Protecting the economy allows the government to invest even more in health care, education and other critical services. With a strong economy, increased investments and better delivery of services, Ontario is putting people, communities and businesses first and ensuring that they will continue to thrive.

Advancing Ontario’s Primary Care Action Plan

Ontario is building on the investments to date for a primary care system that is comprehensive, convenient, and connected for every single person in Ontario. This is why on January 27, 2025, the government announced an investment of $1.8 billion for Ontario’s Primary Care Action Plan, which aims to connect everyone in Ontario to a family doctor or primary care team within four years.

Ontario’s Primary Care Action Plan will implement a broad series of initiatives that will close the gap for people in need of primary care by 2029, including:

- Creating and expanding more than 305 additional primary care teams to connect approximately two million people to primary care, including investing more than $235 million in 2025–26 to establish and expand up to 80 additional primary care teams across the province that will connect 300,000 more people to primary care this year; and

- Supporting primary care infrastructure renewal for the expansion of eligible team-based models.

This investment will establish best-in-class models of primary care to ensure that no matter where residents in Ontario live, everyone is connected to primary care.

Training and Retaining Health Care Providers Across Ontario

The government remains committed to building a stronger and more resilient health care workforce throughout the province. Through the Ontario Learn and Stay Grant, the government is supporting students with funding to cover tuition, books, and other direct educational expenses for eligible health-related programs. This program is helping to train and retain health care providers in underserved and growing communities.

Increasing the Number of Health Care Professionals Across Ontario

Through the Ontario Learn and Stay Grant, the government is increasing the number of nurses, paramedics, and medical laboratory technologists in underserved and growing regions, including in Northern, Eastern and Southwestern Ontario. Eligible students commit to working in the communities where they studied for a term of service after graduation. The government is continuing to invest in the program with an additional $261.7 million over three years. Since its launch in 2023–24, the Ontario Learn and Stay Grant has provided over $90 million in support to more than 8,000 students.

The government is making sure more Ontario-trained doctors practise family medicine here at home in communities that need them. Building on the government’s announcement in the 2024 Ontario Economic Outlook and Fiscal Review, Ontario is investing $159.6 million over three years, beginning in 2026–27, to expand the Ontario Learn and Stay Grant to a total of four cohorts of medical school students to help improve access to primary care across the province. The grant will cover 100 per cent of direct educational costs, including tuition and fees, starting with those who entered medical school in 2024–25, and who commit to working in the community for a term of service as family medicine physicians after completing residency anywhere in the province. The government is also requiring medical schools to prioritize seats for Ontario residents, helping ensure more doctors who study in Ontario stay in Ontario.

Investing in Hospitals

Ontario’s hospitals deliver critical health services in communities across the province. This is why the government is making available up to $1.1 billion in additional hospital funding for 2025–26, which includes up to 4 per cent in base and targeted funding, and one-time funding for the surgical system. As part of this investment, the government will work collaboratively with hospitals to enhance accountability and operational improvements, while ensuring the people of Ontario continue to have access to high-quality public hospital services. With this funding, Ontario continues its historic investment in hospitals for a third consecutive year, providing more connected and convenient care across the province.

Investing in New Surgical and Diagnosis Centre Capacity

The government is committed to reducing backlogs in surgical and diagnostic services and as part of the Your Health: A Plan for Connected and Convenient Care, making it easier and faster for people to connect to publicly funded surgeries and procedures. This is why the government is investing up to $280 million over two years to support the expansion of Integrated Community Health Service Centres. These centres will deliver magnetic resonance imaging (MRI) and Computerized Tomograph (CT) scans, endoscopy procedures and orthopedic surgeries in the community setting.

This funding is in addition to the $275 million over the last three years, including $50 million in 2025–26, which was provided to hospitals to address surgical waitlists.

Building and Expanding Hospitals

The government is investing approximately $56 billion over the next decade in health infrastructure, including over $43 billion in capital grants. This includes investing $103 million in additional planning grants, which builds on Ontario’s ambitious plan to support over 50 major hospital projects and deliver approximately 3,000 new hospital beds to enhance access to quality care and build a connected, people-first health care system.

New planning grants include:

- Campbellford Memorial Hospital: $2.5 million for planning to replace the current hospital and create a “rural hub” with various community support services and additional inpatient beds.

- Orillia Soldiers’ Memorial Hospital: $3.0 million to plan the construction of new hospital facilities to address aging infrastructure and support future growth.

Additional planning grants to move projects forward include:

- Grand River Hospital and St. Mary’s General Hospital: $10 million to support the planning of a greenfield project to construct the new Waterloo Region Acute Care Hospital and redevelop health care infrastructure to meet growing service demand.

- Brant Community Healthcare System – Brantford and Willett Sites: $12.5 million to advance the project planning to build a new acute care tower and non-acute ambulatory care building to address capacity issues, aging infrastructure, and increase the number of inpatient rooms.

- Southlake Regional Health Centre: $10 million to plan for the creation of a distributed health network by building a new acute care hospital and renovating existing facilities to house redeveloped and net new inpatient beds.

- Royal Victoria Regional Health Centre – South Campus: $15 million for the planning of a new South Campus in Innisfil to host an outpatient health hub that would eventually transition to a full-service community hospital that will support health services offered in the existing Barrie hospital.

- Lake of the Woods District Hospital: $50 million to support the advanced planning of a replacement hospital that will include culturally safe spaces for Indigenous communities and expanded medical services.

Recent milestones include:

- Oak Valley Health – Uxbridge Hospital: In winter 2025, a tender was issued to support early works for this project, including road construction and building of a retaining wall, stormwater infrastructure and new parking areas. Once completed, the early works project will enable site readiness for a community health hub, including the planned new hospital to replace the aged hospital building, and proposed long-term care services.

- Cambridge Memorial Hospital: In January 2025, this redevelopment project reached completion, connecting people across Cambridge, North Dumfries and the Region of Waterloo with a new, state-of-the-art facility, to improve care for patients undergoing life-saving surgery or requiring emergency care. This project includes a new patient care tower, 52 new inpatient beds for acute care and support services and fully renovated and enhanced laboratory and diagnostic imaging departments.

- Thunder Bay Regional Health Science Centre: In December 2024, the government completed work on renovations that enabled the centre to house a new Positron Emission Tomography‑Computerized Tomograph (PET-CT) scanner used in diagnostics and expanded the linear accelerator service from two to three units, which increases access for the people in Northwestern Ontario to life-saving radiation therapy.

- Sunnybrook Health Sciences Centre: Work was completed for the new centre for brain science at Sunnybrook Health Sciences Centre. The government has invested $60 million to support the state-of-the-art facility dedicated to brain science research and care, connecting those with complex mental health conditions to the care they need.

- Scarborough Health Network General Site Diagnostic Imaging Department: In February 2025, the new diagnostic imaging department opened, enabling more patients to be seen faster. This project expands and consolidates most of the diagnostic imaging services being provided at that site.

Building Long-Term Care Homes

The government continues to make progress towards its commitment to build 58,000 new and upgraded beds to modern design standards across the province by 2028. As of April 2025, 147 long-term care homes are either open, under construction, or have approval to start construction. This includes:

- 40 homes completed, representing 2,571 new beds and 3,411 beds upgraded to modern design standards; and

- 107 homes under construction or approved to start construction, representing 10,481 new beds and 7,514 beds being upgraded to modern design standards.

As a result of the time-limited supplemental increase to the construction funding subsidy, designed to stimulate the start of construction for more long-term care homes across Ontario, the government enabled 103 long-term care homes to start construction between April 2022 and April 2025.

Building on this success, the government will launch a new construction funding support program to ensure long-term care operators and builders have additional flexibility and support to continue Ontario’s historical level of construction. This new program will unlock more than 8,000 new and redeveloped beds in Ontario.

The Loan Guarantee Program also continues to be available to support financing the development of long-term care beds in non-municipal, not-for-profit projects.

In addition, Ontario is bringing new tools to the long-term care sector to support financing the development of long-term care beds for projects with the support of the newly established Building Ontario Fund. This includes financing support for the Rekai Centres at Cherry Place and four homes through Arch Corporation in Amherstburg, Lancaster, Prescott, and Tay Valley Township, resulting in over 900 beds being redeveloped or added.

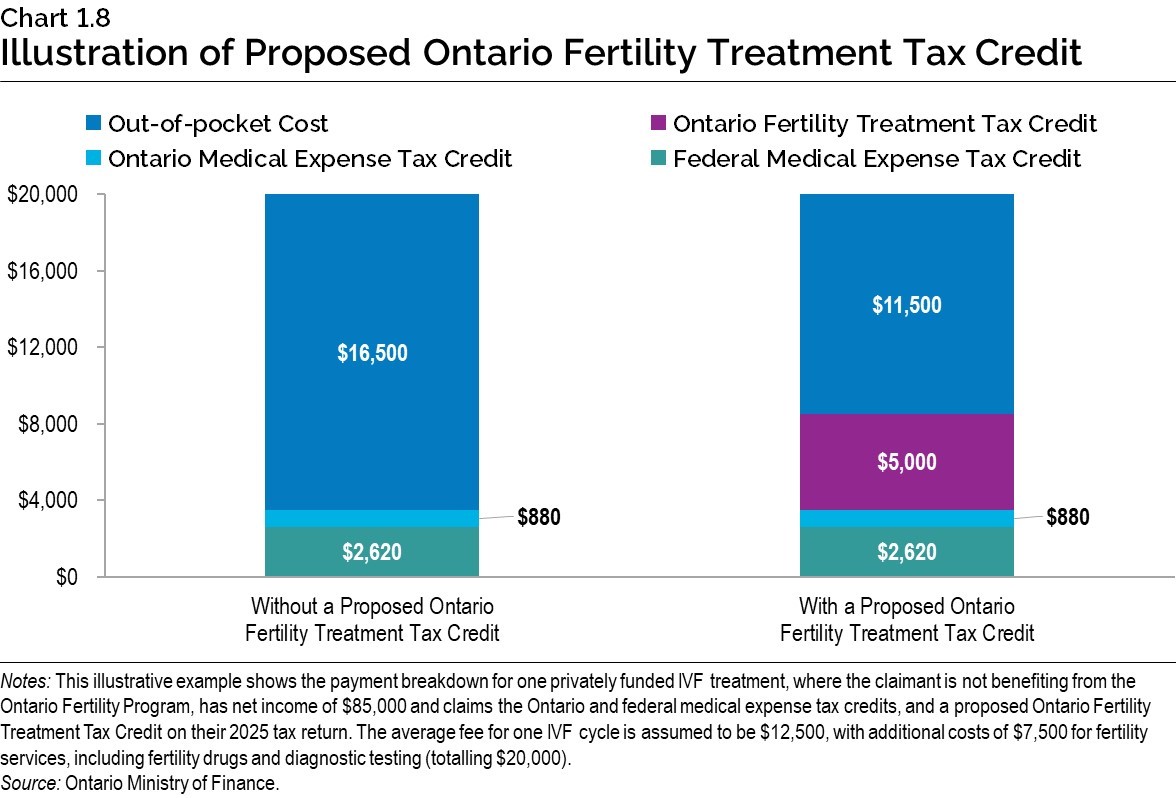

Introducing the Ontario Fertility Treatment Tax Credit

The government believes strong families help build strong communities. This is why the 2024 Ontario Economic Outlook and Fiscal Review announced a refundable Ontario Fertility Treatment Tax Credit to help families with the financial burden of fertility treatments. This proposed new tax credit would be built on Ontario’s existing Medical Expense Tax Credit and would provide support of 25 per cent on eligible fertility treatment expenses up to $20,000, for a maximum credit of $5,000 per year. These expenses would include in vitro fertilization (IVF) cycles, egg and embryo freezing (including storage), fertility drugs, travel, and diagnostic testing. The government will review the effectiveness of the credit after five years.

The proposed Ontario Fertility Treatment Tax Credit would provide Ontario residents with support for eligible fertility treatment expenses, effective January 1, 2025. Goods and services relating to the treatment must be provided entirely within Canada. This credit could be claimed in addition to the existing federal and Ontario medical expense tax credits and is expected to deliver $160 million in tax support over the first three years.

This proposed tax credit builds on the $150 million over two years for the Ontario Fertility Program previously announced through the 2024 Ontario Economic Outlook and Fiscal Review. The government will also invest an additional $100 million in 2027–28 to support the continued expansion of the Ontario Fertility Program. This funding will nearly triple the number of individuals who are able to receive a government‐funded IVF cycle, increase the capacity of fertility clinics and help clear existing waitlists both in hospitals and community settings.

For more information, see the Annex: Details of Tax Measures and Other Legislative Initiatives.

Supporting Seniors and Senior Veterans

Building on the government’s ongoing commitment to improving the quality of life for senior veterans, the government is investing $3 million over the next three years, beginning in 2025–26, to establish a dedicated veteran-focused funding stream within the existing Seniors Community Grant Program. This initiative supports community-based learning opportunities and promotes social and physical activities.

The government also continues to expand access to services and activities for seniors through the addition of up to 100 new Seniors Active Living Centres (SALC) programs across the province. This expansion was fueled by an investment of close to $17 million over three years in additional funding approved through the 2024 Ontario Economic Outlook and Fiscal Review. This also enabled the government to increase base funding to existing SALCs by 10 per cent: up to $55,000 per centre. These programs promote wellness, encourage social interaction, and combat ageism to help seniors stay active, independent and engaged within their communities.

Since this investment, 97 new SALC programs have been approved, increasing the total number of SALC programs across the province to 413. This expansion enhances access to services for seniors and individuals with disabilities in underserved communities.

Helping Individuals with Disabilities and Complex Needs Access Care and Supportive Housing

Ontario is continuing to invest in supportive housing options for adults and children with disabilities to ensure Ontario’s most vulnerable populations are connected to the key services they need. This includes committing funds for the following:

- $16 million to the Luso Canadian Charitable Society to support a new facility in Hamilton for aging individuals with disabilities, including developmental disabilities; and

- $21 million for Safehaven’s Bloor Site Redevelopment Project in Toronto to better support children and adults with complex care needs.

Funding for both projects will include $1 million up front to advance these projects. Once complete, these proposed housing and community spaces may also support other vulnerable people in the Greater Toronto and Hamilton Area.

Building Schools and Child Care Spaces

The government is continuing to address critical needs in growing areas of the province to provide students with modern learning spaces and help future generations learn. This is why Ontario is investing over $30 billion over the next 10 years, including approximately $23 billion in capital grants, to support new and redeveloped schools and child care projects. These investments will provide students with a foundation that will help set them up for success.

In addition, as part of the government’s ongoing efforts to improve and modernize existing schools, Ontario is investing close to $2 billion for the 2025–26 school year to repair and maintain schools, which will foster safe, healthy, accessible and supportive learning environments.

Table 1.2

School Projects Opening for the 2025–26 School Year

Northern

- An addition to HM Robbins Public Elementary School in Sault Ste. Marie, with 26 more student spaces and 64 more licensed child care spaces.

- École élémentaire catholique Notre-Place in Sudbury, which serves 567 students and includes 88 licensed child care spaces

Eastern

- École élémentaire publique Des Visionnaires in Ottawa, which serves 475 students and includes 49 licensed child care spaces.

- Riverside South Public Secondary School in Ottawa, which serves 1,516 students and includes 39 licensed child care spaces.

- An addition to Murray Centennial Public Elementary School in Trenton, with 170 more student spaces.

Southwestern

- A new joint Catholic and public elementary school in Caledonia, which serves 746 students.

- Centre Wellington Public Elementary School in Fergus, which serves 328 students.

- An addition to Queen Elizabeth Public Elementary School in Leamington, with 78 more student spaces and 73 more licensed child care spaces.

- Northwest London Public Elementary School in London, which serves 802 students and includes 88 licensed child care spaces.

- Thundering Heights Elementary School in Niagara Falls, which serves 608 students and includes 49 licensed child care spaces.

Central

- Red Cedar Public School in Brampton, which serves 850 students and includes 73 licensed child care spaces.

- Oro-Medonte Public Elementary School in Oro-Medonte, which serves 570 students.

- Stouffville Public Elementary School in Stouffville, which serves 638 students.

- Bloor Collegiate Institute in Toronto, which serves 924 students.

Source: Ontario Ministry of Education.

Table 1.3

Continuing to Get Shovels in the Ground to Build More Schools

Northern

- A new joint French and English elementary and secondary school in Blind River, which will serve 72 French-language students, 381 English-language students and include 64 licensed child care spaces.

- A new English public elementary and secondary school in Rainy River, which will serve 311 students and include 39 licensed child care spaces

Eastern

- An addition to St. Joseph Catholic School in Belleville, which will serve 334 students and include 49 licensed child care spaces.

- An addition to J.J. O’Neill Catholic School in Greater Napanee, with 331 student spaces and 49 licensed child care spaces.

- An addition to École élémentaire catholique Saint-Viateur in Limoges, with 115 more student spaces.

- A new English Catholic elementary school in Loyalist, which will serve 449 students and include 49 licensed child care spaces.

- An addition to St. Joseph’s Catholic High School in Renfrew, with 434 student spaces and 73 more licensed child care spaces.

Southwestern

- A new joint English public and Catholic elementary school in Haldimand, which will serve 746 students and include 49 licensed child care spaces.

- A new English Catholic elementary school in Kitchener, which will serve 527 students and include 88 licensed child care spaces.

- An addition to Northwood Public Elementary School in Windsor, with 184 more student spaces.

- An addition to Errol Village Public Elementary School in Camlachie, with 46 more student spaces and 49 more licensed child care spaces.

- A new English public elementary school in Woodstock, which will serve 856 students and include 88 licensed child care spaces.

Central

- A new English public elementary school in East Gwillimbury, which will serve 638 students and include 39 licensed child care spaces.

- A new English public secondary school in Oshawa, which will serve 1,387 students.

- A new English public elementary school in Pickering, which will serve 634 students and include 73 licensed child care spaces.

- A new English Catholic secondary school in Toronto, which will serve 1,300 students.

- A new English Catholic elementary school in Toronto, which will serve 350 students and include 49 licensed child care spaces.

Source: Ontario Ministry of Education.

Modern Alcohol Marketplace: Taxes, Mark-Ups and Fees on Alcoholic Beverages

The Ontario government has delivered on its commitment to increase choice and convenience for Ontario consumers through the largest expansion of Ontario’s alcohol marketplace since the end of Prohibition, almost 100 years ago. Today, customers across Ontario can conveniently shop in over 5,000 convenience stores and over 900 grocery stores, providing businesses with more opportunities, and with more Ontario products on the shelves than ever before.

As part of the continued modernization of Ontario’s alcohol marketplace, the government is moving forward with the first phase of actions related to the review of taxes, mark-ups and fees, and will continue to engage on the development of a new wholesale pricing model, as well as exploring a progressive alcohol tax and mark-up system. The government is committed to continuing to promote and prioritize small producers, including Ontario‐made products.

As part of the first phase of actions, Ontario will be implementing several changes in the near term to foster a more dynamic and competitive alcohol marketplace while creating conditions to support affordability for consumers. These actions represent support of approximately $100 million in 2025–26 and approximately $155 million in 2026–27, including:

- A 50 per cent cut to the spirits basic tax rate at on-site distillery retail stores. This will support Ontario distillers and local economic development by bringing the tax rates at Ontario distillers’ on-site retail stores into closer alignment with similar on-site retail channels for other alcohol categories;

- Supporting the competitiveness of smaller brewers with a 50 per cent reduction of the microbrewer basic tax and Liquor Control Board of Ontario (LCBO) mark-up rates, while making targeted changes on the use of contract beer manufacturers, and technical amendments for increased flexibility and efficiency for microbrewers;

- Modernizing the mark-up treatment of cider with an approximately 47 per cent cut to the LCBO basic mark-up rate to bring its rate closer in line with microbrewer basic mark-up rate to support craft cideries and apple growers;

- Streamlining and reducing the LCBO mark-up rates for spirit and wine-based ready-to-drink (RTD) beverages, to provide between 21 per cent to 50 per cent in rate cuts, as a first step in standardizing the mark‑up treatment of this popular and fast-growing alcohol category by bringing the RTD rates closer in line with the current rates for beer and malt-based RTDs; and

- Introducing a regulation framework under which the government would create a new “refreshment beverages” category to modernize and standardize the treatment of the RTD beverage alcohol category and to streamline the tax and mark-up rates for these products.

In addition, the government will continue to develop a new wholesale pricing model, expected to be introduced in 2026. It is intended that the new pricing system will have a framework that applies applicable taxes, mark-ups and fees to the producer set price.

The government also intends to explore targeted enhancements to the LCBO Direct Delivery Program, such as for 100 per cent Ontario non-VQA wine and the possible inclusion of other alcohol product categories. As well, the government is exploring options to enhance the LCBO Supplying Source Program, to support Ontario’s alcohol sector and provide more choice for coordinating the fulfilment and distribution of their products.

These initiatives build on the government’s recent actions to support businesses and create the conditions to keep costs down for consumers, while enabling a competitive, responsible, modernized alcohol marketplace. These recent actions include:

- Increasing the LCBO’s wholesale discount for bars, restaurants, convenience stores and LCBO Convenience Outlets from 10 per cent to 15 per cent on beer, wine, cider, spirits, and RTD beverages;

- Stopping a scheduled 4.4 per cent increase to the cost-of-service fee applied to beer sold through the LCBO, to provide support to businesses and beer producers; and

- Ending minimum retail prices for all spirits products for retail sale to give spirits suppliers greater pricing flexibility.

Together, these measures represent more than $200 million annually in support to businesses and consumers, and will continue to protect Ontario workers, jobs, and the economy in the province’s expanded alcohol marketplace, while improving consumer choice and convenience, affordability, and strengthening domestic supply chains.

As a result of the support measures and other factors, including the impact of U.S. tariffs and changes in consumption trends, LCBO net income is projected to be $1,851 million and $2,361 million in 2025–26 and 2026–27, respectively. By 2027–28, the LCBO’s net income is projected to grow to more than $2.4 billion, driven by its expanded role as a wholesaler in the modernized alcohol marketplace, in addition to its continued role as a retailer, maintaining the LCBO’s strong role in the expanded marketplace.

Consulting on Preferred Provider Networks in Ontario’s Employer-Sponsored Drug Program Sector

Ontario is committed to ensuring that its residents have consistent and affordable access to medicine. Last year, the government’s extensive consultation on the role of Preferred Provider Networks (PPNs) in employer-sponsored drug programs sparked tremendous interest among stakeholders. Building on this momentum, the government is launching a second consultation to explore innovative policy options inspired by the initial findings, including considering the introduction of new Any-Able-and-Willing-Provider legislation, which would enable any eligible pharmacy to join PPNs. The government is dedicated to collaborating closely with stakeholders to thoroughly evaluate all potential policies before determining next steps.

Protecting Consumers in the Life and Health Insurance Sector

As committed to in the 2024 Ontario Economic Outlook and Fiscal Review, the government has created a licensing framework under the Insurance Act for life and accident and sickness managing general agents to better protect Ontario consumers.

The Financial Services Regulatory Authority of Ontario (FSRA) is actively consulting on the associated rule, to support a June 1, 2026, launch date for the framework.

Providing Greater Choice and Convenience to Consumers When Buying Auto Insurance

As announced in the 2024 Ontario Economic Outlook and Fiscal Review, the government is working towards enhancing consumer choice when purchasing auto insurance. The government has completed regulatory changes to make statutory accident benefits other than medical, rehabilitation, and attendant care optional for consumers to purchase, and to make auto insurance pay for motor vehicle accident injuries before extended health care plans.

The government is collaborating with FSRA and stakeholders to support a smooth transition on July 1, 2026.

The government is also advancing its commitment to broaden FSRA’s Test and Learn Environment (TLE) and has made regulatory changes to pilot the sale of insurance at automotive dealerships. This initiative would offer consumers more options and convenience by enabling insurance purchases at the point of sale and foster more competition within the industry. Under the TLE, FSRA would develop and oversee the scope of this pilot project, including any necessary consumer protection safeguards.

Chart Descriptions

Chart 1.8: Illustration of Proposed Ontario Fertility Treatment Tax Credit

This bar chart shows two examples of a patient, with $85,000 of net income, undergoing fertility treatment in Ontario in 2025. In the first example, the patient pays $20,000 in 2025 for fertility treatment in Ontario. In 2026, after filing their 2025 tax return, they receive $880 from the Ontario Medical Expense Tax Credit and $2,620 from the Federal Medical Expense Tax Credit, with a remaining out-of-pocket cost of $16,500.

In the second example, the patient pays $20,000 in 2025 for fertility treatment in Ontario. In 2026, after filing their 2025 tax return, they receive $5,000 from the Ontario Fertility Treatment Tax Credit, $880 from the Ontario Medical Expense Tax Credit, and $2,620 from the Federal Medical Expense Tax Credit, with a remaining out-of-pocket cost of $11,500.

Source: Ontario Ministry of Finance.