The impacts of U.S. tariffs on the province’s economy and continued trade threats have made it clear that Ontario cannot solely rely on its trading relationship with the United States for future growth. The government is building a more competitive, more resilient, and more self-reliant economy to help ensure that Ontario is ready to meet the challenges ahead.

The government is fortifying Ontario’s economic resilience by supporting investments and innovation in manufacturing, the auto sector, critical minerals, nuclear energy, and other high-growth industries such as life sciences. Accelerating the creation of a made-in-Ontario critical minerals supply chain will help ensure resources in the North, including those in the Ring of Fire, are available for manufacturers domestically and across the world. This will help businesses seize new opportunities, including those aligned with national priorities, such as nation-building projects and defence. In addition, the government is continuing to invest in its energy capacity, including large-scale nuclear and leading the G7 to build the first of four small modular reactors (SMRs) at the Darlington nuclear site to help meet the province’s future energy needs. Ontario’s leadership in removing interprovincial barriers to the free movement of goods and labour is also fostering job creation and investment attraction and strengthening economic integration across Canada.

To further support job-creating investments and help unleash the full potential of Ontario’s economy, the government is taking action to reduce business costs, cut red tape, and speed up and simplify approval processes for investment projects. The government has proposed to create Special Economic Zones, which would enable new investments through expedited approvals for projects of critical importance to the province’s economy and security. In addition, the new One Project, One Process framework for advanced exploration and mine development projects will streamline approvals into one process and reduce review times by at least 50 per cent. The proposed Building a More Competitive Economy Act, 2025 and related initiatives also include measures to advance labour mobility and centralize how businesses apply for and monitor permit approvals.

A key part in making Ontario’s economy stronger and more resilient is raising Ontario’s economic potential in ways that help each worker in Ontario make more and better products, leading to better living standards and well-being through bigger paycheques, lower prices and enhanced competitiveness. The government is working to address the challenge of productivity growth by making significant investments in infrastructure, skills development and innovation. Meeting this challenge requires a strategic, concerted and forward-looking effort. Ontario is encouraging businesses to step up and help shape Ontario’s future. To help companies invest in technology, attract high-quality jobs, scale up operations, and drive innovation, the province offers a wide range of programs such as the Ontario Made Manufacturing Investment Tax Credit (OMMITC) and the Invest Ontario Fund. Together, the government and industry have the opportunity to unlock Ontario’s full economic potential and to help secure its long-lasting prosperity.

Powering Ontario’s Affordable Energy Future

In June 2025, the Ontario government released Energy for Generations, the province’s first-ever integrated energy plan — a comprehensive roadmap that brings together electricity, natural gas, hydrogen and other energy sources under a single coordinated strategy to meet future energy needs.

The province is making record investments in energy infrastructure to build a more self-reliant economy, protecting workers in engineering, science, construction and other skilled trades by supporting economic growth and providing job opportunities during a time of economic uncertainty.

The province is also taking action to prioritize electricity investments as a result of increasing demand that supports the province’s economic interests, including those that create high-quality jobs, assist in domestic data hosting and strengthen Ontario’s position in the digital economy. This Canada-first plan will prioritize approvals for data centres that deliver measurable benefits to both local communities and to the province’s long-term competitiveness. This will include good-paying jobs for the people of Ontario, securing local data storage and creating a stronger, more competitive economy.

Positioning Ontario as a Global Leader in Nuclear

Ontario is championing nuclear expansion and is leveraging its nuclear advantage to advance opportunities at home and globally. As part of Ontario’s ambitious plan to expand nuclear energy generation, the government is advancing early‑stage planning for new large-scale nuclear energy generation, both at the Bruce nuclear site in Bruce County and at Ontario Power Generation’s (OPG) Wesleyville site in Port Hope. This also includes leading the G7 in building the first of four SMRs at the existing Darlington nuclear site, considering OPG’s plan to proceed with the next steps towards refurbishing four units at the Pickering Nuclear Generating Station, and supporting the refurbishment of units at the Darlington and Bruce Nuclear Generating Stations.

Together, these projects are expected to provide economic benefits and support job creation.

- According to the Conference Board of Canada, the potential nuclear development in Port Hope would contribute $235 billion to Ontario’s gross domestic product (GDP) over an estimated 95‑year project life and support 10,500 jobs across Ontario, including 1,700 new, good-paying jobs in Port Hope.

- The first of four SMRs at the Darlington nuclear site will produce enough reliable, affordable and clean electricity to power the equivalent of 300,000 homes, with construction of the four units creating up to 18,000 Canadian jobs while injecting $500 million, on average, annually into Ontario’s economy. The construction, operation and maintenance of the four units will add $38.5 billion to Canada’s GDP over the next 65 years.

- The Conference Board of Canada projects the full Pickering refurbishment project would create 11,000 jobs per year while contributing $19.4 billion to Ontario’s GDP over 11 years.

Overall, Ontario’s nuclear refurbishment and build-out plan is expected to contribute about $160 billion to Canada’s GDP during construction and $630 billion during operations, with close to 80,000 jobs created during construction and another 64,000 jobs during operations.

Leveraging Hydrogen to Power Jobs, Growth and Energy Security

In March 2025, Ontario announced a new $30 million round of the Hydrogen Innovation Fund to support the integration of low-carbon hydrogen into the electricity grid and the broader use of hydrogen, such as in transportation and heavy industry. Ontario has asked the Independent Electricity System Operator (IESO) to provide recommendations for a hydrogen interruptible rate pilot that could offer hydrogen producers discounted electricity rates in exchange for reducing consumption during peak demand periods. The province is also exploring options to regulate hydrogen pipelines.

Accelerating Electricity Transmission Expansion

Ontario is making one of the largest electricity transmission expansions in Ontario’s modern history. This includes building two new electricity transmission lines from Bowmanville to the Greater Toronto Area (GTA) and from Windsor to Lakeshore. The province is also upgrading two major lines between Orangeville and Barrie, and between Manby and Riverside Junction, in Toronto.

In September 2025, the Ontario government broke ground on the St. Clair electricity transmission line, a new 64-kilometre electricity transmission line that will connect the County of Lambton and Municipality of Chatham-Kent, while expanding the Chatham Switching Station and Lambton Transformer Station (TS) and converting the Wallaceburg TS to 230 kilovolts (kV) by 2028.

The Ontario government is also working with the City of Toronto to bring a third electricity transmission line into downtown Toronto to meet its electricity demand, which is expected to roughly double by 2050.

Other specific projects include:

- Chatham to Lakeshore Line: A new 230 kV line from Chatham Switching Station (Chatham) to Lakeshore TS (Lakeshore) completed in January 2025 — one year ahead of schedule.

- Longwood to Lakeshore Phase 1: A new 500 kV line from Longwood TS (Strathroy‑Caradoc) to Lakeshore TS (Lakeshore), expected to be in service in 2030.

- Longwood to Lakeshore Phase 2: A possible second 500 kV line from Longwood TS (Strathroy‑Caradoc) to Lakeshore TS (Lakeshore), identified for early development.

- Wawa to Porcupine Transmission Line: A new 230 kV line that is being built to 500 kV standards, between Wawa TS (south of Wawa) and Porcupine TS (Timmins), expected to be in service by 2030.

- North Shore Link Project: A new 230 kV line between Mississagi TS (Sault Ste. Marie) and Third Line TS (west of Sudbury), expected to be in service by 2029.

- Northeast Power Line: A new 500 kV line between Mississagi TS (west of Sudbury) and Hanmer TS (Greater Sudbury area), expected to be in service by 2029.

- Durham to Kawartha Power Line: A new 230 kV line between Dobbin TS (Peterborough) and Clarington TS (Oshawa), expected to be in service in 2029.

Creating Special Economic Zones for Strategically Important Projects

As part of the government’s plan to protect Ontario and build a more resilient and self-reliant economy, the government is proposing to create Special Economic Zones that would help create a predictable and stable environment for investment and growth. Ontario enacted the Special Economic Zones Act, 2025, to support the advancement of job-creating investments by enabling expedited approvals for projects of critical importance to the province’s economy and security. This would help these projects start and advance faster, while ensuring that stringent safeguards and standards for environmental protection are in place, and that the province’s duty to consult with Indigenous communities, as it may arise, is fulfilled.

In October 2025, the government proposed a draft regulation setting out criteria for designating Special Economic Zones, projects, and trusted proponents. As part of consultations on the proposed draft regulation, Ontario has undertaken outreach to over 130 Indigenous communities on the development of a new regulatory framework. The draft regulation is open for public consultation until November 16, 2025, with an aim to finalize the proposed regulation and criteria by the end of the year. The government will continue to consult with Indigenous communities in Ontario to support and advance economic reconciliation through development and will continue to receive and consider feedback on the proposed regulation.

Unlocking Ontario’s Vast Critical Mineral Resources

Ontario is one of the most mineral-rich areas in the world and among the top 10 jurisdictions for mineral exploration. Critical minerals, such as nickel, copper, lithium, cobalt, graphite and rare earth elements, are the foundation upon which modern technology is built. Growing demand is increasing global requirements for critical minerals in strategic industries, including in the defence, aerospace, automotive and energy sectors. The broader mining sector in Ontario contributes approximately $14.4 billion annually to the province’s GDP and supports around 74,000 direct and indirect good‑paying jobs.

In March 2022, the government released the Critical Minerals Strategy to support mineral exploration and development to attract new investment, create jobs and build economic development opportunities for Indigenous partners. The strategy is helping secure Ontario’s position as a global leader of responsibly sourced critical minerals and enhancing supply chain connections between industries, resources and workers in Northern Ontario and the manufacturing sector in Southern Ontario. These measures will help unleash the economic potential of Ontario’s mineral resources and meet international demand as a reliable supplier and trading partner.

Simplifying Mine Permitting: One Project, One Process

Red tape and duplicative processes have held back major infrastructure, mining and resource development projects in the province. Currently, the approval process for an advanced exploration or major mining project is handled through separate reviews across multiple different provincial ministries. The permitting and authorization process for mining projects also requires multiple approvals, including by different levels of government, often leading to a slow and challenging process, meaning it could take up to 15 years to open a mine in Ontario. These delays hold back investment, job creation and access to critical and strategic minerals, especially in high-potential areas such as the Ring of Fire.

In October 2025, the government launched the One Project, One Process framework for advanced exploration and mine development projects. This allows mining companies to apply to have these projects designated under the framework. The framework will streamline government approvals into one process, coordinated by a dedicated team, reducing government review times by at least 50 per cent and maintaining robust environmental standards and Ontario’s duty to consult with Indigenous communities.

By simplifying the permitting process, Ontario is providing the certainty and predictability needed to open new mines faster, strengthening its position as a top destination for mining investment. This will make it easier for companies to plan, hire and execute projects in Northern communities, meaning more well-paying jobs across the province, stronger local supply chains and increased overall economic activity.

Capturing the Economic Potential of the Ring of Fire

Rich in minerals such as nickel, copper, platinum group elements and chromite, the Ring of Fire covers approximately 8,000 square kilometres and represents one of the most promising mineral development opportunities in the world. As part of the plan to unlock the opportunities and the economic potential of this region, in partnership with First Nations, the government continues to support the development of key infrastructure, including all-season, dependable road access and connections to provincial highways.

Ontario has immense critical minerals potential. The potential in the Ring of Fire alone could create more than 70,000 jobs in industries across Ontario and generate approximately $22 billion dollars in gross output for Ontario’s economy over 30 years to help fund schools, hospitals and public services.

In September 2025, Ontario announced an investment of $61.8 million in Geraldton’s Main Street Rehabilitation Project, a critical road infrastructure project in Greenstone that will be the gateway to the Ring of Fire. The project will fortify connections between Highway 11 at the south end to Highway 584 at the north and the Trans-Canada Highway.

The Main Street Rehabilitation Project is part of the government’s strategy to unlock the economic potential of the Ring of Fire region, while helping to ensure First Nation and Northern communities benefit from critical mineral development through partnerships that offer economic opportunities spanning generations.

Improved road access between Northern communities and the provincial highway network will also help people access goods and services, including education, health care and housing, and lay the groundwork for future growth in the region. Ontario is consulting with potentially impacted Indigenous communities in relation to this project and will continue working in partnership with First Nation communities in Northern Ontario to support and advance economic development aligned with Ontario’s Critical Minerals Strategy.

In partnership with First Nations, the government is advancing all-season road projects, which is a critical step to unlocking the opportunities and benefits of the Ring of Fire region. When complete, all-season roads will improve the access to goods and services mentioned above and help connect critical minerals resources in the region with manufacturing hubs in Southern Ontario.

Supporting a Made-in-Ontario Critical Minerals Supply Chain

The government is also working to attract historic investments to help ensure that minerals mined in Ontario will be processed in Ontario, by Ontario workers, instead of being shipped to other jurisdictions. In May 2025, Ontario announced an investment of $500 million to create the Critical Minerals Processing Fund (CMPF) to support projects that accelerate the province’s critical minerals processing capacity. When launched, the fund will help strengthen Ontario’s existing mineral processing facilities, as well as support the construction of new processing facilities in the province.

The CMPF will help Ontario meet international demand for critical minerals as a stable, reliable trading partner. Processing critical minerals mined in Ontario will also help protect local jobs in key manufacturing sectors like the auto industry, by connecting resources from Northern Ontario with state-of-the-art production facilities in Southern Ontario.

Continuing to Invest in Ontario’s Junior Mining Companies and Exploration

A more self-reliant mining sector and made-in-Ontario critical minerals supply chain requires the discovery of new mineral deposits. Early exploration is often high-risk, with long odds of success — only about a one in 1,000 chance of exploration projects becoming a mine. The uncertainty, combined with the need to operate in remote regions and challenging terrain, makes it difficult for companies to secure the necessary investment needed to move projects forward.

The Ontario Junior Exploration Program (OJEP) helps junior mining companies find the mines of the future by covering eligible costs for mineral exploration and development. In July 2025, the government announced an investment of up to $10 million for OJEP in 2025 to support early-stage mineral exploration. The investment included the introduction of two new features under the program: a new dedicated Prospector Stream and Enhanced Indigenous Participation Funding to support Indigenous employment and business opportunities.

This investment builds on $35 million previously announced, which included $23 million to support exploration of all types of minerals and $12 million to support the discovery and development of critical minerals to help build an integrated supply chain for new technologies. The most recent round of OJEP funding is helping 80 junior mining companies finance early exploration projects, with 68 focused on critical minerals.

Supporting Innovation in the Critical Minerals Supply Chain

The government launched the Critical Minerals Innovation Fund (CMIF) in November 2022, in support of the Critical Minerals Strategy. The CMIF supports projects that involve research, development and commercialization of innovative technologies, techniques, processes and solutions for critical minerals.

In July 2025, the government announced an additional $7 million to launch a new intake of the CMIF to help further drive investment in critical minerals exploration, mining development, production and processing of domestically sourced critical minerals. This investment builds on the $20 million invested through the CMIF since its launch, supporting more than 29 Ontario-based projects. Funding supports the government’s efforts to unleash the economic potential of critical minerals, helps build more secure supply chains and reduces reliance on foreign sources of critical minerals in the face of economic uncertainty from U.S. tariffs.

Strengthening Indigenous Partnerships

Indigenous Opportunities Financing Program

As part of Ontario’s commitment to strengthen Indigenous partnerships, foster economic growth and support Indigenous participation in more sectors, the Indigenous Opportunities Financing Program (IOFP) has successfully transitioned from the Ontario Financing Authority to the Building Ontario Fund (BOF) with its enhanced $3 billion funding envelope in loan guarantees.

In July 2025, Caldwell First Nation announced its equity investment in the Chatham to Lakeshore Transmission Line. This investment, which was supported by a loan guarantee from the IOFP, illustrates the program’s ongoing impact in advancing Indigenous economic empowerment, infrastructure partnerships, and Ontario’s commitment to reconciliation and economic inclusion.

In the coming months, the BOF will begin engaging First Nations, Métis, and Inuit communities and organizations, as well as infrastructure financing experts, on the expansion of the IOFP to additional priority sectors, including electricity, critical minerals, resource development, and related infrastructure components. The engagements will inform the design of the enhanced program’s parameters and investment tools, leading to more pathways to Indigenous ownership of infrastructure projects.

Increasing the Indigenous Energy Support Program

As announced in August 2025, the Ontario government is increasing the Indigenous Energy Support Program (IESP) by $10 million, bringing the province’s total annual investment in the IESP to $25 million. This year’s IESP includes a new funding stream of up to $500,000 to help diesel-reliant Indigenous communities build electricity transmission and generation infrastructure. IESP projects create good-paying jobs, attract investment, promote economic growth and ensure Indigenous communities have the support they need to be leaders in the electricity sector.

Making Ontario More Competitive Than Ever

The government continues to work to unleash the province’s enormous economic potential. To help achieve this, it is working to make Ontario more competitive than ever before as a location to invest, do business and create jobs.

Protecting and Strengthening Ontario by Cutting Red Tape

Since 2018, Ontario has taken over 650 actions to reduce regulatory burdens, saving people, businesses, not-for-profit organizations, and the broader public sector over $1.2 billion in annualized compliance costs and delivering 1.8 million hours in annual savings.

As part of these actions, the government introduced the Protect Ontario by Cutting Red Tape Act, 2025 in June 2025. The legislation is a key part of the Spring 2025 Red Tape Reduction Package that includes over 50 new changes to improve services, keep costs down, and protect Ontario’s economy. Altogether, these latest changes in the Spring 2025 Red Tape Reduction Package are expected to save Ontario businesses and individuals $5.8 million and over 256,000 hours every year.

In addition, in October 2025, the government introduced the Building a More Competitive Economy Act, 2025, and related initiatives. If passed, the Act and these measures would support the government’s plan to protect Ontario by putting in place conditions for long-term stability, resiliency and prosperity, while supporting businesses, workers, and communities.

The Act and related measures include 11 initiatives to improve labour mobility and streamline government processes for permits and approvals, for example:

- Supporting economic growth by reviewing all Ontario government economic development-focused permits by 2028, with the goal of eliminating or transforming 35 per cent or more to position the province as the leading G7 jurisdiction for investment, while maintaining robust health, safety and environmental protections.

- Creating a centralized digital permitting system that streamlines how businesses apply for and monitor permits, reducing approval times, enhancing transparency and providing the certainty needed to invest and move projects forward.

- Supporting worker mobility across Canada by expanding “As of Right” provisions for Canadian workers licensed and credentialed in other provinces and territories, particularly health care workers. Also, moving forward with automatic recognition of credentials for doctors and nurses from the rest of Canada.

If passed, the Protect Ontario by Cutting Red Tape Act, 2025 and the Building a More Competitive Economy Act, 2025 would support the province’s goal of making Ontario the most competitive place in the G7 to invest, create jobs, and do business.

Enhancing Competitiveness by Lowering Costs for Businesses

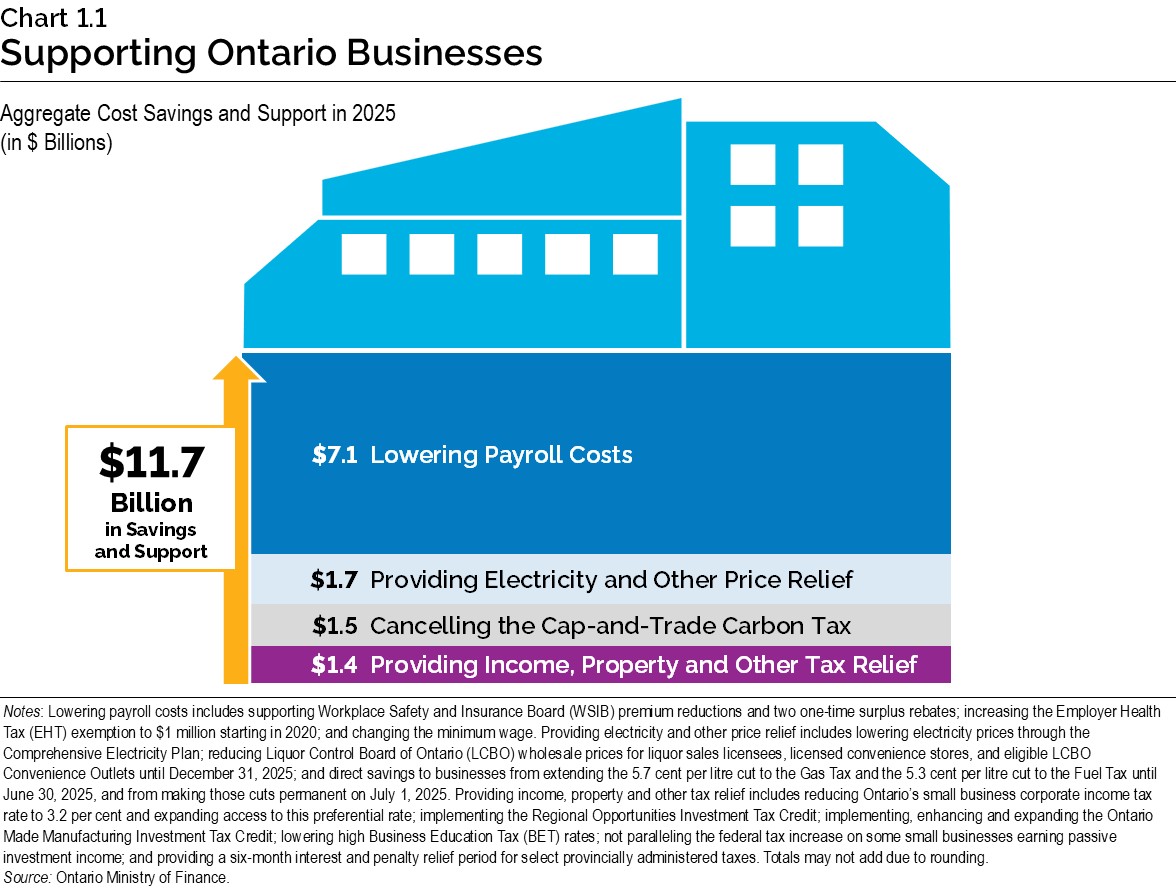

The government has taken significant steps to reduce costs for businesses to help them become more competitive. Through key actions taken since 2018, the government would enable $11.7 billion in estimated cost savings and support for Ontario businesses in 2025, of which $5.6 billion would go to small businesses. Some of these actions include:

- Implementing the Ontario Made Manufacturing Investment Tax Credit, including proposing to temporarily enhance and expand it, to support manufacturing or processing investments in the province;

- Cutting the Gasoline Tax by 5.7 cents per litre and the Fuel Tax by 5.3 cents per litre, to help reduce the cost of gas and fuel for Ontario businesses;

- Supporting the reduction of the WSIB premium rate to the lowest in 50 years. In addition, the WSIB has announced a combined $4 billion worth of one-time rebates in surplus funds for 2025;

- Increasing the Employer Health Tax (EHT) exemption from $490,000 to $1 million. The EHT exemption increase helps businesses by reducing the tax for eligible private‐sector employers;

- Cancelling the cap‐and‐trade carbon tax to remove its cost impact from items such as gasoline, diesel fuel and natural gas;

- Lowering high Business Education Tax (BET) rates in 2021, providing $450 million in annual savings for over 200,000 employers, or 95 per cent of all business properties in Ontario;

- Reducing the small business corporate income tax rate to 3.2 per cent and expanding access to this preferential rate, helping small businesses compete and thrive by lowering their costs;

- Implementing the Regional Opportunities Investment Tax Credit to support businesses that make investments and expand in regions of Ontario that have lagged in employment growth;

- Implementing the Comprehensive Electricity Plan in January 2021, which is lowering electricity costs by an estimated average of 11 to 14 per cent in 2025 for medium‐sized and larger industrial and commercial customers, respectively; and

- Providing a six-month interest and penalty relief period for select provincially administered taxes.

Ontario’s Tax Action Plan

The government is delivering on its plan to protect Ontario workers, businesses and communities from the impacts of U.S. tariffs, and the economic uncertainty they are causing. As part of this work, the government will be developing a multi-year Tax Action Plan to help make Ontario the most competitive jurisdiction in Canada.

Ontario’s Tax Action Plan will build on the government’s actions taken since 2018 to lower costs for businesses, families and individuals. It will also incorporate advice from the government’s comprehensive review of the province’s tax system over the last two years.

Ontario’s Tax Action Plan will focus on updating Ontario’s personal and corporate income taxes to encourage and attract more business investment, improve Ontario’s competitiveness in the G7, and lower costs or provide relief for individuals and families in the years and decades to come.

The province is also calling on the federal government to do its part to improve Canada’s competitiveness, build a more resilient and self-reliant economy, increase productivity, and bring costs down for people and businesses across Canada.

An update on the Tax Action Plan will be provided in the 2026 Ontario Budget.

Positioning Ontario’s Defence Industry for Growth

As the federal government prepares to increase its defence spending commitment to 5 per cent of annual GDP by 2035 to meet Canada’s NATO pledge, Ontario encourages the federal government to make additional defence related capital investments in the province. Federal investments can leverage Ontario’s talent pool and comparative advantages in key defence sectors to meet its national security objectives. The government is committed to supporting new and existing Ontario businesses that are positioned to deliver on the federal procurement needs associated with national defence.

The Ontario government will build on recent measures supporting national defence and explore additional ways to support provincial industries looking to produce and provide made-in-Ontario goods and technologies for the defence sector and to expand export opportunities. This includes the expansion and enhancement of the Ontario Made Manufacturing Investment Tax Credit in the 2025 Budget to support manufacturers, including those in defence-focused industries.

Further, Ontario is exploring the development of other potential new supports, including tax incentives, to spur greater investment by industry in critical technologies that underpin modern defence and resilience — which could include artificial intelligence, cybersecurity, autonomous systems, and advanced sensing. These technologies are not only vital for national security but are also drivers of high-quality jobs and long-term economic growth.

Ontario will also engage the federal government in support of areas critical to defence. This includes wider national security objectives such as energy generation and transmission, cybersecurity, as well as investment in resilient trade infrastructure. The government will also look for opportunities to enhance the province’s investment climate, for example, by strengthening supply chains and adopting innovative and flexible procurement models that prioritize Ontario‑made equipment and raw materials.

Enhancing the Competitiveness of Ontario’s Shipbuilding Industry

The province is investing $215 million to support the shipbuilding industry and the broader marine sector, starting with the establishment of the $15 million Ontario Shipbuilding Grant Program (OSGP). The OSGP has accepted applications to fund projects that support skills training, infrastructure improvements and the purchase of machinery and equipment to support a future‑ready shipbuilding sector.

These investments will enhance Ontario’s economic competitiveness and development throughout the province, which is key to unlocking potential in the shipbuilding industry. This will ensure Ontario is positioned to support Canada’s National Shipbuilding Strategy and help Ontario manufacturing businesses and workers, in the face of U.S. tariffs and economic uncertainty.

Investing in National Defence Technologies Through Venture Ontario

As part of the 2025 Ontario Budget, the government announced an additional investment of $90 million in venture capital (VC) funding through Venture Ontario. This includes $50 million to Ontario-based VC funds focused on technologies that support national defence and related technologies such as artificial intelligence and cybersecurity. This investment will support next‑generation technologies, enhance Ontario’s competitiveness and strengthen economic resilience in the face of U.S.-imposed tariffs.

Attracting Investments That Support and Create Manufacturing Jobs

Ontario is capitalizing on emerging manufacturing opportunities as global producers look for reliable supply chains and to secure access to strategic raw materials needed to thrive in a competitive environment. Since 2018, Ontario has attracted nearly $70 billion in investments across key industries, including in manufacturing, life sciences and technology. The government is also supporting manufacturers of made-in-Ontario solutions as they compete for a share of domestic markets and look for opportunities to expand their business globally.

Continuing to Support the Auto Sector

Ontario’s auto sector is highly integrated with the broader North American manufacturing sector. However, the sector is being harmed by U.S. tariffs targeting auto imports from Canada and other countries. As a result, the government is maintaining its strategic investments in support of the sector to further enhance its competitiveness.

The 2025 Ontario Budget committed $73 million over four years, starting in 2025–26, to continue the Ontario Vehicle Innovation Network (OVIN) program. OVIN is helping to solidify Ontario’s position as the leading jurisdiction in advanced automotive technology and smart mobility solutions by supporting regional technology development sites, research and development (R&D) partnerships, and incubator projects for small and medium-sized enterprises (SMEs) in the automotive and mobility sectors. To date, the program has supported over 700 Ontario SMEs, created or retained over 7,000 jobs, and leveraged over $900 million in private-sector investments.

The Budget also announced that Ontario is committing $12 million over the next three years, starting in 2025–26, to continue the Ontario Automotive Modernization Program (O-AMP). This additional investment will support Ontario’s automotive parts suppliers and SMEs to upgrade outdated equipment and adopt new tools and technologies to innovate their product lines and continue to modernize their processes, helping to enhance their competitiveness and resilience. Since its inception in 2019, O-AMP has supported 215 projects, created over 1,000 jobs, retained nearly 16,000 jobs, and leveraged over $59 million in private-sector investment.

The government is maintaining its financial contributions to the development of the electric vehicle and battery industry in Ontario. Since 2020, Ontario has attracted tens of billions of dollars in new investments that will help support and create thousands of jobs. These investments include a $5 billion battery plant in Windsor by NextStar, which could result in 2,500 jobs. The construction phase is completed, and production is expected to begin this year. In addition, construction is underway for PowerCo’s $7 billion battery cell plant in St. Thomas, and the company has announced the start of hiring at the plant, which will employ up to 3,000 workers.

Empowering the Manufacturing Sector to Compete and Thrive in the Economy of Tomorrow

The government is helping to grow the manufacturing sector’s workforce and production capacity. Through strategic investments, Ontario is helping manufacturers secure next-generation production facilities, strengthen domestic supply chains, leverage productivity-enhancing technologies and build a workforce of the future.

Increasing Support for Ontario Manufacturers and Processors

The Ontario Made Manufacturing Investment Tax Credit (OMMITC) provides support to qualifying Canadian-controlled private corporations (CCPCs) that make eligible investments in buildings, machinery and equipment for use in manufacturing or processing in the province. The OMMITC helps businesses lower their costs, innovate, and become more competitive. In the 2025 Budget, the government proposed to temporarily enhance the OMMITC rate from 10 per cent to 15 per cent for CCPCs, and expand the OMMITC by providing access to a 15 per cent non-refundable version of the credit to corporations that are not CCPCs. The government is now introducing detailed legislation to implement the proposed enhancement and expansion of the credit.

Under these proposed changes to the OMMITC, eligible expenditures for corporations that are not CCPCs would align with those eligible under the existing credit. Eligible expenditures for the enhancement and expansion would also need to be made on or after May 15, 2025, and before 2030.

In addition, the government is now proposing to amend the OMMITC eligibility criteria for investments in machinery and equipment given the potential for delay between when the asset is purchased and when it becomes available for use.

Through the proposed changes to the OMMITC, a qualifying corporation could receive a tax credit of up to $3 million per year. This support would increase the competitiveness and resilience of Ontario’s manufacturing sector, helping to protect and create good-paying manufacturing jobs in the wake of U.S. tariffs that are impacting the sector.

Overall, with the proposed changes to the OMMITC, the credit would provide an estimated $2.7 billion in Ontario income tax support from 2023–24 to 2027–28.

See the Annex: Details of Tax Measures and Other Legislative Initiatives for more information.

Strengthening Ontario’s Advanced Manufacturing Sector

In the face of trade disruptions, the government is committed to growing Ontario’s competitiveness in the advanced manufacturing sector through the Advanced Manufacturing and Innovation Competitiveness (AMIC) Stream of the Regional Development Program. The AMIC Stream supports advanced manufacturers across the province by providing financial support and tools to primarily small and medium-sized businesses to invest in equipment, technologies and skills development so they can continue to grow. As announced in 2024, the government is providing an additional $40 million through the AMIC Stream to support advanced manufacturers and improve competitiveness, while strengthening supply chains. As of September 2025, Ontario has announced investments of more than $45 million in 41 companies and organizations through the AMIC Stream since its launch in 2022. This has leveraged $500 million in investments from the industry, creating over 1,000 jobs in communities across the province.

Expanding and Diversifying Trade Opportunities

U.S. tariffs are impacting the prosperity of Ontario firms, deeply integrated supply chains, and the long-standing relationship with the province’s closest trading partner. From this challenge, however, comes the opportunity for Ontario to diversify trade and reach new markets both internationally and interprovincially. The government is working to unlock free trade in Canada and build lasting trade relationships to realize this potential.

Leading the Way to Unlock Free Trade within Canada

Trade with other provinces is a significant contributor to the economy, with the potential to support stronger growth; however, barriers to interprovincial trade have held back growth provincially and nationally. In times of economic uncertainty, Ontario is reducing barriers and taking a leadership role in driving immediate and meaningful action on internal trade.

The government is supporting trade and mobility across Canada through the Protect Ontario Through Free Trade Within Canada Act, 2025. Passed in June 2025, the Act introduced several measures to unlock trade, which included removing all of Ontario’s party-specific exceptions under the Canadian Free Trade Agreement (CFTA), enabling mutual recognition and expanding labour mobility with new, first-in-Canada “As of Right” rules. These measures, along with other measures included in the bill, will help support economic integration across Canada and expand opportunities for Ontario businesses and workers.

For more information, see the section “Protecting Workers by Introducing First-in-Canada Labour Mobility Changes.”

Since April 2025, Ontario has also secured Memoranda of Understanding (MOUs) with 10 provinces and territories to boost internal trade, improve labour mobility and tear down long‑standing barriers to doing business. These MOUs support the efforts to eliminate red tape, cut costs for businesses and open new pathways for skilled workers to move more freely across the country. Signing these is making Ontario a national leader in strengthening interprovincial trade and cooperation.

Ontario is investing an additional $100 million in the Ontario Together Trade Fund (OTTF) to further help small and medium-sized enterprises (SMEs) diversify into new markets and strengthen trade resiliency. This brings total program funding to $150 million over three years, starting in 2025–26. The increased support will enable businesses affected by U.S. tariffs to pivot production, forge new sales partnerships, and expand interprovincial trade.

Advancing Opportunities to Grow Trade Internationally

The government is promoting Ontario-made goods and services to diversify trade to new markets. In October 2025, Ontario completed a mission to the Association of Southeast Asian Nations (ASEAN) following the opening of Ontario’s fourteenth Trade and Investment Office (TIO) in Singapore. TIOs work closely with Canadian federal, provincial/territorial and municipal partners to facilitate investment deals to help expand the province’s SME exports into global markets and raise Ontario’s commercial profile. Since 2018, TIOs have attracted nearly $27.4 billion in investments, creating 15,800 jobs. These offices have also facilitated market access for over 2,180 Ontario firms across several sectors, which reported $334 million in sales.

Supporting Local Businesses and “Buy Ontario”

The government is stepping up to protect Ontario in response to U.S.-imposed tariffs by deploying immediate strategies to boost investment attraction and strengthen the province’s supply chains for long-term growth. Ontario is taking every necessary step to defend the interests of the people of Ontario and protect the economy and jobs. Investments will focus on made-in-Ontario goods and services, leveraging the estimated $30 billion of annual procurement spend, and Ontario’s procurement agency, Supply Ontario.

As part of this strategy, Ontario is proposing to ramp up its “Buy Ontario” program with a “made‑in‑Ontario” vehicle policy that would require the public sector and its agencies to prioritize purchasing vehicles made in Ontario. Through consultation with the municipal, provincial and automotive sectors, the government will develop a vehicle procurement policy that leverages the significant purchasing power of the municipal and provincial sectors.

Ontario is also continuing to reduce barriers and provide companies in the province with greater access to public procurement opportunities with the Building Ontario Businesses Initiative (BOBI). BOBI, which includes the Industrial Regional and Technology Benefit (IRTB), helps Ontario businesses sell more goods and services and create jobs in their local communities. Under BOBI, public-sector buyers either give preference to Ontario businesses for goods and services, or use weighted domestic criteria (such as environmental standards, labour protections, and safety) to level the playing field for Ontario businesses.

Supply Ontario is also sourcing more products and services locally to reduce reliance on global supply chains, ensuring critical goods remain available within the province. To further protect domestic producers, the province has temporarily restricted public-sector procurement from U.S. businesses in response to U.S. tariffs.

Established by the Protect Ontario Through Free Trade Within Canada Act, 2025, this year, Ontario marked the first-ever Buy Ontario, Buy Canadian Day. Observed annually on the last Friday in June, this day encourages the people of Ontario to support local businesses and workers by purchasing Ontario-made or Canadian products through programs like Ontario Made, Vintners Quality Assurance (VQA) wines, Ontario Wood, Destination Ontario and Foodland Ontario.

Through these and other initiatives, Ontario is working with provinces, territories and Canada to strengthen economic resilience and lessen dependence on U.S. trade to keep jobs here and strengthen the province’s economy.

Ontario is exploring options to improve opportunities for the circular recovery and use of aluminum, tin, and other cross-border materials for local manufacturers and users such as non-alcoholic beverage and consumer product packagers, reducing the province’s reliance on U.S. processors, and strengthening the provincial industrial base — helping to protect and grow good manufacturing jobs at home.

Securing High-Impact Investments Through Invest Ontario

As U.S. tariffs continue to take aim at Canada’s economy, the government is strengthening Ontario’s competitiveness and resilience by continuing to attract major investments to the province through Invest Ontario. The investment attraction agency provides investors with one-window access to expertise and tailored services, as well as financial support through the Invest Ontario Fund. In the 2025 Ontario Budget, the government allocated an additional $600 million to the Fund, bringing the Fund total to $1.3 billion. This additional funding will enhance the agency’s ability to respond to the current economic landscape by offering more predictability for investors and helping to ensure Ontario remains a competitive destination for investment and growth. To date, Invest Ontario has announced over $8.2 billion in investments, which are expected to create more than 10,200 good-paying jobs.

Supporting Ontario’s Forest Sector

Forestry and forest products provide many opportunities to support a resilient and self-reliant economy with wood produced from sustainably sourced and renewable provincial Crown forests. Ontario’s forest sector is an important contributor to the province’s economy, generating $21.6 billion in revenue from the sale of manufactured goods and services in 2023 and supporting over 128,000 direct and indirect jobs in 2024. The government released Sustainable Growth: Ontario’s Forest Sector Strategy in 2020 as a plan to create jobs and encourage economic growth in the forest industry, supporting the Indigenous, Northern and rural communities that depend on the sector.The strategy and provincial programs will continue to support the sector in the face of increased U.S. duties on softwood lumber exports, as well as tariffs on timber, lumber and wood products that came into effect in October 2025.

Renewing Calls for Removal of Duties on Softwood Lumber Exports

In July 2025, the U.S. Department of Commerce announced a further increase of the duties on Canadian softwood lumber. This decision is hurting American and Canadian workers, families and communities alike. In 2023, approximately 22.6 per cent of U.S. lumber demand was met by Canadian producers. These duties disrupt industries, drive up costs and put the shared competitiveness of the two countries at risk.

Ontario softwood lumber producers are proud to bring high-quality, sustainably harvested construction materials to market, building communities and driving economic growth on both sides of the border. Ontario continues to call on the United States to lift duties on Canadian softwood lumber exports entirely, for the benefit of thousands of workers and families on both sides of the border.

Encouraging Innovation in Ontario’s Forest Sector

Ontario’s Forest Sector Investment and Innovation Program (FSIIP) encourages businesses to make investments by providing financial support for projects that improve productivity, increase innovation, support market expansion, and strengthen regional economies and supply chains. The FSIIP is helping Ontario’s forestry companies to develop and implement innovative technology and encouraging innovation in products, services and processes to improve competitiveness. In October 2025, Ontario announced over $10 million through the government’s existing FSIIP program to support the forest sector and bring more made-in-Ontario wood products to market.

The FSIIP continues to support the forest sector through two elements. The business projects stream supports capital investment projects put forward by for-profit forestry companies. The collaboration projects stream supports projects brought forward by project partners that may include for-profit forestry companies, industry associations, forestry-related not-for-profits and/or academia that will have a transformative impact on Ontario’s forest sector. To date, the FSIIP has provided over $72 million in funding, leveraging $425 million in new investment to help Ontario forestry companies adopt innovative technologies to stay competitive in the global market.

Investing in Ontario’s Forest Biomass Program

Under the Forest Biomass Action Plan released in 2022, the government is developing the untapped potential of forest biomass to create new opportunities for forest sector growth. The program invests up to $20 million each year in projects to increase wood harvest, create forest sector opportunities and find new uses for wood in collaboration with stakeholders, industry and Indigenous communities. To date, the government has invested over $50 million under the Forest Biomass Program to support more than 55 projects.

Promoting Made-In-Ontario Wood Building

In June 2025, Ontario released the Advanced Wood Construction Action Plan to increase the manufacturing and use of high-quality, made-in-Ontario wood building products. The use of prefabricated and modular wood-based building materials, known as advanced wood construction, will help build more homes faster and create a more resilient forest sector. This will support the government’s plan to protect Ontario, by attracting investment, increasing revenues and providing economic opportunities that create and sustain local jobs.

Strengthening Ontario’s Agri-Food Sector

Protecting Ontario’s local agriculture and food industry is essential to ensuring a strong, self‑sufficient food supply chain. Ontario has a rich and diverse agri-food sector that produces over 200 agricultural commodities. These locally grown products create jobs and economic growth for the province. The people of Ontario have access to local food every day of the year, with 60 per cent of the food produced in Ontario being processed and consumed right in the province.

In November 2022, the government released Grow Ontario: a provincial agri-food strategy to strengthen agri-food supply chains, attract and grow Ontario’s agri-food talent, as well as support the adoption of new technologies and practices that enhance competitiveness.

Enhancing Agri-Food Innovation Through the Sustainable Canadian Agricultural Partnership

The Sustainable Canadian Agricultural Partnership (Sustainable CAP) is a five-year, $3.5 billion investment by federal, provincial and territorial governments to strengthen the competitiveness, innovation and resiliency of Canada’s agriculture, agri-food and agri‐based products sector. This includes $1 billion in federal programs and activities and a $2.5 billion commitment that is cost‑shared 60 per cent federally and 40 per cent between provinces and territories for programs designed and delivered by the provinces and territories.

In July 2025, the governments of Canada and Ontario announced an investment of up to $4.4 million under the Sustainable CAP to help small businesses in the agri-food industry grow their businesses and enhance their food safety and traceability systems. Funding will support 90 projects across the province through Ontario’s Food Safety and Growth Initiative. These investments build on the Grow Ontario strategy to strengthen the agri-food sector by increasing agri-food innovation and adoption through close collaboration with agri-businesses, research organizations and industry partners.

Promoting Agri-Food Stability Through Ontario’s Risk Management Program

In January 2025, the government announced an increase to annual funding from $150 million to $250 million for its Risk Management Program (RMP) to enhance support for farmers and the province’s $51 billion agri-food sector. The $100 million increase over three years will support farmers in responding to market challenges while boosting their long-term business confidence and competitiveness.

This investment builds on the $50 million annual increase to the RMP in 2020 and past reforms that allowed unused program funds to be rolled over to future year claims, making the program most responsive in times of greatest need. The RMP supports over 383,000 jobs and $24 billion throughout Ontario’s agri-food supply chain across 8,500 farms, which produce cattle, hogs, sheep, veal, grains and oilseeds, as well as edible horticulture, through the Self-Directed Risk Management Program.

Strengthening Ontario’s Tourism Sector

Ontario is continuing to invest in its tourism sector to drive economic growth, support local communities, create jobs, and position the province as a premier global travel destination.

Supporting The Corleck

Ontario is investing $2.2 million to support the final construction phase of The Corleck, a new waterfront venue that pays tribute to the long and meaningful relationship Ontario has with Ireland. This funding helps ensure The Corleck will serve as a cherished cultural attraction — one that promotes economic growth and celebrates Ontario’s shared heritage. The Corleck’s plan to celebrate Irish culture, deliver an exceptional visitor experience and raise awareness of Toronto’s immigration history makes it the perfect addition to a vibrant waterfront that welcomes millions of visitors each year. The funding is part of the government’s plan to protect Ontario by supporting workers, businesses, communities and jobs in the face of ongoing economic uncertainty, while creating a solid foundation for a strong, resilient and competitive future.

Supporting Destination Niagara

The government is committed to exploring opportunities to continue to support the economic potential of the Niagara Region as a tourism destination and tourism driver, grow the existing gaming market, and improve transportation convenience.

As announced in April 2025, Ontario is working on a comprehensive plan to support the economic potential of the Niagara Region, including investing more than $35 million over three years to support the Shaw Festival’s rejuvenation of the iconic Royal George Theatre. Construction has also begun on the redevelopment of the Toronto Power Generating Station into the region’s only five-star hotel, which is funded entirely through a more than $200 million private-sector investment.

Supporting Destination Wasaga

Ontario is also continuing to support the work of the Town of Wasaga Beach to improve its beachfront and downtown area, sustain tourism and preserve the history of the Nancy Island Historic Site, by making available $2 million in tourism planning and almost $25 million in capital funding over two years. This also includes moving forward with the plan to remove certain lands from the Wasaga Beach Provincial Park and transfer provincially owned portions of these lands to the Town, under the condition the beach remain public, with the intention of supporting economic and recreational opportunities in these areas.

Fostering Innovation and Entrepreneurship in Ontario

Innovation and entrepreneurship play important roles in driving economic growth across key sectors. The government continues to foster the province’s innovation ecosystem through investments that drive long-term competitiveness and productivity, as well as enhance resilience to unlock Ontario’s full economic potential. These investments, including in areas such as life sciences innovation, biotechnology, pharmaceuticals, and medical isotope production, also deliver real benefits for the people of Ontario, whether through life-saving treatments, improved health outcomes, or enhanced quality of life.

Strengthening the Life Sciences Sector

Ontario is home to a thriving life sciences sector, employing more than 74,000 people in good-paying jobs across close to 2,000 companies, with annual exports exceeding $11.8 billion. In 2022, the government introduced Ontario’s Life Sciences Strategy, Taking Life Sciences to the Next Level, aimed at attracting investments and promoting research to further solidify the province as a global leader in biomanufacturing and health sciences. In October 2024, the government unveiled Phase 2 of the strategy and is investing $201 million to help fuel the sector’s growth.

As a component of this strategy, in August 2025, the government announced it is investing $5 million through the Ontario Wet Labs Program (OWLP) to support the outfitting of a new wet lab housed within the University of Ottawa’s Advanced Medical Research Centre (AMRC). Wet labs are specialized research facilities where researchers work with chemicals and other materials in controlled environments to drive innovation in fields like biotechnology and pharmaceuticals. The investment will support research collaboration, commercialization and entrepreneurship by providing shared wet lab space for companies with access to leading equipment, advanced biology tools and business support. The state-of-the-art wet lab is expected to support the creation of more than 750 good-paying jobs and drive growth across the region.

Promoting Innovative Biomedical Research Excellence

Fostering homegrown innovation and research excellence in Ontario is integral to ensuring Ontario remains competitive on the global stage. This is why the government is investing $200,000 per year for three years, starting in 2025–26, in the Gairdner Foundation. The Gairdner Foundation is a Canadian non-profit organization that celebrates the world’s most innovative and accomplished biomedical scientists and researchers who improve the health and well-being of people around the world. Through their programs and supports, the foundation has strengthened Ontario’s Science, Technology, Engineering and Mathematics (STEM) pipeline through:

- Gairdner Connects, a national outreach program that brings laureates into Ontario schools, universities and communities to engage with Ontario students and share scientific discoveries, reaching approximately 2,000 students per year;

- The Early Career Investigator (ECI) Competition, which provides researchers with the opportunity to present their research as part of Gairdner Science Week events. Since 2021, 10 out of 25 ECI awardees have been Ontario researchers; and

- The Peter Gilgan Canada Gairdner Momentum Award, which recognizes mid-career researchers in Canada that have produced exceptional scientific research contributions. Four of the six awardees since 2023 have been from Ontario.

This investment will help strengthen Ontario’s biomedical research community by fostering new partnerships, creating new innovations and jobs, and positioning the province as a destination for global researchers and innovators.

Helping Life Sciences Companies and Biomanufacturers Grow Through Venture Ontario

In the 2025 Ontario Budget, the government announced an additional investment of $90 million in venture capital (VC) funding to Venture Ontario, which included $40 million to VC funds that help life sciences companies and biomanufacturers innovate, grow and compete in global markets. These investments in strategic industries will help attract new opportunities for researchers and companies to develop life-saving medicines, support homegrown innovations and create good-paying jobs. Combined with Ontario’s talented workforce and state-of-the-art research and development facilities, the new funding will also help Ontario remain a prime location for businesses in the life sciences, biotechnology and pharmaceutical sectors to invest and grow.

Boosting the Supply of Made-in-Ontario Medical Isotopes

Life-saving medical isotopes have continued to be one of the most consequential tools doctors have available to diagnose and treat cancer, and many of these isotopes are now coming from Ontario’s nuclear generating stations. In September 2025, the Ontario government announced an investment of $18 million to increase production of medical isotopes at the McMaster Nuclear Reactor, expanding operations to 24 hours a day, seven days a week. This investment will create well-paying jobs in Hamilton, produce custom medical isotopes for up to 84,000 treatments each year, and leverage Ontario’s nuclear advantage to support cancer care.

In July 2025, the Ontario government announced the launch of the Nuclear Isotope Innovation Council of Ontario (NIICO), a new expert advisory panel that will help leverage Ontario’s world-class nuclear fleet to double the number of medical isotopes produced in the province over the next four years. The new Nuclear Isotope Innovation Council will help boost Ontario’s nuclear advantage to support cancer care, create jobs and stay competitive in the global economy.

Adopting Innovations in Artificial Intelligence Responsibly

As the province embraces transformational and powerful artificial intelligence (AI) tools to help build a better province, Ontario is committed to implementing guardrails to ensure that AI systems are used transparently, accountably and responsibly in both the public and broader public sectors.

In January 2025, Ontario brought the Enhancing Digital Security and Trust Act, 2024 (EDSTA) into force. The EDSTA builds a foundation to support the responsible use of AI. This legislation establishes Ontario as a leading Canadian jurisdiction in the governance and use of AI in a transparent, responsible and accountable way.

As Ontario advances its digital economy, the government is embracing the growth of the data centre sector as a strategic opportunity to drive investment, innovation and job creation.

Supporting Innovative Start-Ups and Businesses Through Ontario’s Regional Innovation Centres

Ontario is continuing to help entrepreneurs and innovators expand and succeed through its Regional Innovation Centres (RICs). RICs are non-profit organizations that play a vital role in Ontario’s innovation ecosystem by providing early-stage or growing innovation and technology companies with expert advice and mentorship, training and workshops, market intelligence, as well as connections to resources, funding and partners. In 2023–24, RICs provided support to 6,500 unique clients, helped businesses bring over 2,700 new products and services to markets, and assisted businesses in filing over 1,300 intellectual property assets. This contributed to the creation of over 6,700 full-time jobs and helped to retain 41,300 full-time jobs across Ontario.

Helping Entrepreneurs Start and Grow Their Businesses

The government is also helping entrepreneurs start and modernize their operations successfully, so they are on a path for future growth. As announced in the 2025 Ontario Budget, the government is investing $1.9 million over three years to establish a business succession planning services hub within the Small Business Enterprise Centres (SBECs) network. This new hub will support entrepreneurs looking to sell their businesses or acquire new ones. Ontario’s 47 SBECs provide a comprehensive range of business support to entrepreneurs, which offer one-stop access to advisors, programs and services, along with learning opportunities tailored to small business owners in their region. In 2024–25, Ontario’s 47 SBECs helped start over 8,000 businesses, expand 2,700 and create more than 15,800 jobs.

As part of the 2025 Ontario Budget, the government also invested $7.5 million through the Digitalization Competence Centre to help small businesses modernize and grow by adopting digital technologies. Of this amount, $5 million supports the Digital Modernization and Adoption Plan (DMAP), which will help SMEs assess their digital needs and develop effective digital strategies and technology adoption plans to help them transform and grow. Additionally, $2.5 million is allocated to assist small retail businesses with a matching grant to adopt new digital technologies, including tools and services such as online payment systems, inventory management software, customer relationship management tools, digital marketing, cybersecurity solutions, and artificial intelligence.

In August 2025, the government announced the investment of $2 million in Futurpreneur Canada to help young entrepreneurs develop and launch their own businesses. Futurpreneur Canada helps entrepreneurs aged 18 to 39 with mentorship, in-person programming, and up to $75,000 in loan capital from Futurpreneur and the Business Development Bank of Canada (BDC). In 2024–25, Futurpreneur supported 351 businesses in Ontario, including 59 in Northern, rural and remote communities.

Improving Capital Markets

The Ontario government continues to work closely with the Ontario Securities Commission (OSC) and key partners in the capital markets sector to generate further opportunities to increase capital formation and economic growth in Ontario. Financial services are a cornerstone of Ontario’s economy, contributing substantially to GDP and employment. Ontario is navigating a period of significant transformation, marked by shifting global economics, demographic pressures, and challenges to entrepreneurship, business retention, and capital formation.

Capital Formation

The OSC, in collaboration with Canadian regulators, is implementing forward-looking reforms that reduce regulatory burden and accelerate access to capital — ensuring Ontario competes at the highest international standards.

- The maximum amount of capital that can be raised under the listed issuer financing exemption within a 12-month period has been increased, enabling eligible reporting issuers to secure significantly greater amounts of capital more efficiently.

- A multi-year pilot project is being launched to allow smaller public venture companies to file certain financial reports semi-annually rather than quarterly, cutting compliance costs and freeing up resources for innovation. This new approach aligns Ontario with other international regulators and signals the government’s commitment to fostering agile, competitive markets.

Ontario is also fostering early-stage capital formation through the OSC TestLab, which serves as a testing ground for capital markets innovations. Recent successes include:

- The Not-for-Profit Angel Investor Group Registration Exemption, already leveraged by six angel groups to unlock new investment channels.

- The Self-Certified Investor Prospectus Exemption, extended following strong market feedback, enabling seven issuers to raise over $450,000 and opening doors for broader participation in Ontario’s growth economy.

The government is determined to make Ontario a global hub for entrepreneurial finance — where capital formation fuels cutting-edge technologies, job creation, and sustained economic growth.

Enabling Credit Unions to Raise Alternative Capital

Credit unions and caisses populaires are pillars of Ontario’s financial ecosystem, driving economic growth by providing essential financing to businesses, entrepreneurs, and local and rural communities.

In the 2025 Ontario Budget, the government committed to consulting on measures that would allow Ontario credit unions to raise capital beyond their membership base by offering shares to non-members — a transformative step toward unlocking new growth opportunities.

Building on strong interest and support from stakeholders across the credit union and capital markets sectors, the government is now proposing legislative amendments to the Credit Unions and Caisses Populaires Act, 2020. These changes would expand credit unions’ access to diverse public and private sources of capital, enabling them to scale up, innovate, and strengthen capital formation, not only within the sector, but across Ontario’s economy. This modernization positions Ontario’s credit unions to compete, invest in cutting-edge financial technologies, and deliver greater choice and resilience for consumers and businesses alike.

Strengthening Competition

The government recognizes that the people of Ontario expect real choice and flexibility in their financial services. Ontario strongly supports measures that accelerate and simplify investment account transfers, ensuring that individuals can move their assets seamlessly and without unnecessary cost or delay. The government applauds the Canadian Investment Regulatory Organization (CIRO) for its leadership in modernizing transfer processes and will continue to champion initiatives that put consumers first.

The government supports strategic collaborations with jurisdictions worldwide to strengthen Ontario’s role as a trusted hub for global investment, including the OSC’s recent agreement with the Securities and Futures Commission of Hong Kong.

Driving Ontario’s economy forward means embracing innovation and preparing for the future of finance. In this pursuit, the government is looking to explore opportunities to make Ontario a leading jurisdiction for digital asset innovation, including further regulatory clarity, while ensuring strong consumer protections and market integrity. In addition, Ontario calls on the federal government to work closely with provinces to establish a clear and coordinated regulatory framework that enables both innovation and stability in the Canadian stablecoin sector.

Increasing Investment Opportunities

The OSC, the Investment Company Institute, and the Securities and Investment Management Association have announced a joint session to advance the OSC’s Long-Term Asset Fund program through the OSC LaunchPad. This initiative is designed to encourage innovative proposals that expand investment opportunities for the people of Ontario and strengthen Ontario’s position as a leader in modern capital markets.

Frameworks for retail investment in long-term assets exist in leading global jurisdictions, and Ontario is working to facilitate broader access to these investment products, not only to empower retail investors to diversify their portfolios, but also to drive the development of critical infrastructure that supports sustained economic growth.

Increasing Investor Confidence and Protection

The government is committed to increasing investor confidence in Ontario’s capital markets. On September 1, 2025, legislative amendments and new OSC rules came into force to implement a modernized framework that provides for a more efficient, timely and transparent process to distribute funds to investors who have sustained direct financial losses from misconduct that results in a disgorgement order. The government remains committed to a modernized capital markets framework that also protects investors.

Highlighting Ontario’s Cannabis Sector

The Ontario Grown Cannabis badge was announced in the 2025 Ontario Budget and launched by the Ontario Cannabis Store (OCS) on June 27, 2025, in coordination with the “Buy Ontario, Buy Canadian” Day to help promote locally grown cannabis. In the first three months, over 600 products grown by more than 45 cannabis producers have qualified for the designation, with new product applications continuing to grow. All cannabis products sold by authorized retailers and the OCS are grown, processed and packaged in Canada.

Helping Municipalities and Communities Build Ontario

Ontario recognizes that municipalities are critical partners in delivering important local services and that by working together, the province and municipalities will build up Ontario’s communities and move its economy forward.

The province has taken meaningful actions to support and strengthen local communities with record investments in the municipal sector. In fact, from 2019 to 2024, key provincial support to municipalities grew by over 45 per cent. In 2024 alone, the government provided over $10 billion through key programs.

The government has continued to support municipalities across the province by:

- Investing an additional $1.6 billion through the Municipal Housing Infrastructure Program (MHIP) to speed up construction on homes and critical infrastructure, nearly doubling the total investment to $4 billion and complementing the province’s Building Faster Fund.

- Enhancing the Ontario Municipal Partnership Fund (OMPF) through an increase to the program of $100 million over two years and bringing the total funding envelope to $600 million annually, which will further support municipalities to deliver critical services to communities across the province.

- Increasing annual funding for Connecting Links from $30 million to $45 million, to support municipalities in addressing critical road or bridge improvement needs to extend the life cycle of their assets and continue with local developments.

Municipalities are also eligible to access programs meant to help communities and businesses impacted by tariffs, including $40 million in funding through the Trade-Impacted Communities Program and financing for eligible infrastructure projects through the Building Ontario Fund.

Looking ahead, the government will continue to work with municipalities to build more housing, support economic growth, and further strengthen Ontario’s communities.

Safeguarding Ontario’s Workforce

Ontario is protecting workers by building a more resilient and competitive workforce. The province is making investments to support major industries and sectors anticipated to grow in the coming years, as well as those facing pressure from U.S. tariffs, while helping to prepare the workers needed to build and strengthen Ontario’s economy.

Protecting Workers Through the Skills Development Fund

Ontario is working to protect its world-class workforce by providing workers with the training and tools necessary to land in-demand jobs, while helping Ontario remain competitive in the face of U.S. tariffs and economic uncertainty. This is why the government has committed $2.5 billion in the Skills Development Fund (SDF) Training and Capital streams, which help organizations deliver better training programs and upgrade and build new training centres across the province. Since 2021, the SDF has helped support over one million workers access the training they need to enter rewarding careers in priority sectors in every corner of the province.

Investing in Job Training to Protect Ontario Workers

The government is continuing to deliver on its plan to protect workers by launching the sixth round of the SDF Training Stream. This round will provide $260 million for innovative projects that support the hiring, training and upskilling of workers in manufacturing, health care, construction, automotive and other key sectors. This funding is part of the government’s $2.5 billion investment to protect Ontario workers through the SDF. Since its launch in 2021, the SDF Training Stream has supported over 1,000 training projects across the province that aim to connect over 700,000 people with training for better jobs with bigger paycheques.

Building and Expanding Skills Training Centres

As part of the $2.5 billion invested in SDF, the Ontario government is continuing to support the building, expansion and retrofitting of training facilities through the Capital Stream. As announced in the 2025 Ontario Budget, the government is providing an additional $150 million over three years, starting in 2025−26, to support ongoing demand in the Capital Stream. The SDF Capital Stream supports upgrades to or the construction of new training centres to prepare people for emerging and in-demand jobs in critical sectors of Ontario’s economy. Construction on three of these training facilities has been completed, with another 24 construction projects underway.

Helping Job Seekers Train for In-Demand Jobs

The Better Jobs Ontario program helps eligible job seekers transition to in-demand jobs by providing financial support to cover expenses like tuition, transportation and child care. As announced in the 2025 Ontario Budget, the government is investing an additional $50 million into the program to support vocational and skills training that will help more job seekers quickly train and upskill for in-demand, good-paying careers. This new funding will include a fast-track stream for job seekers in trade-impacted sectors, helping to protect workers in the face of U.S. tariffs and economic uncertainty. Since January 2021, this program has supported the retraining of nearly 18,000 job seekers.

Supporting Workers Through Investments in Skilled Trades

To attract people to rewarding careers in the skilled trades and help support Ontario’s economy during a time of uncertainty caused by the U.S. tariffs, Ontario continues to support a variety of skilled trades programs. Ontario has invested over $2.1 billion in the skilled trades since 2020, with a focus on breaking the stigma around skilled trades, simplifying the apprenticeship system, and encouraging employer participation.

As announced in the 2025 Ontario Budget, the government is continuing to invest an additional $159.3 million over three years to strengthen skilled trades programs. This includes expanding the In-Class Enhancement Fund to increase training capacity and cover classroom fees for Level 1 apprentices. This investment will help attract more people into skilled trades and support their training toward becoming certified journeypersons.

Enrolling More Students in Construction-Related Postsecondary Programs

As announced in the 2025 Ontario Budget, the province is investing $75 million over three years to train up to 7,800 additional postsecondary students across the province for in-demand construction-related jobs. This investment will strengthen Ontario’s construction workforce, enabling it to meet current and future labour demands, and is essential to deliver on the province’s ambitious infrastructure plan.

Protecting Workers by Introducing First-in-Canada Labour Mobility Changes

To build a unified Canadian workforce that can stand up to U.S. tariffs and economic uncertainty, the province is breaking down interprovincial barriers for regulated occupations. To implement this, the province has filed first-in-Canada regulations that will facilitate the entry of certified Canadian workers into Ontario’s workforce.

Starting January 1, 2026, certified professionals from other Canadian provinces — such as architects, engineers, electricians and geoscientists — will be able to start working in Ontario within 10 days once credentials and requirements are confirmed by the regulator. These changes will boost productivity and help provide the workforce necessary to deliver nation-building projects across critical sectors, all while maintaining Ontario’s gold standard for worker safety and qualifications. This marks a significant shift from the current system that can take months. The historic implementation of “As of Right” rules will apply across 300 occupations covered by more than 50 regulatory authorities.

Creating Resource Development Scholarships for First Nation Students