Introduction

COVID‑19 has made day-to-day life more challenging for people and businesses in Ontario, as each and every one takes the difficult but necessary steps to help stop the spread of the virus. Since the pandemic reached the province, the government has been delivering supports for families, for workers and for businesses struggling through this difficult time.

Dealing with COVID‑19 wasn’t a choice for any of us, but how we responded was. From the very beginning, we chose to do whatever was necessary to protect the people of Ontario from this pandemic and support them as they deal with the unprecedented impact on their lives.

Rod Phillips

Minister of Finance

2020–21 First Quarter Finances

To support this commitment, Ontario’s Action Plan: Responding to COVID‑19, made available $11 billion in direct support for people and jobs and about $11.3 billion in cash flow support at a time when it made the biggest impact. Recognizing the need to remain responsive to a situation evolving at an unprecedented pace, the plan was nimble and focused on directing resources where they would make the biggest difference, while maximizing the impact of federal government spending and programs.

The government is taking further action to support people and employers by putting in place $2.4 billion in additional supports. The plan will help those who need it the most navigate the second wave of COVID‑19 and beyond.

Highlights of the Province’s support for people and jobs include:

- Supporting students, parents and seniors;

- Providing support for people to help navigate these challenging new circumstances;

- Providing support for jobs; and

- Supporting municipal partners.

People and employers in Ontario navigated the first wave of the pandemic, with the support of their governments. But as we learn more about the virus, it is clear that many in Ontario, through no fault of their own, will continue to face challenges as long as COVID‑19 is here. This is why the government will continue to build on what was previously introduced while rolling out new supports to get through this difficult time.

Supporting People

Everyone has been affected by COVID‑19, but some more so than others. What ties all communities together is the Ontario Spirit — a commitment to kindness, respect and responsible behaviour — that not only successfully guided people through the first wave, but that led to countless stories of how the pandemic brought out the best in people amidst a global crisis. Ontario is committed to providing support so that every person in the province can navigate these challenging new circumstances.

Helping Parents with COVID‑19 Costs

Whether students are attending school in person, online or a mix of both, parents are facing additional costs in the form of technology, child care and new activities for their children in a COVID‑19 world. The government cannot take away the stress and pressures of COVID‑19, but it can provide a measure of relief with the Support for Learners initiative.

That is why Ontario will once again provide parents payments of $200 per each child aged 0 to 12, and $250 for children and youth 21 years old or younger with special needs.

Financial supports will be provided directly to parents to help support their children’s learning this year. Overall, this investment could provide learners with access to key educational resources like workbooks, school supplies and technology.

This $380 million investment is in addition to the support the government provided in Ontario’s Action Plan: Responding to COVID‑19, released in March, which assisted parents while Ontario schools and child care centres were closed during the first wave of the COVID‑19 pandemic.

Reopening Schools Safely

Ontario’s back-to-school plan was developed in consultation with Ontario’s Chief Medical Officer of Health with a focus on the safety of students, staff and their families.

Ontario was the largest jurisdiction in North America to reopen schools and is leading the nation in school funding for COVID‑19 by making $1.3 billion in resources available to school boards, including an additional $381 million from the federal government’s Safe Return to Class Fund.

This September, all publicly funded elementary schools reopened provincewide with in-class instruction five days a week. Most secondary schools started the school year in an adapted model that includes a hybrid of in-person and remote learning. These approaches were designed to support cohorting and limiting direct and indirect contacts for students. The layered health and safety requirements also include daily screening, mandatory mask policies, cleaning protocols and encouraging hand washing. The government is also publicly reporting on COVID‑19 cases in schools every week day.

The government has respected parents in making decisions that work best for their children by providing the option for students to attend classes in person or remotely as a result of COVID‑19. This school year, approximately 20 per cent of students are choosing to attend school remotely.

The Province is also working with school boards through the Broadband Modernization Program to deliver access to reliable, fast, secure and affordable internet services for all Ontario students and educators. See Chapter 1, Section C: Recover — Creating the Conditions for Growth for more details.

Helping Elementary Students Learn Online

The Province is providing students and teachers with new learning supports to help them during COVID‑19 by investing $7 million over three years. New online modular content for elementary grades will be introduced to cover the full curriculum and support flexibility between face-to-face and remote learning. TVO and Groupe Média TFO will develop this content in English and French, respectively, drawing upon their expertise in the development of digital educational content. These new elementary content modules will be developed through a phased approach, starting with four subjects — language, math, science and social studies.

Creating a Digital Learning Portal

The Province is changing how it makes curriculum available to help parents, students and teachers see connections between learning in different grades and subjects. In June 2020, the new elementary math curriculum was the first to be uploaded to the new Curriculum and Resources website, a digital space where anyone can access curriculum and learning resources. The website also currently hosts digital versions of three other recently revised curricula: elementary Health and Physical Education, Grade 10 Careers Studies and Grade 9 to 12 First Nations, Métis and Inuit Studies. The Province is working to expand the website to include additional curricula, content and functionalities.

Building and Renovating Schools and Child Care Spaces

The government is making substantial investments of $13 billion in capital grants over 10 years to build new schools and renew existing schools across Ontario, to ensure that students have safe and modern education environments in which to learn and thrive. COVID‑19 has underscored the importance of this commitment.

As part of this investment, Ontario will provide $1.4 billion for the 2020–21 school year for facility repair and renewal, which continues to meet the recommended funding level by the Auditor General of Ontario to preserve the condition of Ontario’s school facilities. The Province also provided, as part of the safe return to school, an additional investment of $50 million in one-time funding to support improved ventilation, air quality and HVAC system effectiveness in schools.

The government is taking an inclusive approach to help families succeed and remains committed to providing child care options to meet the diverse needs of the people of Ontario. In 2019–20, the total number of licensed child care spaces grew by over 16,000, representing an increase of almost four per cent compared to the prior year. Moving forward, the government will continue to deliver on its commitment to create up to 30,000 new child care spaces in the next five years.

Through the 2019–20 school year capital priorities allocation, Ontario invested over $500 million to build 30 new schools and make permanent additions to 15 existing facilities, supporting over 25,000 student spaces.

Moving forward, the Province will also partner with the federal government through the COVID‑19 Resilience stream of the Investing in Canada Infrastructure Program to support infrastructure improvements in schools.

Helping University and College Students Navigate COVID‑19

The Province is helping students acquire the skills they need to succeed in the workforce by making postsecondary education more affordable. After a historic 10 per cent reduction in tuition fees for Ontario students at every publicly funded college and university in all funding-eligible programs in the 2019–20 school year, the Province has frozen tuition fees for the 2020–21 school year.

Additionally, to ease the financial burden on students during COVID‑19, the Province temporarily deferred Ontario Student Assistance Program (OSAP) loan payments for borrowers from March 30, 2020 to September 30, 2020. During this period, borrowers were not required to make any loan payments and interest did not accrue on their OSAP loans.

In the wake of the COVID‑19 outbreak, the Province distributed $25 million in additional funding to publicly assisted colleges, universities and Indigenous Institutes to help address each institution’s most pressing needs including purchasing medical supplies, offering mental health supports and deep cleaning campus facilities.

The Province has partnered with postsecondary institutions to prepare for a safe start to the 2020–21 academic year. This partnership has helped establish best practices for limited in-person teaching, including COVID‑19 testing for students in quarantine as a result of travel outside of Canada.

The Province is working with postsecondary institutions in meeting federal requirements for international students, ensuring that quarantine and outbreak management plans are in place.

Helping Seniors Make Their Homes Safer

As the COVID‑19 outbreak has highlighted, home is a special place where one should feel comfortable and safe. However, for many seniors, their homes require improvements for them to remain safe and accessible. Without these improvements, many seniors end up leaving the homes that they love.

The government had been committed to helping seniors stay in their homes longer even before the pandemic. But COVID‑19 has underscored the urgency of this important priority.

That is why Ontario is proposing the new Seniors’ Home Safety Tax Credit for the 2021 taxation year to help seniors, and intergenerational families who have seniors living with them, make their homes safer and more accessible. The proposed new personal income tax credit would support seniors regardless of their incomes and whether they owe income tax for 2021.

The Seniors’ Home Safety Tax Credit would be worth 25 per cent of up to $10,000 in eligible expenses for a senior’s principal residence in Ontario. The maximum credit would be $2,500. Eligible expenses would include grab bars and related reinforcements around the toilet, tub and shower, wheelchair ramps, stair lifts and elevators. They would also include renovations to permit first floor occupancy or a secondary suite for a senior.

This new tax credit would provide an estimated $30 million in support that would benefit about 27,000 people, including seniors and people who live with senior relatives.

See Annex: Details of Tax Measures and Other Legislative Initiatives for further information.

Delivering Meals, Medicine and Other Essentials to Vulnerable People

Ontario is continuing the Ontario Community Support Program, with a total investment of $16 million over two years, to connect people with disabilities, older adults and others with underlying medical conditions who are self-isolating, with meals, medicines and other essentials while they stay at home. Since April 2020, the program has delivered more than 230,000 meals and essential supplies to vulnerable individuals. In September, the government announced that this program will be extended until March 2021 to ensure that eligible low-income older adults and people with disabilities can continue to get meals and other essential supplies delivered to their homes in the upcoming winter months.

Based on the success of the Ontario Community Support Program, the government will invest an additional $5 million in 2021–22, on top of the of $11 million in 2020–21 announced as part of Ontario’s Action Plan: Responding to COVID‑19.

Expanding the Seniors Active Living Centre Program

Seniors Active Living Centres (SALCs) provide a diverse range of programs to almost 11,000 adults in Ontario each day promoting wellness, social interaction and education to help these individuals stay active, independent and engaged.

At the start of the pandemic, SALC programs closed their in-person programming to prevent the spread of the virus among a particularly vulnerable group. To combat the effects of social isolation, many SALC operators began to offer virtual or remote programs to enable older adults to stay connected from the safety of their homes and to combat social isolation. While many participate in virtual and remote programing, some older adults are seeking opportunities for safe, in-person programing at their SALC program locations.

To continue to help Ontario’s older adults stay engaged and to help combat social isolation during COVID‑19, the government is investing an additional $3.1 million in 2021–22 for a total of $17.2 million, which represents a 22 per cent increase to funding. This additional funding will offer remote and virtual programming to connect seniors at home and provide safe in-person programming when their local public health unit says it is safe to do so.

Launching the Inclusive Community Grants Program

Ontario is committed to working cooperatively with municipalities and local organizations to create wrap-around community-based services that enable people of all ages and all abilities to engage in their communities and in the economy. That is why the government is investing $2 million over two years to create a new Inclusive Community Grants program. This program will fund the development of community supports that promote healthy and active aging, supporting the social engagement of older adults and people with disabilities, helping them to be safe and secure at home and in the community as well as participate in the labour force.

Previous grants have assisted in the development of accessible housing units, the development of a regional transit strategy and the integration of new residents into their local community, breaking down the walls of social isolation.

Doubling Investment in the Black Youth Action Plan

The Province is investing an additional $60 million over three years, starting in 2020–21, in the Black Youth Action Plan (BYAP). This represents a doubling of base funding for the program beginning in 2021–22. The new investment will extend the current program and create a new economic empowerment stream that will support Black youth in achieving social and economic success.

Building on the success of the BYAP, consultations led by the Premier’s Council on Equality of Opportunity, chaired by the Premier’s Community Advocate, Jamil Jivani, are underway with community partners. The consultations will inform these new enhanced BYAP investments, which will support pathways for lifelong social and economic success including:

- Refining focus to better support Black communities to thrive and achieve economic success;

- Expanding government partnerships, particularly with businesses and high-growth sectors, to increase economic inclusion and address systemic barriers; and

- Enhancing educational outcomes for Black children and youth and increasing labour market participation through entrepreneurship and trades.

Investing in the Special Services at Home Program

The government is committed to strengthening the ability of children and their families to reach their full potential. The government is investing $70.3 million over three years, beginning in

2020–21, in the Special Services at Home program, which supports families caring for children with developmental and/or physical disabilities including autism.

The Special Services at Home program helps children learn new skills to improve their daily living, including mobility and communications skills, and supports respite services for primary caregivers. This investment will support approximately 4,700 more children and their families in 2020–21, and approximately 2,100 additional children and families in each subsequent year.

The investment will help to respond to recommendations of the Ontario Autism Program Advisory Panel on a needs-based autism program. The government remains committed to supporting children and youth with autism, which is why the Province doubled funding in the Ontario Autism Program to $600 million annually, beginning in 2019–20.

Supporting Agricultural and Horticultural Societies

The government recognizes the unique characteristics and challenges of rural areas and is taking steps to support rural Ontario during the COVID‑19 pandemic. The Province has enabled a one-time change in eligibility requirements to allow agricultural and horticultural societies to receive their annual grants. The Province is now providing an additional $5 million in new funding to supplement their annual grants this fiscal year, helping to offset revenue losses and the impacts from having to cancel agricultural exhibitions and annual fall fairs due to COVID‑19. The government recognizes the importance of these communities and is taking steps to help them address the challenges they are facing.

Ontario’s Community Building Fund

The Province is investing $100 million over two years to develop a Community Building Fund that supports community tourism, cultural and sport organizations, which are experiencing significant financial pressures due to the pandemic. These organizations support community engagement, tourism and recreation through a variety of attractions, experiences, events and activities. Funding support would be available to not-for-profit organizations and municipalities, and the program will be delivered by the Ontario Trillium Foundation (OTF) with two streams:

- Supports for local community tourism, heritage and culture not-for-profits, such as community museums, local theatres, fairs and cultural institutions, to help sustain their operations in the short term and create new attractions, experiences and events; and

- Funding for municipalities and not-for-profit sport and recreation organizations to make investments in infrastructure rehabilitation and renovation, in order to meet public health protocols and local community needs.

Supporting Local Festivals and Events

In October the government announced it is investing $9 million through the new Reconnect Festival and Event Program to support municipalities and event organizers during COVID‑19. The program is meant to safely reconnect the people of Ontario with their communities through online, drive-through and other innovative experiences. Funding may be used for eligible expenses such as programming and production, promotion, mobile applications and website development, and implementation of health and safety measures. Eligible organizers could receive support to develop programs such as virtual Remembrance Day events, holiday parades with drive-by static floats, drive-in music concerts and movies, holiday tree lightings and New Year’s Eve displays that light-up iconic buildings.

Assisting Ontario’s Arts Institutions

The government is providing one-time emergency funding of $25 million for Ontario’s arts institutions to help cover operating losses incurred as a result of COVID‑19. This funding will help these organizations remain solvent and prepare for a time when they can fully re-open their facilities, resume full programming and welcome back their visitors and audiences.

In addition, the Ontario Arts Council and the Ontario Trillium Foundation are providing increased flexibility to grant recipients and applicants to help rebuild and reposition the arts and non-profit sectors. These organizations are also providing funding support through new and enhanced grant programs. This funding will be invested in heritage, sport, tourism and culture projects to aid organizations’ medium- to longer-term recovery efforts, help with stabilization and build capacity in response to COVID‑19, while protecting jobs and enabling economic recovery.

The government has also helped the arts and culture industries during the pandemic with:

- The launch of Ontario Live in June 2020, which established a virtual platform for the people of Ontario to explore all the province has to offer from the comfort of their own home including local attractions, festivals, artists and content from other creative sectors.

- The launch of musictogether.ca in April 2020. This website gives musicians a virtual hub to perform concerts from the safety of their homes. It has facilitated live concert streams by at least 300 Ontario-based artists, each of whom receives a one-time performance fee of $1,000 from an emergency relief fund. The government supported the fund through a matched investment of $150,000.

- A modernized Ontario Music Investment Fund, which strengthens support for artists, as well as focuses resources on record labels and music companies with strong growth potential. The fund will drive long-term growth and create opportunities for emerging artists to record and perform in Ontario.

- Community re-engagement in safe arts and cultural experiences at Ontario Place. In July the government provided Ontario Place with $2 million to support on-site activities, including drive-in festivals and virtual events.

Supporting Sports and Recreation

Due to COVID‑19, public health protocols have impacted all amateur sport and recreation programming as well as amateur and professional sporting events. The government has taken steps to support this sector by consulting with the Minister of Heritage, Sport, Tourism and Culture Industries Advisory Councils, and through regional and local consultations. In June, the government compiled safety guidelines with support from the sport and recreation sector to ensure the people of Ontario can safely return to play. These resources are available to the public and stakeholders to help people better understand how to prevent the spread of COVID‑19 while training, practicing and competing in sport and recreation activities.

Supporting Francophone Non-Profits

The government is supporting organizations that contribute to the development of Ontario’s French-speaking community.

The government is establishing the COVID‑19 Relief Fund for Francophone Non-Profit Organizations to help support organizations with operating costs, including preventing closures and retaining and recruiting skilled bilingual staff.

There are over 300 Francophone non-profit organizations serving the French-speaking community in essential areas including social services, health care, early childhood education as well as other key employment and economic sectors. Keeping these organizations operating by providing much needed financial support and thus maintaining their stability would help pave the way for economic recovery and growth.

In addition, the fund will help maintain and strengthen organizational capacity during the pandemic. Francophone non-profit organizations contribute to the vitality of Ontario’s Francophonie, which is an important asset for the province.

Supporting People Facing a Mental Health Crisis

Ensuring the safety and well-being of all people of Ontario is a top priority for the government. Police officers are increasingly being called to respond to complex situations involving individuals experiencing a mental health crisis. Through mobile crisis intervention teams, mental health crisis workers and police services partner to support the de-escalation and stabilization of situations involving persons in crisis. To provide vulnerable populations with the support they deserve, the government is investing $3 million annually to enhance mobile crisis intervention teams to help build a province where all people feel safe and protected.

Supporting Survivors of Domestic Violence and Human Trafficking

During this difficult time, there have been increasing rates of domestic violence and victims are struggling to access services. The government is taking action to curb the impacts of domestic violence and human trafficking in Ontario’s communities by investing $2.5 million in a new Victim Support Grant to fund partnerships between police services and community groups to fill existing service gaps and tailor programming to address local needs across Ontario. This investment will improve supports for victims of these crimes and ensure they have timely access to culturally appropriate services.

Providing Electricity Cost Relief to Ontario Families

The Province continues to recognize the challenges families are facing as a result of the COVID‑19 pandemic. In Ontario’s Action Plan: Responding to COVID‑19, the government increased its funding for residential, farm and small business consumers through the Ontario Electricity Rebate (OER) and other electricity cost relief programs by $1.5 billion in 2020–21, compared to the 2019 Budget. The Province is also continuing to provide targeted relief, including for eligible low-income households, rural or remote customers and on-reserve First Nations consumers.

These relief programs are funded by the Province from its general revenues and cash flows, which include the Province’s dividends from its ownership in Hydro One, which were approximately $291 million in 2019–20. In fall 2020, the government launched a new website to provide greater transparency on electricity rate mitigation programs. For more details, please visit: Ontario.ca/yourelectricitybill.

The government also took immediate action at the onset of the COVID‑19 pandemic to provide additional relief and put money back in the pockets of the people of Ontario. The government announced electricity relief for residential, farm and small business time-of-use (TOU) customers by providing off-peak electricity pricing 24 hours a day, beginning on March 24 to May 31, 2020. Effective June 1, 2020, further action was taken to make electricity bills more stable with the introduction of a fixed electricity price, known as the COVID‑19 Recovery Rate, of 12.8 cents per kWh, for all TOU customers, 24 hours a day, 7 days a week until October 31, 2020.

The government is focused on providing greater customer choice for families, small businesses and farms who pay TOU electricity rates. As of November 1, 2020, these consumers are able to choose a rate plan that best suits their household and lifestyle, with the option of either TOU or tiered pricing. Tiered pricing provides a set rate for electricity up to a certain level of consumption regardless of the time of day it is consumed. The government has worked to ensure that the Ontario Energy Board and local distribution companies will provide electricity consumers with the guidance and information that they need to make an informed decision regarding what rate plan is best for them.

Supporting Jobs

Employers across the province have struggled as a result of COVID‑19. Through no fault of their own, people have lost their jobs and businesses have been negatively impacted by the pandemic.

Supporting Employers in COVID‑19 Hotspots

The government recognizes that necessary COVID‑19‑related public health measures, such as temporarily restricting businesses or prohibiting indoor food and drink service at restaurants, come at a cost to Ontario’s businesses.

To help support businesses impacted by these public health measures, the government is making $300 million available to assist eligible businesses with costs associated with municipal and education property taxes, and energy bills.

The Province is providing this support to eligible businesses in any region of Ontario where the Province determines recently modified Stage 2 public health restrictions are necessary.

Continued assistance from the federal government is required to support Ontario’s businesses. The Province is closely collaborating with its partners, including the federal government and Ontario’s municipalities, on ensuring businesses receive the support they need.

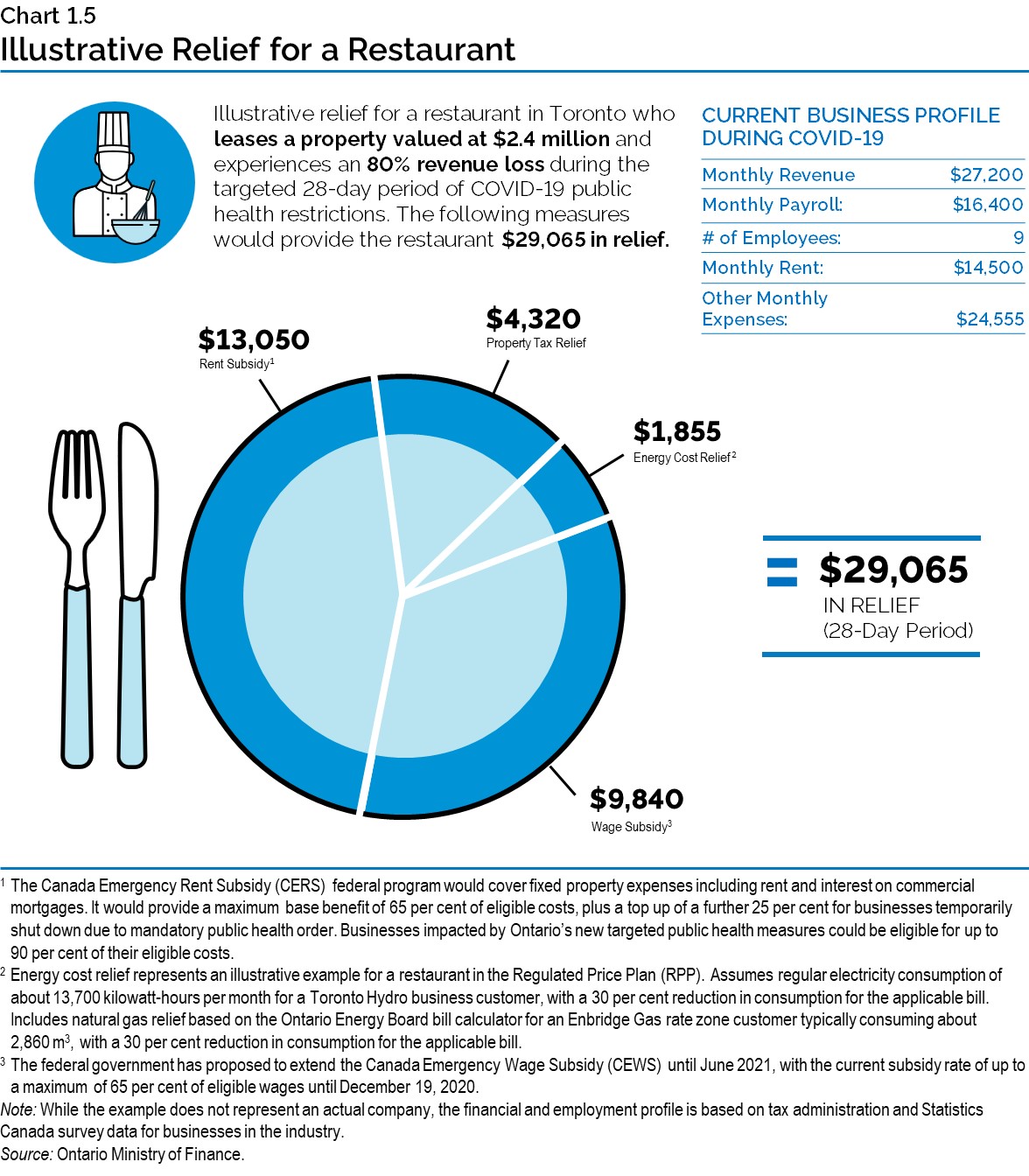

To illustrate measures from Ontario’s Action Plan: Protect, Support, Recover that are providing assistance to Ontario’s businesses significantly impacted by targeted public health restrictions related to COVID‑19, consider a restaurant in Toronto. The restaurant leases a property valued at $2.4 million and had experienced an 80 per cent monthly revenue loss during the COVID‑19 pandemic. During the targeted 28-day period of public health restrictions, the restaurant could be eligible for support including relief towards property tax ($4,320), energy costs ($1,855), wages paid ($9,840) and rent ($13,050). In total, the restaurant would see relief of $29,065 during the 28-day period.

Supporting Main Street Businesses

Small businesses, in particular, have been significantly impacted by COVID‑19. They have experienced a proportionately larger reduction in employment than medium- and large-sized business. This is why Ontario is strengthening support for small businesses through a wide range of measures.

In October the government announced Ontario’s Main Street Recovery Plan. The plan includes:

- Providing $60 million in one-time grants of up to $1,000 for eligible main street small businesses — in retail, food and accommodations, and other service sectors with fewer than 10 employees — to help offset the unexpected costs of personal protective equipment (PPE);

- Ontario’s Small Business COVID‑19 Recovery Network, which links 47 Small Business Enterprise Centres across the province as places where small businesses can access tailored advice and information on local, provincial and federal programs;

- Digital Main Street Squads to help small businesses grow online by providing one-on-one help with digital assessments, website creation, social media advertising and e-commerce platforms; and

- Ontario’s Small Business Recovery Webpage to provide single window access to small business supports.

The Plan also introduces regulatory and legislative changes through the Main Street Recovery Act, 2020 that, if passed, will remove hurdles faced by small businesses and allow them to pursue new opportunities. Some examples include:

- Committing to explore options to permanently allow licensed restaurants and bars to include alcohol with food as part of a take-out or delivery order before the existing regulation expires;

- Permanently allowing 24/7 deliveries to businesses that include retail stores, restaurants and distribution facilities;

- Supporting the distribution of local food and food products by increasing the range of products sold at the Ontario Food Terminal; and

- Supporting Ontario’s taxi and limousine industry by increasing fines for illegal operators.

Helping Small Businesses Go Digital

The government is helping small businesses reach more customers through the Digital Main Street platform. Announced in June 2020, it is a $57 million program that will help up to 22,900 Ontario businesses create and enhance their online presence and generate jobs for more than 1,400 students.

Supporting Small Businesses with Rent

Ontario partnered with the federal government to deliver rent support to small business tenants and their landlords through the Canada Emergency Commercial Rent Assistance (CECRA) for small businesses. Between April and September 2020, Ontario committed $241.2 million to CECRA for small businesses, making more than $900 million in support available, which has helped roughly 64,000 small business tenants, employing approximately 617,000 people.

The Legislature passed the Helping Tenants and Small Businesses Act, 2020 to extend the temporary ban on commercial evictions. This temporary ban on evictions applied to small business tenants that were eligible for rent assistance through CECRA for small businesses for the duration of the program. Small business tenants continue to need support, which is why the government is proposing to further extend the temporary ban on evictions for commercial tenants that would have been eligible for the CECRA for small businesses program.

The government heard from small business owners across the province that some landlords were not participating in CECRA for small businesses, and small business owners would need additional direct rent support after the program ended to continue to survive. The government listened to these concerns and urged the federal government to act. On October 9, 2020, the federal government announced it will help Ontario small business owners until June 2021 by providing commercial rent support directly to small businesses, with the newly introduced Canada Emergency Rent Subsidy.

Supporting Consumers, Hospitality Businesses and Alcohol Producers

The government has made a number of changes in response to the unique circumstances and economic hardships being faced by Ontario’s vibrant hospitality sector and beverage alcohol sector. This included measures such as temporarily allowing restaurants and bars to extend outdoor patios, and to include alcohol as part of food take-out and delivery orders. The government is committed to explore options to permanently allow alcohol to be included with food take-out and delivery orders before the existing regulation expires on December 31, 2020.

The government is freezing beer tax and mark-up rates until March 1, 2022 and is proposing to retroactively cancel the increase in wine basic tax rates legislated to occur on June 1, 2020. The government issued an order under the Financial Administration Act during the state of emergency that prevents that increase from being applied between June 1, 2020 and December 31, 2020. The government is also directing the LCBO to not proceed with the scheduled wine mark-up.

Ontario Together: Helping Businesses Retool to Fight against COVID‑19

On March 21, 2020, Premier Ford launched the Ontario Together web portal, a procurement portal that allows businesses and innovators to submit their proposals to government to enable the rapid procurement of essential emergency goods and services. To date, the portal has received nearly 30,000 submissions offering to provide everything from hand sanitizer, gowns and coveralls, to masks, face shields, testing equipment and ventilators. This interest showcases how the people of Ontario are ready to band together to provide essential supplies and equipment to support frontline workers in their fight against the pandemic.

To support the development of proposals submitted by businesses and individuals through the Ontario Together web portal, the government launched the $50 million Ontario Together Fund on April 1. This fund helps businesses to invest in innovative solutions or retooling of their operations in order to manufacture or ramp-up production of key essential medical supplies and equipment. Thousands of businesses stepped up to help convert the manufacturing sector into a strategic asset by providing critically needed supplies and equipment for frontline workers as they continue to keep the people of Ontario safe.

Some of the projects that the Ontario Together Fund has supported include:

- Linamar Corp. — A Guelph-based advanced manufacturing company supplying the automotive, agriculture and aerial work platform markets. The Province invested $2.5 million to support the retooling of Linamar’s assembly line to manufacture ventilator components to produce 10,000 Ontario-made e700 ventilators. O-Two Medical Technologies partnered with Linamar and other businesses, including Bombardier, to produce the ventilators.

- Greenfield Global — a multi-national company that manufactures and ships more than 1,600 products in almost 50 countries worldwide. The Province is investing $2.5 million to support major upgrades at Greenfield Global’s distillation facility in Johnstown, Ontario. This project will allow Greenfield to produce the equivalent of over 150 million one litre bottles of specialty medical-grade alcohol annually, which will be used in hand sanitizers and other applications that rely on high-purity specialty alcohol.

- Southmedic — a Barrie-based medical device manufacturer that distributes to more than 60 countries around the world. The Province is providing $1.8 million to help the company re‑engineer and retool its current production and purchase new moulding equipment. With this new equipment, the company will double its output of oxygen masks, triple its output of ETCO2 masks used to monitor breathing prior to ventilator use, and quadruple its output of eye and face shields.

- Eclipse Innovations Inc. — a Cambridge-based manufacturer of custom automated equipment for the life sciences, energy, transportation, consumer, industrial and electronics industries. The Province is providing $1.4 million to help the company scale up its operations to manufacture one million N95 masks per week.

Protecting Workers, Volunteers, and Organizations Who Make Honest Efforts to Follow COVID‑19 Public Health Guidelines

The government introduced the proposed Supporting Ontario’s Recovery Act, 2020 on October 20, 2020. If passed, this Act will provide liability protection for workers, volunteers and organizations that make an honest effort to follow public health guidelines and laws relating to exposure to COVID‑19. At the same time, it would also maintain the rights of the people of Ontario to take legal action against those who willfully, or with gross negligence, endanger others.

Improving the Business Climate for Indigenous Communities and Northern Municipalities

The Province remains committed to resource revenue sharing, including exploring expansion of the program so that more Indigenous communities as well as Northern municipalities share in the benefits of resource development. To that end, the government will continue to advance resource revenue sharing opportunities and will explore sharing revenues from aggregates development, as well as forestry and mining, with more Indigenous partners and Northern municipalities. These efforts would help increase prosperity for Indigenous communities and Northern municipalities, improve the business climate for natural resources development, and reduce investment risks in the sector, while supporting economic recovery and progress in the North.

Supporting Indigenous-Owned Businesses during COVID‑19

In June 2020, the government announced that it would provide up to $10 million to support Indigenous-owned small and medium-sized enterprises experiencing revenue shortfalls and unique challenges during COVID‑19. Many of these businesses are often located in rural or remote areas or operate in hard-hit service sectors like tourism. With this provincial funding, loans of up to $50,000 will be provided through Aboriginal Financial Institutions for businesses that are ineligible for, or unable to access, existing federal and provincial COVID‑19 response initiatives for small businesses. Up to 50 per cent of each loan will be in the form of a non-repayable grant, with no interest due on the loan portion until December 31, 2022. Businesses may use these funds to cover costs including payroll, rent, utilities or accommodating social distancing requirements.

Helping Northern Businesses

The government recognizes the unique needs of Northern Ontario’s economy in the face of COVID‑19. For this reason, the government announced the Northern Ontario Recovery Program in September 2020, in order to help businesses to adapt their operations to local public health guidelines under re-opening stages and continue to serve their communities and customers. Eligible projects will help ensure employee and consumer safety through a range of activities, including the acquisition of personal protective equipment (PPE), building renovations and other important measures. This short-term program will cover 100 per cent of eligible costs and will be administered by the Northern Ontario Heritage Fund Corporation, which promotes economic prosperity across Northern Ontario.

Supporting the Commercial Fishing Industry

The commercial fishing industry creates jobs and opportunities in many rural and coastal communities across the province. As a result of COVID‑19 impacts on this important industry, the government is temporarily suspending and refunding commercial fishing royalty payments for fish harvested in 2020.

Based on advice from the Ministerial Advisory Council for the Commercial Fishing Sector, this relief will help businesses that have been significantly impacted by COVID‑19 and have had challenges accessing federal relief and wage subsidy programs. Providing immediate relief to the commercial fishing industry will help support these local businesses and protect jobs.

Supporting Municipal Partners

Working Together to Support Municipalities through COVID‑19

Municipalities are facing unprecedented challenges as a result of the COVID‑19 pandemic.

To help local governments with the unforeseen pressures that have resulted from the pandemic, the Ontario government, in partnership with the federal government, is providing up to $4 billion in one-time assistance to Ontario’s 444 municipalities and 110 public transit systems as part of the Safe Restart Agreement (SRA). This includes up to $2 billion to assist municipalities with operating pressures and up to $2 billion for COVID‑19 related financial impacts to municipal transit agencies.

This 4 billion dollars in funding is an extraordinary measure for extraordinary times; it will take the heavy burden of pandemic costs away from the property tax bill, helping municipalities, communities and citizens of Ontario recover.

Allan Thompson

Mayor, Town of Caledon

Chair, Rural Ontario Municipal Association

This historic investment will help local governments protect the health and well-being of the people of Ontario, while continuing to deliver critical public services such as public transit, community supports and shelters, as the province continues down the path of renewal, growth and economic recovery. As part of the first phase of the SRA, municipalities are being provided with $1.6 billion. This includes an additional $212 million of funding through the Social Services Relief Fund to help municipal service managers and Indigenous housing partners protect homeless shelter staff and residents, expand rent support programming and create longer-term housing solutions. Building on the initial assistance provided earlier this year, this brings the government’s total Social Services Relief Fund investment to $510 million.

Municipalities also have a critical role to play in addressing fiscal challenges arising from COVID‑19 by finding savings and efficiencies, as well as using other available tools so that they can continue to deliver the services their communities rely on.

For most municipalities, phase one funding, together with the actions they have taken to find efficiencies, should be sufficient to manage financial pressures arising from the pandemic. However, the government is making a second phase of funding available to those municipalities that may require additional support to address extraordinary financial pressures related to COVID‑19.

The government has also worked with municipalities to provide them with the tools and supports they need including enabling them to hold virtual council and local board meetings, and temporarily extending expiring development charge bylaws to ensure municipalities could continue to collect this vital source of revenue. In addition, through the Municipal Modernization Program and the Audit and Accountability Fund, the government is providing up to $350 million by 2022–23 to help municipalities lower costs and improve services for local residents over the long term.

Postponing the Property Tax Reassessment and Helping to Defer Property Tax Payments

As announced in the March 2020 Economic and Fiscal Update, the government postponed the property tax reassessment that was scheduled to be conducted during 2020 for the 2021 taxation year. This measure was taken in view of the unique and unforeseen challenges that municipalities, residents and businesses are facing during 2020. Postponing the reassessment has provided stability for Ontario’s property taxpayers and municipalities, and it has enabled municipal governments to focus their attention on critical public health initiatives and other efforts to manage the local response to COVID‑19.

As part of the Province’s response to the COVID‑19 pandemic, the government also deferred the June and September quarterly property tax payments that municipalities make to school boards by 90 days. This measure provided municipalities with the flexibility to, in turn, provide property tax deferrals of over $1.8 billion to residents and businesses in Ontario. In fact, 75 per cent of municipalities representing 98 per cent of all municipal property tax levied in the province implemented property tax deferrals.

Providing Stability through the Ontario Municipal Partnership Fund

The government understands the importance of stability for municipalities during these uncertain times, which is why the $500 million envelope and structure of the Ontario Municipal Partnership Fund (OMPF) are being maintained for 2021. In addition to ensuring stability, maintaining the program envelope will allow for a further $5 million in support to be targeted to Northern and rural municipalities with challenges, including rural farming communities.

Delivering on the commitment to provide municipalities with timely information, the government announced 2021 OMPF allocations in October.

The government has been reviewing the OMPF in consultation with municipalities, to ensure the program meets the needs of local communities, especially small, Northern and rural municipalities. Given the unprecedented circumstances surrounding the COVID‑19 pandemic, the government will be taking more time for the review. Discussions with municipal partners are expected to resume later this year.

Chart Descriptions

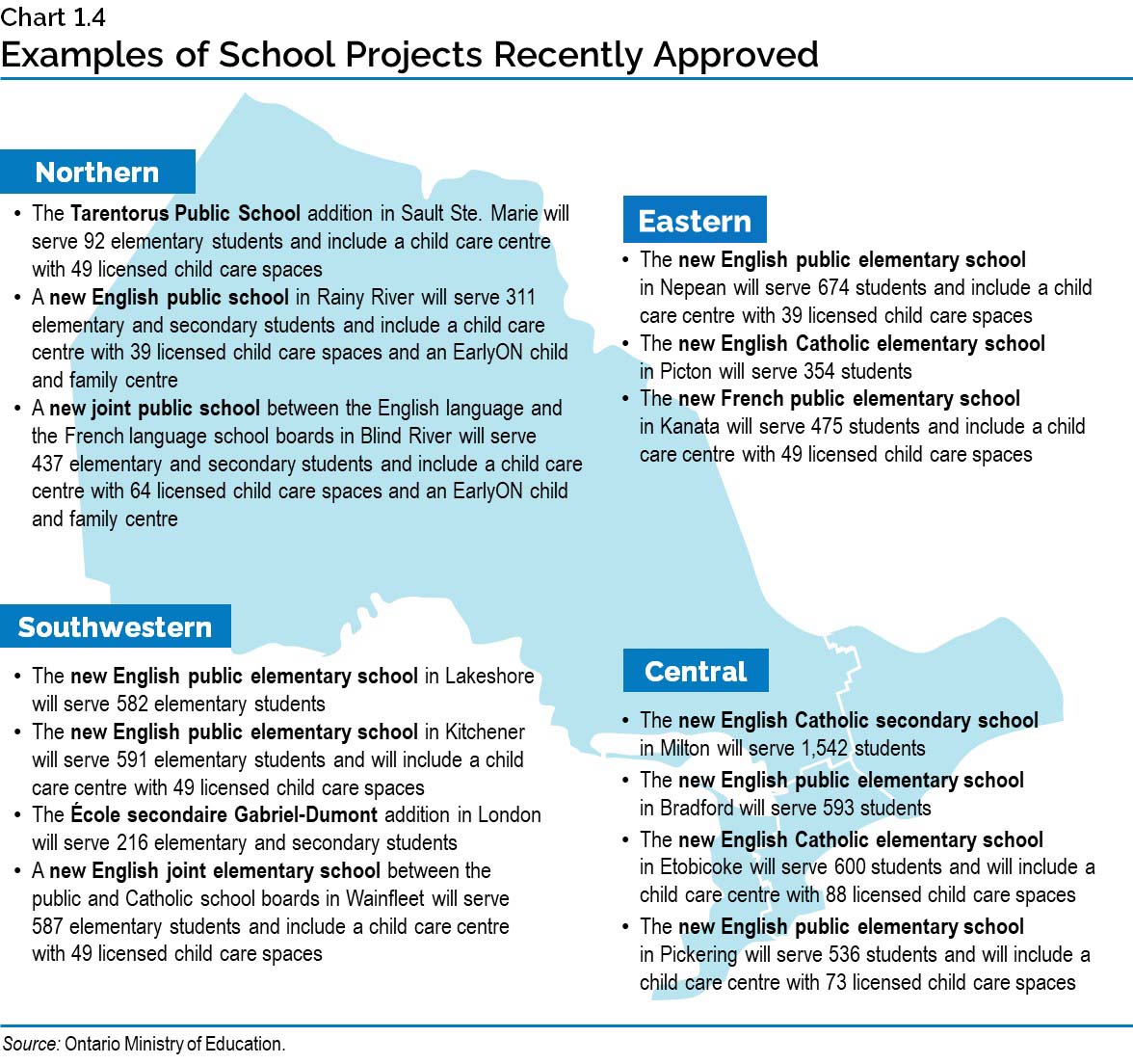

Chart 1.4: Examples of School Projects Recently Approved

This map shows examples of school projects that have been recently approved across different regions in Ontario.

Northern: The Tarentorus Public School addition in Sault Ste. Marie will serve 92 elementary students and include a child care centre with 49 licensed child care spaces. A new English public school in Rainy River will serve 311 elementary and secondary students and include a child care centre with 39 licensed child care spaces and an EarlyON child and family centre. A new joint public school between the English language and the French language school boards in Blind River will serve 437 elementary and secondary students and include a child care centre with 64 licensed child care spaces and an EarlyON child and family centre.

Eastern: The new English public elementary school in Nepean will serve 674 students and include a child care centre with 39 licensed child care spaces. The new English Catholic elementary school in Picton will serve 354 students. The new French public elementary school in Kanata will serve 475 students and include a child care centre with 49 licensed child care spaces.

Central: The new English Catholic secondary school in Milton will serve 1,542 students. The new English public elementary school in Bradford will serve 593 students. The new English Catholic elementary school in Etobicoke will serve 600 students and will include a child care centre with 88 licenced child care spaces. The new English public elementary school in Pickering will serve 536 students and will include a child care centre with 73 licensed child care spaces.

Southwestern: The new English public elementary school in Lakeshore will serve 582 elementary students. The new English public elementary school in Kitchener will serve 591 elementary students and will include a child care centre with 49 licensed child care spaces.

The École secondaire Gabriel-Dumont addition in London will serve 216 elementary and secondary students. A new English joint elementary school between the public and Catholic school boards in Wainfleet will serve 587 elementary students and include a child care centre with 49 licensed child care spaces.

Source: Ontario Ministry of Education

Chart 1.5: Illustrative Relief for a Restaurant

Illustrative relief for a restaurant in Toronto during the targeted 28-day period of public health restrictions due to COVID‑19. The restaurant leases a property valued at $2.4 million and experiences an 80 per cent revenue loss during the 28-day period. The restaurant will see total estimated support of $29,065 during the 28-day period through the following initiatives: property tax relief ($4,320), energy cost relief ($1,855), the Canada Emergency Wage Subsidy (CEWS) ($9,840) and rent subsidy ($13,050).

The restaurant has the current profile during COVID‑19: monthly revenue of $27,200, monthly payroll of $16,400, has nine employees, and pays $14,500 in monthly rent and $24,555 in other monthly expenses.

Rent subsidy would be provided through the Canada Emergency Rent Subsidy (CERS) federal program, which would cover fixed property expenses including rent and interest on commercial mortgages. It would provide a maximum base benefit of 65 per cent of eligible costs, plus a top up of a further 25 per cent for businesses temporarily shut down due to mandatory public health order. Businesses impacted by Ontario’s new targeted public health measures could be eligible for up to 90 per cent of their eligible costs.

Energy cost relief represents an illustrative example for a restaurant in a Regulated Price Plan (RPP). Assumes regular electricity consumption of about 13,700 kilowatt-hours per month for a Toronto Hydro business customer, with a 30 per cent reduction in consumption for the applicable bill. Includes natural gas relief based on the Ontario Energy Board bill calculator for the Enbridge Gas rate zone customer typically consuming about 2,860 m3, with a 30 per reduction in consumption for the applicable bill.

The federal government has proposed to extend the Canada Emergency Wage Subsidy (CEWS) until June 2021, with the current subsidy rate of up to a maximum of 65 per cent of eligible wages until December 19, 2020.

Note: While the example does not represent an actual company, the financial and employment profile is based on tax administration and Statistics Canada survey data for businesses in the industry.

Source: Ontario Ministry of Finance