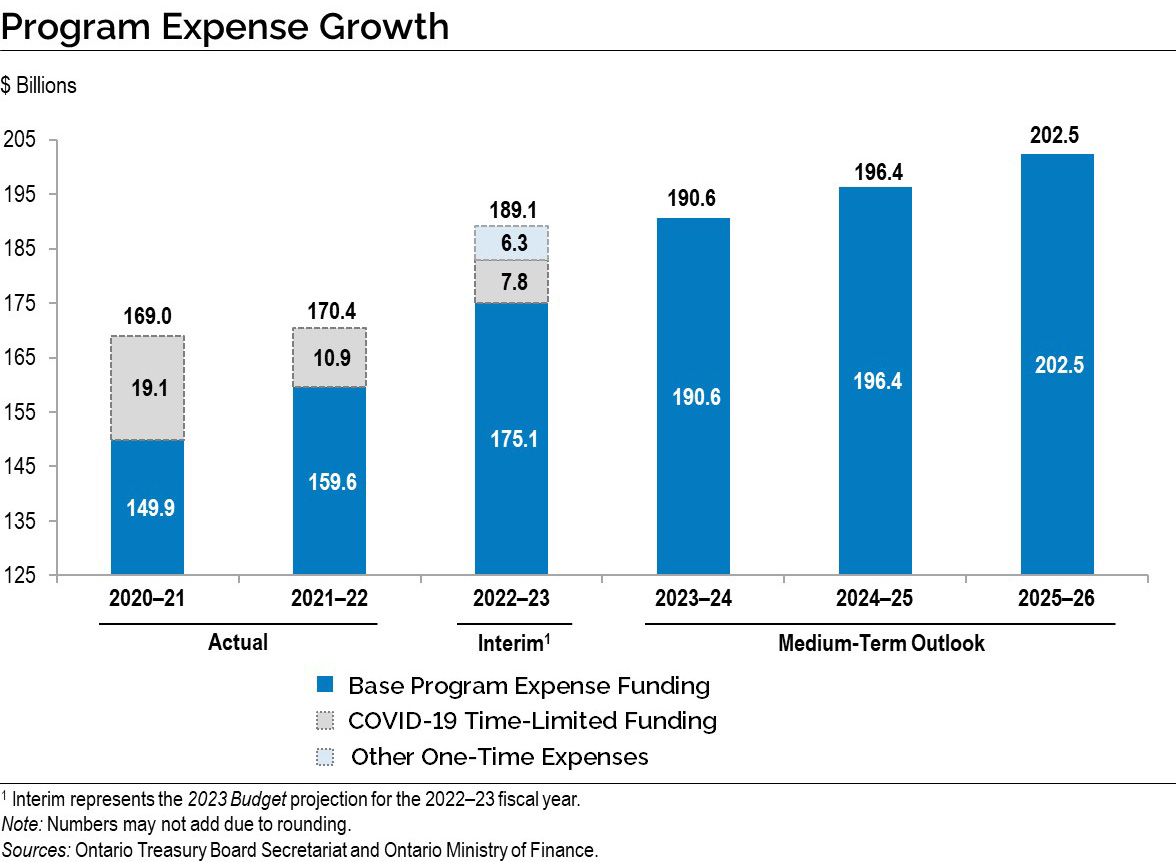

The government will continue to take a responsible, targeted approach with its Plan to Build to support people and businesses while laying a strong fiscal foundation for future generations. Total program expense is projected to grow from $189.1 billion in 2022–23 to $202.5 billion in 2025–26, representing an annual average increase of 2.3 per cent. Base program expense is projected to increase by $27.4 billion over the same period, representing an annual average increase of 5.0 per cent.

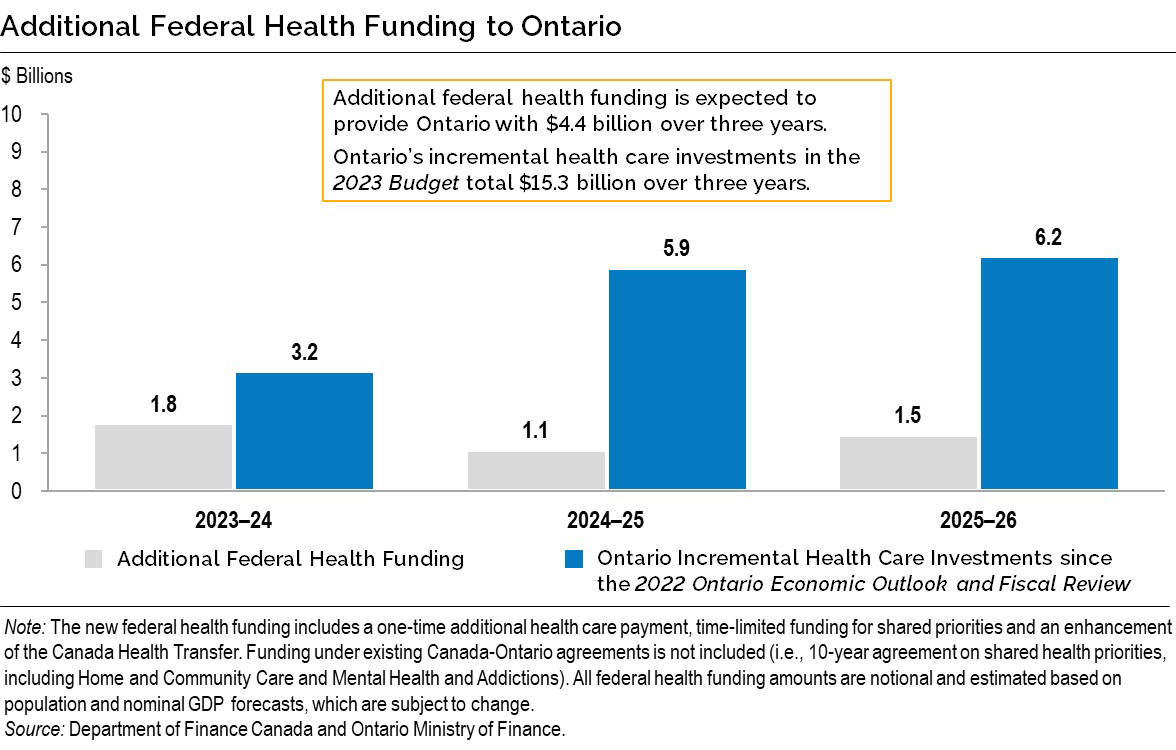

Additional Federal Health Funding in Ontario

Recently, the Government of Canada and the provinces and territories agreed on a framework to provide a modest enhancement to federal health funding. This represents a down payment from the Government of Canada that will help support the work Ontario is doing to transform the health care system, but Ontario’s incremental investments in health care in the 2023 Budget far exceed the additional federal health funding. The long‐term pressures facing the health system continue to be a significant challenge to all provinces and territories, and Ontario will continue to advocate for sustainable federal support for health care in the years to come.

Chart Descriptions

Program Expense Growth

The bar chart shows program expense growth from 2020–21 to 2025–26 excluding COVID‑19 Time-Limited Funding and Other One-Time Expenses. For 2020–21, base program expense, excluding COVID‑19 Time-Limited Funding and Other One-Time Expenses, is $149.9 billion, $159.6 billion in 2021–22, $175.1 billion in 2022–23, $190.6 billion in 2023–24, $196.4 billion in 2024–25 and $202.5 billion in 2025–26.

There are only three fiscal years from 2020–21 to 2022–23 where COVID‑19 Time-Limited Funding is included as part of total program expense. In 2020–21, COVID‑19 Time-Limited Funding of $19.1 billion increases total program expense to $169.0 billion. In 2021–22, COVID‑19 Time-Limited Funding of $10.9 billion increases total program expense to $170.4 billion. In 2022–23, COVID‑19 Time-Limited Funding of $7.8 billion as well as $6.3 billion for Other One-Time Expenses, increases total program expense to $189.1 billion.

Note: Numbers may not add due to rounding.

Sources: Ontario Treasury Board Secretariat and Ontario Ministry of Finance.

Additional Federal Health Funding to Ontario

This chart illustrates that the additional dollars Ontario is investing into health care in the 2023 Budget significantly exceed the new federal health funding. Ontario will receive a total of $4.4 billion in new federal health funding over three years: $1.8 billion in 2023–24, $1.1 billion in 2024–25 and $1.5 billion in 2025–26, while Ontario will make incremental health care investments of $15.3 billion over three years: $3.2 billion in 2023–24, $5.9 billion in 2024–25 and $6.2 billion in 2025–26.

Note: The new federal health funding includes a one-time additional health care payment, time-limited funding for shared priorities and an enhancement of the Canada Health Transfer. Funding under existing Canada–Ontario agreements is not included (i.e., 10-year agreement on shared health priorities, including Home and Community Care and Mental Health and Addictions). All federal health funding amounts are notional and estimated based on population and nominal GDP forecasts, which are subject to change.

Sources: Department of Finance Canada and Ontario Ministry of Finance.