Ontario led the fight against the federal carbon tax, put thousands of dollars back into people’s pockets, and continues to do more to lower costs for hard-working families. From providing direct financial relief to families and individuals, saving commuters money by removing tolls, making public transit more affordable through the One Fare program and cutting the Gasoline Tax and Fuel Tax, the government is continuing to build on its track record of putting money back in people’s pockets.

Delivering the $200 Ontario Taxpayer Rebate

In the 2024 Ontario Economic Outlook and Fiscal Review, the government announced that it would be providing a $200 taxpayer rebate to each eligible adult and $200 for each eligible child under 18. Providing these rebates helps deliver on the government’s commitment to make life more affordable. The government began issuing rebate cheques in January 2025, providing $3 billion in support to about 15 million eligible people in Ontario. Ontario continues to work to ensure all eligible families receive their taxpayer rebates.

Permanently Reducing Gasoline Tax and Fuel Tax Rates

The Ontario government temporarily cut the Gasoline Tax rate by 5.7 cents per litre and the Fuel (diesel) Tax rate by 5.3 cents per litre on July 1, 2022, and has extended the cuts four times. The latest of these extensions is set to end on June 30, 2025, providing families and individuals with $1.7 billion in gas and fuel tax relief since the cuts began.

To provide ongoing relief to households and businesses in Ontario, the government is introducing legislation that would amend the Gasoline Tax Act and the Fuel Tax Act to keep the provincial rates of tax on gasoline and fuel at 9 cents per litre, permanently. This permanent measure would save households, on average, about $115 per year going forward.

The Ontario government has also consistently called for the elimination of the carbon tax. The government welcomes the federal decision to set the carbon tax rate to zero effective April 1, 2025, helping to reduce prices at the pump and continues to advocate for repealing the carbon tax.

For more information, see the Annex: Details of Tax Measures and Other Legislative Initiatives.

Removing Highway 407 East Tolls

Effective June 1, 2025, the government will permanently remove tolls from the provincially owned Highway 407 East — saving drivers approximately $94 million annually. This initiative will help fight gridlock and reduce the cost of travel while increasing convenience and choice, and is expected to save daily commuters an estimated $7,200 annually.

This is in addition to a number of other measures the government has implemented to put money back in drivers’ pockets, including eliminating licence plate renewal fees and stickers, removing tolls on Highway 412 and Highway 418, freezing fees for driver’s licences and Ontario Photo Cards, and temporarily cutting Gasoline and Fuel Tax rates. These initiatives have saved drivers over $1.8 billion in the last year.

Preventing New Charges and Streamlining Collection Efforts Against Drivers

In this time of economic uncertainty, the government is keeping costs down for drivers by amending the Municipal Act, 2001 and the City of Toronto Act, 2006 to prevent municipalities from implementing road tolls, including traffic gridlock pricing measures. Amendments would also remove the City of Toronto’s authority to implement a personal vehicle tax, bringing it in line with other municipalities. This will provide certainty to drivers that they will be protected from new charges for using their vehicles and accessing roads.

The government will also work with its municipal partners to help drivers pay outstanding traffic tickets or fines by streamlining the collection process. The government is launching a consultation that will focus on fine collection and enforcement of offences such as traffic violations under the Provincial Offences Act. This is in an effort to help keep costs down for drivers with outstanding fines, improve customer service and reduce possible duplication.

Providing Affordable and Convenient Transit Through the One Fare Program

Ontario’s One Fare program launched on February 26, 2024, enabling free transfers between the Toronto Transit Commission (TTC) and GO Transit, Brampton Transit, Durham Region Transit, MiWay (Mississauga), Peel TransHelp, and York Region Transit. The program provides the customer with a free transfer and subsidizes transit agencies for lost revenue. Since the launch of One Fare, transit users across participating agencies have saved over $123 million so far, making cross-boundary travel more affordable and convenient for students, seniors, low-income riders, and other travellers.

The program continues to perform strongly, offering customers free transfers between the TTC and six connecting transit systems. More than 38 million transfers were made using the fare integration program so far.

By eliminating double fares on participating transit systems throughout the Greater Golden Horseshoe through One Fare, the government is saving the daily transit user an average of $1,600 each year.

Saving on Electricity Costs

The government continues to ensure electricity bills remain affordable, stable and predictable by providing rate relief for eligible households, small businesses and farms through the Ontario Electricity Rebate (OER). The government also provides targeted electricity bill relief for eligible low-income households and on-reserve First Nation consumers, as well as eligible rural or remote customers.

Supporting Affordable Rental Housing

The government is continuing to review the property assessment and taxation system, focusing on fairness, affordability, business competitiveness, and modernized administration tools.

As announced in the 2024 Ontario Economic Outlook and Fiscal Review, one early priority arising from this review is to provide municipalities with the ability to reduce municipal property tax rates on affordable rental housing.

Starting in 2026, municipalities will have the option to reduce the municipal property tax rate for eligible affordable rental housing units by up to 35 per cent. Eligible properties could be either existing or newly built and would be required to meet the definition of affordable rental units in the Development Charges Act, 1997.

The government remains committed to working with municipalities to build more housing, support economic growth and further strengthen Ontario’s communities.

Supporting Families and Individuals

The government recognizes the financial challenges faced by many people in Ontario, particularly given recent economic pressures and uncertainty around tariffs driving up prices. This is why the government has consistently acted early to protect people’s wallets by making life more affordable for families and individuals across the province.

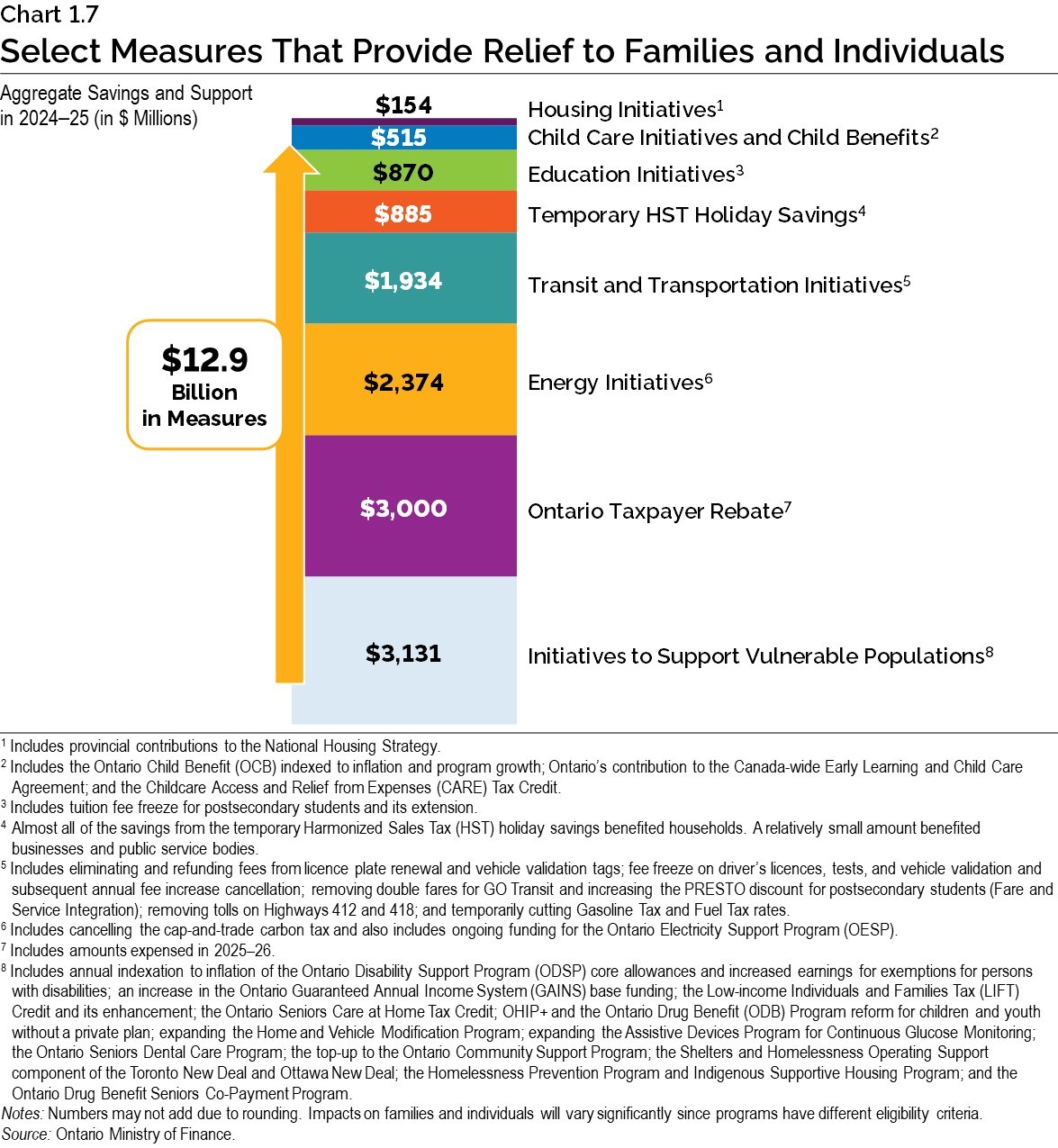

The government committed almost $12.9 billion in relief for families and individuals in the 2024–25 fiscal year, as detailed in Chart 1.7.

Chart Descriptions

Chart 1.7: Select Measures That Provide Relief to Families and Individuals

This chart illustrates selected measures that provide relief for Ontario’s families and individuals in 2024–25. Government actions would total $12.9 billion for families and individuals in 2024–25. This includes housing initiatives ($154 million), child care initiatives and child benefits ($515 million), education initiatives ($870 million), temporary Harmonized Sales Tax (HST) holiday savings ($885 million), transit and transportation initiatives ($1,934 million), energy initiatives ($2,374 million), Ontario taxpayer rebate ($3,000 million) and initiatives to support vulnerable populations ($3,131 million).

Housing initiatives include provincial contributions to the National Housing Strategy. Child care initiatives and child benefits include the Ontario Child Benefit (OCB) indexed to inflation and program growth; Ontario’s contribution to the Canada-wide Early Learning and Child Care Agreement; and the Childcare Access and Relief from Expenses (CARE) Tax Credit. Education initiatives include tuition fee freeze for postsecondary students and its extension. Almost all of the savings from the temporary HST holiday savings benefited households. A relatively small amount benefited businesses and public service bodies. Transit and transportation initiatives include eliminating and refunding fees from licence plate renewal and vehicle validation tags; fee freeze on driver’s licences, tests, and vehicle validation and subsequent annual fee increase cancellation; removing double fares for GO Transit and increasing the PRESTO discount for postsecondary students (Fare and Service Integration); removing tolls on Highways 412 and 418; and temporarily cutting Gasoline Tax and Fuel Tax rates. Energy initiatives includes cancelling the cap-and-trade carbon tax and also includes ongoing funding for the Ontario Electricity Support Program (OESP). The Ontario Taxpayer Rebate includes amounts expensed in 2025–26. Initiatives to support vulnerable populations include annual indexation to inflation of the Ontario Disability Support Program (ODSP) core allowances and increased earnings exemptions for persons with disabilities; an increase in the Ontario Guaranteed Annual Income System (GAINS) base funding; the Low-income Individuals and Families Tax (LIFT) Credit and its enhancement; the Ontario Seniors Care at Home Tax Credit; OHIP+ and the Ontario Drug Benefit (ODB) Program reform for children and youth without a private plan; expanding the Home and Vehicle Modification Program; expanding the Assistive Devices Program for Continuous Glucose Monitoring; the Ontario Seniors Dental Care Program; the top-up to the Ontario Community Support Program; the Shelters and Homelessness Operating Support component of the Toronto New Deal and Ottawa New Deal; the Homelessness Prevention Program and Indigenous Supportive Housing Program; and the Ontario Drug Benefit Seniors Co-Payment Program.

Note: Numbers may not add due to rounding. Impacts on families and individuals will vary significantly since programs have different eligibility criteria.

Source: Ontario Ministry of Finance.