The government recognizes the financial challenges faced by many people in Ontario, particularly given recent economic pressures and uncertainty around tariffs driving up prices. To put more money back in people’s pockets, the government is providing direct financial relief to families and individuals, saving commuters money by removing tolls, making public transit more affordable through One Fare, and permanently cutting the Gasoline Tax and Fuel Tax.

Supporting Families and Individuals

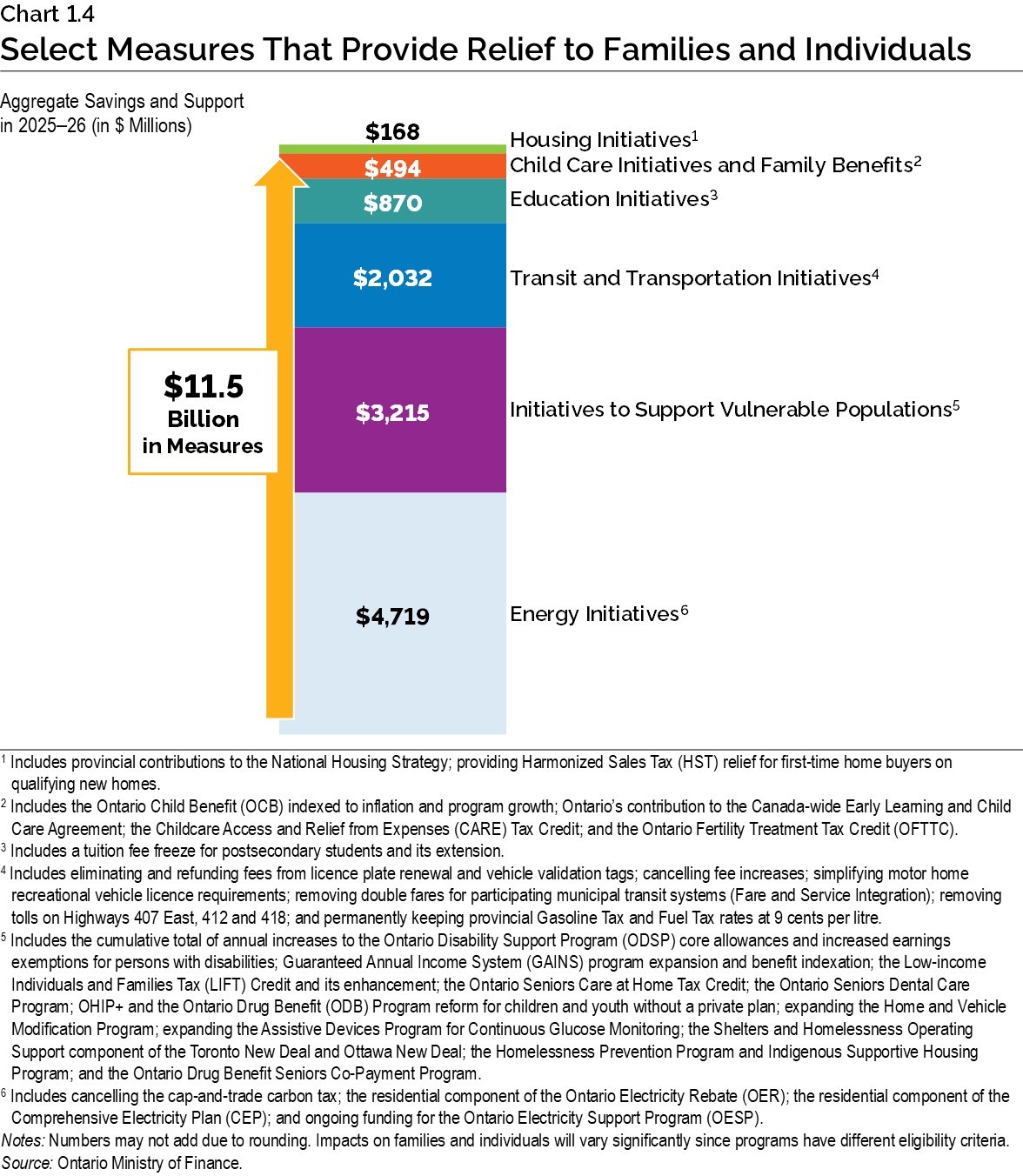

In the 2025–26 fiscal year, the government is committing nearly $11.5 billion in direct relief for individuals and families, as outlined in Chart 1.4.

Providing Harmonized Sales Tax Relief for First-Time Home Buyers on New Homes

In the 2025 Budget, the government called on the federal government to introduce further measures to address housing affordability. Ontario is pleased to see the federal government take steps to provide relief for first-time home buyers by proposing to eliminate the federal portion of the Harmonized Sales Tax (HST) on qualifying newly built or substantially renovated homes.

Based on what the federal government proposed on May 27, 2025, Ontario is taking steps to temporarily remove the full 8 per cent provincial portion of the HST for first-time home buyers on qualifying new homes. This relief would mirror the proposed federal Goods and Services Tax/Harmonized Sales Tax (GST/HST) First-Time Home Buyers Rebate. Ontario will work with the federal government to implement a new provincial rebate subject to passage of federal legislation that would bring the federal rebate into force.

The new Ontario rebate would remove the provincial portion of the HST for first-time home buyers on new homes valued up to $1 million, with the amount of relief reduced for higher-valued new homes. The proposed new federal and provincial rebates combined would remove the full 13 per cent HST for first-time home buyers on qualifying new homes in Ontario.

To qualify for the new Ontario rebate, the purchaser must be acquiring the new home for use as their primary place of residence. The province will work with the federal government to propose that Ontario’s new rebate be available for agreements of purchase and sale entered into on or after May 27, 2025.

Ontario’s existing HST New Housing Rebate provides relief of up to $24,000 and would continue to be available for all other eligible purchasers. This includes purchasers who are not first-time home buyers and purchasers of higher-valued properties that do not qualify for the new rebate.

For a new home valued at $1 million, a first-time home buyer would benefit from $80,000 in combined provincial tax relief as a result of the new and existing Ontario rebates.

See the Annex: Details of Tax Measures and Other Legislative Initiatives for more information.

Permanently Reducing Gasoline Tax and Fuel Tax Rates

To provide ongoing relief to households and businesses in Ontario, the government has permanently cut the Gasoline Tax rate by 5.7 cents per litre and the Fuel (diesel) Tax rate by 5.3 cents per litre.

This measure has already delivered $1.7 billion in gas tax and fuel tax relief to families and individuals since it was first introduced on a temporary basis on July 1, 2022. These cuts are now permanent, effective July 1, 2025, saving households, on average, about $115 per year going forward.

Removing Municipal Speed Cameras to Protect Taxpayers

The Ontario government has introduced legislation that, if passed, would ban the use of municipal automated speed enforcement cameras across the province, ensuring they are no longer used as a source of revenue. To support continued road safety, the province will, instead, establish a new provincial fund to help affected municipalities implement alternative transportation safety measures, including proactive traffic-calming initiatives like speed bumps, roundabouts, raised crosswalks and curb extensions, as well as public education and improved signage, to help slow down drivers. These measures are proactive and proven ways to slow down traffic.

To further support driver awareness in school zones, the province will also introduce requirements for municipalities to install larger and more visible signs in school zones where automated speed enforcement cameras are currently in place.

Removing Highway 407 East Tolls

Effective June 1, 2025, the government permanently removed tolls from the provincially owned Highway 407 East — saving drivers approximately $94 million annually. This initiative will reduce the cost of travel while increasing convenience and choice, and it is expected to save daily commuters an estimated $7,200 annually.

This is in addition to a number of other measures the government has implemented to put money back in drivers’ pockets, including eliminating licence plate renewal fees, removing tolls on Highway 412 and Highway 418, freezing fees for driver’s licences and Ontario Photo Cards, and permanently cutting gasoline and fuel tax rates.

Helping Transit Users Save with One Fare

Ontario’s One Fare program, launched on February 26, 2024, lets transit customers transfer free between the Toronto Transit Commission (TTC) and GO Transit, Brampton Transit, Durham Region Transit, MiWay (Mississauga), Peel TransHelp, and York Region Transit.

One Fare is making cross-boundary travel more affordable and convenient for all transit customers, including students, seniors, and low-income riders, by providing the customer with a free transfer between the TTC and six connecting transit systems.

By eliminating double fares on participating transit systems throughout the Greater Golden Horseshoe through One Fare, the government is saving the daily transit user an average of $1,600 each year. In its first year, the program facilitated over 38 million transfers and resulted in an estimated $123 million in customer savings.

Saving on Electricity Costs

The Ontario Electricity Rebate (OER) continues to ensure electricity bills remain affordable, stable and predictable by providing rate relief for eligible households, small businesses and farms. Through the OER, the government has invested about $2 billion annually, on average, in recent years to keep residential, small business and farm electricity bills low and stable. The government also provides targeted electricity bill relief for eligible low-income households and on-reserve First Nation consumers, as well as eligible rural or remote customers.

The government is also helping families and businesses save money and reduce energy demand by investing $10.9 billion over 12 years in energy efficiency programs, the largest investment in energy efficiency in Canadian history.

Delivering the $200 Ontario Taxpayer Rebate

Last year, in the 2024 Ontario Economic Outlook and Fiscal Review, the government announced that it would provide a $200 taxpayer rebate to each eligible adult and $200 for each eligible child under 18. The government has provided about $3 billion in timely support to almost 15 million eligible people in Ontario. Providing these rebates helped deliver on the government’s commitment to make life more affordable, especially in these times of economic uncertainty. Ontario continues to work to ensure all eligible families receive their taxpayer rebates.

Increasing the Minimum Wage for Workers

As of October 1, 2025, Ontario increased the province’s minimum wage from $17.20 to $17.60 per hour, benefiting over 800,000 workers. This increase, tied to the Ontario Consumer Price Index, reflects the province’s commitment to supporting workers while keeping Ontario competitive in the face of U.S. tariffs.

Maintaining an Effective Property Assessment and Taxation System

The government has received feedback from a broad range of stakeholders, including residential and business property owners, their organizations, municipalities, and the professional property tax and assessment sector, on approaches that could make the property assessment and taxation system more effective. This feedback has informed the implementation of recent initiatives that advance the principles of fairness, business competitiveness, and modernized administration tools.

The review has already resulted in the implementation of several measures, including:

- Affordable Rental Housing — Municipalities now have the authority to reduce municipal tax rates on affordable rental housing beginning in 2026.

- Student Housing — Legislative amendments have been implemented that ensure consistent property tax treatment for university‐operated student housing. In addition, the government continues to review options to support student housing solutions at Ontario universities.

- Information Sharing >— Municipalities can now use Municipal Property Assessment Corporation (MPAC) data more broadly to strengthen planning, and MPAC now has the authority to deliver property assessment notices digitally.

The government continues to consider additional initiatives to ensure the property assessment and taxation system is working effectively for Ontario businesses and families.

Chart Descriptions

Chart 1.4: Select Measures That Provide Relief to Families and Individuals

This chart illustrates selected measures that provide relief for Ontario families and individuals in 2025–26. Government actions would total $11.5 billion for families and individuals in 2025–26. This includes housing initiatives ($168 million), child care initiatives and family benefits ($494 million), education initiatives ($870 million), transit and transportation initiatives ($2,032 million), initiatives to support vulnerable populations ($3,215 million), and energy initiatives ($4,719 million).

Housing initiatives include provincial contributions to the National Housing Strategy and providing Harmonized Sales Tax (HST) relief for first-time home buyers on qualifying new homes. Child care initiatives and family benefits include the Ontario Child Benefit (OCB) indexed to inflation and program growth; Ontario’s contribution to the Canada-wide Early Learning and Child Care Agreement; the Childcare Access and Relief from Expenses (CARE) Tax Credit; and the Ontario Fertility Treatment Tax Credit. Education initiatives include a tuition fee freeze for postsecondary students and its extension. Transit and transportation initiatives include eliminating and refunding fees from licence plate renewal and vehicle validation tags; cancelling fee increases; simplifying motor home recreational vehicle licence requirements; removing double fares for participating municipal transit systems (Fare and Service Integration); removing tolls on Highways 407 East, 412 and 418; and permanently keeping provincial Gasoline Tax and Fuel Tax rates at 9 cents per litre. Initiatives to support vulnerable populations include the cumulative total of annual increases to the Ontario Disability Support Program (ODSP) core allowances and increased earnings exemptions for persons with disabilities; Guaranteed Annual Income System (GAINS) program expansion and benefit indexation; the Low-income Individuals and Families Tax (LIFT) Credit and its enhancement; the Ontario Seniors Care at Home Tax Credit; the Ontario Seniors Dental Care Program; OHIP+ and the Ontario Drug Benefit (ODB) Program reform for children and youth without a private plan; expanding the Home and Vehicle Modification Program; expanding the Assistive Devices Program for Continuous Glucose Monitoring; the Shelters and Homelessness Operating Support component of the Toronto New Deal and Ottawa New Deal; the Homelessness Prevention Program and Indigenous Supportive Housing Program; and the Ontario Drug Benefit Seniors Co-Payment Program. Energy initiatives include cancelling the cap-and-trade carbon tax; the residential component of the Ontario Electricity Rebate (OER); the residential component of the Comprehensive Electricity Plan (CEP); and ongoing funding for the Ontario Electricity Support Program (OESP).

Notes: Numbers may not add due to rounding. Impacts on families and individuals will vary significantly since programs have different eligibility criteria.

Source: Ontario Ministry of Finance.