U.S. tariffs represent a significant threat to the economy. Historically, Canada has relied on open trade with the United States and each economy has benefited immensely from this relationship. This trade has supported trillions of dollars annually in economic activity and millions of jobs in both countries. Despite this long-standing partnership, Canada faces unnecessary and unjust tariffs from the United States, which are harming businesses and workers on both sides of the border.

The people of Ontario are particularly exposed to these tariffs and the widespread economic uncertainty that comes with them. Ontario’s workers and businesses, which form the backbone of its economy, have been unfairly targeted by tariffs, putting at risk the province’s prosperity. Across the province, 285,000 jobs depend on exporting goods to the United States (almost 3.5 per cent of total employment), with many thousands more jobs relying on U.S. exports across domestic supply chains.

This is why the government is taking steps to protect Ontario’s economy and workers and to prepare for the challenges ahead. The 2025 Budget includes measures to protect livelihoods from the impacts of U.S. economic aggression, as well as a plan to build an economy that is more competitive, resilient and self-reliant. Against a backdrop of massive change on the world stage, the government is taking bold action. This Budget lays the groundwork for the government’s goal to transform Ontario into the most competitive place to invest in the G7.

Immediate Supports for Tariff-Impacted Workers and Businesses

The tariffs imposed by the United States represent an immediate economic threat that impacts key industries and the livelihoods of workers on both sides of the border. These tariffs pose significant challenges for Ontario’s sectors, such as automotive and steel production, and are expected to lead to job losses across the economy, as well as higher costs for consumers.

The government is taking action to help weather this storm by providing urgent relief and support for workers, businesses and communities, while building an economy that is more competitive, resilient and self-reliant. Ontario will seize this opportunity by boosting the province’s internal trading capacity as well as investing in infrastructure, and critical mineral and resource development projects, including those in the Ring of Fire. This will help unleash Ontario’s economic potential while remaining a competitive place to invest, create jobs and grow businesses.

Taking Steps to Protect Workers Amid Economic Uncertainty

In the face of U.S. tariffs, the Ontario government announced in April 2025 that it was providing approximately $11 billion in relief and support as a first step to protect workers and businesses. These measures will help give workers and businesses the support they need amid growing economic uncertainty.

Helping Businesses Through the Deferral of Select Provincially Administered Taxes

Ontario is supporting businesses impacted by U.S. tariffs by providing a six-month interest and penalty-free period, during which penalties and interest will not apply to any Ontario businesses that choose to defer payment under select provincially administered taxes. This measure will provide up to $9 billion in cash flow support to about 80,000 Ontario businesses and job creators, giving them more flexibility to deal with any challenges resulting from U.S. tariffs.

From April 1, 2025, to October 1, 2025, all businesses who pay taxes under 10 of Ontario’s business-focused tax programs can defer payments for taxes owed, without incurring interest and penalties. Ontario businesses are required to continue to file their tax returns on time during this period.

Supporting Businesses Through Workplace Safety and Insurance Board Rebates and Premium Reductions

Through the Workplace Safety and Insurance Board (WSIB), the government has taken significant steps to help businesses weather economic uncertainty, thanks to rebates and premium rate reductions to protect businesses and jobs in Ontario.

As announced in November 2024, starting in 2025, WSIB rates have been reduced to the lowest in half a century, which will save Ontario businesses about $150 million annually. In addition, the WSIB will distribute rebates of $4 billion in surplus funds to safe employers in 2025. These measures reflect the government’s commitment to fostering a robust and resilient business environment to protect against economic uncertainty and the impact of U.S. tariffs.

Strengthening and Growing Ontario’s Economy Through Strategic Investments

Tariffs levied by the U.S. government are undermining Ontario’s economy. These tariffs are generating economic instability globally and forcing Ontario-based businesses to reconsider their U.S. trading dependency to protect the province’s local economy. The provincial government has already taken action to provide relief and support for workers and businesses.

Moving forward, the Ontario government is creating the Protecting Ontario Account (POA), a fund of up to $5 billion designed to provide businesses with critical support to protect jobs, transform businesses, and grow strategic sectors of the economy.

The Protecting Ontario Account will work in tandem with federal government supports to provide up to $1 billion in immediate liquidity relief aimed at protecting Ontario businesses and workers facing significant tariff-related business disruptions. This liquidity relief will augment the existing supports and serves as an emergency backstop for Ontario businesses that have exhausted available funding.

The government will continue to assess the tariff-related impacts to Ontario’s economy and will leverage the Protecting Ontario Account, which will make $4 billion in funding available for a variety of programs designed to support businesses affected by tariff-related disruptions, as needed.

Ontario is also calling on the federal government to work together with the province to enhance and augment support to these businesses.

Supporting Laid-Off Workers

The government is investing $20 million in 2025−26 to mobilize new training and support centres, formerly known as action centres, providing immediate transition supports for laid-off workers, including those impacted by U.S. tariffs. These centres coordinate access to programs to help workers, employers and communities impacted by mass layoffs, and will bring together partners like Service System Managers, unions, local community organizations, and colleges and universities to help laid-off workers. The centres provide temporary places for affected workers to receive services, including referrals to in-demand training, job search assistance, upskilling and Employment Ontario programs.

Protecting Communities from Tariffs and Trade Disruptions

U.S. tariffs have created economic challenges across Ontario, and individual communities may face major disruptions. The government is taking action to respond to the unique and unprecedented needs of Ontario communities by creating the new Trade-Impacted Communities Program (TICP).

The TICP will help communities and local industries in Ontario navigate significant economic challenges caused by U.S. trade disruptions. This new program will provide up to $40 million in grants, starting in 2025–26, which are flexible and tailored to the needs of individual communities and local industries. This funding will support projects that help communities respond to trade disruptions and pivot to procurement from domestic and local suppliers where possible. The program will also support large-scale strategic initiatives that enable and transform key sectors and industrial clusters to help businesses grow, find new markets and investments, and diversify their supply chains. Municipal governments, economic development organizations, business accelerators, and incubators, as well as sector or industry associations, will be eligible for the program.

Lowering Costs for Businesses Selling Alcohol

The government is lowering costs for over 23,000 small businesses across Ontario by increasing the Liquor Control Board of Ontario (LCBO) wholesale discount rate from 10 per cent to 15 per cent on beer, wine, cider, spirits, and Ready-to-Drink beverages wholesaled by the LCBO to bars, restaurants, convenience stores, and LCBO Convenience Outlets from spring 2025 until the end of 2025. This will result in a total estimated savings of approximately $56 million for Ontario businesses in 2025.

Standing By Ontario’s Investments in the Auto and Electric Vehicle Battery Sector

The government will continue to stand firmly behind, and maintain, its financial contributions to the electric vehicle and battery auto pact that helped attract over $46 billion in transformative investments from global automakers, parts suppliers, and manufacturers of electric vehicle batteries and battery materials since 2020. Ontario expects the federal government to do the same.

However, the progress Ontario has made to help build and transform the sector is threatened by U.S. tariffs targeting auto exports from Canada and other countries. To support the sector through these challenges and further enhance its competitiveness, the government is extending its investment in the Ontario Automotive Modernization Program (O-AMP) and the Ontario Vehicle Innovation Network (OVIN), through a total investment of $85 million.

Ontario is providing additional funding to continue the OVIN program delivered by the Ontario Centre of Innovation through an investment of $73 million over the next four years, starting in 2025–26. The funding will support regional technology development sites, research and development (R&D) partnerships, and incubator projects for automotive and mobility small and medium-sized enterprises (SMEs). To date, the program has supported over 600 Ontario SMEs, created or retained over 6,000 jobs, and leveraged over $850 million in private-sector investments.

Ontario is also investing $12 million over the next three years, starting in 2025–26, to continue O-AMP. The program is designed to support Ontario’s automotive parts suppliers by helping these SMEs upgrade outdated equipment and adopt new tools and technologies to innovate their product lines and continue to modernize their processes. Since inception, the program has supported 215 projects, creating over 1,000 jobs, retaining nearly 16,000 jobs, and leveraging over $59 million in private-sector investment.

Chart Descriptions

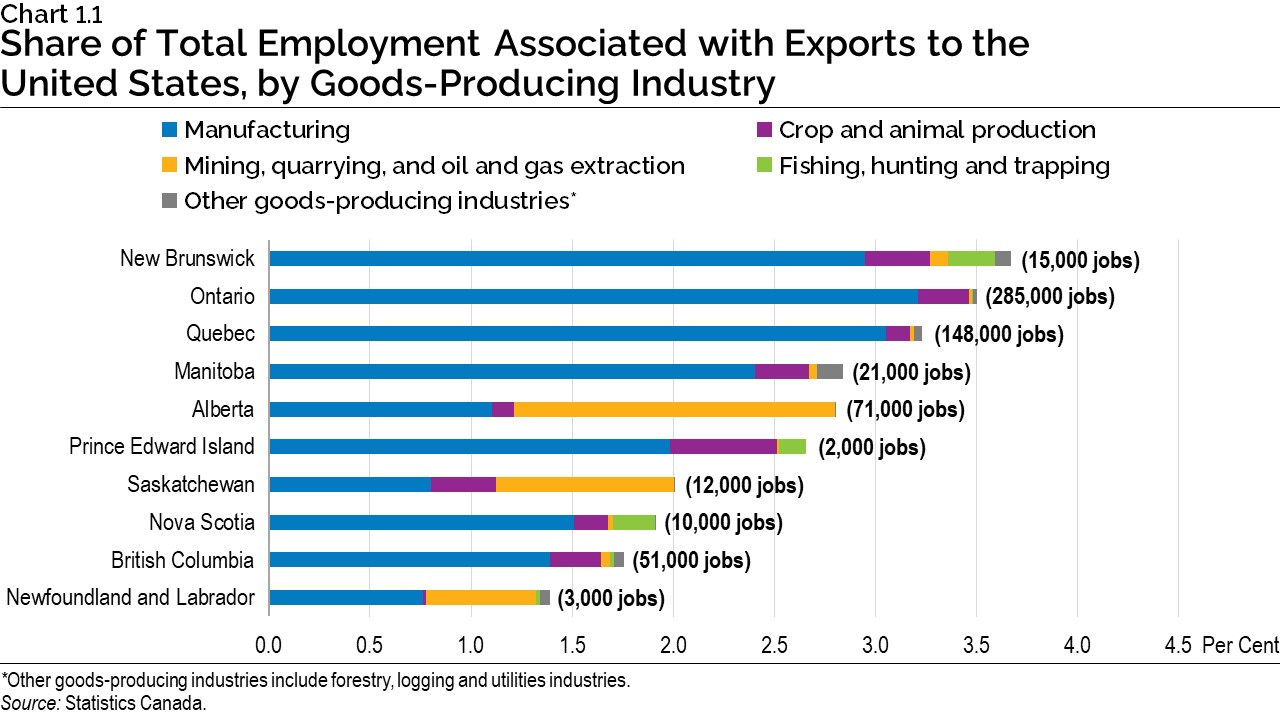

Chart 1.1: Share of Total Employment Associated with Exports to the United States, by Goods-Producing Industry

The bar chart shows the share of total employment directly associated with exports to the United States by province and goods-producing industry. It represents the share of employment directly exposed to trade actions by the United States. Goods-producing industries is comprised of the following: manufacturing; crop and animal production; mining, quarrying, and oil and gas extraction; fishing, hunting and trapping; and other goods-producing industries (which include forestry, logging and utilities). The data are summarized in the following table. Figures are in percentages.

| Province | Manufacturing | Crop and Animal Production | Mining, Quarrying, and Oil and Gas Extraction | Fishing, Hunting and Trapping | Other Goods-Producing Industries | Total Goods-Producing Industries (Jobs) |

|---|---|---|---|---|---|---|

| New Brunswick | 2.95 | 0.32 | 0.09 | 0.23 | 0.08 | 3.67 (15,000) |

| Ontario | 3.21 | 0.26 | 0.02 | 0.00 | 0.02 | 3.5 (285,000) |

| Quebec | 3.05 | 0.12 | 0.02 | 0.00 | 0.04 | 3.23 (148,000) |

| Manitoba | 2.40 | 0.27 | 0.04 | 0.00 | 0.13 | 2.84 (21,000) |

| Alberta | 1.10 | 0.11 | 1.59 | 0.00 | 0.00 | 2.8 (71,000) |

| Prince Edward Island | 1.98 | 0.53 | 0.01 | 0.13 | 0.00 | 2.66 (2,000) |

| Saskatchewan | 0.80 | 0.32 | 0.88 | 0.00 | 0.01 | 2.01 (12,000) |

| Nova Scotia | 1.51 | 0.17 | 0.02 | 0.21 | 0.00 | 1.91 (10,000) |

| British Columbia | 1.39 | 0.25 | 0.05 | 0.02 | 0.05 | 1.76 (51,000) |

| Newfoundland and Labrador | 0.76 | 0.01 | 0.55 | 0.02 | 0.05 | 1.39 (3,000) |

Source: Statistics Canada.