Keeping Costs Down

Households across the province are struggling to make ends meet. Inflation, high interest rates and the federal carbon tax have increased the cost of living and put pressure on families, workers and seniors trying to afford everyday expenses like housing, utilities and transportation.

The government recognizes that this is a challenging time for many people in Ontario. This is why the government is not raising taxes and is putting more money back into people’s pockets to make life more affordable.

Putting Money Back in Your Pocket

The government is providing over $11.9 billion in relief to individuals and families across Ontario by lowering taxes and making it less expensive to take transit, drive a car, and attend postsecondary education, while increasing support for seniors with low income and keeping energy costs down.

Providing a Taxpayer Rebate

Life is expensive for families in Ontario, due to rising prices, high interest rates, and the federal carbon tax. At the same time, higher economic growth, inflation and federal tax changes have resulted in a projected increase in government revenues. This projected revenue increase is expected to help reduce the province’s deficit while providing an opportunity to put money back into people’s pockets, at this time of need.

The government is proposing to provide a $200 taxpayer rebate to all adult Ontario tax filers who have filed their 2023 Income Tax and Benefit Return by December 31, 2024.

In addition, the government understands that affordability is even more of a strain for families with children. This is why Ontario is proposing to provide an additional one-time $200 taxpayer rebate for each eligible child under age 18 to those families who qualify for a Canada Child Benefit (CCB) payment for 2024.

The one-time taxpayer rebate would provide $3.0 billion in support for about 12.5 million adults in Ontario and 2.5 million children. Cheques would begin to be sent out in early 2025.

For Ontario families with children who did not receive the CCB for 2024, the government would provide an opportunity for a one-time $200 taxpayer rebate per child through an alternative process.

See the Annex: Details of Tax Measures and Other Legislative Initiatives for further information.

Continuing to Extend the Temporary Gasoline Tax and Fuel Tax Rate Cuts

In spring 2022, the Ontario government announced it would temporarily cut the gasoline tax rate by 5.7 cents per litre and the fuel (diesel) tax rate by 5.3 cents per litre. Statistics Canada had previously noted that the province’s rate cut was a contributor to the decline in gas prices in Ontario in July 2022, helping to lower consumer price inflation.1

To continue to provide relief, the government is proposing to extend these temporary rate cuts for a fourth time, so that the rate of tax on gasoline and fuel (diesel) would remain at 9 cents per litre until June 30, 2025. This would save Ontario households $380, on average, over the three years since July 2022. This relief is especially important as the federal carbon tax is set to increase again on April 1, 2025.

See the Annex: Details of Tax Measures and Other Legislative Initiatives for more information.

Keeping Transit Costs Down

Ontario is keeping costs down for public transit riders through One Fare, which will save daily riders on participating systems an average of $1,600 each year. Since February 2024, transit riders only pay once to transfer between transit systems in the Greater Toronto Area (GTA). This is expected to lead to over eight million new rides every year. One Fare builds on improvements the government made in 2022 and will make cross‐boundary travel more affordable and convenient for students, seniors and other commuters.

Banning Road Tolls

Ontario is keeping costs down for drivers by banning any new tolls on new and existing provincial highways. This ban would also apply to the Don Valley Parkway and the Gardiner Expressway once uploaded to the province. The government already removed tolls on Highways 412 and 418 in April 2022. Removing tolls on these highways is expected to save drivers $68 million between 2022 and 2027.

Consistent with the Get It Done Act, 2024, the proposed Highway 401 tunnel expressway would not be tolled.

Eliminating Licence Plate Renewal Fees and Stickers

The government put money back in people’s pockets in 2022 by refunding eligible licence plate renewal fees paid since March 2020 for nearly eight million vehicle owners in Ontario. The government also eliminated licence plate renewal fees and plate stickers on a go‐forward basis for passenger vehicles, light‐duty commercial vehicles, motorcycles and mopeds that are owned by individuals, a company or business, resulting in savings of $600 for the average household to date. Ontario is making life easier and more convenient by becoming the first jurisdiction in North America to introduce automatic licence plate renewals. The change came into effect on July 1, 2024, and will save vehicle owners time, amounting to more than 900,000 hours every year.

To further keep costs down, through the Get It Done Act, 2024, the government froze fees for driver’s licences and Ontario Photo Cards, saving drivers an estimated $66 million over five years.

Keeping Electricity Costs Down

The government continues to ensure energy bills remain affordable, stable and predictable by providing rate relief for eligible households, small businesses and farms through the Ontario Electricity Rebate (OER). The government also provides targeted electricity bill relief for eligible low‐income households and on‐reserve First Nation consumers, as well as eligible rural or remote customers. The Ontario Electricity Support Program (OESP) provides a monthly on-bill credit to assist low-income households to manage their electricity costs. The First Nations Delivery Credit provides a credit equivalent to the delivery charge on First Nations residential customers’ electricity bills. The Rural or Remote Rate Protection (RRRP) and the Distribution Rate Protection (DRP) programs provide a rate subsidy to eligible rural or remote residential customers and specified residential customers who are served by eight local distribution companies with higher distribution costs, respectively.

Keeping Costs Down by Extending the Tuition Freeze

The government understands the importance of supporting access to affordable postsecondary education. As announced in the 2024 Budget, the province is extending the tuition fee freeze at publicly assisted colleges and universities for at least three more years. Institutions will maintain the flexibility to increase tuition by up to 5 per cent for out-of-province domestic students. Since the 10 per cent reduction in tuition and the subsequent freeze were introduced, Ontario students and parents have saved an estimated average of $1,600 per year to attend a university and $350 per year to attend a public college, compared to what they would have paid under the previous government’s policy.

Ontario is focused on supporting the postsecondary education sector in delivering high quality educational experiences in an efficient, accountable and transparent manner, which is why in the 2024 Budget, the government also announced nearly $1.3 billion in funding to help stabilize Ontario’s colleges and universities, while maintaining the tuition fee freeze to keep costs down for Ontario students and parents.

Providing Financial Support to More Seniors

To ensure that more seniors who need financial help get it, the government expanded the Ontario Guaranteed Annual Income System (GAINS) program and indexed the GAINS benefit to inflation.

As of July 2024, the maximum benefit increased to $87 per month for eligible single seniors and to $174 per month for couples. Going forward, the benefit will be adjusted to inflation annually.

Also in July, the annual private income eligibility threshold increased from $1,992 to $4,176 for single seniors, and from $3,984 to $8,352 for couples.

These changes will see up to 100,000 more low‐income seniors receive payments, representing an approximate 50 per cent increase in recipients.

Saving Individuals and Families Nearly $12 Billion in 2024–25

Since 2018, the government has acted early to make life more affordable for individuals and families across Ontario.

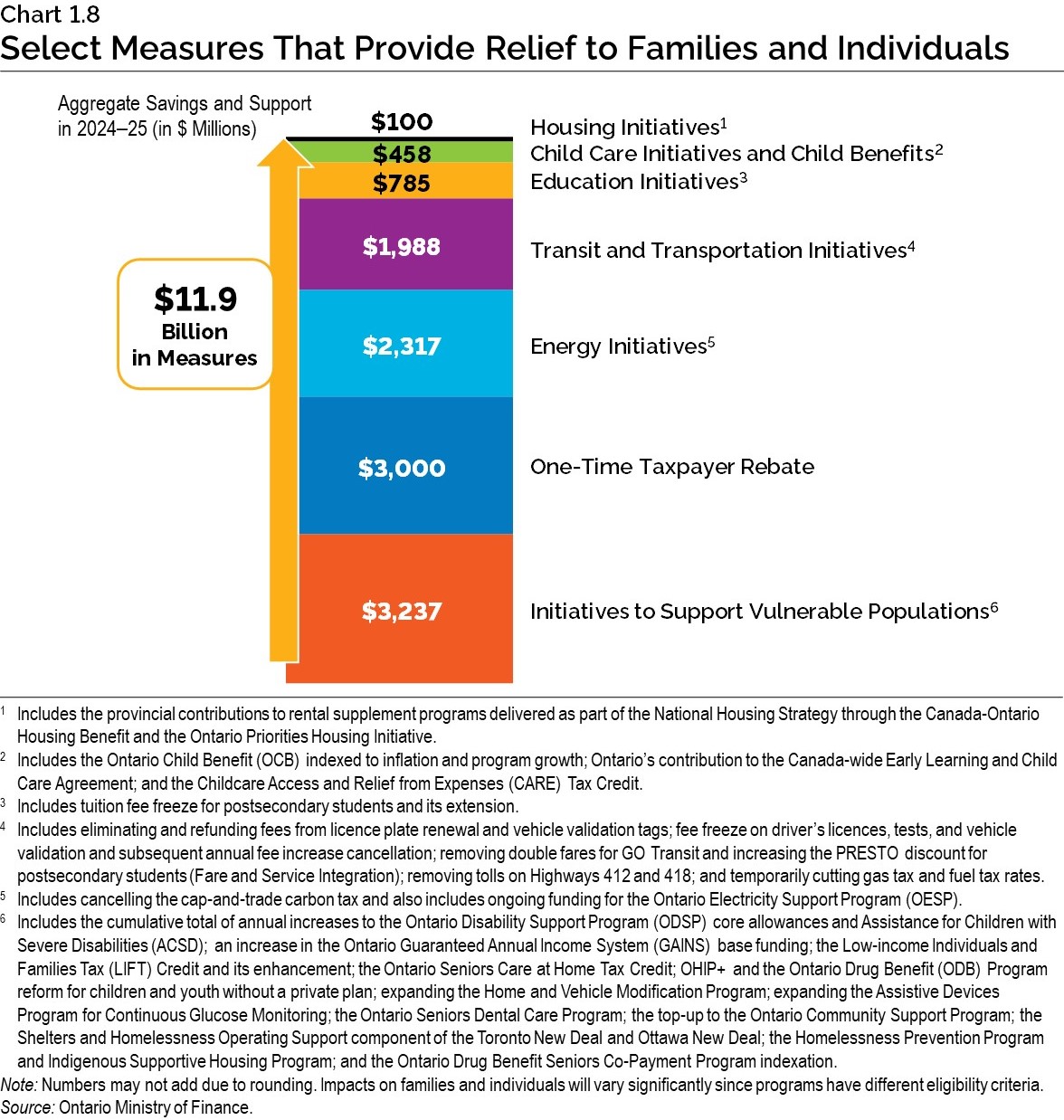

Select actions taken to date, summarized in Chart 1.8, will total $11.9 billion in relief for families and individuals in the 2024–25 fiscal year.

Helping to Increase Housing Supply and Affordability

The government is taking action to make more homes available to the people of Ontario, supporting lower taxes on affordable rental housing, and increasing homebuyer protections.

Supporting a Fair and Affordable Property Tax System

The government is continuing to review the property assessment and taxation system, focusing on fairness, affordability, business competitiveness, and modernized administration tools. Provincewide property tax reassessments will continue to be deferred until this work is complete.

Through this review, constructive input has been received from municipalities, business representatives, property tax professionals and other stakeholders.

While the review is underway, the government is prioritizing three areas that were identified through the consultation process:

- Affordable Rental Housing — Providing municipalities with the ability to reduce municipal tax rates on affordable rental housing through the creation of an optional property tax subclass. As well, the government will continue exploring potential assessment methodology changes for these properties.

- Student Housing — Introducing a legislative amendment that would provide consistent treatment for university-operated student housing whether the institution’s property tax status is governed by the Assessment Act or an institution-specific statute.

- Information Sharing — Undertaking work with the Municipal Property Assessment Corporation (MPAC), municipalities, and other stakeholders to enhance information sharing and develop new digital solutions, including:

- Enabling broader municipal use of MPAC data to improve planning;

- Evaluating new tools to help municipalities manage their assessment base;

- Making assessment roll information available to the public through a centralized electronic platform; and

- Authorizing digital delivery of property assessment notices.

Strengthening Consumer Protections for Homeowners and Buyers of New Homes

The government took strong action to protect consumers from significant financial harm, after becoming aware of increasing misuse of consumer Notices of Security Interest (NOSIs) by some businesses that were charging exorbitant fees to have NOSIs removed from title to consumers’ land. The Homeowner Protection Act, which received Royal Assent on June 6, 2024, bans the registration of NOSIs on title for consumer goods, deems existing NOSI registrations for consumer goods to be expired, and provides a mechanism to have those expired consumer NOSI removed from title.

The Act also made changes that, once in effect, would provide buyers of new freehold homes with a 10-day cooling-off period, consistent with the one provided to buyers of new condominiums. During the 10-day cooling-off period, these buyers would be able to cancel their purchase agreement at any time and for any reason without fear of financial penalty. The government recently consulted on regulations that would support the implementation of the 10-day cooling-off period.

Better Services for You

A growing province requires investments in public services. As a responsible steward of government revenue, including tax dollars, the government is doing things differently in areas that have the biggest impact for the people of Ontario, such as primary care, expanding access to fertility treatments and protecting you and your family. The province is making investments that enhance choice and access to ensure that communities and businesses continue to thrive.

Making Health Care More Connected and Convenient

Connecting People to Primary Care

Primary care serves as the foundation of a strong health care system. It provides individuals with essential, continuous and comprehensive health services that promote prevention, early intervention, and management of day-to-day health. This is why the government has announced a new task force, chaired by Dr. Jane Philpott, that will help connect every person in Ontario to primary health care within the next five years. Additionally, through the 2024 Budget, the government committed $546 million over three years to improve access to primary care. This investment will connect approximately 600,000 people to team-based primary care by expanding and creating new interprofessional care teams across the province.

Interprofessional primary care teams include a variety of health professionals — such as doctors, nurse practitioners, registered nurses and registered practical nurses, physiotherapists, social workers and dietitians — who work together to deliver comprehensive care. In addition to connecting people to care in their communities, interprofessional teams also alleviate pressure on hospital emergency departments and walk-in clinics. This proactive approach helps people stay healthier longer by creating faster access to diagnosis and treatment while reducing pressures on other parts of the health care system like emergency departments.

The government is focusing these resources on high-need areas to further its goal of ensuring every person in Ontario who wants access to a primary care provider can connect to one. Recent expansions and new teams include:

- Expansion of Couchiching Family Health Team — part of nearly $10 million to connect up to 34,000 more people in Simcoe County, Bruce County and York Region to primary care by establishing two satellite clinics serving vulnerable populations.

- Expansion of Seaway Valley Community Health Centre — part of nearly $22 million to connect more than 73,000 people to primary care in Eastern Ontario by expanding to Cornwall to help three different interprofessional teams work together and help close gaps in care for the region.

- New and Expanded Lakehead Nurse Practitioner-Led Clinic — part of more than $5 million to connect over 16,000 people to primary care in Northwestern Ontario by establishing a new satellite Nurse Practitioner-Led Clinic that will focus on mental health and addictions support and provide care for newborns as well as community paramedicine patients in the Thunder Bay area.

- New Hamilton Family Health Team — Mobile Teams — part of more than $3.1 million to connect over 14,000 people to primary care in Hamilton and surrounding communities, by leveraging three existing primary care teams to provide care to more people without access to primary care in urban and rural communities, by expanding services at fixed locations and through new mobile outreach teams.

- Expansion of Central Lambton Family Health Team — part of $6.4 million to connect over 23,000 people to primary care in the Lambton, London and Chatham-Kent regions through an expanded Family Health Team in Elgin County that will partner with another Family Health Team and Community Health Centre to provide primary care to unattached patients, isolated seniors, socially disadvantaged groups and other vulnerable people.

- New Community Health Centre and Expanded Maamwesying North Shore Community Health Services — $1.1 million to connect more than 4,000 people in Sault Ste. Marie and surrounding area by establishing a new Community Health Centre that will provide primary care services to a marginalized population and expand an Indigenous Primary Health Care Organization focused on providing primary care for unattached patients in six First Nations and downtown Sault Ste. Marie.

Training More Family Doctors

Ontario is investing $17.7 million in 2026–27 to expand the Ontario Learn and Stay Grant (OLSG) to further improve access to primary care across the province.

This expansion will extend the grant to include medical school students who commit to working in the community for a term of service as family medicine physicians after graduation from family medicine residency anywhere in the province. As part of this initiative, the government will review its current physician Return of Service programs, which will help to improve physician distribution across the province. This work will help encourage more learners to work as family medicine physicians and to practise in underserviced communities across the province.

This builds on the government’s ongoing efforts to grow the number of health care professionals in underserved and growing communities in Northern, Eastern and Southwestern Ontario through the OLSG. The current program provides full, upfront funding for tuition, books and other direct educational costs for students who enrol in an eligible nursing, paramedic or medical laboratory technologist program in return for working in the communities where they studied for a term of service after graduation. Nearly $60 million in support has already been provided to 7,300 students through the OLSG since it launched in 2023–24.

Prioritizing Ontario Residents for Medical School Seats

Building on the 2023 Budget’s $133.8 million commitment to medical school expansion, Ontario continues to enhance its health care capacity, especially access to primary care services in underserved areas, by increasing the supply of physicians. The government’s planned medical school education expansion, coupled with a focus on prioritizing seats for Ontario residents, is aimed at facilitating access for aspiring doctors. The government is introducing legislative amendments to reserve 100 per cent of undergraduate medical education seats for Canadian students, with a minimum of 95 per cent of seats for Ontario residents. In addition, the government will examine the postgraduate visa trainee program to ensure it is serving the best interest of Ontario’s medical professionals and patients. The government will also provide greater opportunities for Ontarians who studied medicine abroad to access postgraduate residency spots, encouraging them to complete their training domestically. By working closely with medical schools and health-sector stakeholders, the government is continuing to build a more resilient physician workforce that meets growing health care needs across the province. This investment is advancing the largest expansion of Ontario’s medical education system in over a decade.

Increasing Nursing Enrolment

To support the growing demand for nurses, Ontario is continuing to expand nursing enrolment in colleges and universities. As announced in the 2024 Budget, the government is investing $128 million over the next three years to support continued increases in nursing spaces at publicly assisted colleges and universities by 2,000 registered nurse and 1,000 registered practical nurse seats. The government’s sustained commitment is helping support a steady pipeline of health human resource professionals that address Ontario’s health care needs of today and the future.

Supporting Patients with Amyotrophic Lateral Sclerosis Across Ontario

The government is committing more than $13 million over three years, starting in 2024–25, to establish an Amyotrophic Lateral Sclerosis (ALS) provincial program. This program will support patient care at Ontario’s five regional multidisciplinary ALS clinics, as well as for the ALS Society of Canada’s Community Leads program and Equipment Program. It will also enable the expansion of regional multidisciplinary ALS services into Northern Ontario for improved access to care. The government is also exploring the creation of a comprehensive assistive devices loan and recycling program to allow Ontarians living with physical disabilities to have improved access to a larger range of affordable recycled devices.

Expanding Access and Reducing the Cost Burdens for Fertility Services

Beginning in 2025–26, the government will invest an additional $150 million over two years to expand the Ontario Fertility Program (OFP). This funding will nearly triple the number of individuals who are able to receive a government-funded in vitro fertilization (IVF) cycle, increase the capacity of fertility clinics and reduce waitlists both in hospitals and community settings. By expanding the OFP, the government will improve timely access to specialized services and offer greater support to families seeking to conceive a child. The government is also exploring opportunities to expand the OFP to clinics that are not currently participating in the program, to further expand options for patients.

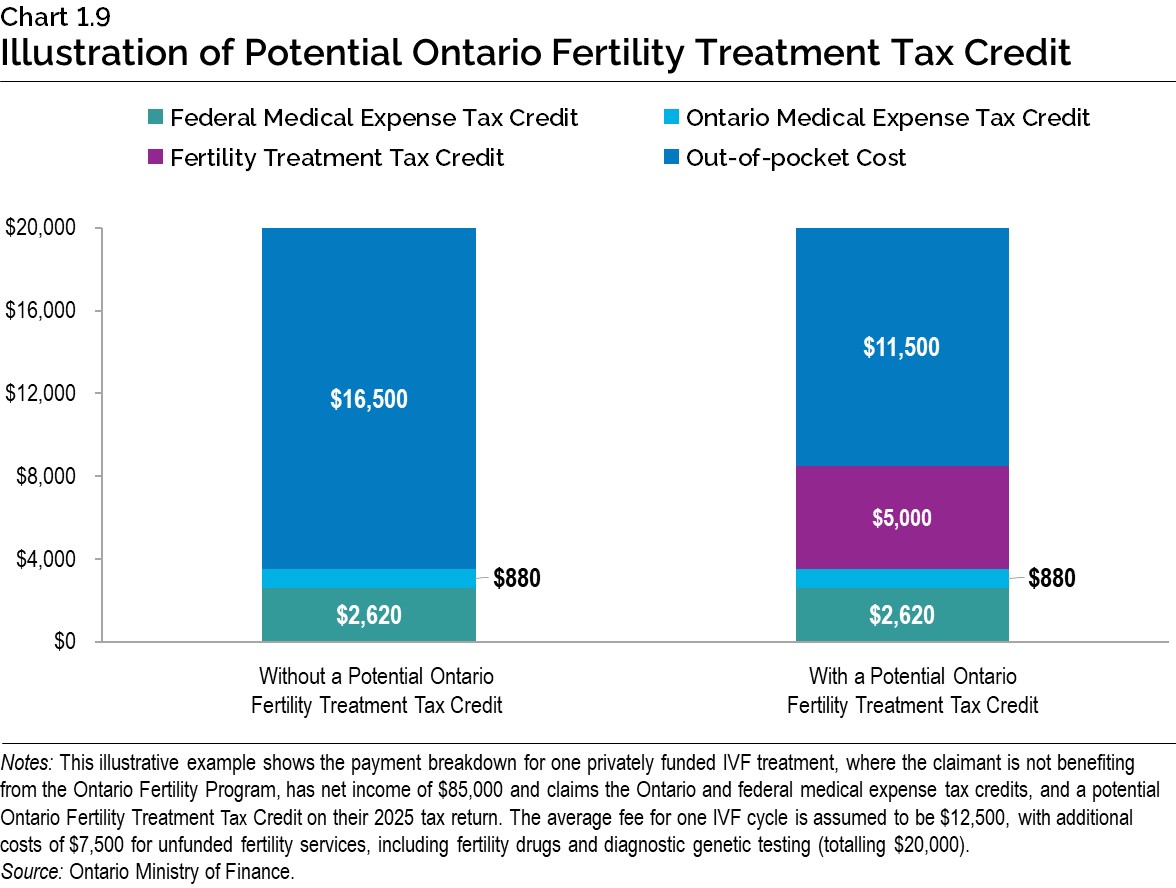

In 2025, the government will introduce additional support to families who are seeking fertility treatment, through a new tax credit effective January 2025, which builds on Ontario’s existing medical expense tax credit. This proposed new tax credit would provide support of up to 25 per cent of eligible fertility treatment expenses. These expenses could include IVF cycles, fertility drugs, travel and diagnostic testing. The government is setting aside $115 million for this initiative over three years. An update on this measure will be announced in the 2025 Budget.

Supporting Individuals with Developmental Disabilities

The government is committed to supporting the people of Ontario who need it most, including individuals with developmental disabilities, physical disabilities, seniors and other vulnerable individuals. This is why Ontario is investing $7.7 million in 2024–25 to support the Frankfort Family Reena Residence in constructing new spaces for employment services, sports programs, meeting rooms and wellness programs for building residents and the surrounding community. This project will enhance quality of life for people in their community and help them live with dignity.

Building on the Success of Seniors Active Living Centres

The government is investing close to an additional $17 million over the next three years to expand access to services and activities for seniors through 100 new Seniors Active Living Centres (SALC) programs across the province. These programs promote wellness, social interaction and reduce ageism to help seniors stay active, independent and engaged in their communities. This builds on the government’s annual investment of $15 million for the SALC program.

Due to the overwhelming success of Ontario’s 316 existing Seniors Active Living Centres, the government made changes to the Seniors Active Living Centres Act, 2017 in June 2024 that enable more types of organizations to better support these programs. In addition to municipalities, other local and community-based organizations such as Legions, Lions Clubs and recreational clubs are now eligible. A call for proposals was open throughout summer 2024 to eligible organizations, and the government is working to review applications to support the launch of new programs.

Building and Expanding Hospitals

The government is investing nearly $50 billion over the next decade in health infrastructure, including $36 billion in capital grants. This ambitious plan will support over 50 hospital projects and deliver approximately 3,000 new hospital beds to enhance access to quality care and build a connected, people-first health care system. See Table 1.2 below for recent milestones.

Table 1.2

Building and Expanding Hospitals

Northern

- Centre de santé communautaire de Timmins: Construction began in spring 2024 with expected completion by May 2025. The new facility will strengthen community-based health care by providing essential services such as health promotion, disease prevention and physiotherapy, and support medical student education.

- Weeneebayko Area Health Authority — Redevelopment Project: Early works began in August 2024 with expected completion by 2030 for a state-of-the-art hospital and Elder Care Lodge in Moosonee, along with a new ambulatory care centre on Moose Factory Island, bringing much-needed health services to the region.

- Dryden Regional Health Centre — Satellite Renal (Hemodialysis) Unit: This project will create a four station hemodialysis unit, with room for expansion, to provide better access to quality services in the Northwest.

Eastern

- Pembroke Regional Hospital — Surgical Services and Central Sterile Reprocessing Project: This project, which is on track for completion by January 2025, will improve surgical unit efficiency and expand patient care capacity, providing more timely access to vital surgical services.

- Quinte Health — Prince Edward County Memorial Hospital Site Redevelopment Project: Construction is currently underway with expected completion by 2027. The new health care facility will include 23 in-patient beds, a 24/7 emergency department, modern surgical suites, dialysis treatments and diagnostic imaging.

Southwestern

- South Niagara Hospital: Construction is currently underway with expected completion by 2028. The new hospital is planned to have approximately 469 patient rooms and a 24/7 emergency department to meet growing demands in the region.

Central

- West Park Healthcare Centre Redevelopment Project, Toronto: In spring 2024, patients began moving into the newly constructed six-storey facility, which increased capacity, with up to 314 beds upon opening. The new facility also provides enhanced outpatient care and advanced diagnostic and therapeutic services.

- Lakeridge Health Broader Redevelopment: This multi-phased redevelopment project is currently in early planning to expand hospital campuses in Bowmanville, Oshawa, Whitby, Ajax and Pickering to meet growing demands in the region.

Source: Ontario Ministry of Health.

Building Long-Term Care Homes

Ontario continues to make progress on its plan to build modern, safe and comfortable long‐term care homes for residents. Through planned investments that total a historic $6.4 billion since 2019, Ontario is making progress to build 58,000 new and upgraded beds across the province by 2028.

Since the 2024 Budget, progress has been made on completing and opening long-term care homes to new residents, including:

- Brouillette Manor opened in June 2024 with 36 new long-term care beds and 60 upgraded long‑term care beds in Tecumseh;

- Extendicare Countryside opened in March 2024 with 256 upgraded long-term care beds in Sudbury;

- Pleasant Meadow Manor opened in August 2024 with 35 new long-term care beds and 61 upgraded long-term care beds in Norwood; and

- The Village of Winston Park opened in July 2024 with 109 new long-term care beds and 179 upgraded long-term care beds in Kitchener.

Building an Education System That Delivers for Kids

Building Schools and Child Care Spaces

As part of the government’s commitment to provide healthy learning environments that accommodate student needs, Ontario is investing about $23 billion over the next 10 years, including $16 billion in capital grants, to build new schools, create child care spaces and modernize school infrastructure. This includes $1.4 billion for the 2024–25 school year to support the repair and renewal needs of schools.

For the 2024–25 school year, 37 new schools and additions have opened, creating over 18,000 new student spaces, including four French-language school projects.

Table 1.3

School Projects Opening for the 2024–25 School Year

Northern

- An addition to St. Hilary Catholic School in Red Rock, with 23 more student spaces.

Eastern

- Easthill Elementary School in Belleville, which serves 472 students and includes 49 licensed child care spaces.

- Swift Waters Elementary School in Brockville, which serves 500 students and includes 64 licensed child care spaces.

- École élémentaire catholique Sainte-Geneviève in Kingston, which serves 481 French-language students and includes 73 licensed child care spaces.

- Mino Mikan Elementary School in Ottawa, which serves 674 students and includes 39 licensed child care spaces.

- An addition to École secondaire catholique Paul-Desmarais in Ottawa, with 389 more student spaces.

Southwestern

- St. Teresa of Calcutta Catholic School in Chatham, which serves 564 students and includes 49 licensed child care spaces.

- Erie Migration District School in Kingsville, which serves 1,798 students and includes 98 licensed child care spaces.

- An addition to Listowel Eastdale Public School in Listowel, with 98 more student spaces and 49 more licensed child care spaces.

- An addition to Eagle Heights Public School in London, with 300 more student spaces.

- Beacon Heights Public School in Tecumseh, which serves 651 students and includes 73 licensed child care spaces.

- An addition to Laurelwood Public School in Waterloo, with 184 more student spaces.

Central

- An addition to St. Leonard Catholic School in Brampton, with 92 more student spaces.

- Cedar Ridge Public School in Milton, which serves 770 students and includes 88 licensed child care spaces.

- St. Josephine Bakhita Catholic Elementary School in Milton, which serves 671 students and includes 88 licensed child care spaces.

- An addition to Mary Street Community School in Oshawa, with 190 more student spaces.

- Tanya Khan Public School in Vaughan, which serves 638 students and includes 39 licensed child care spaces.

Source: Ontario Ministry of Education.

Table 1.4

Continuing to Get Shovels in the Ground to Build More Schools

Northern

- A new joint French and English elementary and secondary school in Blind River, which will serve 72 French-language students, 381 English-language students and include 64 licensed child care spaces.

- A new French Catholic elementary school in Hanmer-Val Thérèse, which will serve 567 students and include 88 licensed child care spaces.

- A new English public elementary and secondary school in Parry Sound, which will serve 815 students and include 49 licensed child care spaces.

- A new English public elementary and secondary school in Rainy River, which will serve 311 students and include 39 licensed child care spaces.

Eastern

- An addition to St. Joseph Catholic School in Belleville, which will serve 334 students and include 49 licensed child care spaces.

- An addition to J.J. O’Neill Catholic School in Greater Napanee, which will serve 331 students and include 49 licensed child care spaces.

- A new English Catholic elementary school in Loyalist, which will serve 449 students and include 49 licensed child care spaces.

- A new French public elementary school in Ottawa, which will serve 475 students and include 49 licensed child care spaces.

- An addition to St. Joseph’s Catholic High School in Renfrew, which will serve 434 students and include 73 licensed child care spaces.

Southwestern

- A new English public elementary school in Grey Highlands, which will serve 374 students and include 39 licensed child care spaces.

- A new joint English public and Catholic elementary school in Haldimand, which will serve 746 students and include 49 licensed child care spaces.

- A new English Catholic elementary school in Kitchener, which will serve 527 students and include 88 licensed child care spaces.

- A new English public elementary school in London, which will serve 802 students and include 88 licensed child care spaces.

- A new English public elementary school in Woodstock, which will serve 856 students and include 88 licensed child care spaces.

Central

- A new English public elementary school in Brampton, which will serve 850 students and include 73 licensed child care spaces.

- A new English public elementary school in East Gwillimbury, which will serve 638 students and include 39 licensed child care spaces.

- A new English public elementary school in Niagara Falls, which will serve 608 students and include 49 licensed child care spaces.

- A new English public elementary school in Pickering, which will serve 634 students and include 73 licensed child care spaces.

- A new English Catholic elementary school in Toronto, which will serve 350 students and include 49 licensed child care spaces.

Source: Ontario Ministry of Education

Modernizing High School Graduation Requirements

Ontario is committed to ensuring that students have the resources and supports they need to build a successful future. This is why the government is modernizing the Ontario Secondary School Diploma (OSSD) requirements for the first time in 25 years, with a focus on a back-to-basics agenda. The province is launching a suite of reforms, including:

- Introducing a new financial literacy graduation requirement to equip students with practical financial literacy skills, such as creating and managing a household budget, saving for a home, learning to invest wisely, and protecting themselves from financial fraud.

- Consulting with parents and experts on what important life skills students should learn in school and bringing back home economics education.

- Requiring new teachers to pass the Math Proficiency Test beginning in February 2025.

- Revitalizing guidance and career education for the first time in 13 years to better support students’ understanding of local labour market needs and pathways to good careers.

- Investing up to $14 million in 2024–25 to launch career coaching for Grade 9 and 10 students, to explore new opportunities in STEM and the skilled trades.

- Re-introducing the student exit survey to gather feedback on the impact of reforms.

Modernizing the OSSD requirements is part of the government’s plan to prepare students for life beyond the classroom and ensure that they graduate with practical learning that leads them to better jobs and bigger paycheques.

Putting Beer, Wine, Cider and Coolers in Convenience Stores, Grocery Stores and Big-Box Stores

The Ontario government is delivering on its commitment to expand the province’s beverage alcohol marketplace to increase choice and convenience for shoppers earlier than planned.

The government’s phased expansion, which began earlier this year, is giving customers across Ontario more choice and convenience, supporting businesses and helping to promote small and Ontario-made beverage alcohol producers. As part of the government’s plan to expand alcohol sales, up to 8,500 eligible convenience, grocery and big-box grocery stores in Ontario could be licensed to sell beer, cider, wine and ready-to-drink alcoholic beverages, marking the largest expansion of consumer choice and convenience in the province’s beverage alcohol marketplace since the end of prohibition almost 100 years ago.

Given the scale of the transformation, the government committed to providing an update related to revenue from alcohol, including the impacts of the expansion of the alcohol retail marketplace. There will be regular updates to projections as businesses and consumers adjust to the new marketplace.

In 2026–27, projected revenue for the Liquor Control Board of Ontario (LCBO) will be $8.5 billion, which is $0.8 billion higher than its projected revenue in the LCBO’s forecast. This increase is primarily driven by the LCBO’s expanded role as a wholesaler in the new alcohol marketplace, in addition to its continued role as a retailer, partly offset by the impacts of consumption trends. As a result, the LCBO’s net income in 2026–27 is projected to be $2,647 million, which exceeds the previous net income forecast by $96 million. In the near term, the LCBO net income for 2024–25 and 2025–26 will be $2,165 million and $2,232 million, which is below 2024 Budget forecasts. This is largely driven by the labour action in July 2024, overall decreases in consumption, the outcomes of collective bargaining, and measures related to the transition to the new marketplace, partly offset by the impact of the increase to the LCBO’s wholesale market share. It is anticipated that the government’s approach to enhance choice and convenience through alcohol marketplace expansion will continue to strengthen the LCBO’s future in the expanded marketplace.

| 2024–25 | 2025–26 | 2026–27 | |

|---|---|---|---|

| LCBO Net Income (2024 Budget) | 2,450 | 2,486 | 2,551 |

| Strike Impact | (102) | ||

| Retail Expansion1 | (99) | (80) | 267 |

| Baseline sales projection and other expenses2 | (86) | (175) | (171) |

| Total Change from 2024 Budget* | (286) | (254) | 96 |

| LCBO Net Income (2024 Ontario Economic Outlook and Fiscal Review)* | 2,165 | 2,232 | 2,647 |

Table 1.5 footnotes:

*Totals may not add due to rounding.

[1] Retail expansion impacts are based on projections related to the initial phases of the alcohol retail modernization rollout. Projections are subject to change.

[2] Baseline sales projection shows the impacts from consumption trends. Other expenses include impacts from the collective bargaining agreement and changes to other expenditure items. Figures in 2025–26 and 2026–27 were estimated by the Ontario Ministry of Finance from information provided by the LCBO.

Sources: Liquor Control Board of Ontario and Ontario Ministry of Finance.

Protecting You and Your Family

Fighting Auto Theft and Organized Crime with the Expanded New Joint Air Support Unit

As announced in the 2024 Budget, the government is investing additional resources in new air support to fight car thieves and organized crime. This includes $134 million to purchase five new police helicopters for use in the Greater Toronto Area and Ottawa. As part of a new Joint Air Support Unit, the Ontario Provincial Police (OPP) will acquire two new H135 helicopters to provide support to Ottawa and Toronto Police Services. In addition, three helicopters will be procured, owned and operated by Durham, Halton and Peel Regional Police Services to support current patrols and improve response times.

This investment supports the government’s ongoing efforts to enhance public safety in Ontario by ensuring police services have the resources to respond to major incidents and urgent situations. Equipped with the latest technology, the helicopters will help keep highways and roadways safe from violent carjackings, auto theft, street racing and impaired driving.

Combatting the Illegal Cannabis Market

The government remains committed to combatting the illegal cannabis market and to ensuring the integrity of the regulated market. Illegal cannabis poses numerous risks to public health and safety and takes business away from responsible legal businesses across the province.

This is why, in the 2024 Budget, the government announced an additional $31 million over the next three years to support enforcement against illegal cannabis operations through the Provincial Joint Forces Cannabis Enforcement Team.

The government is also planning to help law enforcement crack down on the advertising and promotion of illicit online cannabis sales to better protect Ontario’s communities.

Last, the government will continue to support the development of a vibrant legal cannabis market in Ontario to ensure it is well positioned to displace the illegal market.

Exploring Tools to Better Address Financial Crimes

The government is exploring options that would require private corporations to submit information about their beneficial owners to a registry. This would provide law enforcement and other regulatory authorities with the information to better detect and address instances of tax evasion, money laundering, and other financial crimes. These types of activities negatively impact Ontario’s economy and its reputation as a leading financial centre. Money laundering also poses a risk to public safety as the misuse of corporate structures is a common practice used by organized crime. The government previously introduced changes to the Business Corporations Act (Ontario) to require private corporations to maintain a record of individuals with “significant control.”

Providing More Choice and Better Access to Automobile Insurance Benefits

The government is committed to continue empowering Ontario’s drivers by enabling more consumer choice and moving away from a one-size-fits-all approach. The government has made regulatory changes that make statutory accident benefits other than medical, rehabilitation, and attendant care optional for consumers to purchase. These changes go into effect July 1, 2026.

Making auto insurance pay for motor vehicle accident injuries before extended health care plans reduces the risk of consumers using up their supplementary health insurance plan benefits for expenses related to motor vehicle accidents. The proposed change to the Insurance Act is also expected to simplify the claims process and increase administrative efficiency in the system. If passed, this change will come into effect July 1, 2026.

Following on the government’s commitment to have Financial Services Regulatory Authority of Ontario (FSRA) review the Health Service Provider Guidelines and Frameworks, FSRA launched a public consultation to review the Professional Services Guideline and the Attendant Care Hourly Rate Guideline. FSRA is also reviewing the Health Service Provider Framework and the Health Claims for Auto Insurance (HCAI) system to find further efficiencies in the system.

Protecting Ontario Consumers

Protecting Deposits at Credit Unions

With assets totalling more than $97 billion, 1.8 million members and almost 9,000 employees across the province, Ontario’s credit unions and caisses populaires play an important role in servicing people and businesses in urban and rural communities.

To bolster public confidence, protect depositors’ assets, and help ensure broader market stability, the government is proposing amendments to the Credit Union and Caisses Populaires Act, 2020 that would provide FSRA with enhanced investigative and resolution tools to support effective oversight of credit unions.

The government continues to support the need for Ontario credit unions to be able to have direct access to the Bank of Canada’s emergency liquidity facilities to help ensure broader market stability.

Protecting Consumers in the Life and Health Insurance Sector

Ontario recognizes the important role that the life and health insurance sector plays in our economy. Increasingly, insurers have been selling products and services through distributors such as Managing General Agents (MGAs).

To align with sector development and better protect consumers, the government is proposing to create a licensing framework for distributors under the Insurance Act and clarify the roles and responsibilities of insurers, distributors and agents.

This builds on previous work by the government and FSRA to promote greater transparency and consumer protection through banning deferred sales charges in Ontario and initiating the implementation of Total Cost Reporting for individual variable insurance contracts.

Consulting on Preferred Provider Networks in Ontario’s Employer-Sponsored Drug Program Sector

Ontario recognizes the importance of consumer choice regarding cost-effective access to medicines and the need for having a competitive pharmacy sector.

The government recently concluded consultations on the role of Preferred Provider Networks (PPNs) in Ontario’s employer-sponsored drug programs. The government engaged with large and small pharmacy operators, the insurance industry, employers, drug manufacturers and consumer advocacy groups to better understand the impact of such arrangements on individuals and businesses. The government will be reviewing its findings while continuing to work closely with stakeholders.

Working for Workers

Ontario workers are at the centre of the province’s plan to build Ontario, and the province will need an all-hands-on-deck approach to deliver roads, schools, hospitals, highways and homes. Ontario cannot just rely on temporary workers to fill these positions. This is why the province is continuing to support workers here at home in their skills development, training and retirement planning.

Supporting Skills Development and Training

Expanding Training Programs for Workers

Ontario’s Skills Development Fund Training Stream helps address recruitment challenges by connecting job seekers with employers, allowing them to begin rewarding careers in in-demand sectors like manufacturing, construction and health care. This is why Ontario is investing up to an additional $260 million in the current fifth round of the fund, the biggest funding round since it launched in 2021. This latest round of funding brings Ontario’s total investment through the Skills Development Fund up to $1.4 billion.

Building New Skills Training Centres

The Skills Development Fund Capital Stream helps ensure that Ontario has the world-class training facilities it needs to train more workers and build Ontario’s economy. This is why Ontario continues to invest $224 million to build and expand brick-and-mortar training centres through the Skills Development Fund Capital Stream. The funding is helping unions, employers, Indigenous centres and local organizations to convert existing facilities and build new training centres with state-of-the-art equipment and technology. These new training centres will prepare people for emerging and in‑demand jobs in critical sectors, including construction and health care, among others.

Encouraging More Ontarians to Take Up a Skilled Trade

Ontario is training people for in-demand careers in the skilled trades to support the province’s growing economy, deliver on the government’s ambitious capital plan, and provide more pathways to better jobs and bigger paycheques. As announced in the 2024 Budget, the government is providing an additional $16.5 million annually over the next three years to support a variety of programs that focus on breaking the stigma and attracting more young people into the skilled trades, simplifying the system, and encouraging employer participation in apprenticeships. This year, Ontario is expanding its successful Level Up! Skilled Trades Career Fairs to be the biggest yet, introducing over 35,000 students and parents across 15 cities to exciting, in-demand careers in the trades. Since 2020, Ontario has invested over $1.5 billion in the skilled trades.

Ontario is also launching a new online job-matching portal for potential apprentices, journeypersons and employers to network and share apprenticeship opportunities. This portal will help potential apprentices find interested sponsors, register and begin their training.

In addition, the Ontario government is opening a new pathway to the skilled trades for youth. Building on the successful Ontario Youth Apprenticeship Program, Ontario is creating a new stream called Focused Apprenticeship Skills Training (FAST) that will allow students in Grades 11 and 12 to participate in more apprenticeship learning through additional co-operative education credits while completing high school. Students will be able to take up to 80 per cent of their senior courses in co‑op education, and graduates will receive a new seal on their Ontario Secondary School Diploma (OSSD) to signify their successful completion of the program.

Helping More Women Build Skills and Get Jobs

The government is investing up to $26.7 million over three years through the Women’s Economic Security Program to help low-income women gain the skills, knowledge and experience they need to find a job in an in-demand sector like the skilled trades, start a business and achieve financial independence. To remove barriers to participation, women are provided with supports like meals, transportation, help finding child care and other referrals.

Helping Workers Train for and Access In-Demand Jobs

The Better Jobs Ontario program helps eligible job seekers access short-term training programs, by providing up to $28,000 to cover expenses including tuition, transportation and child care. In the 2023 Budget, Ontario invested an additional $15 million over three years to support the recent expansion of the program to more job seekers, including youth, gig workers, newcomers and those on social assistance, who may face barriers to finding stable employment. Since January 2021, this program has supported over 12,6002 job seekers looking to retrain and obtain in-demand skills.

Ontario is delivering on its commitment to bring integrated, streamlined pre-employment services to every region through the province’s Employment Services Transformation, which is helping connect job seekers, including those on social assistance and people with disabilities, to secure rewarding careers close to home.

Providing Mentorship and Job Opportunities to Support Successful Reintegration

To improve outcomes and reduce recidivism for individuals in and leaving the correctional system, the government is investing $8.6 million over two years to increase access to programs for those in custody or on community supervision, so they can successfully reintegrate into their communities. Through this pilot project, the province will partner with community organizations in the Greater Toronto Area that will provide employment and skills training to people with experience in the justice system and under community supervision.

Public safety is and will always be an important focus for the Ontario government. When individuals in custody or on probation and parole can contribute to society in a meaningful way, it reduces the likelihood they will reoffend, leading to safer, stronger communities across the province.

Attracting International Talent Through the Ontario Immigrant Nominee Program

While the government is focused on preparing workers here in Ontario to meet the demands of employers, shortages in some sectors require looking outside of Canada for help. The Ontario Immigrant Nominee Program (OINP) supports Ontario’s labour market and economic development needs by providing employers with a means to attract international talent, address skills shortages and retain skilled individuals. The government will invest an additional $5.5 million in the program in 2024–25 to help process more applications and support program integrity. This investment is in addition to the $25 million over three years announced in the 2023 Budget.

The government is also making changes to the program to expand the health care workforce, increase the occupations eligible for the In-Demand Skills stream and protect newcomers from immigration fraud. Additionally, the province is the first in Canada to ban the use of Canadian work experience as a requirement in job postings or application forms. These changes help address recruitment challenges in key sectors such as health care, while better protecting newcomers to the province.

Giving Workers More Retirement Savings Options

Supporting More Pensions for Workers

Target benefit pension plans provide a secure stream of income in retirement at a predictable cost for employers. Multi‐employer pension plans that provide target benefits are often created by a union or association within a specific industry, especially industries involving the skilled trades. Members of these plans can move from employer to employer while continuing to participate in the same pension plan, which encourages job mobility and will help to attract more people to the skilled trades.

The government has been consulting with the sector on a permanent target benefit framework that builds on best practices for plan funding and governance and enhances communication with plan members. Taking into consideration feedback received during these consultations, the government has finalized regulations supporting the framework, enabling the permanent framework to come into effect on January 1, 2025. This permanent framework provides higher certainty and confidence for workers and employers than was provided under the prior temporary rules.

As pension plans begin operating under the target benefit framework, the government will monitor the new regime to ensure that it is working as intended and meeting the needs of all plan members. The permanent framework will help support the sustainability of multi-employer pension plans and pave the way for more employers to offer them, helping workers to save for their retirement.

Consulting on Variable Life Benefits

As part of the government’s plan to support more choice for workers in managing their retirement savings, the government will be consulting on a new pension option. In 2021, the federal government made amendments to the federal Income Tax Act to permit Canadian jurisdictions to regulate a new pension option that can be offered to members called a Variable Life Benefit (VLB). A VLB, also referred to as a variable payment life annuity, can be paid from pooled registered pension plans, defined contribution pension plans, and those pension plans that provide for additional voluntary contributions. Retirees who choose a VLB would receive a monthly benefit with payments that are adjusted based on the investment performance of the fund and mortality experience of the fund’s members.

Starting this fall, the Ontario government will consult with stakeholders regarding the regulation of this new option.

Chart Descriptions

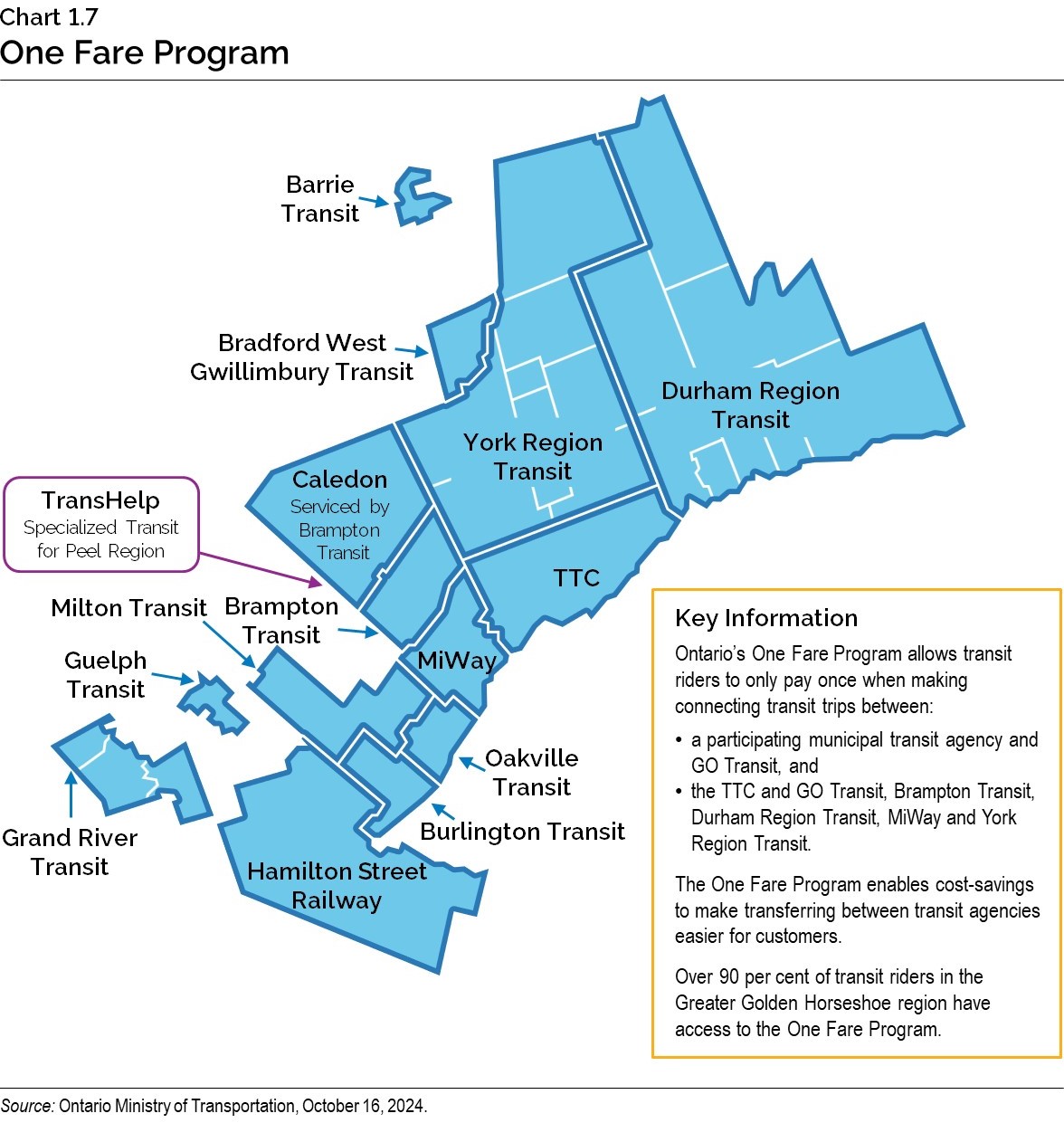

Chart 1.7: One Fare Program

This chart shows Ontario’s One Fare Program, which allows transit riders to pay only once when making connecting transit trips between a participating municipal transit agency and GO Transit, and the TTC and GO Transit, Brampton Transit, Durham Region Transit, MiWay and York Region Transit.

The One Fare Program enables cost-savings to make transferring between transit agencies easier for customers. Over 90 per cent of transit riders in the Greater Golden Horseshoe region have access to the One Fare Program.

Chart 1.8: Select Measures That Provide Relief to Families and Individuals

This chart illustrates select measures that provide relief for Ontario’s families and individuals in the 2024–25 fiscal year. Government actions would total $11.9 billion for families and individuals in 2024–25. This includes housing initiatives ($100 million), child care initiatives and child benefits ($458 million), education initiatives ($785 million), transit and transportation initiatives ($1,988 million), energy initiatives ($2,317 million), a one-time taxpayer rebate ($3,000 million), and initiatives to support vulnerable populations ($3,237 million).

Housing initiatives include the provincial contributions to rental supplement programs delivered as part of the National Housing Strategy through the Canada-Ontario Housing Benefit and the Ontario Priorities Housing Initiative. Child care initiatives and child benefits include the Ontario Child Benefit (OCB) indexed to inflation and program growth; Ontario’s contribution to the Canada-wide Early Learning and Child Care Agreement; and the Childcare Access and Relief from Expenses (CARE) Tax Credit. Education initiatives include tuition fee freeze for postsecondary students and its extension. Transit and transportation initiatives include eliminating and refunding fees from licence plate renewal and vehicle validation tags; fee freeze on driver’s licences, tests, and vehicle validation and subsequent annual fee increase cancellation; removing double fares for GO Transit and increasing the PRESTO discount for postsecondary students (Fare and Service Integration); removing tolls on Highways 412 and 418; and temporarily cutting gas tax and fuel tax rates. Energy initiatives include cancelling the cap-and-trade carbon tax and also include ongoing funding for the Ontario Electricity Support Program (OESP). Initiatives to support vulnerable populations include the cumulative total of annual increases to the Ontario Disability Support Program (ODSP) core allowances and Assistance for Children with Severe Disabilities (ACSD); an increase in the Ontario Guaranteed Annual Income System (GAINS) base funding; the Low-income Individuals and Families Tax (LIFT) Credit and its enhancement; the Ontario Seniors Care at Home Tax Credit; OHIP+ and the Ontario Drug Benefit (ODB) Program reform for children and youth without a private plan; expanding the Home and Vehicle Modification Program; expanding the Assistive Devices Program for Continuous Glucose Monitoring; the Ontario Seniors Dental Care Program; the top-up to the Ontario Community Support Program; the Shelters and Homelessness Operating Support component of the Toronto New Deal and Ottawa New Deal; the Homelessness Prevention Program and Indigenous Supportive Housing Program; and the Ontario Drug Benefit Seniors Co-Payment Program indexation.

Note: Numbers may not add due to rounding. Impacts on families and individuals will vary significantly since programs have different eligibility criteria.

Source: Ontario Ministry of Finance.

Chart 1.9: Illustration of Potential Ontario Fertility Treatment Tax Credit

This bar chart shows two examples of a patient undergoing fertility treatment in Ontario in 2025. In the first example, the patient pays $20,000 in 2025 for fertility treatment in Ontario. In 2026, after filing her 2025 tax return, she receives $880 from the Ontario Medical Expense Tax Credit and $2,620 from the federal Medical Expense Tax Credit, with a remaining out-of-pocket cost of $16,500.

In the second example, the patient pays $20,000 in 2025 for fertility treatment in Ontario. In 2026, after filing her 2025 tax return, she receives $5,000 from the potential Ontario Fertility Treatment Tax Credit, $880 from the Ontario Medical Expense Tax Credit and $2,620 from the federal Medical Expense Tax Credit, with a remaining out-of-pocket cost of $11,500.

Source: Ontario Ministry of Finance.

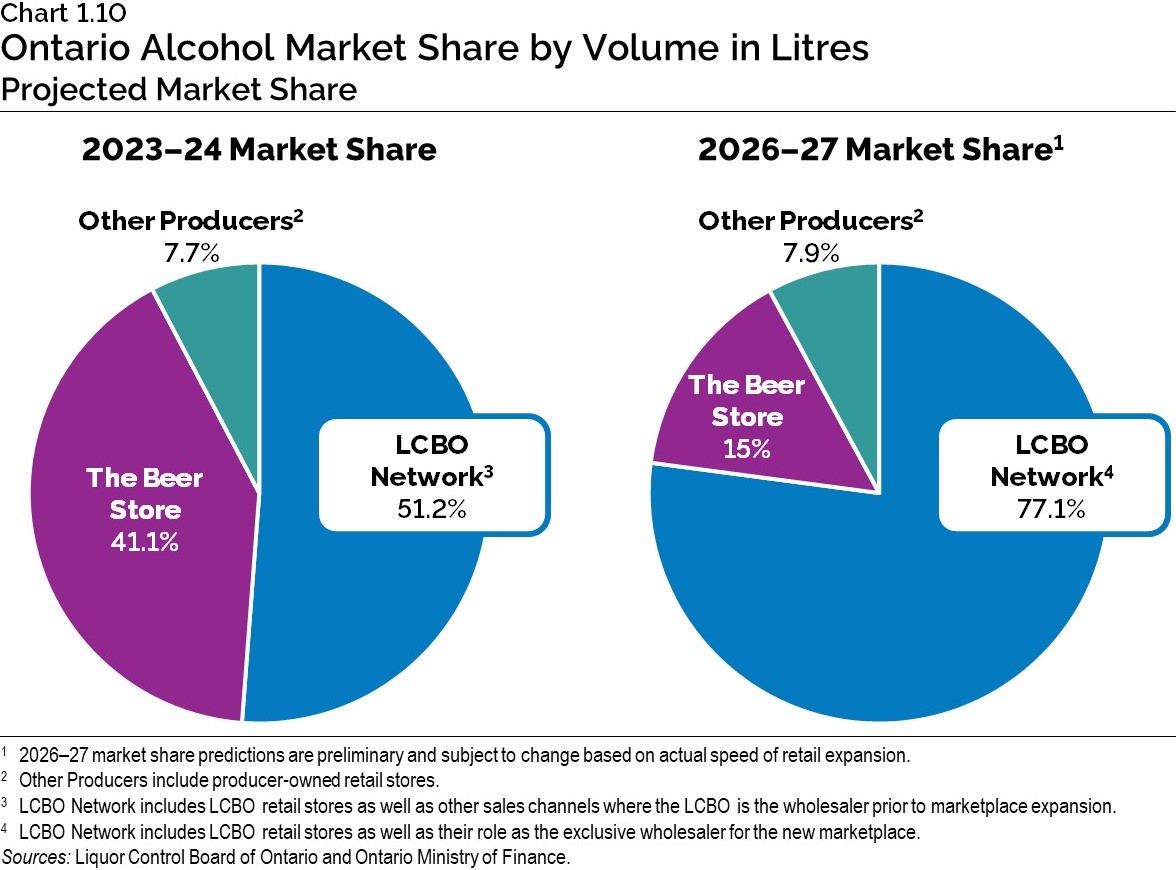

Chart 1.10: Ontario Alcohol Market Share by Volume in Litres – Projected Market Share

The pie chart on the left shows the market share of Ontario Alcohol Marketplace by Volume in Litres in 2023–24. LCBO Network holds 51.2 per cent market share whereas The Beer Store holds 41.1 per cent, and Other Producers holds 7.7 per cent of the market share.

The pie chart on the right shows the projected market share of Ontario Alcohol Marketplace by Volume in Litres in 2026–27. LCBO Network is projected to hold 77.1 per cent market share whereas The Beer Store is expected to hold 15 per cent and Other Producers hold 7.9 per cent of the market share.

Notes:

- 2026–27 market share predictions are preliminary and subject to change based on actual speed of retail expansion.

- Other Producers include producer-owned retail stores.

- LCBO Network includes LCBO retail stores as well as other sales channels where the LCBO is the wholesaler prior to marketplace expansion.

- LCBO Network includes LCBO retail stores as well as their role as the exclusive wholesaler for the new marketplace.

Sources: Liquor Control Board of Ontario and Ontario Ministry of Finance.

Footnotes

[1] Statistics Canada, The Daily: Consumer Price Index, July 2022.

[2] As of June 30, 2024.