Introduction

The government is working to make Ontario’s workers the most highly skilled and best supported in the world. By investing in skills training, introducing first-in-Canada protections, and helping businesses attract and retain the best and brightest, Ontario is working for workers to support better jobs and bigger paycheques.

Putting Workers First

Ontario is leading with first-in-Canada changes to make Ontario the best place to live, work and raise a family. Everyone in Ontario, from all backgrounds, deserves a chance to be better off. The government’s plan leaves no one behind and puts workers first.

Launching the Better Jobs Ontario Program

The Second Career program has traditionally helped laid-off unemployed workers access the training they need to become qualified for in-demand, well‑paying jobs. It has also helped connect local employers with the high-skilled workers they need. The government has enhanced the program by improving client experiences, supporting short duration training, increasing funding for wrap-around supports, and prioritizing support for laid-off and unemployed workers in sectors most impacted by COVID-19.

In 2021, the government also announced that it would be providing access to the program for people with limited or non-traditional work experience, including gig workers, newcomers and the self-employed who need training to get a job.

Building on these improvements, the government is relaunching this program as the Better Jobs Ontario program to support a larger, more diverse range of Ontario workers. The Ontario government is also investing $5 million in new funding in 2022–23 in addition to the nearly $200 million invested over the last three years. This additional funding will support the expansion of the program and help improve access for more workers.

Enhancing the Skills Development Fund

The Skills Development Fund, announced in the 2020 Budget, supports innovative, market-driven solutions to address challenges to hiring, training or retaining workers, including apprentices, during the COVID-19 pandemic. Building on the success of the program, Ontario is providing an additional $15.8 million in 2022–23 to support the development and expansion of brick-and-mortar training facilities, which could include union training halls, to help more workers get the skills they need to find good, well-paying jobs and ensure employers can find the talent they need to build and grow their businesses.

Modernizing Skilled Trades and Apprenticeships

We applaud the government’s rapid response to finding innovative ways to accelerate the uptake of workers in the trades.

Adam Auer

President

Cement Association of Canada

Skilled trades workers are vital to Ontario’s future growth and prosperity, so it is more important than ever to break the stigma associated with these jobs, simplify the system and encourage employer participation. It is also important to identify and remove barriers for those who do not often consider the trades, such as women and Indigenous peoples, to encourage their participation in apprenticeship training. This is why the government is investing an additional $114.4 million over three years in its Skilled Trades Strategy.

These investments include:

- $73.8 million over three years for in-class training for apprentices to accommodate an increase in enrolment, assist students with accessibility and accommodation needs and support additional in-demand classes.

- $10 million in 2022–23 to maintain the Infrastructure Talent Accelerator grant, which helps apprentices participating in the in-demand trades train to help build historic infrastructure projects, such as the Ontario Line Subway Project and Scarborough Subway Extension.

- $15 million over three years for the Tools Grant, which provides increased financial support for apprentices completing their apprenticeship program and receiving certification by helping apprentices pay for their tools and equipment.

- $6.3 million over three years for the Achievement Incentive program, which encourages and supports skilled trades employers, including those in group sponsor arrangements, when apprentices meet training and certification milestones.

- $6 million over three years for the Group Sponsorship Grant, which improves apprentice progression and completion by supporting small- to medium-sized employers to come together to train apprentices in the full scope of their trade.

- $3.3 million over three years for the Apprenticeship Capital Grant to provide supports for Training Delivery Agents to meet the evolving needs of the workplace with innovative technology.

Last year, Ontario passed the Building Opportunities in the Skilled Trades Act, 2021, which established Skilled Trades Ontario, a Crown agency created to improve trades training and simplify services.

Advancing the Ontario Workers’ Plan

The Ontario government is committed to creating a comprehensive, long-term Ontario Workers’ Plan to address labour shortages and to train the workers of the future. This plan will include initiatives already underway like the expansion of the Skills Development Fund and the employment transformation project. It will also include new initiatives like real-time labour market data and partnerships with local organizations to develop better programs that match workers with jobs and jobs with workers. Consultations will begin this summer to ensure all sectors of the economy are reflected in the plan.

Expanding College Degree Granting

The Ontario government is providing workers with every opportunity to develop the skills they need to participate in the province’s economic future in fields including battery and electric vehicle manufacturing, as well as help build roads, highways, hospitals and long-term care homes, among other critical infrastructure projects. This is why Ontario is committed to increasing choices and reducing barriers to high-quality, local education for students by expanding the degrees publicly assisted colleges in Ontario can offer.

New, three-year applied degrees and additional four-year degree programs will help build a pipeline of job-ready graduates in applied fields, enhance access to degree-level education in smaller communities and rural areas, and allow students to gain the education, experience and skills to enter the workforce faster.

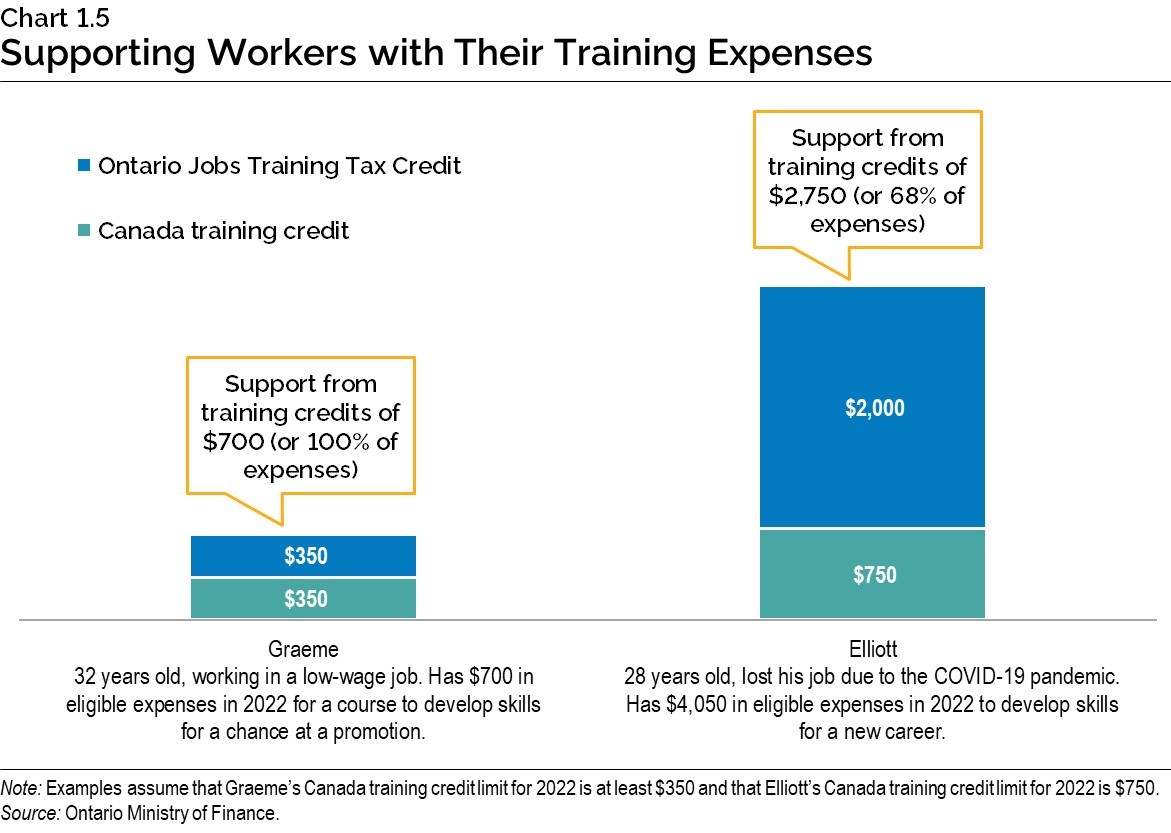

Helping with the Cost of Training through the Ontario Jobs Training Tax Credit

To help offset the cost of training for workers, the government introduced the temporary Ontario Jobs Training Tax Credit for 2021 and 2022.

The credit provides up to $2,000 in relief for 50 per cent of a person’s eligible training expenses for the year, such as tuition at an eligible Canadian institution and fees paid to certain bodies in respect of an occupational examination.

The Ontario Jobs Training Tax Credit will provide an estimated $535 million in support over 2021 and 2022. It is expected to provide support to about 240,000 people in 2022.

For example, as shown in Chart 1.5, Elliott who has $4,050 in eligible expenses in 2022, would receive a maximum credit of $2,000.

Increasing Rapid Retraining to Support Economic Recovery

Every worker in Ontario deserves the opportunity to retrain for a better job. This is why the government is providing an additional $268.5 million over three years in funding through Employment Ontario to strengthen Ontario’s skills training and employment programs, including pandemic recovery initiatives. This funding will address an increase in demand for programming by workers and employers and help more job seekers get guidance, rapid retraining and other assistance to upgrade their skills and find good jobs.

Supporting Workers and the Future of Work

Every worker in Ontario deserves protections, rights and access to opportunities. In the fall, the Ontario government passed the Working for Workers Act, 2021, a series of first-in-Canada

pro-worker legislative and regulatory changes that lead to building a stronger economy by supporting, protecting and attracting workers. The Act:

- Requires employers with 25 or more employees to have a written policy on workers’ right to disconnect from their job at the end of the workday;

- Bans the use of non-compete agreements that prevent workers from exploring other work opportunities;

- Requires recruiters and temporary help agencies to apply for a licence to operate in the province to protect vulnerable employees, including temporary migrant workers, from being exploited; and

- Requires business owners to allow delivery workers to use a company’s washroom if they are delivering or picking up items.

Building on this achievement, the government introduced the Working for Workers Act, 2022. This ground-breaking legislation provides first-in-Canada foundational rights and core protections to workers who offer rides and delivery services through a digital platform, entitle digital platform workers to earn at least the general minimum wage, receive written notice if they are being removed from the platform, and also include pay transparency, regular pay periods and critical information on how the algorithm manages their work. It also protects them from reprisal should they seek to assert their rights.

This legislation includes amendments to the Employment Standards Act, 2000 and Occupational Health and Safety Act to introduce stronger worker protections. The amendments include:

- Expand military reservist leave to cover time spent training and reduce the amount of time they need to hold a job before they have it protected from six to three months;

- Clarify the treatment of many information technology (IT) and business consultants under the Employment Standards Act, 2000 to give them greater opportunities for work;

- Require employers with 25 or more workers to have written policies on electronic monitoring of employees, which would include how, when and why electronic monitoring is taking place;

- Reduce the risk of death caused by opioid overdoses in workplaces by requiring employers with a known risk to provide a naloxone kit and training in workplaces where overdoses are a potential hazard; and

- Introduce the highest fines in Canada for companies that fail to follow workplace health and safety laws that lead to severe worker injury or death.

Taken together, these two Acts will deliver one of the most comprehensive transformations of worker protection in Ontario’s history.

Raising the Minimum Wage

Recognizing that wages for many have not kept up with the rising cost of living, the Ontario government is raising the general minimum wage to $15.50 per hour on October 1, 2022.

As part of the plan to put workers first, the government eliminated the separate, lower wage for bartenders and alcohol servers and is guaranteeing digital platform workers the general minimum wage, something no other province in Canada has done.

Implementing a Target Benefit Pension Plan Framework

Target benefit pension plans, which provide a monthly income stream in retirement, offer an alternative pension plan model, combining features of both the defined benefit and defined contribution pension plan models.

Specified Ontario Multi-Employer Pension Plans, which provide these types of benefits, have been operating under temporary regulations that will expire beginning in 2024 unless replaced by a permanent framework. The government will consult with affected stakeholders on proposed regulations before implementing a permanent target benefit framework in 2023.

A permanent target benefit framework would bring certainty to the sector and pave the way for improved pension coverage as Ontario workplaces will be able to provide employees with lifetime pensions at a more predictable cost for employers.

Enhancing Postsecondary Education and Training for Indigenous Learners

Ontario is committed to helping Indigenous workers develop the skills they need to find good, well‑paying jobs. This is why Ontario is investing $9 million over three years to support the nine Indigenous governed and operated Indigenous Institutes. This includes funding for:

- The Indigenous Institutes operating grant to expand postsecondary program offerings including new, independently delivered programs to train more Indigenous learners. This will promote a greater diversity of programs that meet the economic, health and social needs of Indigenous communities.

- The Indigenous Institutes capital grant to bring equitable access for facility renewal funding. This investment would support capital repairs and renovations to accommodate additional programs and students.

Creating Economic Opportunities for Women

Informed by the work of Ontario’s Task Force on Women and the Economy, the government is taking action to address the challenges women face in the workforce. Building on the commitment in the 2021 Ontario Economic Outlook and Fiscal Review: Build Ontario, the government is providing an additional $6.9 million over three years to enhance the Investing in Women’s Futures program. This funding will ensure that the program can continue to deliver employment training opportunities and wrap-around supports for women facing challenges including abuse, isolation and mental health issues so they can develop the in-demand skills they need to successfully participate in the labour market.

Enhancing the Ontario Immigrant Nominee Program

The government is attracting high-skilled immigrants to fill current labour shortages to strengthen the economy and grow communities by investing $15.1 million over three years in the Ontario Immigrant Nominee Program (OINP), which nominates applicants for permanent residence who have the skills and experience to match the province’s labour market needs. This additional funding will enhance the OINP’s information technology system capabilities, support the anticipated increase in nominations and ensure the program’s long-term sustainability.

Removing Barriers Facing Internationally Trained Workers

Immigrants and newcomers to Ontario deserve the opportunity to use their skills to build better lives for themselves and contribute to the province’s economy. As part of the Working for Workers Act, 2021, the Ontario government is the first in Canada to remove many significant barriers that internationally trained immigrants face when attempting to get licensed in certain regulated professions and trades, such as law, accounting, architecture and plumbing, including:

- The requirement for Canadian work experience for professional registration and licensing;

- Duplicative and costly official language proficiency testing; and

- Long processing times, ensuring the licensing process is completed in a timely manner.

These changes will help alleviate labour shortages and make it easier for internationally trained immigrants to practise their profession or trade. The government is also investing $67 million over three years through the Ontario Bridge Training Program to connect internationally trained immigrants with in-demand jobs in their communities.

Making It Easier to Come to Ontario to Work

To help address labour shortages, the government is making it easier for out-of-province workers in over 30 in-demand professions to move to Ontario with their families for work. Regulated professionals and tradespeople such as engineers, auto mechanics and plumbers can get their credentials processed within a service standard of 30 business days. This is enhancing Ontario’s competitive advantage and driving economic growth by filling vacant in-demand jobs.

In addition, the government is recognizing three fuel-related professions under the province’s skilled trades legislation, meaning Ontario is moving towards officially recognizing all 55 Red Seal trades. To make it easier for apprentices from other provinces to continue their training in Ontario, the government directed Skilled Trades Ontario to harmonize training standards for a dozen trades.

Supporting Frontline Workers

Ontario’s brave police, firefighters and paramedics deserve our respect and gratitude. In fact, everyone who works on the front lines keeping people safe deserves our respect and gratitude. They have always had the people of Ontario’s backs. They can be confident that their government has theirs.

Addressing Mental Health Needs of Public Safety Personnel

Frontline workers in Ontario’s justice system are frequently exposed to work-related trauma that can have damaging long-term effects. Public safety personnel such as police officers, coroners, correctional employees, fire investigators, and emergency health services workers experience unique occupational stressors and suffer from high rates of mental health concerns.

This is why Ontario is investing $45.2 million over three years into programs focusing on early intervention and providing access to specialized mental health services delivered by trauma-informed clinicians. This investment will also be used to create an online provincewide inventory of regional mental health programs to help public safety personnel get the services and supports they need when and where they need them.

Additionally, the government is investing $3.2 million over three years to establish a Mental Health Support Unit to provide confidential counselling services, mental health tools and training programs for frontline court staff.

These measures are part of the government’s efforts to support frontline workers and public safety personnel as they carry out their critical duties for the people of Ontario.

Supporting Ontario’s First Responders

Emergency health first responders have provided vital services during the COVID-19 pandemic. In addition to taking 911 calls, paramedics have supported public health efforts by distributing and administering vaccines to vulnerable populations. To further support first responders, the government is investing $56.8 million in 2022–23 to increase capacity in emergency health services in communities across Ontario.

Ontario Spirit: Promoting Volunteerism in Ontario

The people of Ontario showed their spirit and resilience throughout the COVID-19 pandemic as they went above and beyond to support their communities and help one another. This is why the government is investing an additional $2 million over two years to support the province’s emergency volunteer program. This program harnesses the “Ontario Spirit” to promote volunteerism and enhance the capacity of communities to respond to emergencies.

Chart Descriptions

Chart 1.5: Supporting Workers with Their Training Expenses

The chart provides examples of savings in 2022 from the Canada training credit and the proposed 2022 extension of the Ontario Jobs Training Tax Credit.

In the first example (on the left), Graeme is a 32-year-old working a low-wage job. Graeme has $700 in eligible expenses for a course to develop skills for a chance at a promotion. Out of the $700 in expenses, Graeme will receive $350 back through the Canada training credit and will receive $350 from the Ontario Jobs Training Tax Credit. In total, Graeme will receive $700 in support from the two training credits, or 100 per cent of his eligible expenses. This example assumes that Graeme has a Canada training credit limit for 2022 of at least $350.

In the second example (on the right), Elliott is a 28-year-old who lost his job due to the COVID-19 pandemic. Elliott has $4,050 in eligible expenses in 2022 to develop skills for a new career. Out of the $4,050 in expenses, Elliott will receive $750 back through the Canada training credit (the maximum amount available for 2022) and will receive $2,000 from the Ontario Jobs Training Tax Credit (the maximum amount that would be available for 2022). In total, Elliott will receive $2,750 in support from the two training credits or 68 per cent of his eligible expenses. This example assumes that Elliott has a Canada training credit limit for 2022 of $750.

Source: Ontario Ministry of Finance.