Introduction

Every day, Ontario is getting stronger. Critical minerals in the North, including from the Ring of Fire, will become part of the future of clean steel, batteries, and hybrid and electric vehicles as the next generation of automobiles are built in Ontario, by Ontario workers, and sold across North America. Small businesses and entrepreneurs will have the support they need to realize their dreams. The government’s plan will help bring better jobs and higher wages for the people of Ontario.

Seizing Ontario’s Critical Minerals Opportunities

The next chapter in the story of Ontario’s prosperity begins in the North. Ontario’s vast and varied geology provides tremendous opportunities for critical minerals exploration and development. Critical minerals are key components of innovative technologies for high-growth sectors such as batteries, electronics, electric vehicles (EVs) and cleantech.

Advancing the Critical Minerals Strategy

In March 2022, the government released its first-ever Critical Minerals Strategy. Since Ontario announced the development of the strategy in the 2021 Budget, stakeholders have provided feedback on how Ontario can build more integrated supply chains, and enhance investment in mineral exploration and development, as well as support partnership opportunities with Indigenous peoples.

Ontario’s Critical Minerals Strategy is a five-year road map that will help strengthen Ontario’s position as a global leader in supplying critical minerals. The strategy focuses on priorities that will support better supply chain connections between industries, resources and workers in Northern Ontario and manufacturing in the South, including Ontario-based EV and battery manufacturing. Ontario’s supply of critical minerals, processing capabilities and proximity to North American manufacturing hubs makes the province an ideal location for mineral exploration, mining and investment.

These roads will help bring critical minerals to the manufacturing hubs in the South, which will bring prosperity to Ontario’s North.

The Honourable Peter Bethlenfalvy

Ontario’s Minister of Finance

Building the Corridor to Prosperity: Ring of Fire

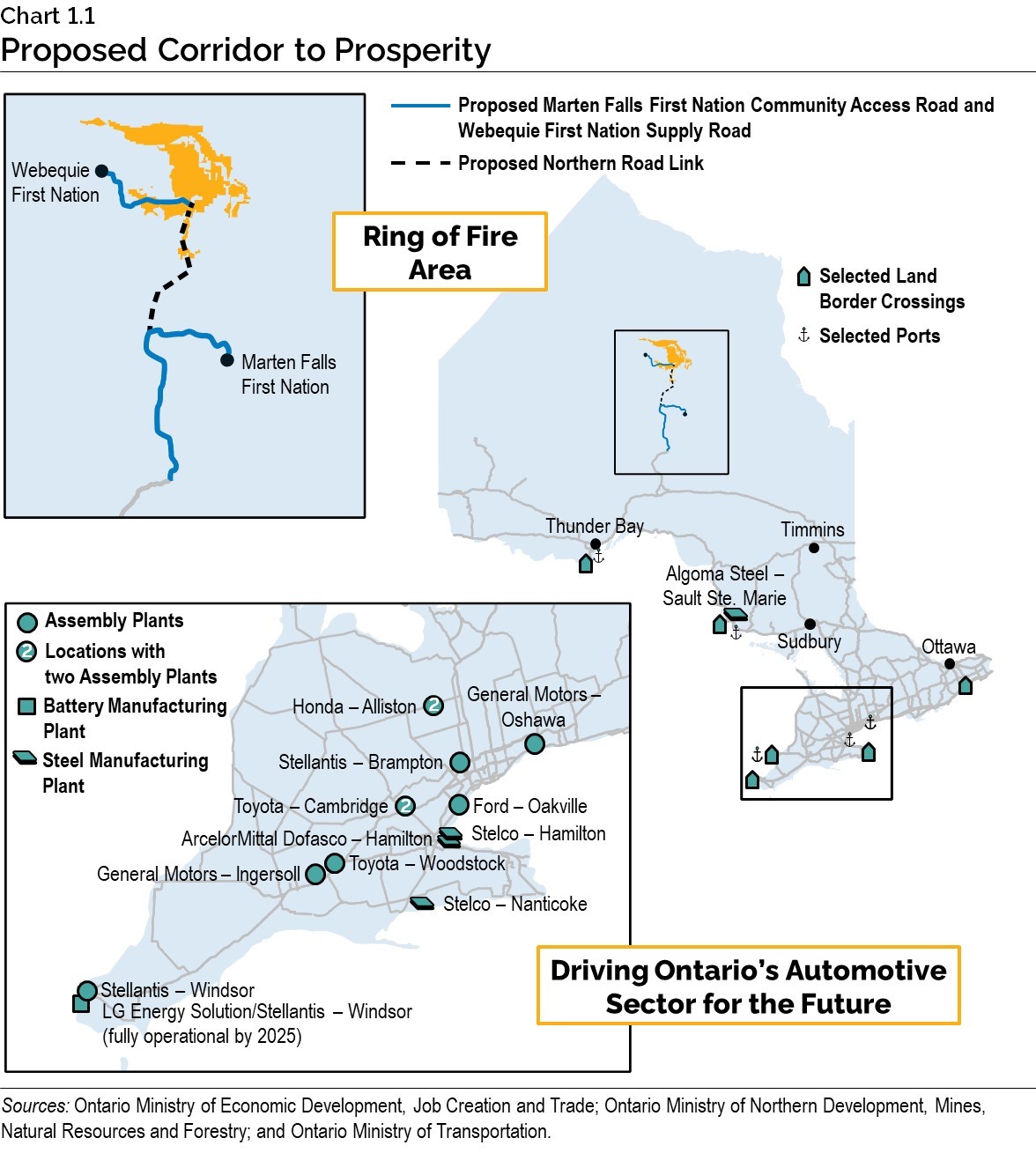

The Ring of Fire is one of the most promising mineral deposits in the world and will play a key role in Ontario’s future economic prosperity. It will create jobs, unlock critical minerals and bring multigenerational opportunities to Northern and First Nation communities. All-season, dependable road access is a prerequisite to unlocking opportunity in the region. These roads will help bring critical minerals to the manufacturing hubs in the South, which will bring prosperity to Ontario’s North, including First Nation communities, improving access to education, health care, goods and services, and housing.

Ontario has committed close to $1 billion to support critical legacy infrastructure such as all-season roads to the Ring of Fire. To support the construction of all-season roads, the government approved the provincial Terms of Reference for the Environmental Assessment for the proposed Marten Falls First Nation Community Access Road and Webequie First Nation Supply Road projects in October 2021. In addition, in April 2022, Marten Falls First Nation and Webequie First Nation announced that they will be submitting a Terms of Reference for the proposed Northern Road Link Environmental Assessment. The proposed road is the final piece of critical road infrastructure needed to ensure reliable, all-season road access to potential mining sites in the Ring of Fire and connect both First Nation communities to Ontario’s highway network. The provincial government will continue to work with the federal government to coordinate the impact assessment requirements for these projects.

Geopolitical forces are fueling a surging demand for reliable and responsibly sourced critical minerals, making this a strategic imperative for Canada. The Ring of Fire will bring significant economic, social and community benefits to the entire nation, and this historic project needs a full federal partner. This is why Ontario will continue to call on the Government of Canada to step up and match Ontario’s funding commitments to getting the road to the Ring of Fire built.

Enhancing the Ontario Junior Exploration Program and Establishing the Critical Minerals Innovation Fund

Enhancing the Ontario Junior Exploration Program

Junior mining companies will play an important role in unlocking Ontario’s critical minerals opportunity. This is why, in the 2021 Budget, the government announced the Ontario Junior Exploration Program (OJEP) to cover eligible costs of up to $200,000 for mineral exploration and development. To continue supporting this historic opportunity, the government is investing $12 million to extend the OJEP for an additional two years, attracting further investment and creating opportunities and jobs in this growing sector.

Ontario is also creating a Critical Minerals Stream for the OJEP by investing an additional $4 million per year for the next three years. The new stream will help ensure that funding from the OJEP supports critical minerals projects, in addition to those focused on precious metals. It will also provide critical mineral explorers with more opportunities to discover minerals that support electric vehicles and advanced manufacturing.

Investing in Critical Minerals Innovation

The government is investing $2 million in 2022–23 and $3 million in 2023–24 to create a Critical Minerals Innovation Fund. This initiative will help the mining industry, academia, startups, and research and development firms collaborate to develop new, innovative ways to extract and process critical minerals. The fund will support organizations pursuing innovative projects that create jobs, develop new technologies and attract private-sector investments, further strengthening the manufacturing supply chain and make Ontario a leader in battery technology, electric and hybrid vehicles, as well as advanced manufacturing.

Powering Ontario’s Economy

The government is taking action to build on the province’s clean energy advantage to power Ontario’s growing economy. Global companies are looking to invest in jurisdictions with affordable, reliable and clean energy. This is why the government has released Ontario’s Low-Carbon Hydrogen Strategy, proposed the creation of a clean energy credit registry, supported Small Modular Reactors (SMRs), and is accelerating electricity transmission projects in Southwestern Ontario. The government has a plan to power Ontario for the future.

Ontario’s Energy Transition and Electrification

Supporting Growth in Ontario’s Hydrogen Sector

The government is leveraging the province’s strengths, such as clean electricity, to develop a low-carbon hydrogen economy in Ontario that will create jobs, attract investment and reduce greenhouse gas emissions. In April 2022, the Ontario government released its Low-Carbon Hydrogen Strategy to ensure the province’s clean technology and hydrogen sectors continue to grow and contribute to a prosperous green future for the province.

As part of the hydrogen strategy, the government is supporting a proposal from Atura Power, an Ontario Power Generation (OPG) subsidiary, for the province’s largest low-carbon hydrogen production facility, in Niagara Falls, through a 10-year regulatory exemption to the Gross Revenue Charge for electricity generated at OPG’s Sir Adam Beck 2 Generating Station used specifically for hydrogen production.

Creating a Clean Energy Registry

The Ontario government is leveraging its world-class clean electricity grid by developing a voluntary clean energy credit (CEC) registry to boost Ontario’s international competitiveness and attract jobs. The government has directed the Independent Electricity System Operator (IESO) to consult and report back by July 4, 2022, on the design of a provincial CEC registry that would provide businesses more choice in how they achieve their corporate sustainability goals. Voluntary CECs would represent clean electricity that has been generated from a non-emitting source, such as solar, wind, bioenergy, as well as hydroelectric and nuclear power. A CEC registry would return funds raised through the purchase of CECs to Ontario ratepayers and support future clean energy generation in the province.

Supporting Economic Growth in Southwestern Ontario through Better Electricity Transmission Infrastructure

With new investments in electric vehicles and battery manufacturing bringing jobs and opportunity to Southwestern Ontario, the government is accelerating the development of five transmission line projects.

In April 2022, Ontario prioritized Hydro One’s work to build transmission lines to address growing electricity demand in the region, driven by growth in the electric vehicle, battery manufacturing and greenhouse sectors. These new transmission lines will supply more clean electricity to the region, create jobs and partnerships for Indigenous communities, and further support economic growth in this part of the province. The transmission projects between London, Windsor and Sarnia represent an investment of more than $1 billion and are proposed to be developed in phases through 2030.

Building Ontario’s Nuclear Advantage

When it comes to clean energy, Ontario leads by example. First, it eliminated coal-fired electricity generating stations, which stands as the single largest emissions reduction action in North American history. Today, Ontario is at the cutting edge of new nuclear development and countries around the world are watching. For example, in November 2021, Bruce Power reached a historic milestone, by issuing the first Green Bond globally for nuclear power, helping to further Ontario’s and Canada’s position as a world leader in clean energy.

Ontario will also be home to Canada’s first grid-scale Small Modular Reactor (SMR), with a made-in-Ontario SMR set to be deployed, subject to appropriate approvals, at Ontario Power Generation’s Darlington site as early as 2028. The project will help Ontario enhance a clean, affordable and reliable electricity grid and support good-paying jobs in the nuclear sector for decades to come. It will also help pave the way for Ontario businesses to export this technology to other provinces and countries, helping them to reduce dependence on fossil fuels and decarbonize their electricity grids.

Selling Ontario Made Products to the World

Ontario’s manufacturing sector is a key contributor to the economic success of the province. The sector employed over 776,000 people in 2021 and generated $78.4 billion in real GDP in 2020.

However, Ontario’s manufacturing sector experienced a 30.5 per cent decline in employment from the sector’s peak in 2004 until 2018. Over this period, the competitiveness of the sector was negatively impacted by the high cost of doing business, gaps in skills training programs and a lack of business investment.

From electric and hybrid vehicles to barbecues, the government is supporting the development of home-grown supply chains, creating the next generation of products and returning Ontario to its rightful place as the workshop of Canada. Through these efforts, products made in Ontario, by Ontario workers, will be shipped across North America and the world.

Producing Clean Steel in Ontario

Low-carbon steel production has become critical for jurisdictions to compete for manufacturing investments as businesses look to reduce greenhouse gas emissions in their supply chain. These investments support the creation of new jobs and economic growth as steel producers, automakers and other industries transform their operations.

In February 2022, Ontario announced it would contribute up to $500 million in support for ArcelorMittal Dofasco’s $1.8 billion investment in Hamilton to replace its coal-fed coke ovens and blast furnaces with new, low-emission technology. The project will move the facility to a hydrogen-ready direct reduced iron fed electric arc furnace, targeted for completion by 2028, to support the livelihoods of 4,600 people working at the facility. ArcelorMittal Dofasco’s investment will also significantly lower the carbon footprint of the facility and reduce carbon dioxide (CO2) emissions by about three million tonnes annually.

In addition, in November 2021, Algoma Steel announced a $700 million investment in an all-new, low-emission electric arc furnace. This investment will help lay the foundation for long-term competitiveness, economic prosperity, and new, well-paying jobs in Sault Ste. Marie and across all of Northern Ontario. Ontario’s revitalized Northern Energy Advantage Program and its new investor-class stream provide the energy rate certainty that Algoma Steel needs to move ahead with this project and secure the jobs of the future.

These investments will support Ontario’s low-carbon steel transformation and help make the province a world-leading producer of low-emission steel. This includes building the vehicles of the future as well as the technology, transit, hospitals, schools and community infrastructure that are vital for the province’s future prosperity and growth. Moving towards clean steel will also significantly reduce the province’s greenhouse gas emissions, helping Ontario achieve its target of reducing emissions by 30 per cent by 2030.

Building Ontario Made Electric Vehicles

Critical minerals in the North will drive electric vehicle (EV) manufacturing in the South, where Ontario’s automotive sector is poised for resurgence as the industry continues its large-scale transformation. The government’s plan will help Ontario become a North American leader in building the vehicles of the future.

Shifting into Phase 2 of Driving Prosperity

In November 2021, Ontario announced Phase 2 of Driving Prosperity: The Future of Ontario’s Automotive Sector, the government’s plan to build the next generation of vehicles in Ontario by securing auto production mandates to build electric and hybrid vehicles. The government will also help transform the supply chain by supporting the exploration, mining and production of critical minerals to create a domestic battery ecosystem and encourage research and development.

Attracting Game-Changing Auto Sector Investments

Manufacturing employment in the province peaked in 2004 and declined significantly by 2018. The Ontario government is taking action to bring back manufacturing that will create jobs and support families and communities across Ontario.

The auto industry has responded to Ontario’s plan to help transform and grow the auto sector, lower taxes, reduce electricity costs and cut red tape. Over the past 18 months, the automotive sector in Ontario has seen more than $12 billion in investments for new vehicle production mandates and battery manufacturing. These investments include:

- Over $5 billion for a joint investment between LG Energy Solution and Stellantis to build the province’s first large-scale EV battery manufacturing plant in Windsor, supported by Ontario, along with municipal and federal governments.

- $1.8 billion in commitments from Ford to produce battery EVs and five new EV models at its Oakville assembly complex, with the Ontario government providing $295 million in support and the federal government making a matching contribution.

- More than $2 billion by General Motors to transform the company’s Oshawa and Ingersoll manufacturing facilities to deliver the company’s next generation of vehicles, including new all-electric commercial vehicles, with the Ontario government providing up to $259 million in grant support and the Government of Canada making a matching contribution.

- $1.5 billion in commitments from Stellantis to upgrade its assembly plant in Windsor to build new electrified vehicles.

- Almost $1.4 billion from Honda to upgrade and retool its plants in Alliston and begin manufacturing hybrid models, with the Ontario government providing $131.6 million in grant support and the Government of Canada making a matching contribution.

As of early April 2022, almost $11 billion of these investments are in transformative hybrid and electric vehicle production and battery manufacturing in Ontario.

This represents an important milestone for Honda as we move forward in our ambitious vision to make battery electric vehicles represent 100 per cent of our North America vehicle sales by 2040. Honda of Canada Mfg. (HCM) is home to a team of remarkably talented associates who build some of Honda’s most popular and fuel-efficient products. This investment not only ensures our product and manufacturing competitiveness within Ontario, Canada and abroad, but also significantly bolsters our ongoing efforts to reduce greenhouse gas emissions to help Canada attain its overall climate targets.

Jean Marc Leclerc

President and CEO

Honda Canada Inc.

Building Batteries in Ontario

Developing Ontario’s battery cell production capacity is critical to the creation of a new, high-value supply chain of lithium-ion batteries to support EV production in automotive assembly plants in the province. This is why the government continues to make key investments in the battery supply chain to drive innovation and create jobs.

We are securing the future for thousands more local workers and securing Windsor’s strategic location as the home of Canada’s electric vehicle future. As the world pivots to EVs, Windsor will soon be home to the battery manufacturing facility that powers it all.

Drew Dilkens

Mayor

City of Windsor

In March 2022, the Ontario government announced its support, along with municipal and federal governments, for a joint investment between LG Energy Solution and Stellantis of over $5 billion to build the province’s first large-scale EV battery manufacturing plant in Windsor. This investment represents the largest automotive manufacturing investment in the history of the province and puts Ontario on the path to becoming one of the most vertically integrated automotive jurisdictions in the emerging North American EV market. The battery facility will be fully operational by 2025 and will employ an estimated 2,500 people to supply Stellantis plants in the North American market.

In February 2022, Ontario invested $1.5 million through the Regional Development Program to support an $18.5 million investment by auto parts manufacturer Ventra Group to create the Flex-Ion Battery Innovation Centre in Windsor. Also, in February, the government invested $250,000 to support the development of two new battery production lines at the Electra Battery Materials Corporation’s future Battery Materials Park near Cobalt. These two new production lines would be the first of their kind in Ontario, meeting the demand for batteries that support the EV supply chain in North America.

Building Transportation Electrification Infrastructure

The Ontario government is providing $91 million to help make electric vehicle (EV) chargers more accessible to the public across the province. The funding will add more EV chargers across Ontario, including highway rest stops and in community hubs like hockey arenas, carpool lots, and provincial and municipal parks. The government will also introduce the Rural Connectivity Fund to support the installation of EV chargers in rural communities.

The investment in new public charging stations, along with the government’s programs to reduce electricity prices, will support the uptake of electric vehicles and further strengthen Ontario’s auto industry, as cars of the future are built here in Ontario.

The government has also asked the Ontario Energy Board to provide options for implementing a new ultra low overnight time of use price plan. This new ultra low rate could help support electric vehicle adoption.

Defending the Auto Sector from Protectionism

For over 50 years, the shared supply chain between Ontario and America’s Great Lakes states has created jobs and supported families on both sides of the border. Currently, the United States is considering protectionist measures that would threaten the strong supply chain and impact automotive trade under the Canada-United States-Mexico Agreement (CUSMA). In December 2021, the Ontario government announced the creation of the Premier’s Council on U.S. Trade and Industry Competitiveness. The Council is providing advice and recommendations to protect Ontario’s rights under trade agreements and the workers who depend on them. The Council is also engaging industry partners across the United States, particularly in Great Lakes states where existing supply chains are integrated with Ontario industries.

Supporting Advanced Manufacturing

The government has a plan for the province’s future prosperity to be made in Ontario by ensuring the economy is built on a strong and vibrant manufacturing base that focuses on globally competitive, domestic production. For example, Ontario’s business community, including advanced manufacturers, has played a critical role in the COVID-19 pandemic by producing medical supplies and personal protective equipment (PPE) for Ontario’s health care professionals and other frontline workers.

Over the last four years, steps taken by Ontario have helped plot a new trajectory for long-term growth in manufacturing. These steps include increasing competitiveness, encouraging investment and supporting skills development. However, emerging trends like automation, digitization, the shift to carbon-neutral products and international supply chain disruptions have forced Ontario’s manufacturers to retool and reimagine their production lines and capacity.

This is a “call to action” for Ontario. This is why the government will work collaboratively with the manufacturing industry to develop an Advanced Manufacturing Strategy. This strategy will ensure the province’s manufacturers remain globally competitive and that domestic production remains strong and vibrant now and into the future.

Ontario will create an Advanced Manufacturing Council to help inform the strategy. The Council will engage industry, regional, government and academic experts on a range of key themes impacting manufacturers to help provide input into the development of the Advanced Manufacturing Strategy.

Developing Investment-Ready Land

To compete for global investment opportunities, the government is working with municipalities and businesses to support the necessary assembly and infrastructure work to develop shovel-ready investment land. This includes mega sites that can support large-scale manufacturing operations. While Ontario is ahead of the curve among Canadian jurisdictions, the province’s current inventory of mega sites lags behind key competitors in the United States. Ontario’s Job Site Challenge, launched in 2019, was designed to close this critical gap in investment-ready land by proactively identifying potential mega sites in the province.

In addition, in October 2021, the Ontario government launched the Site Readiness Program, which provides financial assistance to help municipalities and land owners complete site preparatory work for an eligible industrial property. This important work is supported by the Investment Ready: Certified Site Program, which provides provincial certification and marketing support to help attract potential investors to industrial sites once certain due diligence has been completed. To increase awareness of these programs, the government will launch an initiative to showcase investment-ready land in the province.

Forging a Stronger Supply Chain

Advancing the Ontario Public Sector Supply Chain Strategy

In November 2020, the government announced the creation of Supply Ontario, a new centralized procurement agency that will leverage $29 billion in government buying power to better protect the people of Ontario, create jobs, unlock savings and create opportunities for small business and local companies.

Supply Ontario is building the public sector’s supply chain that works together as one, demonstrates and uses modern supply chain capabilities, and creates better outcomes for Ontario. This will ensure the people of Ontario are getting the greatest value by leveraging the buying power of the entire province, strengthening the province’s resilience by ensuring reliable access to critical products, and supporting economic development and innovation across the province.

Standing Up for Small Businesses and Supporting Entrepreneurship

Ontario’s small businesses are an important part of Ontario’s economy, employing more than two million people in communities across the province. The COVID-19 pandemic has impacted small businesses significantly, and they continue to face unique challenges in accessing capital, talent and markets. Small business owners are resilient and hard-working, with big dreams and bold ambitions. The Ontario government is committed to helping the province’s entrepreneurs recover and thrive.

Harnessing Ontario’s Entrepreneurial Spirit

Behind every small business is an entrepreneur with ambition and determination, enriching the lives and livelihoods of families and communities across Ontario.

The government will create an Entrepreneurship Council to focus on a range of key themes that will support the development of a dedicated Entrepreneurship Strategy. The new Entrepreneurship Council will include leaders from across diverse sectors to advise on the issues facing Ontario entrepreneurs and small businesses, and actions needed to set them up for success.

Ontario’s Entrepreneurship Strategy will set out a bold vision to harness Ontario’s entrepreneurial spirit by positioning the province as the fastest and easiest jurisdiction to start up and scale up a business. The strategy will also be supported by key initiatives, including:

- Recruiting 100 international entrepreneurs to start or grow businesses in regions outside of the Greater Toronto Area through the entrepreneur stream of the Ontario Immigrant Nominee Program;

- Expanding access to startup and growth capital through the proposed Venture Ontario, currently known as Ontario Capital Growth Corporation, the province’s venture capital agency;

- Accelerating the development of new products and services by improving access to provincial procurement opportunities through measures such as the Building Ontario Businesses Initiative;

- Increasing access to markets for small businesses by addressing logistical and competition challenges; and

- Supporting digital literacy and technology adoption through the new Digitization Competence Centre.

By showcasing Ontario’s various business supports and programs, the government is working to ensure that entrepreneurs have what they need to seed, start and scale up their businesses quickly and efficiently.

For more details on the Digitization Competence Centre and the proposed Venture Ontario, see theEnhancing Digital Competence and the Growing Ontario’s Venture Capital Sector sections within this chapter.

Supporting Immigrant Entrepreneurs

The government is attracting 100 international entrepreneurs to start or grow businesses in regions outside of the Greater Toronto Area (GTA) through the Entrepreneur Stream of the Ontario Immigrant Nominee Program. Through this two-year project, international entrepreneurs will be able to purchase or start new companies, hire local workers and drive economic growth in their new communities. This initiative will create more local jobs in a variety of sectors including information technology (IT), life sciences and tourism while bringing new investments to cities and towns that have been hit hard by COVID-19 pandemic job losses.

Supporting Futurpreneur Canada

Small entrepreneurial firms are an important source of innovation, jobs and economic growth for Ontario. The government is investing $2 million in 2022–23 for Futurpreneur Canada to give entrepreneurs the tools required to pursue business ownership and grow into successful companies. Futurpreneur Canada provides mentorship services and collateral-free loan capital to young entrepreneurs at an important stage of business development. The additional investment builds on the $1 million of funding provided to Futurpreneur Canada through the 2021 Ontario Economic Outlook and Fiscal Review: Build Ontario. This support will also increase the focus on underrepresented demographic groups, helping to overcome some of the unique economic barriers facing youth, women, as well as racialized and Indigenous entrepreneurs.

Transforming Business with the Digital Main Street Program

During the COVID-19 pandemic, many of Ontario’s small businesses had to find alternative ways of doing business, such as online platforms and digital sales. The government has helped small businesses reach more customers through the Digital Main Street program, which provides grants for the implementation of digital strategies, offers technical training for workers to reach more customers in person and online, and helps businesses open online stores with support from the ShopHERE program. The government enhanced the Digital Main Street program in fall 2021, investing $40 million over 2022–23 and 2023–24 to further help Ontario’s businesses increase their digital presence.

Enhancing Digital Competence

In fall 2021, the government announced an investment of $10 million over 2022–23 and 2023–24 to create a new Digitization Competence Centre. Its purpose is to provide small businesses with the training and support to use new equipment and processes, helping them understand and adopt digital technologies. This is in collaboration with the Ontario Centre of Innovation and will begin in 2022.

Building Procurement Opportunities for Small Business

The Ontario government is continuing to strengthen the province’s supply chain security and economic growth through the Building Ontario Businesses Initiative (BOBI). This initiative will reduce barriers and provide companies in Ontario with greater access to public procurement opportunities, helping them sell more goods and services as well as create jobs in their local communities. BOBI will also strengthen Ontario’s supply chain resiliency.

As part of BOBI, the Legislature passed the Building Ontario Businesses Initiative Act, 2022, which mandates public-sector entities to give Ontario businesses preference when conducting procurement for goods and services under a specified threshold amount. This legislative change will see the government targeting to spend at least $3 billion in contracts awarded to Ontario businesses annually by 2026, creating additional economic opportunity for the people of Ontario.

As part of Supply Ontario’s procurement strategy, it will implement initiatives to make it easier for Ontario’s entrepreneurs to sell their innovative products in Ontario.

Creating a Simplified Path for Business to Grow

It should be simple and straightforward to start, grow and manage a business in Ontario.

A single window for business will make it easier for businesses to navigate to relevant business information, including information tailored by industry, all in one place. The single window for business will introduce service standard guarantees so businesses can track the information they need from the government.

This is just one of the many actions the government is taking to help businesses thrive and grow.

Helping Innovators Protect and Commercialize their Intellectual Property

Ontario has a world-class postsecondary education system and is home to many innovative startups and scale-up firms. However, the province’s postsecondary institutions, businesses and innovators often lack the resources to harness the value of their intellectual property (IP). Between 2017 and 2019, only 17 per cent of Ontario businesses reported owning IP. This is why, in March 2022, the government announced the creation of Intellectual Property Ontario, which is being supported by an investment of about $58 million over three years.

The new agency will serve as a go-to resource for IP expertise to help postsecondary institutions, researchers and companies maximize the value of their IP and strengthen their capacity to grow and compete in the global market. For example, Intellectual Property Ontario will offer strategic advisory services to help clients develop effective IP strategies. The agency will also provide legal solutions to clients to support the protection of their IP. Intellectual Property Ontario will help local innovators, researchers and organizations capitalize on their IP while helping to keep the economic and commercial benefits right here in Ontario.

Accelerating Ontario’s Economy through Critical Technologies

New technologies are revolutionizing how businesses deliver products and services. The development and adoption of these technologies will help boost Ontario’s advanced manufacturing and technology ecosystem by creating new opportunities for commercialization, preparing businesses for the future and increasing productivity.

The Ontario government is investing nearly $107 million over the next three years in new critical technology initiatives to support access to and the commercialization of these technologies. These initiatives will help Ontario grow and compete with jurisdictions in a global race to develop and own critical technologies.

Building Prosperity Everywhere, for Everyone

For too long, employment growth and opportunities have been concentrated in Ontario’s largest metropolitan areas. Too many regions have not shared in the prosperity of the province. Every small city, town and village in Ontario has something to offer, and the Ontario government has a plan to help deliver prosperity everywhere, for everyone.

Bringing Jobs to Local Communities

Through the Community Jobs Initiative, the government is working to bring jobs at provincial agencies to communities across Ontario to help spur economic growth. This begins with exploring the relocation of the headquarters of the Workplace Safety and Insurance Board (WSIB) to London, working in close partnership with the agency and other partners, and identifying main street communities to headquarter new government agencies. The government will explore the location for new agencies, including Supply Ontario, Invest Ontario and Intellectual Property Ontario to help ensure opportunities for all the people of Ontario.

Centralizing government organizations in one place misses the opportunity that these jobs can bring to different communities. Through this initiative, the provincial government can reduce costly third-party leases, make better use of its buildings and unlock the potential of smaller communities to help grow regional economic opportunities across the province.

The government is committed to working closely with ministries, agencies and stakeholders this year to ensure this initiative is managed thoughtfully, supported by government directives, and with respect and proper regard for regional economic impacts. This is why each provincial agency under this initiative will be assessed on a case-by-case basis to consider the best opportunities for potential implementation.

Maximizing Investments in Government Office Locations

The provincial government has one of the largest and most complex real estate portfolios in Canada, including everything from offices to courthouses to schools. Recognizing the unique needs of each community, the government can help public-sector organizations work together to use property for what communities need the most. This may include using public-sector real estate and other spending to stimulate local economies or moving out of expensive leased office space.

This is why the government is moving forward with an Office Optimization Strategy as an enterprise-wide approach to space planning and delivery, to unlock and increase the value of real estate assets across the province. Office Optimization has already begun in Toronto and Sudbury and will soon begin in London.

Creating Ontario Public Service Regional Hubs

As part of the government’s plan to continue to distribute jobs and work across the province, allowing people to live and work in their communities, the Ontario Public Service (OPS) will examine how best to design hybrid workplace environments that help reduce transportation congestion, contribute to environmental conservation and reduce future real estate costs while also maintaining excellence in the delivery of services.

To further enable people to live and work in their communities, the OPS is designing, testing and implementing touchdown coworking spaces for workers in North York, Hamilton, London, Sudbury and Ottawa, and will look to expand this to other regional locations to support the future of work as needed.

These are important elements in the design of hybrid workplaces that will help to attract the best and the brightest talent, while also demonstrating to the public the ability for government to improve and advance the delivery of services and productivity. Providing functional workspaces in multiple communities increases accessibility and flexibility for OPS employees while also maintaining excellence in service delivery.

Encouraging Growth through the Regional Opportunities Investment Tax Credit

The Regional Opportunities Investment Tax Credit was introduced in March 2020 to help lower costs for businesses seeking to expand and grow in areas of the province where employment growth in the past was slower than the provincial average. This tax credit supports corporations that build, renovate or purchase eligible commercial or industrial buildings in qualifying areas of Ontario.

In the 2021 Budget, the government temporarily doubled the tax credit rate from 10 per cent to 20 per cent until the end of 2022 to provide additional support to businesses looking to re-open or transition their operations due to disruptions from the COVID-19 pandemic. This enhancement increased the available tax credit support for regional investment from a maximum of $45,000 to a maximum of $90,000 in a year.

The government is proposing to extend the temporary enhancement to the Regional Opportunities Investment Tax Credit to the end of 2023, giving businesses more time to make use of the enhanced support. By extending the time-limited enhancement to the Regional Opportunities Investment Tax Credit until the end of 2023, Ontario would be investing an additional $40 million, resulting in total estimated tax credit support of over $280 million from 2020–21 to 2024–25.

See Annex: Details of Tax Measures and Other Legislative Initiatives for further information.

Attracting Investment Across Ontario’s Regions

It is critical to position Ontario as a top-tier destination for investment to create more jobs and opportunities for Ontario workers. In July 2020, the government established Invest Ontario, an agency focused on promoting the province as a key investment destination and to transform the provincial approach to business attraction to support high-value job creation and help drive economic growth.

A part of Invest Ontario’s focus will be a “Team Ontario” approach to attract strategic and transformative investments throughout the province. Invest Ontario will provide investors with timely access to a suite of customized tools and services in cooperation with regional economic development organizations and other levels of government. Over the next year, Invest Ontario will engage municipalities, local, regional and federal agencies, the private sector, higher education as well as industry for a coordinated, all-of-Ontario approach to investment attraction. As the province’s economy recovers, this approach will ensure that Ontario’s competitive advantages and unique regional strengths position it as a key investment destination.

Investing in Regional Economic Development

Ontario’s economic prosperity is also rooted in the strength of its regional economies. In 2019, the Regional Development Program was launched with the Eastern Ontario Development Fund and the Southwestern Ontario Development Fund supporting business growth in their respective regions. The program also provides eligible businesses and organizations with access to a broad range of complementary services and supports from across government. These include advisory services, assistance with environmental compliance approvals, as well as support in accessing skills and talent and information on tax credits or land use planning.

To continue to support regional development across the province, in January 2022, the government of Ontario launched the $40 million Advanced Manufacturing and Innovation Competitiveness Stream, under the Regional Development Program. This provincewide stream provides complementary services and funding to companies to invest in the equipment, advanced technologies and skilled workforce needed to improve competitiveness, productivity and growth.

Bringing High-Speed Internet Access to Every Community

This partnership with the government of Ontario will not only achieve the province’s goal of connecting everyone, regardless of where they live, to affordable high-speed Internet, but also positions Ontario at the forefront of the highly strategic New Space Economy through Telesat’s local investments in jobs and technology innovations.

Dan Goldberg

President and CEO

Telesat

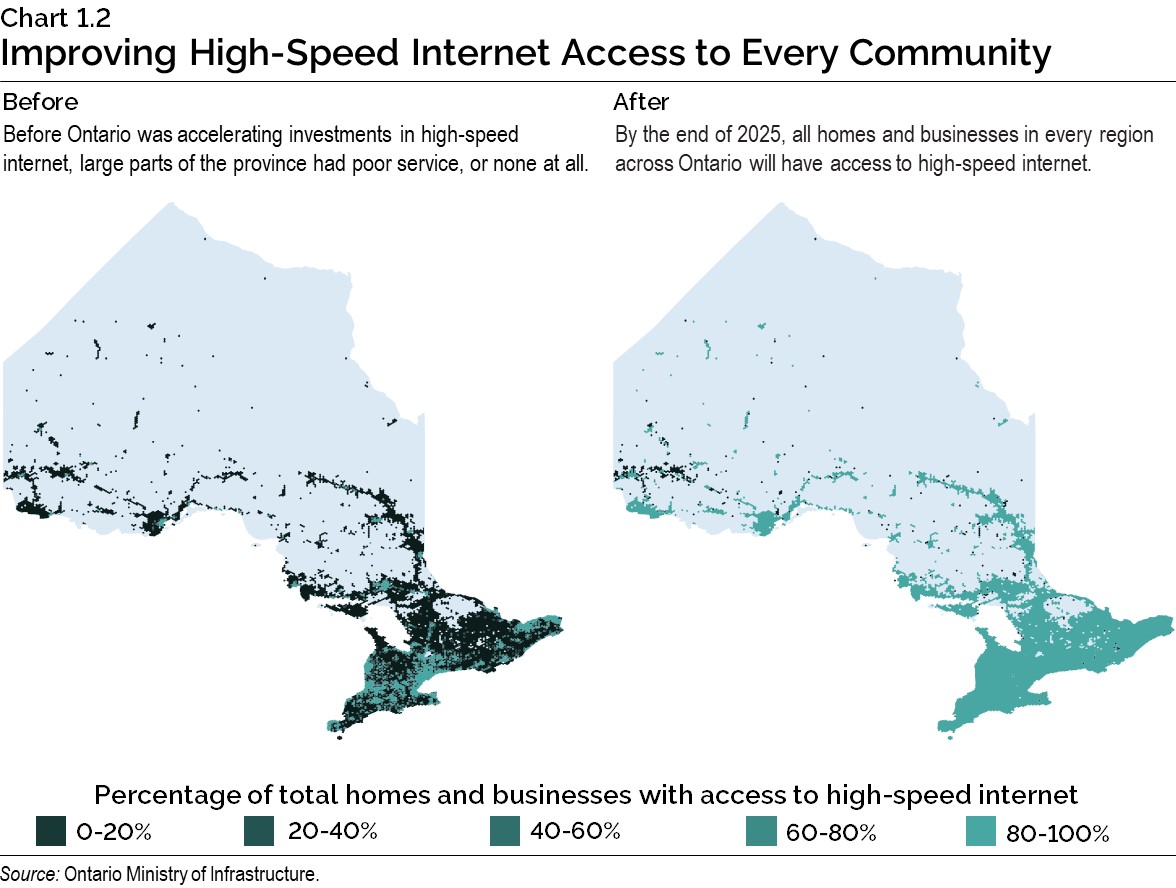

Access to high-speed internet in communities across Ontario will bring new economic opportunities, create jobs and improve quality of life for families, workers and communities. This is why, in the 2021 Budget, the government increased its overall investment in broadband to nearly $4 billion beginning in 2019–20 to ensure every community in Ontario has access to high-speed internet by the end of 2025.

Prior to the COVID-19 pandemic, as many as 700,000 households and businesses in Ontario lacked access to reliable high-speed internet. Through shovel-ready projects and new investments, the government continues to maximize each provincial dollar to ensure unserved and underserved communities are connected more quickly.

Initiatives are underway to provide better internet access to homes and businesses across Ontario, including:

- Utilizing reverse auctions, a new, innovative and transparent competitive process to provide high-speed internet access to at least 266,000 households and businesses across Ontario.

- Partnering with the federal government to support large-scale, fibre-based projects made possible by a joint investment of up to $1.2 billion.

- Accelerating construction of projects, through the Supporting Broadband and Infrastructure Expansion Act, 2021 and the Building Broadband Faster Act, 2021. To build on this legislation, in March 2022, the Ontario government introduced the Getting Ontario Connected Act, 2022, to help remove barriers, duplication and delays, making it easier and faster to build high-speed internet infrastructure across the province.

- Investing more than $109 million in Telesat’s next-generation Low Earth Orbit satellite network, to help secure future access to dedicated high-speed bandwidth for remote communities.

- Investing $71 million in the Eastern Ontario Regional Network (EORN) to improve access to cellular service.

- Investing more than $63 million in the Southwestern Integrated Fibre Technology (SWIFT) project to bring high-speed internet to 63,000 more homes, businesses and farms across Southwestern Ontario.

- Supporting broadband upgrades at approximately 50 libraries with a provincial investment of $4.85 million through the Connecting Public Libraries initiative.

- Improving connectivity in Northern Ontario, including $10.9 million to bring faster internet connections to several First Nation and Northern communities.

The government continues to make significant progress to help achieve the commitment to enable high-speed internet access for all unserved and underserved homes and businesses across the province. No one will be left behind.

Helping Families Explore Ontario

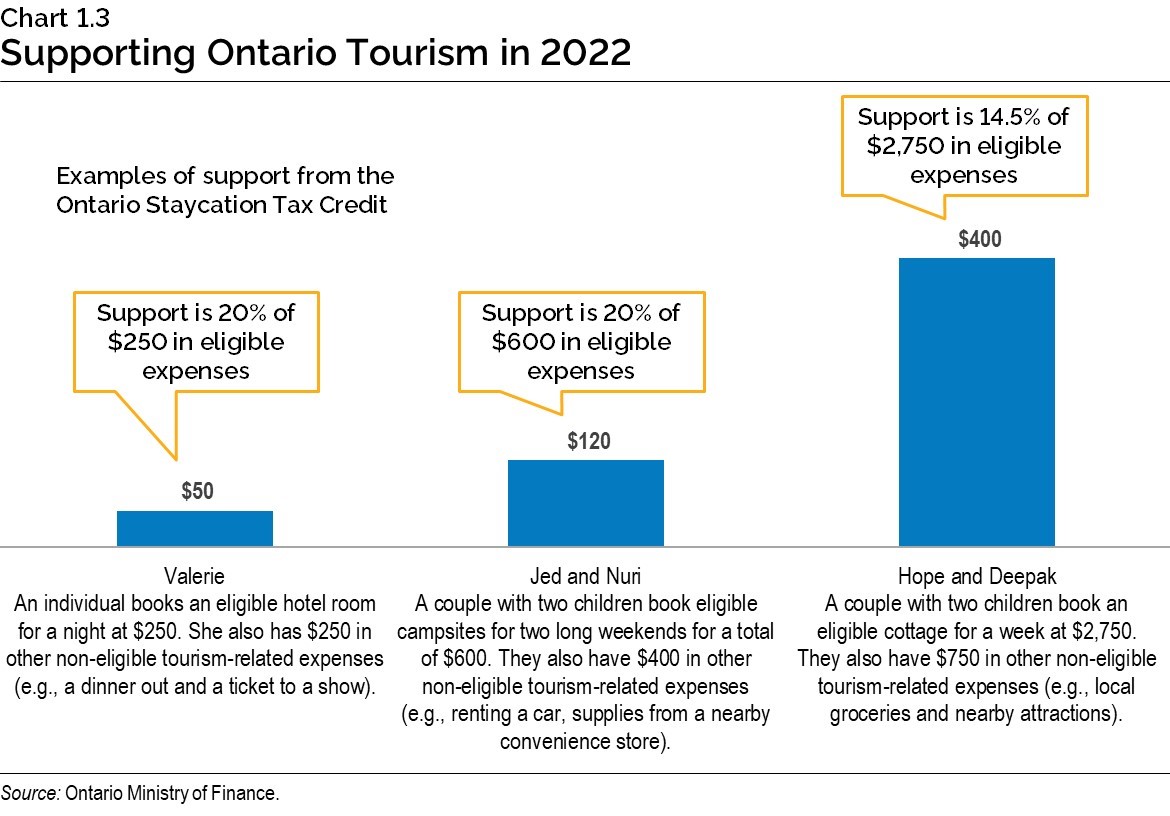

The people of Ontario deserve the opportunity to enjoy the very best this province has to offer. To help encourage everyone to explore Ontario and support local tourism, the government introduced the temporary Ontario Staycation Tax Credit for 2022. This credit will provide eligible Ontario residents with support of 20 per cent of eligible 2022 accommodation expenses in Ontario, up to $1,000 for an individual or $2,000 for a family, for a maximum credit of $200 or $400, respectively.

The credit is expected to provide an estimated $270 million in support to about 1.85 million Ontario families for 2022.

Supporting Ontario’s Cultural Industries

The province’s cultural industries showcase the best Ontario has to offer, while creating opportunities and jobs for Ontario’s creative workers. These industries, including film and television production, interactive digital media, book and magazine publishing and sound recording, contributed over $7.2 billion to the province’s GDP and accounted for almost 65,000 jobs in 2019.1

Responding to the Film and Television Advisory Panel

The 2019 Budget announced the creation of a Film and Television Advisory Panel to ensure that the government is well-informed about this important industry. The panel was asked to provide evidence and advice on industry trends, challenges and opportunities to grow high-value film and television production in Ontario and maximize benefits for the province.

The panel submitted its final report in November 2021. The government would like to thank the panel for its dedication to Ontario and for its work on the report.

COVID-19 also had a significant impact on the industry. Given the industry’s important cultural and economic contributions to Ontario, the government will continue to engage with stakeholders on opportunities to support the industry, and expand film and television production in communities across the province.

The Province has long been a champion of Ontario’s film and television industry, providing production, marketing and export support through Ontario Creates as well as other government programs. The provincial Film Commission also works to attract investment to the province by showcasing the province’s locations, talent, and incentives. This support, in addition to the stability of the film and television tax credits, has spurred the doubling of the industry’s size over the past twenty years.

Film and Television Advisory Panel Final Report

November 2021

Modernizing Ontario’s Cultural Media Tax Credits

Ontario is providing more than $800 million in estimated annual support through five refundable cultural media tax credits that aim to increase production in Ontario’s cultural industries and create jobs. These credits are:

- The Ontario Film and Television Tax Credit;

- The Ontario Production Services Tax Credit;

- The Ontario Computer Animation and Special Effects Tax Credit;

- The Ontario Interactive Digital Media Tax Credit; and

- The Ontario Book Publishing Tax Credit.

The tax credits were introduced in the late 1990s, before the growth of digital content production and distribution. The government is listening to the advice of the Film and Television Advisory Panel and other industry stakeholders to update eligibility requirements for these tax credits. By adapting the credits to reflect the latest cultural industry practices and modern distribution channels, Ontario would be positioned to attract key investment and high-value jobs in the sector.

To modernize the credits, the government proposes to:

- Make regulatory amendments to Ontario’s film and television tax credits to include professional film and television productions distributed exclusively on online platforms, as recommended by the Film and Television Advisory Panel; and

- Update the Ontario Book Publishing Tax Credit to remove the requirement that books be published in a hard copy edition of 500 bound books.

The government will also explore opportunities to:

- Simplify the Ontario Computer Animation and Special Effects Tax Credit; and

- Encourage more film and television production in communities across Ontario by reviewing the Ontario Film and Television Tax Credit regional bonus and the eligibility of location fees for the Ontario Production Services Tax Credit.

In addition, the government has clarified that labour expenditures for employees working from home or in hybrid work arrangements are eligible for the Ontario Interactive Digital Media Tax Credit and the Ontario Computer Animation and Special Effects Tax Credit.

More information on these items is outlined in the Annex: Details of Tax Measures and Other Legislative Initiatives.

Securing the Agri-Food Supply Chain

Ontario’s agri-food sector is diverse and dynamic, contributing $45 billion to the province’s economy in 2020. The sector produces some of the safest and highest-quality food products in the world while providing high-value jobs across the province.Agri-food also has deep roots in Ontario. The sector supports rural and urban communities, workers and families while putting fresh, local products on store shelves and kitchen tables.

To ensure that agri-food will continue to play an important and growing role in Ontario’s economy, the government is taking a strategic approach to securing the province’s supply chain and driving innovation in the sector.

Creating Ontario’s Food Security and Supply Chain Stability Strategy

Ontario’s food supply has proven to be resilient throughout the COVID-19 pandemic, but there are gaps that need to be addressed to ensure Ontario’s food supply chain remains strong and stable particularly as global events present risk for increasing the cost of food.

This is why the government is building up made-in-Ontario capacity by developing an Ontario Food Security and Supply Chain Stability Strategy, informed by agriculture and agri-food leaders. The strategy will provide a roadmap to boost domestic agri-food production capacity and strengthen Ontario’s future food supply. It will also seek to address ongoing agri-food sector vulnerabilities to support supply chain stability, increase resilience and fuel economic growth in the agri-food sector for the long term.

Developing Ontario’s Agri-Food Innovation and Technology Strategy

Embracing innovation is key to the success and growth of the agri-food sector. This is why the government is developing Ontario’s Agri-Food Innovation and Technology Strategy. The strategy will prioritize attracting and developing agri-food talent. It will also include targeted investments into research and development to boost innovation adoption, driving commercialization to increase competitiveness and productivity. In addition, Ontario’s Agri-Food Innovation and Technology Strategy will support the implementation of new and innovative technologies and grow data-driven solutions to increase efficiencies. From innovative research to opening new markets, the strategy will build strong, diverse partnerships and enable Ontario’s agri-food businesses to continue to grow and thrive.

Supporting Agri-Food Supply and Processing Capacity

Processing capacity challenges in the agri-food sector, including labour and supply chain disruptions, are affecting the productivity and growth of this important sector of the economy. Supply chain challenges lead to higher input costs, decreased competitiveness and higher food prices — affecting workers and consumers and their standard of living.

The government is announcing new investments to sustain food processing capacity and increase the resiliency of supply chains against future disruptions while maintaining access to locally grown and processed food for the people of Ontario. These include:

- Investing $10 million in 2022–23 to establish a Food Security and Supply Chain Fund to strengthen Ontario’s food supply, including addressing barriers to recruitment by attracting and retaining domestic workers, closing sector skill gaps, and supporting the well-being of workers;

- Providing $10 million in 2022–23 for ongoing support and expansion of the Enhanced Agri-Food Workplace Protection Program to help farms and agri-food operations take additional measures to support the health and safety of agri-food workers;

- Allocating $5 million in 2022–23 for emergency support initiatives to help livestock producers if emergency processing disruptions occur. For example, the beef set-aside programs will help Ontario farmers to deal with increased costs related to market delays; and

- Protecting the health and safety of incoming international agricultural workers through a $2.6 million investment that will include a welcome centre with health resources, as well as additional vaccination clinics.

Protecting Public Safety and Food Supply

In recent years, farmers have faced increased levels of trespass and risk to their livestock, as well as mental health stress due to threats of trespassing. On June 18, 2020, the Security from Trespass and Protecting Food Safety Act, 2020 received Royal Assent. The Act increases protection for farmers, agri-food businesses, farm animals and Ontario’s food supply from the risk of trespassing activities, while maintaining the right of people to participate in lawful protests on public property.

Working with Indigenous Partners

Ontario is committed to reconciliation with Indigenous peoples and communities by focusing on initiatives that promote economic prosperity and create a better future for everyone across the province. Indigenous-owned businesses face unique challenges, which have worsened with the COVID-19 pandemic. This is why the government is investing $25 million over three years to support Indigenous communities, including providing Indigenous-owned businesses and entrepreneurs with working capital to ensure continued business operations.

The Indigenous Economic Development Fund will enhance Indigenous training and capacity development by providing grants to First Nation communities, Indigenous organizations, and other key partners to better support skills enhancement, Indigenous apprentices and economic development. The investment will also develop and maintain an Ontario First Nations supply chain map and portal to increase procurement opportunities for Indigenous businesses.

Supporting Ontario’s Francophone Community

Ontario’s Francophone community is continuing to grow. The government is creating favourable conditions that will support the social, cultural and economic development of the Franco-Ontarian community through the French Language Services Strategy and the Francophone Economic Development Strategy.

With the newly modernized French Language Services Act, the government will improve access to frontline services in French by designating more points of service and delivering on active offer by shifting the onus of finding services from the user to providers.

The government is also committed to increasing the Francophone economic footprint, promoting Ontario’s Francophone workforce and stimulating job creation by supporting the innovative know-how and growth of Francophone private businesses and social enterprises. This includes working with the Fédération des gens d’affaires francophones de l’Ontario, which serves about 6,000 small to medium-sized businesses and entrepreneurs, and promoting cooperation and exchanges with other jurisdictions, including Quebec.

Showcasing Ontario as Open for Business

The government has sent a clear message that Ontario is open for business. To support the creation of jobs, growth and prosperity, the government will continue to encourage and attract business investments, lower costs, reduce red tape and enhance access to capital.

Providing Cost Savings and Support to Businesses

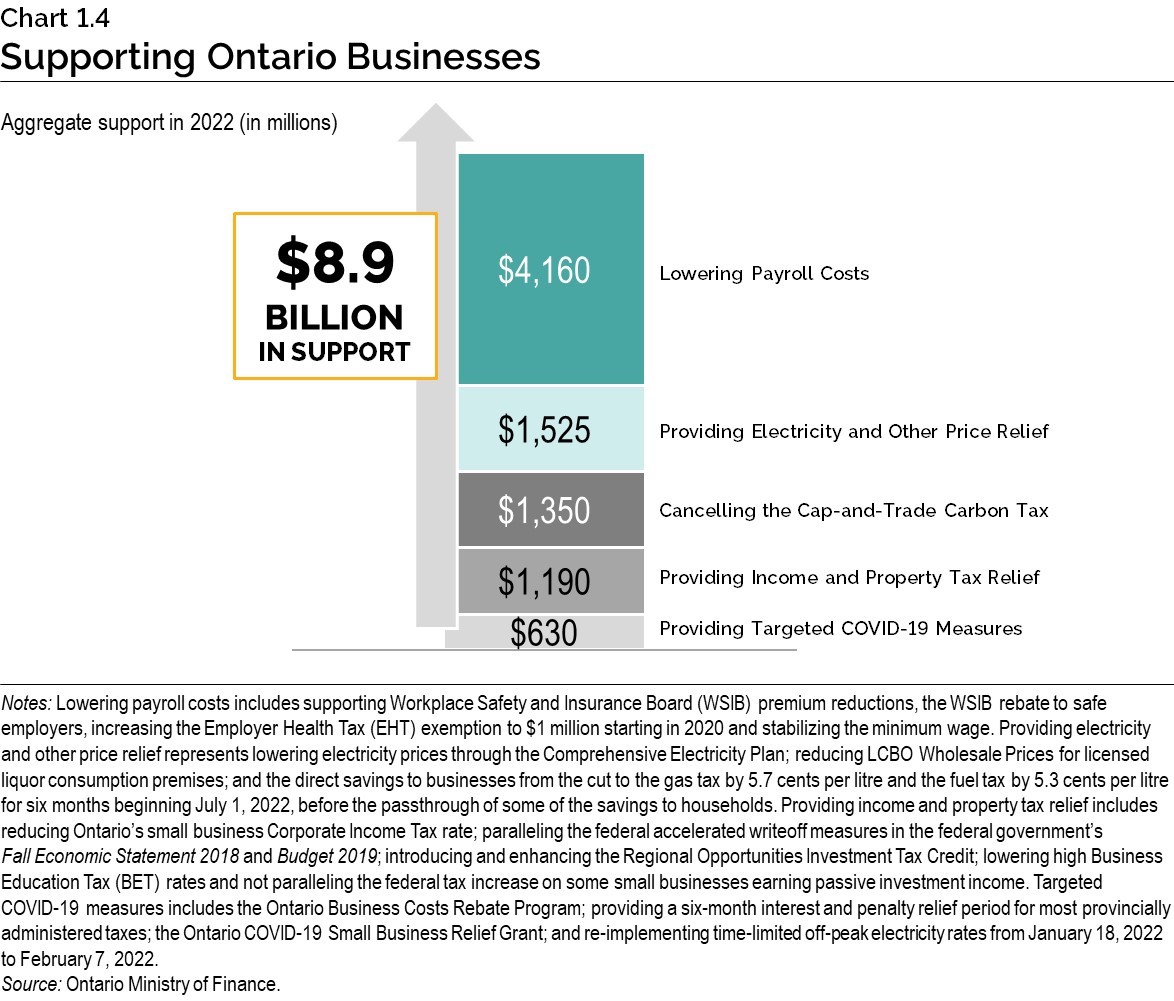

Since June 2018, the government has undertaken significant actions to lower costs for employers to help them grow, protect existing jobs and create opportunities for workers. In 2022, the government would enable an estimated $8.9 billion in cost savings and support for Ontario businesses, with $4.1 billion to go to small businesses. Examples include:

- Supporting a reduction in Workplace Safety and Insurance Board (WSIB) premiums and the WSIB rebate;

- Increasing the Employer Health Tax (EHT) exemption from $490,000 to $1 million;

- Cancelling the cap-and-trade carbon tax;

- Allowing businesses to accelerate writeoffs of capital investments for tax purposes;

- Lowering high Business Education Tax (BET) rates for job creators;

- Reducing the small business Corporate Income Tax rate to 3.2 per cent;

- Introducing and temporarily enhancing the Regional Opportunities Investment Tax Credit to encourage investments in certain geographic areas of Ontario that have lagged in employment growth in the past;

- Lowering electricity costs by 15 to 17 per cent in 2022 for medium-size and larger commercial and industrial customers under the Comprehensive Electricity Plan, with the government paying for a portion of high-priced, non-hydro renewable energy contracts;

- Lowering electricity bills for eligible residential, farm and small business customers through measures such as time-limited off-peak electricity pricing 24 hours a day, from January 18, 2022, to February 7, 2022;

- Cutting the gas tax by 5.7 cents per litre and the fuel tax by 5.3 cents per litre for six months beginning July 1, 2022;

- Providing support through the Ontario Business Costs Rebate Program and the Ontario COVID-19 Small Business Relief Grant for eligible businesses that were required to close or reduce capacity due to public health measures in response to the Omicron variant of COVID-19;

- Providing a deeper wholesale discount on the cost of alcohol purchased from the Liquor Control Board of Ontario (LCBO) for bars, restaurants and other eligible licence holders; and

- Providing a six-month interest and penalty relief period for most provincially administered taxes.

Providing Financial Relief to Safe Employers

The Workplace Safety and Insurance Board (WSIB) is providing a rebate of up to $1.5 billion in surplus funds to safe employers in 2022. This rebate will go to 300,000 eligible employers, allowing them to pay their workers more, create new jobs and help grow the economy. This builds on $2.4 billion in financial relief for employers through WSIB premium reductions since 2018.

Growing Ontario’s Venture Capital Sector

Venture capital is vital for early-stage entrepreneurial companies to grow and reach their full potential. To promote high-potential companies with venture capital funding, the government is proposing to rebrand the Ontario Capital Growth Corporation as Venture Ontario. This venture capital agency would continue to support a portfolio of valuable companies. Provincial venture capital investments of approximately $380 million to date have leveraged over $4.5 billion in growth capital.

To continue growing Ontario’s venture capital sector and support high-value technology companies, Venture Ontario’s venture capital funding will increase from $100 million to $300 million. This will enable the agency to make an additional $200 million in investments under the Venture Ontario Fund II, focusing on building Ontario’s competitive advantages in key sectors, including life sciences, clean technology, information technology and artificial intelligence. Venture Ontario’s commitments will be in a number of early-stage, late-stage and growth fund investments. The additional funding is expected to leverage an additional $1.8 billion to Ontario-based and Ontario-focused venture capital fund managers.

Ontario will also consult with the angel investment community to explore opportunities to grow this important source of capital and bring its benefits to communities across the province.

Reducing Red Tape

Unnecessary, burdensome regulations discourage investment by local and international job creators and reduce economic competitiveness. This results in higher costs and delays in approvals for businesses in Ontario. One of the most important ways to support businesses is to make compliance with regulations easier, simpler and less expensive.

Since 2018, nine regulatory modernization packages, including eight bills, have been brought forward with a focus on reducing costs, enabling Ontario to be more competitive while strengthening those standards that are essential to keeping people safe and protecting the environment.

As a result of these efforts, the government has enabled $449 million in net annual savings for businesses, not-for-profits, municipalities, universities and colleges, school boards and hospitals in regulatory compliance costs as of December 31, 2021. This exceeds the target set to generate $400 million in annual cost savings for businesses announced in the 2018 Ontario Economic Outlook and Fiscal Review.

Modernizing Ontario’s Vehicle Registration Process

Ontario is investing $23.9 million in the Digital Dealership Registration (DDR) program to allow eligible car dealerships to register new vehicles online and issue stock, including permits and licence plates. This move will bring the government’s driver and vehicle services into the 21st century and improve the consumer experience by removing layers of the registration process.

Once fully implemented, DDR will help move online up to 4.8 million dealership registration transactions annually including the registration of pre-owned vehicles, vehicle transfers and vehicle permit replacements, all of which must currently be conducted in person. At full implementation, the new DDR process will, for the first time ever, provide over 7,000 Ontario car dealerships access to an online program that eliminates duplicative paperwork and time-consuming trips to ServiceOntario centres. Modernizing the vehicle registration process is another way the government is making services simpler, faster and better for Ontario.

It will also mark the successful completion of the government’s commitment to improve or bring online the 10 highest-volume ServiceOntario transactions. This fulfils the government’s commitment outlined in the 2019 Budget.

Breaking Down Interprovincial Trade Barriers

Trade with other provinces plays an important role in supporting jobs and growth across Ontario and providing opportunities for companies throughout the province. Ontario is the national leader in interprovincial trade, shipping $142.3 billion of goods and services to other provinces and territories in 2020. However, interprovincial trade barriers cost Ontario businesses time and money and stand in the way of enhancing their economic competitiveness and opportunities for growth. According to Deloitte’s report The Case for Liberalizing Interprovincial Trade in Canada, prepared for the Working Group on Interprovincial Trade Barriers, the removal of non-geographic trade barriers is estimated to increase Ontario’s GDP by $23.1 billion (2.9 per cent).2

Ontario supports reducing interprovincial trade barriers through the federal–provincial–territorial Regulatory Reconciliation and Cooperation Table (RCT), where the province is leading work on testing and deployment of automated and connected vehicles and on electronic logging devices for the trucking industry. Ontario is participating actively across the range of RCT areas to reconcile or harmonize regulations in personal protective equipment, safety codes and labour mobility, among others.

The government of Ontario is willing to work with all of its provincial, territorial and federal counterparts to address domestic barriers to trade that increase business costs and impose unnecessary burdens on Ontario businesses. This will be a core priority in the government’s plan to create growth and prosperity.

Modernizing Ontario’s Capital Markets to Attract Investment and Create Jobs

More competitive capital markets benefit everyone by attracting investment and creating jobs. The government is delivering on its commitment to modernize Ontario’s capital markets, including implementing recommendations made by the Capital Markets Modernization Taskforce.

The government will be proclaiming the new Securities Commission Act, 2021. This legislation would modernize the governance framework of the Ontario Securities Commission (OSC) and support the OSC as a 21st century capital markets regulator. This includes separating the combined Chair and Chief Executive Officer role into two distinct positions and establishing the Capital Markets Tribunal within the OSC led by a Chief Adjudicator.

The government has also expanded the OSC’s mandate to include fostering capital formation and competition in Ontario’s capital markets. The government believes that improving consumer choice and ensuring the people of Ontario have broad access to the investment products they desire is positive for all market participants.

Ontario has also conducted an initial consultation on a draft Capital Markets Act. The draft Act is intended to modernize capital markets regulation to create a more modern and flexible regulatory framework. The government will carefully consider stakeholder submissions prior to determining next steps.

The government is committed to protecting investors and ensuring that Ontario continues to be an attractive jurisdiction to invest and raise capital. The government will continue to consider measures to modernize capital markets and review issues raised by the Capital Markets Modernization Taskforce, such as tied selling, access to bank shelf space, corporate diversity, electronic communications, and environmental, social and governance disclosure.

Strong capital markets are critical to Ontario’s economy. The modernization initiatives undertaken by the government will help position the province as a leading capital markets jurisdiction moving forward.

Supporting Management of Broader Public Sector Funds

The government recognizes the importance of efficient and prudent management of assets across the Ontario broader public sector (BPS). The Investment Management Corporation of Ontario (IMCO) operates at arm’s length from the government to provide pooled asset management for Ontario’s BPS. IMCO can offer smaller public-sector funds benefits such as improved access to alternative investments that private or larger funds typically enjoy through scale. IMCO helps provide BPS pension and investment funds with access to an end-to-end solution that includes asset mix advice and implementation, a range of investment strategies, risk management and reporting.

Footnotes

[1] Provincial and Territorial Culture Indicators (PTCI), 2010 to 2019, Statistics Canada (released May 27, 2021).

[2] Deloitte LLP, The Case for Liberalizing Interprovincial Trade in Canada (November 2021), https://www2.deloitte.com/content/dam/Deloitte/ca/Documents/finance/ca-en-the-case-for-liberalizing-interprovincial-trade-in-canada-aoda.pdf

Chart Descriptions

Chart 1.1: Proposed Corridor to Prosperity

The chart depicts the current proposed road projects to help create a north-south corridor connecting the Ring of Fire area to the provincial highway network. This includes the proposed Marten Falls First Nation Community Access Road project, the proposed Webequie First Nation Supply Road project and the proposed Northern Road link. The chart provides a visualization of how these proposed roads would connect with select roads and highways between Northern and Southern Ontario. The chart indicates selected land border crossings and ports. The chart also depicts auto assembly plants and steel manufacturing plants, as well as a planned electric vehicle battery manufacturing plant in Southern Ontario. The auto assembly plants include: Stellantis facilities in Windsor and Brampton; General Motors in Ingersoll and Oshawa; Toyota in Woodstock and Cambridge; Ford in Oakville; and Honda in Alliston. Steel manufacturing plants include ArcelorMittal Dofasco in Hamilton, Algoma Steel in Sault Ste. Marie, and Stelco plants in Nanticoke and Hamilton. The joint LG Energy Solution–Stellantis battery manufacturing plant in Windsor is scheduled to be fully operational by 2025.

Sources: Ontario Ministry of Economic Development, Job Creation and Trade; Ontario Ministry of Northern Development, Mines, Natural Resources and Forestry; and Ontario Ministry of Transportation.

Chart 1.2: Improving High-Speed Internet Access to Every Community

Before: Before Ontario was accelerating investments in high-speed internet, large parts of the province had poor service, or none at all.

- Before: Map showing that 20 to 40 per cent of total homes and businesses had access to high-speed internet before the Ontario government accelerated its investments.

After: By the end of 2025, all homes and businesses in every region across Ontario will have access to high-speed internet.

- After: Map showing that 80 to 100 per cent of total homes and businesses will have access to high-speed internet by the end of 2025, as a result of government investments.

Source: Ontario Ministry of Infrastructure

Chart 1.3: Supporting Ontario Tourism in 2022

The bar chart shows three examples in 2022 of the temporary Ontario Staycation Tax Credit to support eligible accommodation expenses in Ontario. In the first example (on the left), Valerie books an eligible hotel room for one night at $250. She also has $250 in non-eligible tourism-related expenses (e.g., a dinner out and a ticket to a show). As a result, Valerie would receive $50, or 20 per cent of her eligible accommodation expenses, through the temporary Personal Income Tax (PIT) credit.

In the second example (in the middle), Jed and Nuri are a couple with two children. They book eligible campsites for two long weekends for a total cost of $600. They also have $400 in non-eligible tourism-related expenses (e.g., renting a car and purchasing supplies from a nearby convenience store). As a result, Jed and Nuri would receive $120, or 20 per cent of their eligible accommodation expenses, through the temporary PIT credit.

In the third example (on the right), Hope and Deepak are a couple with two children. They book an eligible cottage for one week at $2,750. They also have $750 in non-eligible tourism-related expenses (e.g., local groceries and nearby attractions). As a result, Hope and Deepak would receive $400, or the maximum available for a family, through the temporary PIT credit.

Source: Ontario Ministry of Finance.

Chart 1.4: Supporting Ontario Businesses

This bar chart illustrates that Ontario businesses would receive $8.9 billion in aggregate support in 2022. This includes combined support from lowering payroll costs ($4,160 million), providing electricity and other price relief ($1,525 million), cancelling the cap-and-trade carbon tax ($1,350 million), providing income and property tax relief ($1,190 million), and providing targeted COVID-19 measures ($630 million).

Notes: Lowering payroll costs includes supporting Workplace Safety and Insurance Board (WSIB) premium reductions, the WSIB rebate to safe employers, increasing the Employer Health Tax (EHT) exemption to $1 million starting in 2020 and stabilizing the minimum wage. Providing electricity and other price relief represents lowering electricity prices through the Comprehensive Electricity Plan; reducing LCBO Wholesale Prices for licensed liquor consumption premises; and the direct savings to businesses from the cut to the gas tax by 5.7 cents per litre and the fuel tax by 5.3 cents per litre for six months beginning July 1, 2022, before the passthrough of some of the savings to households. Providing income and property tax relief includes reducing Ontario’s small business Corporate Income Tax rate; paralleling the federal accelerated writeoff measures in the federal government’s Fall Economic Statement 2018 and Budget 2019; introducing and enhancing the Regional Opportunities Investment Tax Credit; lowering high Business Education Tax (BET) rates and not paralleling the federal tax increase on some small businesses earning passive investment income. Targeted COVID-19 measures includes the Ontario Business Costs Rebate Program; providing a six-month interest and penalty relief period for most provincially administered taxes; the Ontario COVID-19 Small Business Relief Grant; and re-implementing time-limited off-peak electricity rates from January 18, 2022 to February 7, 2022.

Source: Ontario Ministry of Finance.