On this page Skip this page navigation

- Overview

- Supporting People and Families

- Strengthening the Non-Resident Speculation Tax

- Modernizing Ontario’s Cultural Media Tax Credits

- Extending the Temporary Enhancement of the Regional Opportunities Investment Tax Credit

- Extending Time-Limited Relief for the Electricity Distribution Sector

- Addressing Unregulated Tobacco

- Property Tax Stability and Competitiveness

- Summary of Tax Measures

- Technical Amendments

- Other Legislative Initiatives

Overview

This Annex contains detailed information on proposed tax measures and other legislative initiatives as well as tax measures announced since the 2021 Ontario Economic Outlook and Fiscal Review: Build Ontario.

Supporting People and Families

Enhancing the Low-income Individuals and Families Tax Credit

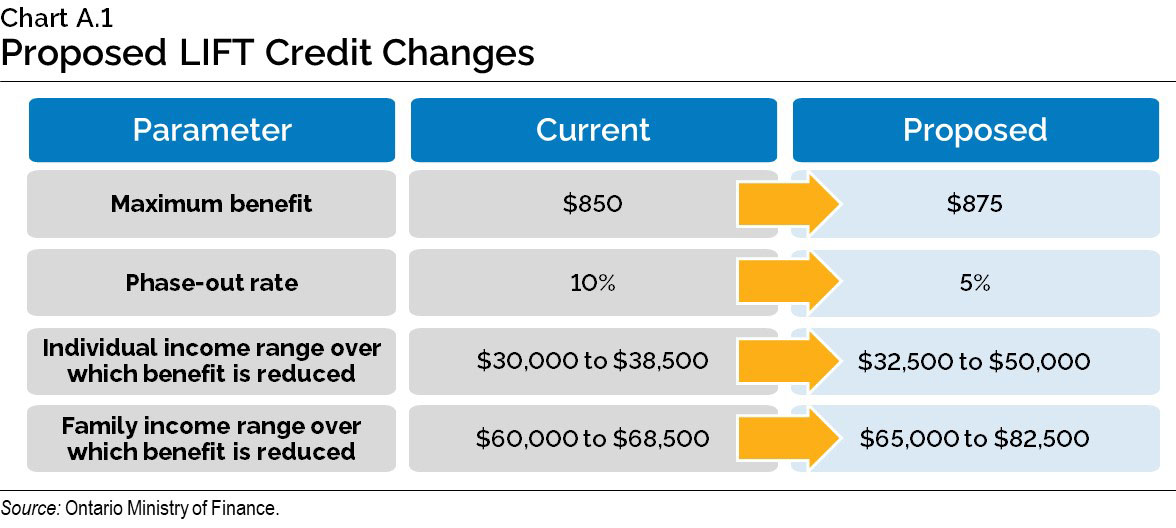

The government is proposing an enhancement to the non-refundable Low-income Individuals and Families Tax (LIFT) Credit, starting with the 2022 tax year.

Since 2019, the LIFT Credit has provided up to $850 in Ontario Personal Income Tax (PIT) relief each year to lower-income tax filers with employment income.

Starting in 2022, the enhanced LIFT Credit would be calculated as the lesser of:

- $875 (up from the current $850); and

- 5.05 per cent of employment income.

This amount would then be reduced by five per cent (down from the current 10 per cent) of the greater of:

- Adjusted individual net income in excess of $32,500 (up from the current $30,000); and

- Adjusted family net income in excess of $65,000 (up from the current $60,000).

The resulting amount would then be applied against the taxpayer’s Ontario PIT otherwise payable, excluding the Ontario Health Premium.

With the proposed enhancement, about 700,000 more people would be able to benefit from the LIFT Credit. Most of these new credit recipients would have incomes between $38,500 and $50,000. Lower-income workers would continue to have their PIT reduced or eliminated by the LIFT Credit and other existing tax relief measures. In total, about 1.7 million lower-income workers would benefit from the LIFT Credit with the proposed enhancement.

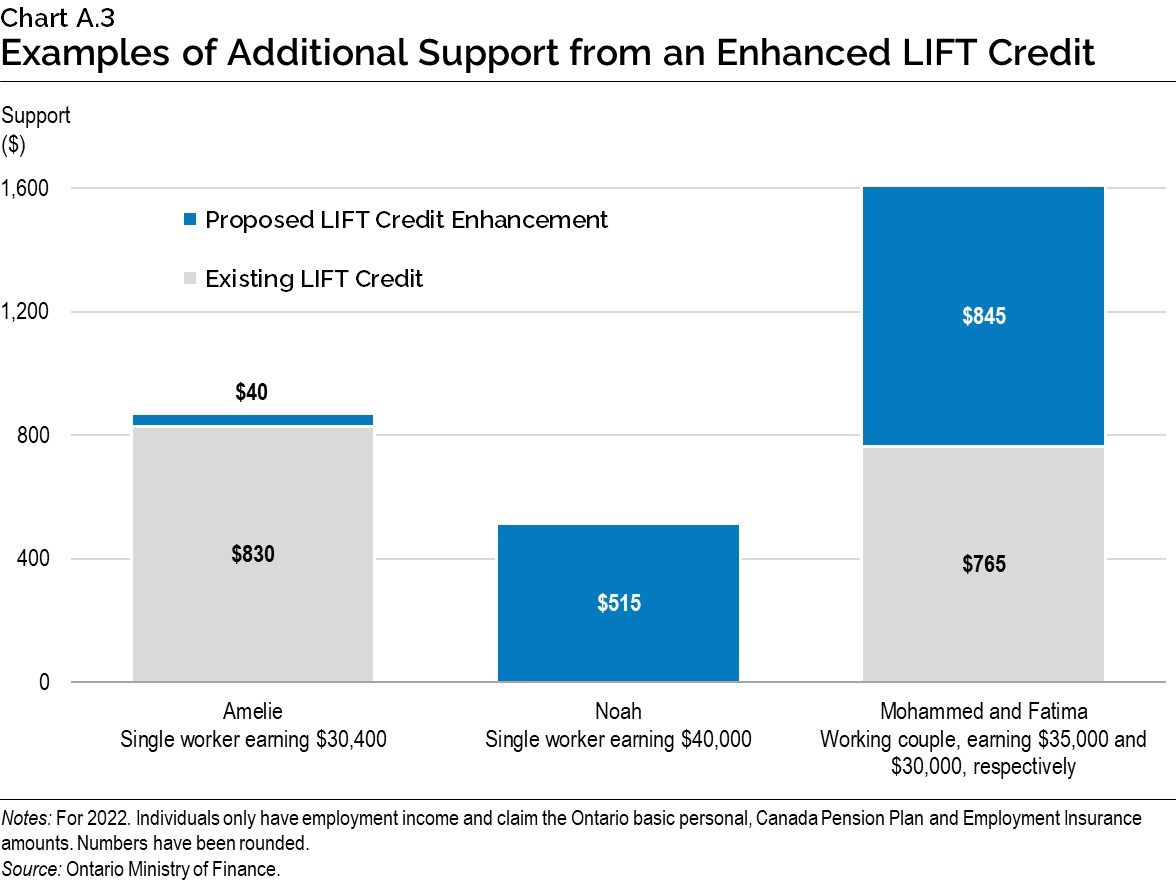

For example, as shown in Chart A.3, people like Noah who earn $40,000 in 2022 cannot currently benefit from the LIFT Credit but would receive about $515 in tax relief from the enhanced LIFT Credit.

Further, about 400,000 low- to moderate-income workers would receive more tax relief from the credit than they do now. As shown in Chart A.3, people like Amelie who work eight hours a day at minimum wage throughout 2022 would receive about $40 in additional tax relief, for a total of about $870, fully eliminating their PIT for the year. Mohammed and Fatima, a working couple earning $35,000 and $30,000, respectively, would see their LIFT Credit more than double from $765 to $1,610.

Taxpayers who would not get tax relief from the LIFT Credit would include those who have:

- No Ontario PIT otherwise payable;

- No employment income;

- More than $50,000 in adjusted individual net income (up from the current $38,500); or

- More than $82,500 in adjusted family net income (up from the current $68,500).

Helping Seniors through a New Ontario Seniors Care at Home Tax Credit

The government is proposing a new refundable Personal Income Tax credit to help seniors with eligible medical expenses, including expenses that support aging at home. Eligible recipients of the new Ontario Seniors Care at Home Tax Credit would receive up to 25 per cent of their claimable medical expenses up to $6,000, for a maximum credit of $1,500.

Starting with the 2022 tax year, the proposed credit would support a wide range of medical expenses to help low- to moderate-income senior families age at home. To make it easier to claim, the new Ontario Seniors Care at Home Tax Credit would be based on the medical expenses claimed for the existing Ontario Medical Expense Tax Credit (METC).

Tax filers would be eligible for the proposed credit if they:

- Turned 70 years of age or older in the year, or have a spouse or common-law partner who turned 70 years of age or older in the year; and

- Are resident in Ontario at the end of the tax year.

Eligible medical expenses would be the same as those claimed for the Ontario METC, which can include:

- Attendant care (certification required);

- Care of a provincially authorized medical practitioner (e.g., nurse, occupational therapist);

- Dental, vision and hearing care (e.g., glasses, dentures, hearing aids);

- Walking aids (e.g., walkers, canes);

- Wheelchairs and electric scooters;

- Bathroom aids (e.g., grab bars, grips, rails);

- Diapers and disposable briefs;

- Hospital beds;

- Oxygen and assisted breathing devices; and

- Renovation or construction that improves a person’s mobility, access or functioning within the home because of severe and prolonged impairment.

For detailed rules, including which medical expenses are eligible, tax filers can consult relevant Canada Revenue Agency publications or federal and provincial legislation.

The Ontario METC allows Ontario tax filers to claim medical expenses over a certain threshold. For low- to moderate-income seniors, the threshold for the eligible amount is three per cent of a tax filer’s net income.

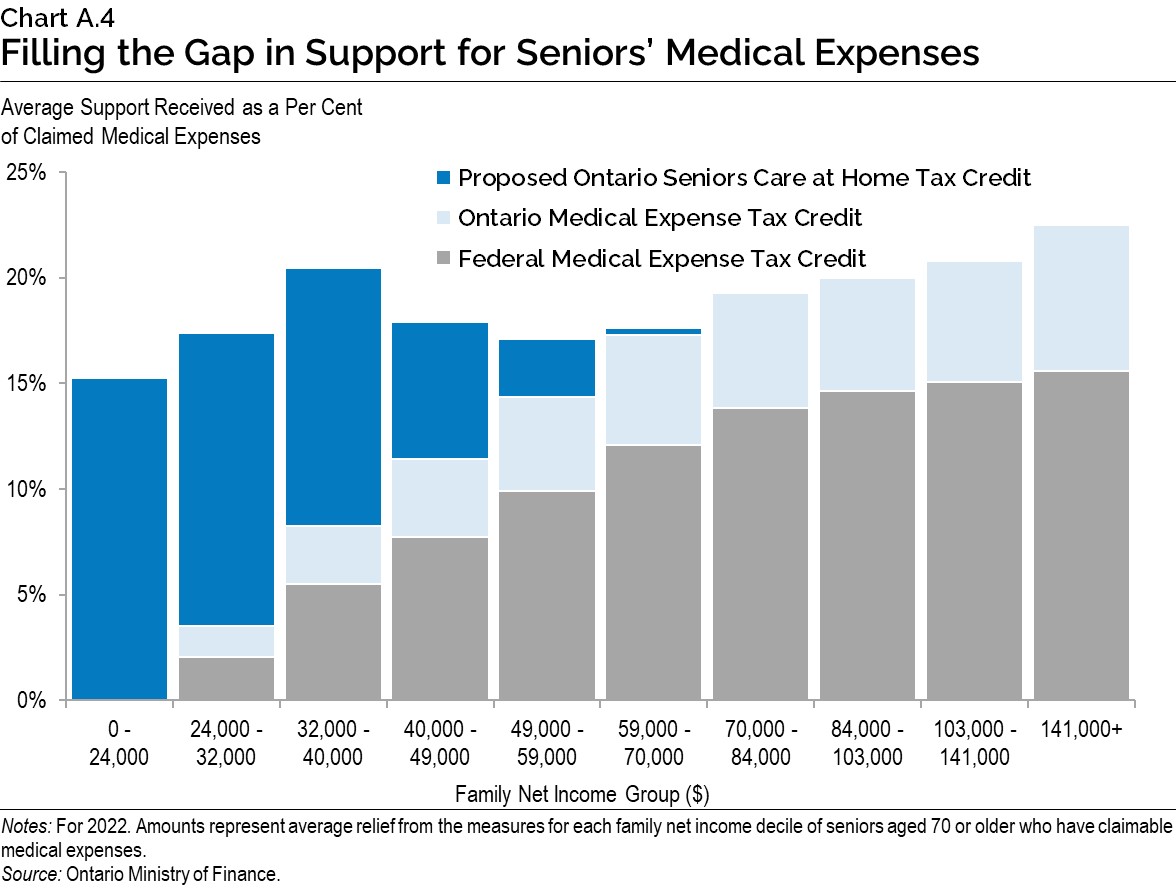

The proposed credit would be 25 per cent of claimed medical expenses, up to a maximum credit of $1,500. This amount would be reduced by five per cent of family net income over $35,000 and be fully phased out by at most $65,000. This family net income test is the same for singles and couples, recognizing that single seniors incur higher medical expenses on average compared to senior couples.

The proposed credit could be claimed in addition to the non-refundable federal and Ontario medical expense tax credits for the same eligible expenses. The proposed credit would be refundable, supporting low- to moderate-income senior families, even if they do not owe any Personal Income Tax (PIT). Therefore, the proposed credit would fill a gap by supporting low- to moderate-income senior families who cannot fully benefit from the existing non-refundable medical expense tax credits, because they owe little to no PIT. In 2022, it is expected that the new credit would provide an estimated $110 million in support to about 200,000 low- to moderate-income senior families.

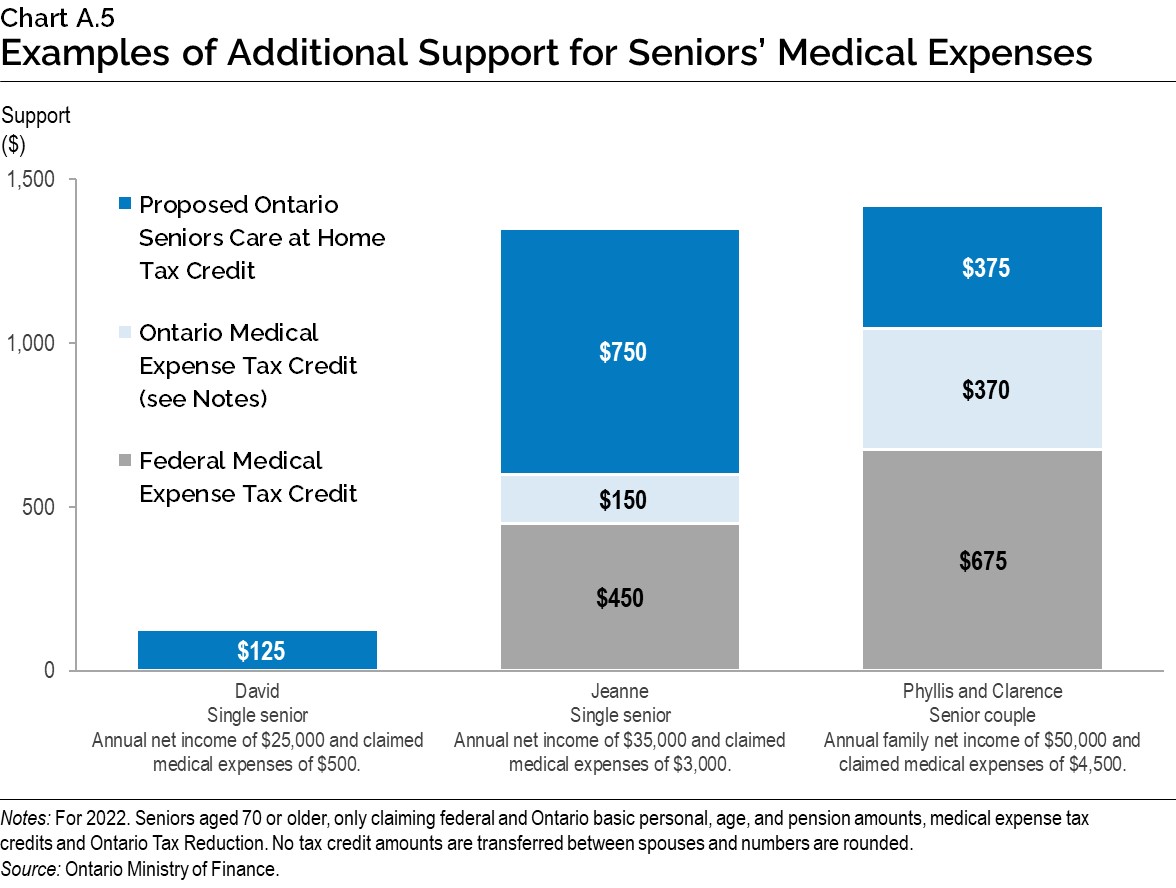

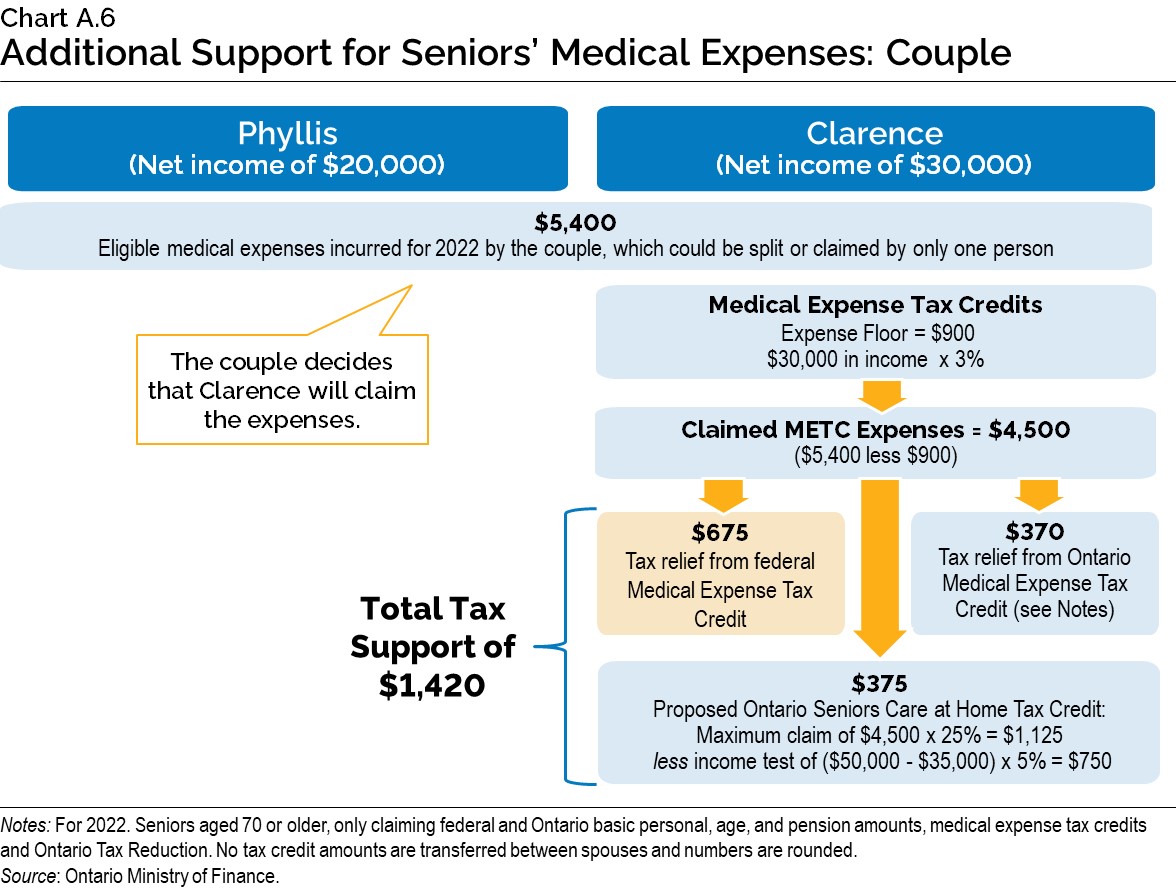

Chart A.5 provides three examples of seniors who would benefit from the proposed credit. Lower-income seniors like David do not receive any tax relief from the existing federal or Ontario medical expense tax credits. With the introduction of the proposed new credit, seniors like David would now benefit. Jeanne, who currently has 20 per cent of her claimed medical expenses offset by the existing federal and Ontario medical expense tax credits, would now see 45 per cent ― or more than double ― of her total claimed expenses covered thanks to the proposed Ontario Seniors Care at Home Tax Credit. Phyllis and Clarence, a senior couple with $50,000 in family net income and claimed medical expenses of $4,500, would see their Ontario credits more than double.

As with existing medical expense tax credits, expenses could be combined with those of the claimant’s spouse, common-law partner or dependants. The incomes of both spouses would also be combined for the phase-out of this credit. In the following example, a senior couple combines their eligible medical expenses. They receive support through the federal and Ontario medical expense tax credits. They would also claim the proposed Ontario Seniors Care at Home Tax Credit, which would be income tested based on their family net income.

With the proposed credit, couples like Phyllis and Clarence would get $1,420 in total tax support for their $5,400 of eligible medical expenses, or $4,500 of claimed medical expenses.

Senior families would claim the Ontario Seniors Care at Home Tax Credit when filing their personal Income Tax and Benefit Returns. To claim the proposed tax credit, seniors should save receipts and other required documentation for their eligible medical expenses, as already required for existing medical expense tax credits.

Cutting Gas and Fuel Taxes Temporarily

On April 4, 2022, the government proposed legislation that would amend the Gasoline Tax Act and Fuel Tax Act to temporarily cut the gasoline tax by 5.7 cents per litre and the fuel tax by 5.3 cents per litre for six months beginning July 1, 2022.

The current gasoline tax rate is 14.7 cents per litre and the current fuel tax rate is 14.3 cents per litre. Both rates would be reduced to 9 cents per litre from July 1, 2022, until December 31, 2022.

The Ontario Ministry of Finance has developed a one-time tax adjustment process to credit importers, wholesalers and retailers who may have inventories of gasoline or fuel for which tax was pre-collected at the higher rates.

Importers, wholesalers and retailers who hold inventory purchased at the higher rate would be required to take inventory at 12:01 a.m. on July 1, 2022. Suppliers up the supply chain would issue tax adjustments in the form of credits to accounts based on inventory reported.

For more about these proposed changes, please see the Ontario Ministry of Finance website.1

Strengthening the Non-Resident Speculation Tax

Effective March 30, 2022, the government implemented several amendments to O. Reg. 182/17 made under the Land Transfer Tax Act in relation to the Non-Resident Speculation Tax (NRST).

The changes include an increase to the NRST rate to 20 per cent, expansion of the NRST’s application provincewide, and elimination of two rebates specific to international students and foreign nationals working in Ontario. Agreements of purchase and sale entered into on or after March 30, 2022, will be subject to these changes. To ensure taxpayer fairness, binding agreements of purchase and sale entered into before March 30, 2022, may be eligible for relieving transitional provisions.

Prior to these amendments, the NRST rate was 15 per cent and the tax only applied within the Greater Golden Horseshoe Region.

Rebates remain available for foreign nationals who become permanent residents of Canada within four years after the tax became payable if eligibility criteria are met. Exemptions also remain available for nominees under the Ontario Immigrant Nominee Program, protected persons (refugees), and spouses of individuals not subject to the NRST if eligibility criteria are met.

For more about the changes to the NRST, please see the Ontario Ministry of Finance website.2

Modernizing Ontario’s Cultural Media Tax Credits

Extending Film and Television Tax Credits to Online Productions

To better reflect modern digital distribution models, the government proposes to make regulatory amendments to the Ontario Film and Television Tax Credit and the Ontario Production Services Tax Credit to extend eligibility to professional film and television productions distributed exclusively online.

To ensure the Ontario Film and Television Tax Credit only supports professional productions, film and television productions distributed exclusively online would be subject to additional eligibility requirements for this credit. These would include, but would not be limited to, requirements that the production:

- Meet a minimum budget threshold of $250,000;

- Have an agreement in writing with an eligible exhibitor service for consideration at fair market value to have the production shown on the internet in Ontario within two years of completion; and

- Not include certain content (e.g., opinion, advice or how-to instructions).

Further information about the proposed changes and new requirements for productions distributed exclusively online, including details on the effective date of these amendments, will be provided in the fall.

Under the proposed measure, productions distributed exclusively online that become eligible for the Ontario Film and Television Tax Credit or the Ontario Production Services Tax Credit may also become eligible for the Ontario Computer Animation and Special Effects Tax Credit if they meet all of the other eligibility requirements.

Updating the Ontario Book Publishing Tax Credit

To be eligible for the Ontario Book Publishing Tax Credit, a literary work must be published in an edition of at least 500 copies of a bound book.

This requirement was temporarily removed for the 2020 and 2021 taxation years to help companies continue to qualify for tax support while experiencing printing delays due to COVID-19.

Recognizing the importance and growth of e-books and audiobooks, which are not printed in hard copy, the government proposes to permanently remove this requirement effective for the 2022 and subsequent taxation years.

Simplifying the Ontario Computer Animation and Special Effects Tax Credit

To be eligible for the Ontario Computer Animation and Special Effects Tax Credit, a film or television production must receive either the Ontario Film and Television Tax Credit or the Ontario Production Services Tax Credit, “tethering” the tax credits together. This tethering requirement helps target tax credit support to productions with significant cultural or economic impact. However, this tethering can result in complexities and challenges with claiming and processing the tax credits since the three tax credits are claimed over different time frames and are not always claimed by the same company.

To help simplify the tax credit, the government will examine ways to untether the Ontario Computer Animation and Special Effects Tax Credit from the other film and television tax credits, while continuing to ensure support remains targeted to professional productions with significant cultural or economic impact.

Exploring Opportunities to Encourage More Film and Television Production Across Ontario

The Ontario Film and Television Tax Credit is a 35 per cent refundable tax credit on qualifying labour expenditures available to corporations producing certified domestic film and television productions in Ontario. The tax credit includes a 10 per cent regional bonus on all expenditures for productions primarily filmed or produced outside of the Greater Toronto Area (GTA).

To ensure the Ontario Film and Television Tax Credit is providing effective and appropriate incentives and support for film and television production in all regions of Ontario, the government will review the credit’s regional bonus.

The Ontario Production Services Tax Credit is a 21.5 per cent refundable tax credit on qualifying labour and other production expenditures for foreign and domestic film and television productions that meet minimum budget thresholds (e.g., $1 million for feature films). Fees to rent property for on-location filming (i.e., location fees) are generally not eligible expenditures for the tax credit.

To better understand the importance and contribution of on-location film production to Ontario’s film and television industry, the government will review the eligibility of location fees for the Ontario Production Services Tax Credit and will work to advance solutions for the industry.

Clarifying Treatment of Work-from-Home Labour for Interactive Digital Media and Computer Animation and Special Effects

As with many other sectors of the economy, there has been an increase in remote work in the interactive digital media and computer animation and special effects industries. To provide clarity and certainty, the government is confirming that, under the current legislation, eligible labour expenditures for employees working remotely can be claimed under the Ontario Computer Animation and Special Effects Tax Credit and the Ontario Interactive Digital Media Tax Credit, provided the work is undertaken in Ontario by an Ontario resident who reports to and is under the direction of an eligible tax credit applicant with a permanent establishment in Ontario.

Extending the Temporary Enhancement of the Regional Opportunities Investment Tax Credit

The Regional Opportunities Investment Tax Credit is a 10 per cent refundable Corporate Income Tax credit available to Canadian-controlled private corporations that make qualifying investments in eligible geographic areas of Ontario. For the complete list of eligible geographic areas of Ontario, refer to the 2021 Budget, Annex: Details of Tax Measures and Other Legislative Initiatives, Enhancing the Regional Opportunities Investment Tax Credit.3

The tax credit is available for eligible expenditures in excess of $50,000 and up to $500,000 in a year, for investments that become available for use on or after March 25, 2020. Qualifying investments include expenditures for constructing, renovating or acquiring eligible commercial and industrial buildings and other assets.

The government temporarily doubled the tax credit rate in the 2021 Budget from 10 per cent to 20 per cent for eligible expenditures on assets that become available for use in the period beginning on March 24, 2021, and ending before January 1, 2023.

The government is now proposing to extend the temporary enhancement period by one year. The enhanced credit of 20 per cent would be available for eligible expenditures in excess of $50,000 and up to $500,000 for property that becomes available for use in the corporation’s taxation year, and in the period beginning on March 24, 2021, and ending before January 1, 2024.

“Available for use” refers to the rules set out in the federal Income Tax Act that determine the taxation year in which a taxpayer can start to claim capital cost allowance for a depreciable property.

Qualifying investments are eligible expenditures for capital property included in Class 1 and Class 6 for the purposes of calculating capital cost allowance.

Extending Time-Limited Relief for the Electricity Distribution Sector

Under the Electricity Act, 1998, municipal electricity utilities (MEUs) are subject to Transfer Tax of 33 per cent on the fair market value of electricity assets sold to the private sector.

In the 2015 Budget, Ontario announced tax relief measures for sales of assets during the period beginning January 1, 2016, and ending December 31, 2018. The Transfer Tax rate was reduced from 33 per cent to 22 per cent for larger MEUs and the rate was reduced from 33 per cent to zero per cent for MEUs with fewer than 30,000 customers. Additionally, any capital gains arising under the payments in lieu of tax (PILs) deemed disposition rules were exempted from PILs.

These tax relief measures were extended until December 31, 2022, in the 2018 Ontario Economic Outlook and Fiscal Review.

Through regulatory amendments, Ontario is further extending this relief until December 31, 2024.

Addressing Unregulated Tobacco

The government has been engaging a variety of industry, retail and public health stakeholders and Indigenous partners on the issue of unregulated tobacco. In addition, two independent Indigenous facilitators have submitted a report to the government summarizing their engagement with First Nations.

The facilitators’ work highlights the importance of the tobacco economy for First Nations, and the need to continue to work together on common interests such as economic development, smoking cessation, business regulation and community safety. The government remains committed to dialogue with First Nations on the report and its recommendations and welcomes discussions with interested communities.

The government will continue to work towards a balanced approach to addressing unregulated tobacco, including making further progress by:

- Reviewing and modernizing the Tobacco Tax Act based on recommendations from the consultations to ease administrative burden and strengthen provincial oversight;

- Continuing to enhance raw leaf tobacco oversight through adoption of “track and trace” technologies; and

- Expanding enforcement partnerships with interested provincial, local and First Nations police services.

Property Tax Stability and Competitiveness

During the past two years, the government conducted the Property Assessment and Taxation Review and sought input on three broad themes:

- Supporting a competitive business environment;

- Improving the accuracy and stability of property assessments; and

- Strengthening the governance and accountability of the Municipal Property Assessment Corporation (MPAC).

Input to this review was received from municipalities, taxpayers, business and industry associations and other interested stakeholders. Outcomes from the review, which are summarized below, have been implemented by the government in a phased approach based on priorities that were identified during different stages of the review.

- Supporting a Competitive Business Environment:

- Reduced high business education tax rates in 2021 and onwards, providing annual savings of $450 million for approximately 95 per cent of business properties in Ontario.

- Provided municipalities with flexibility to deliver targeted property tax relief to small businesses through a new optional small business property subclass.

- Enhanced the Brownfields Financial Tax Incentive Program (BFTIP) to encourage rehabilitation of contaminated land by extending the time period for provincial education tax relief.

- Enhanced property tax programs that support farm businesses, including increasing the property tax exemption for farm woodlots, expanding eligibility for the farm property class to include processing of all tree saps, and increasing the assessment threshold for the small-scale on-farm business subclass.

- Improving Property Assessment Accuracy and Stability:

- Provided stability and certainty to residents and businesses and enabled municipalities to focus on responding to the challenges posed by the COVID-19 pandemic by postponing property tax reassessments for the 2021 to 2023 tax years.

- Working with MPAC to identify opportunities to improve the information exchange process between MPAC and property owners to support enhanced assessment accuracy for the next reassessment.

- Amended legislation to create flexibility for the government to respond to municipal requests for targeted assessment tools that could moderate assessment changes for business properties in areas impacted by redevelopment pressures and speculative sales.

- Addressed concerns related to specific property types, such as airports operated by federal authorities in Ontario.

- Strengthening MPAC Governance and Accountability:

- Worked with MPAC to develop a comprehensive performance measurement framework related to assessment accuracy, customer service and operational efficiency, with annual reports to be published starting in 2022.

- Worked with MPAC to enhance the clarity of assessment notices that are sent to property owners.

- Amended legislation to strengthen MPAC’s board governance by ensuring that a vacancy on the board of directors does not impede the conduct of business by the corporation.

- Supporting modernization efforts by working with MPAC to explore more flexible options for delivery of digital assessment products to property owners and municipalities.

While the Property Assessment and Taxation Review has concluded, the input that has been received during the review will help to inform the government’s plans regarding the timing and valuation date for future reassessments. In addition, the government will continue to work with stakeholders and municipal partners to identify further opportunities to improve the accuracy, stability and competitiveness of Ontario’s property assessment and taxation system.

Summary of Tax Measures

Table A.1 reflects the impact over the medium-term outlook of proposed tax measures and measures announced since the 2021 Ontario Economic Outlook and Fiscal Review: Build Ontario.

| 2022–23 | 2023–24 | 2024-25 | |

|---|---|---|---|

| New Tax Measures — LIFT Credit Enhancement | 400 | 320 | 320 |

| New Tax Measures — Ontario Seniors Care at Home Tax Credit | 140 | 120 | 125 |

| New Tax Measures — Extending Film and Television Tax Credits to Online Productions | 4 | 15 | 20 |

| New Tax Measures — Updating the Ontario Book Publishing Tax Credit | – | – | – |

| New Tax Measures — Extending the Temporary Enhancement of the Regional Opportunities Investment Tax Credit | 10 | 30 | – |

| New Tax Measures — Extending Time-Limited Relief for Electricity Distribution Sector | – | – | – |

| Tax Measures Announced Since the 2021 Ontario Economic Outlook and Fiscal Review — Cutting Gas and Fuel Taxes Temporarily | 645 | – | – |

| Tax Measures Announced Since the 2021 Ontario Economic Outlook and Fiscal Review — Strengthening the Non-Resident Speculation Tax | (175) | (230) | (235) |

| Net Fiscal Impact of Tax Measures | 1,025 | 255 | 230 |

Table A.1 footnotes:

Notes: Positive numbers reflect the benefit to individuals, families or businesses. Positive numbers also represent an increase in government expense or a decrease in government revenue. Negative numbers represent an increase in government revenue. Numbers may not add due to rounding.

“–” indicates an amount that is nil or cannot be determined.

Source: Ontario Ministry of Finance.

Technical Amendments

Amendments may be proposed to various statutes administered by the Ontario Minister of Finance, or other statutes, to improve administrative effectiveness or enforcement, maintain the integrity and equity of Ontario’s tax and revenue collections system, or enhance legislative clarity or regulatory flexibility to preserve policy intent.

Other Legislative Initiatives

Additional proposed legislative amendments include:

- An amendment to the Workplace Safety and Insurance Act, 1997 to remove the requirement for the Workplace Safety and Insurance Board (WSIB) head office to be located in Toronto, which would give the WSIB the flexibility to determine where its head office is located.

Footnotes

[1] For information on Gas Tax, see https://www.ontario.ca/document/gasoline-tax and for Fuel Tax, see https://www.ontario.ca/document/fuel-tax

[2] For information regarding the NRST, see https://www.ontario.ca/document/land-transfer-tax/non-resident-speculation-tax

[3] For areas of the province where investments would be eligible, see https://budget.ontario.ca/2021/annex.html#section-2

Chart Descriptions

Chart A.1: Proposed LIFT Credit Changes

The chart consists of three columns with the following headings: Parameter (left column), Current (middle column) and Proposed (right column).

Second level: Maximum benefit (left column), $850 (middle column), $875 (right column). Yellow arrow points from middle to right column.

Third level: Phase-out rate (left column), 10 per cent (middle column), 5 per cent (right column). Yellow arrow points from middle to right column.

Fourth level: Individual income range over which benefit is reduced (left column), $30,000 to $38,500 (middle column), $32,500 to $50,000 (right column). Yellow arrow points from middle to right column.

Fifth level: Family income range over which benefit is reduced (left column), $60,000 to $68,500 (middle column), $65,000 to $82,500 (right column). Yellow arrow points from middle to right column.

Source: Ontario Ministry of Finance.

Chart A.2: Enhanced Support from the LIFT Credit

This line graph shows the support provided from the current and proposed LIFT Credit enhancement.

The Y-axis represents the reduction in Ontario Personal Income Tax from the LIFT Credit, and ranges from $0 to $1,000.

The X-axis represents employment income, and ranges from $0 to $60,000.

The current LIFT credit line starts at $0 of support below about $17,500 of employment income, increasing to $850 of support at about $30,000 of employment income, then decreasing to and staying at $0 of support from about $38,500 of employment income onwards.

The proposed LIFT credit enhancement line is shown starting at $0 of support below about $17,500 of employment income. The line then increases to $875 of support from about $30,500 of employment income and remains at $875 until about $32,500 of employment income, and then decreases to and stays at $0 of support from about $50,000 of employment income onwards.

Notes: For 2022. This illustrative example shows a single person with only employment income and who only claims the Ontario basic personal, Canada Pension Plan, and Employment Insurance amounts.

Source: Ontario Ministry of Finance.

Chart A.3: Examples of Additional Support from an Enhanced LIFT Credit

This bar chart shows the existing and enhanced support two individuals and one couple would get from the proposed LIFT Credit enhancement. The enhanced credit is shown on top of the existing LIFT Credit.

Left section: Amelie is a single worker with earnings of $30,400. Amelie would receive about $830 from the existing LIFT Credit and about $40 in additional tax relief from the proposed enhancement to the LIFT Credit.

Middle section: Noah is a single worker with earnings of $40,000. Noah would receive $0 from the existing LIFT Credit and about $515 from the proposed enhancement to the LIFT Credit.

Right section: Mohammed and Fatima are a working couple, earning $35,000 and $30,000, respectively. They would get about $765 in tax relief from the existing LIFT credit, and about $845 in additional tax relief from the proposed enhancement to the LIFT Credit.

Notes: For 2022. Individuals only have employment income and claim the Ontario basic personal, Canada Pension Plan and Employment Insurance amounts. Numbers have been rounded.

Source: Ontario Ministry of Finance.

Chart A.4: Filling the Gap in Support for Seniors’ Medical Expenses

This bar chart shows the support received through the federal and Ontario medical expense tax credits and the proposed Ontario Seniors Care at Home Tax Credit, as a percentage of claimed medical expenses by family net income decile ($0 to $24,000, $24,000 to $32,000, $32,000 to $40,000, $40,000 to $49,000, $49,000 to $59,000, $59,000 to $70,000, $70,000 to $84,000, $84,000 to $103,000, $103,000 to $141,000, and $141,000+).

The chart shows that the federal and Ontario tax relief provided by the medical expense tax credits (the gray and light blue bars, respectively) increases with family net income, providing relatively little benefit for lower-income senior families. This can be seen by the increasing size of the gray and light blue bars as family net income increases. The chart also shows the additional support that the proposed Ontario Seniors Care at Home Tax Credit (dark blue bars) would provide. Support from the proposed credit as a percentage of claimed medical expenses would be the highest for the family net income group of $0 to $24,000 (largest dark blue bar). As support would be reduced as family net income increases above $35,000 and would be fully phased out by a family net income of at most $65,000, there are no dark blue bars showing for the $70,000 to $84,000 and higher family net income groups.

Notes: For 2022.Amounts represent average relief from the measures for each family net income decile of seniors aged 70 or older who have claimable medical expenses.

Source: Ontario Ministry of Finance.

Chart A.5: Examples of Additional Support for Seniors’ Medical Expenses

This bar chart shows examples of support that would be received under the proposed Ontario Seniors Care at Home Tax Credit, on top of the current Ontario Medical Expense Tax Credit (see Notes) and the federal Medical Expense Tax Credit.

Left section: David is a single senior with annual net income of $25,000 and claimed medical expenses of $500. David would receive no tax relief from the Ontario Medical Expense Tax Credit or the federal Medical Expense Tax Credit but would receive $125 from the proposed Ontario Seniors Care at Home Tax Credit.

Middle section: Jeanne is a single senior with annual net income of $35,000 and claimed medical expenses of $3,000. Jeanne would get tax relief of $450 from the federal Medical Expense Tax Credit, about $150 from the Ontario Medical Expense Tax Credit and $750 from the proposed Ontario Seniors Care at Home Tax Credit.

Right section: Phyllis and Clarence are a senior couple with annual family net income of $50,000 and claimed medical expenses of $4,500. The couple would get tax relief of $675 from the federal Medical Expense Tax Credit, about $370 from the Ontario Medical Expense Tax Credit and $375 from the proposed Ontario Seniors Care at Home Tax Credit.

Notes: For 2022. Seniors aged 70 or older, only claiming federal and Ontario basic personal, age, and pension amounts, medical expense tax credits and Ontario Tax Reduction. No tax credit amounts are transferred between spouses and numbers are rounded.

Source: Ontario Ministry of Finance.

Chart A.6: Additional Support for Seniors’ Medical Expenses: Couple

This graphic shows the steps required to calculate the total tax support for a representative senior couple with higher medical expenses.

First level, left (dark blue): Phyllis has net income of $20,000.

First level, right (dark blue): Clarence has net income of $30,000.

Second level (light blue): The couple incurred $5,400 in eligible medical expenses for 2022, which could be split or claimed by only one person. The couple decides that Clarence will claim the expenses.

Third level, right (light blue): Clarence’s medical expense floor is $900, calculated by multiplying his $30,000 in net income by three per cent.

Fourth level, right (light blue): Clarence’s claimed Medical Expense Tax Credit expenses are equal to $4,500, calculated by subtracting $900 (Clarence’s medical expense floor) from the couple’s $5,400 of eligible medical expenses.

Fifth level, left (light orange): Tax relief from the federal Medical Expense Tax Credit is $675.

Fifth level, right (light blue): Tax relief from the Ontario Medical Expense Tax Credit is about $370 (see Notes).

Sixth level, right (light blue): Support from the proposed Ontario Seniors Care at Home Tax Credit is $375. First, Clarence calculates the maximum credit claim of $1,125, which is 25 per cent of the claimed Ontario Medical Expense Tax Credit expenses of $4,500. From this amount, Clarence subtracts five per cent of the couple’s combined family net income ($50,000) in excess of $35,000, or $750, to reach a credit amount of $375.

The total tax support provided by these three credits would be about $1,420.

Notes: For 2022. Seniors aged 70 or older, only claiming federal and Ontario basic personal, age, and pension amounts, medical expense tax credits, and Ontario Tax Reduction. No tax credit amounts are transferred between spouses and numbers are rounded.

Source: Ontario Ministry of Finance.