Building Ontario’s Economy

Introduction

Despite the challenges from rising inflation to slower global growth, the government has confidence in the resilience of the province’s economy, its workers and its people. The government is supporting people and businesses by laying the foundation for better jobs and more opportunities for everyone.

As the province navigates global economic uncertainty, the government will continue to deliver on and enhance its plan to build Ontario. This plan will leverage the province’s greatest strengths — its workers, its people and its businesses.

Creating Opportunities by Cutting Red Tape

With economic turbulence on the horizon, the government is reducing more burdensome and unnecessary red tape that is preventing Ontario’s people and businesses from reaching their full potential.

Over the past four years, the government has reduced the estimated net annual cost of complying with regulations for businesses, not-for-profits, municipalities, universities and colleges, school boards and hospitals by $576 million, far exceeding its target of $400 million by March 31, 2022.

Now, as part of its plan for building Ontario, the government is refocusing its red tape reduction efforts towards helping to create jobs and making it easier to invest and build in Ontario. This includes clearing provincial supply chain delays to get goods and services to customers quickly; accelerating industrial land approvals and permitting; supporting Ontario’s agri-food system to increase supply and cut down on food costs; and working with partners across the country to remove interprovincial trade barriers. The government will continue to engage with stakeholders and bring forward red tape reduction legislation to remove unnecessary, duplicative processes and red tape, while ensuring appropriate regulatory oversights remain in place to protect the public, workers and the environment.

The government will also establish consultation groups to support its refocused red tape reduction efforts, inviting representatives from key industries and areas of activity across Ontario.

Informed by their industry experience and knowledge, the representatives will provide ideas on ways Ontario can continue to reduce red tape and administrative burden across government, making the province more competitive and a better place to do business and create jobs.

Creating a Clean Energy Credit Registry

The government is taking action and proposing legislation that would leverage Ontario’s world-class clean electricity grid by launching a voluntary clean energy credit (CEC) registry to boost competitiveness and attract jobs. The proposed registry would provide businesses with more choice in how they pursue their environmental and sustainability goals. Companies in various sectors of the economy, including the automotive sector, have corporate Environmental, Social and Governance (ESG) goals and commitments to use 100 per cent clean or renewable electricity.

A registry for CECs would provide businesses with a tool to meet these goals and demonstrate that their electricity has been sourced from clean resources, such as hydroelectric, solar, wind, bioenergy and nuclear power. Funds generated through the purchases of CECs could be returned to ratepayers, help lower electricity costs, or support future clean energy generation, further supporting Ontario’s environmental goals.

Supporting Main Street Ontario

Ontario’s small businesses are an important part of the province’s economy and communities. They create jobs and help make main streets across the province exciting and vibrant. There have been significant impacts on main street businesses due to the economic downturn caused by COVID-19, and many have not yet recovered. This is why Ontario is continuing to help main street small businesses recover and thrive by cutting taxes to support their growth. In addition, the government’s actions to cut red tape will further lower the cost of doing business, ease financial burdens and remove overly complex processes that frustrate business owners.

Supporting Small Business Growth

In 2020, the government delivered on its promise to cut the small business Corporate Income Tax (CIT) rate from 3.5 per cent to 3.2 per cent. This preferential small business CIT rate delivers annual tax relief of over $3 billion to Ontario’s small businesses.

In the 2022 Ontario Economic Outlook and Fiscal Review, the government now proposes to provide this rate to more small businesses to encourage them to grow.

Ontario’s small business CIT rate is currently subject to a small business limit of $500,000 of income that phases out between $10 million and $15 million of taxable capital employed in Canada. The government is proposing to extend the phase-out range to between $10 million and $50 million of taxable capital. This would mirror the federal government’s extension of its phase-out range for the federal small business CIT rate, supporting small businesses.

This measure would provide $185 million in Ontario income tax relief over the next three years and benefit about 5,500 small businesses. An eligible corporation could receive over $36,000 in Ontario income tax relief each year, which could be used to invest in the business, their workers and in their community.

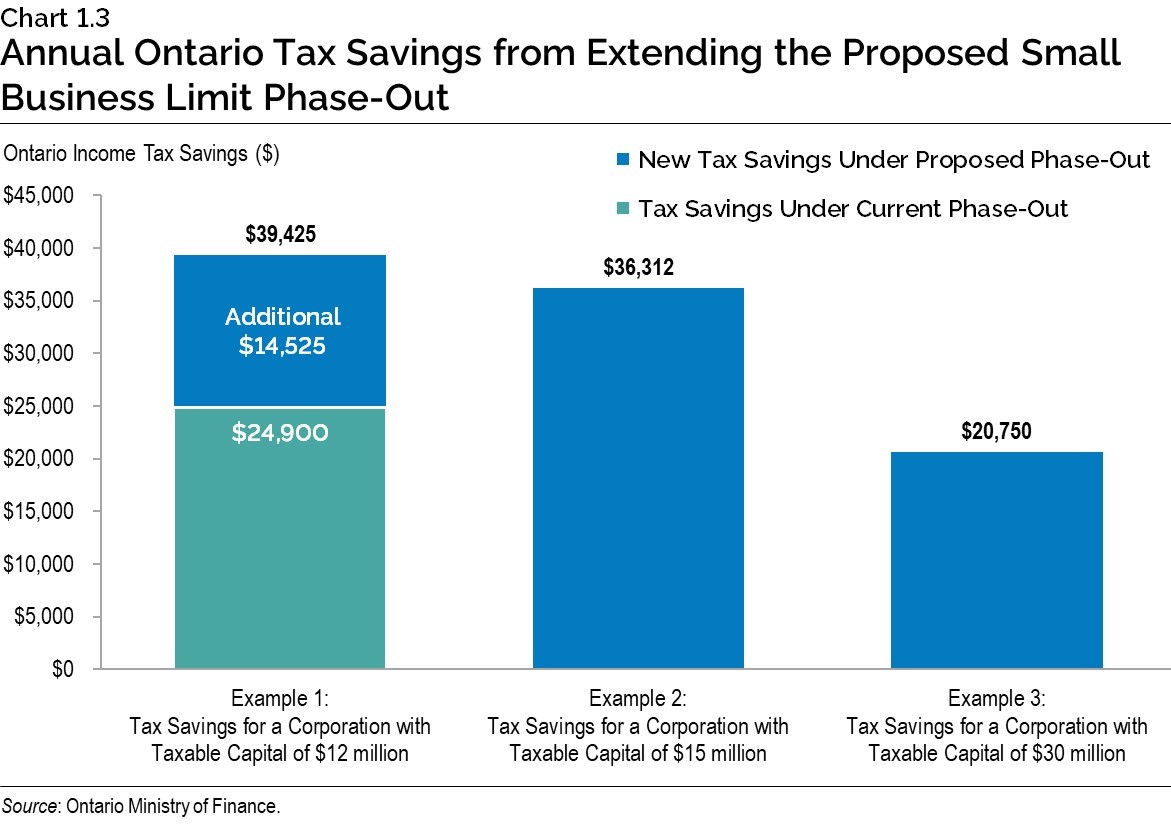

The examples in the chart below show the annual Ontario income tax savings to a corporation at $12 million, $15 million and $30 million of taxable capital.

Reducing Property Taxes for Small Businesses

Small businesses are the cornerstones of communities across the province. The government is ensuring that the property tax system fosters a competitive business environment. In addition to cutting high Business Education Tax rates, which has provided $450 million in annual savings for businesses, the government has provided municipalities with the flexibility to target property tax relief to small businesses. As announced in the 2020 Budget, municipalities can now provide a municipal tax reduction of up to 35 per cent for eligible commercial and industrial properties through the adoption of the optional small business property subclass.

The City of Toronto and City of Ottawa have already adopted the small business property subclass to provide tax reductions to their small businesses. The government is matching these municipal tax reductions with reductions in the education property tax to provide additional support for small businesses.

To further encourage municipalities to reduce taxes on small businesses, the government will automatically provide matching tax reductions for small businesses within all other municipalities that adopt the subclass.

Allowing for Immediate Expensing To Encourage Business Investment

The government is temporarily allowing eligible businesses to immediately expense up to $1.5 million per year for certain capital investments. Ontario is providing this support in parallel with the federal government under the common federal–provincial income tax base.

Through this action, Ontario is providing over $675 million in Ontario income tax relief over three years. As Ontario moves forward during this time of economic uncertainty, this measure will help encourage business investment that will support every sector.

See the Annex: Details of Tax Measures and Other Legislative Initiatives for more information.

Expanding Tax Support for Film and Television Production

The 2022& Budget announced that the government is undertaking work to modernize Ontario’s cultural media tax credits, to reflect the latest industry practices and to continue to attract investment and jobs.

As part of this work, the government is expanding eligibility for Ontario’s film and television tax credits to professional productions distributed exclusively online. Proposed regulatory amendments to implement this measure will be posted in the coming months for public review and comment.

The government also committed in the 2022& Budget to review the eligibility of location fees for the Ontario Production Services Tax Credit, a refundable tax credit which helps attract big-budget domestic and foreign film and television production to the province. To improve the competitiveness of this tax credit and incentivize more on-location filming in communities across Ontario, the government proposes to expand eligible expenditures for the credit to include location fees.

See the Annex: Details of Tax Measures and Other Legislative Initiatives for more information.

Modernizing Capital Markets

Ontario is moving ahead with modernizing how public companies communicate with investors and with the market to reduce regulatory burden and support the digitization of the economy. In alignment with a recommendation made by the Capital Markets Modernization Taskforce, the government is proposing amendments to the Securities Act to provide rule-making authority to the Ontario Securities Commission (OSC) to enable digital access to documents, also known as Access Equals Delivery. Market participants would benefit from a more convenient, cost‑efficient, timely and environmentally responsible approach to communicating information.

Working for Workers

Introduction

Ontario is facing a historic labour shortage. In the second quarter of 2022, there were over 387,000 jobs unfilled, the highest quarterly number on record. Every unfilled job represents an opportunity not taken, and a paycheque not collected.

This is a challenge not only for the economy, but for individual workers who are not reaching their full potential. This is why the government is making significant investments in skills training, so young people and those looking for the chance to start a new career can pursue their dreams. It is why the government is continuing to expand worker supports and encourage more immigrants and newcomers to come to Ontario to build a better life by helping to build Ontario. It is also why the government is moving forward with one of the most ambitious capital plans in Ontario’s history, including plans to build highways, hospitals, broadband and public transit, which will help boost the economy and support good paying jobs.

By investing in training, building on Ontario’s worker programs and supporting newcomers, the province is working for workers.

Launching Skilled Trades Ontario

In January 2022, Skilled Trades Ontario, a new Crown agency, was established to improve trades training and simplify services for tradespeople and employers across the province. It promotes and markets the trades, develops the latest training and curriculum standards, and provides a seamless one-window experience for tradespeople with many services offered digitally.

In partnership with Skilled Trades Ontario, the Ontario government has launched a one-window digital portal, which provides secure access to services, including how to apply for an apprenticeship, view exam results and renew Certificates of Qualification in compulsory trades. Additional online services will be added in phases. These changes will make it easier for more people to learn about and enter into the trades, as well as reduce processing and registration times for applicants from 60 days to 12 days.

Encouraging More Students to Enter the Trades

The government wants to encourage more secondary school students to consider the trades as a career opportunity and create meaningful pathways into rewarding careers. This is why the government is providing an additional $4.8 million over two years, beginning in 2023–24, to expand the Dual Credit program. This Dual Credit expansion will allow more eligible students to take apprenticeship and technological education courses that will count towards their Ontario Secondary School Diploma and a college credential, or Certificate of Apprenticeship.

This expansion will allow an additional 800 secondary students to pursue Dual Credits in 2023–24, including 400 in technological education and 400 in Level 1 Apprenticeship programs. These streams will grow in future years. Over two years, this expansion will allow up to 1,800 more students to benefit from Dual Credit programs.

In addition to the skilled trades, the government is also expanding the Dual Credit program to attract students into the Early Childhood Educator career pathway, which would provide opportunities for up to 420 students over two years.

Part of the skilled trades expansion also involves the inclusion of other apprenticeship Training Delivery Agents (TDAs) in addition to colleges in the delivery of Level 1 Apprenticeship Dual Credit programs. Approximately eight non-college TDAs will be included in 2023–24, with potential to consult and add additional TDAs including more private career colleges in Ontario for the expansion in future years.

This investment increases pathways for secondary school students seeking a career in the skilled trades. Successful completion will result in credits towards both an Ontario Secondary School Diploma and a Certificate of Apprenticeship or college credential. The pathway will be available, accessible and promoted to students across the province through their school board.

The government will explore additional tools that could allow students to graduate high school with credentials.

Improving Assistance for People on the Ontario Disability Support Program

The government will always help those who need it most and is making record investments in the Ontario Disability Support Program (ODSP). The government is making significant changes that would allow a person with a disability on the ODSP to keep more of the money they earn by increasing the monthly earnings exemption from $200 to $1,000 per month. For each dollar earned above $1,000, the person with a disability would keep 25 cents of income support.

These changes would allow the approximately 25,000 individuals currently in the workforce to keep more of their earnings and could encourage as many as 25,000 more to participate in the workforce. This would complement other ways in which the province is helping to address the labour shortage, such as by supporting workers to get the skills training they need through the Better Jobs Ontario program.

The government is also delivering on its promise to help offset rising costs for low-income people with disabilities. In August 2022, the government announced an increase to ODSP core allowances and the maximum monthly amount for the Assistance for Children with Severe Disabilities (ACSD) by five per cent. Beginning in July 2023, the government plans to adjust core allowances under the ODSP and the maximum monthly amount for the ACSD annually to inflation.

The government also plans to improve the disability eligibility determination processes, which along with other system changes are intended to reduce the time individuals are waiting to get a decision. This would include strengthening the documentation at application, streamlining the assessment process and increasing the use of digital disability submissions. Streamlining the system would help connect participants to supports faster and help make the system more accessible.

While the government is creating greater incentives, for recipients who can, to participate in the workforce, reforms are required to ensure that only those who need social assistance are the ones receiving it. This includes plans to enhance measures to deter and detect abuse of the system to maintain program integrity.

Enhancing the Skills Development Fund to Address Challenges to Hiring, Training or Retraining Workers

The Skills Development Fund supports innovative training projects that upskill workers and job seekers, including apprentices, preparing them for meaningful careers. This is why, building on the success of the Skills Development Fund announced in the 2020 Budget, the government is providing an additional $40 million in 2022–23, including $30 million in new funding, for a total investment of $145 million this year for the latest round of funding.

This additional funding will prioritize training programs to help people with prior involvement in the criminal justice system, at-risk youth, people with disabilities, those on social assistance, Indigenous people, Ukrainian newcomers, and others facing barriers to employment. Funding will also support youth employment and training, as well as ensuring there is sufficient skilled labour to support priority housing and infrastructure projects across the province, including building highways, transit and hospital projects.

The first two rounds of funding through the Skills Development Fund delivered 388 training projects, helping more than 393,000 workers take the next step in their careers in in-demand industries, including carpenters, plumbers and health care workers. These investments will help get shovels in the ground to build highways, transit and other essential infrastructure projects, as well as help keep Ontario’s workers and businesses competitive.

Implementing a Target Benefit Pension Plan Framework

Target benefit pension plans are intended to provide a monthly stream of income in retirement with predictable contributions for employers. These multi-employer plans would often be created by a union or association within a specific industry, enabling workers to maintain their participation in the plan even though they may move from employer to employer over time.

Specified Ontario Multi‐Employer Pension Plans, which provide these types of benefits, have been operating under temporary regulations that will expire beginning in 2024, unless replaced by a permanent framework.

As announced in the 2022& Budget, this winter the Ontario government will launch its consultation with stakeholders on proposed regulations necessary for implementing a permanent target benefit framework in Ontario.

Implementation of a permanent target benefit framework would pave the way for more employers to offer workplace pension plans, increasing the opportunities for workers to save for their retirement.

Keeping Costs Down

Introduction

The cost of too many essentials remains high. Families, workers and seniors, especially low-income workers and those on fixed incomes, are feeling the pressure on their household budgets.

The government has always worked to keep costs down and put more money back into the pockets of the people of Ontario. Whether by cutting the gas tax and fuel tax, providing licence plate sticker rebates or providing tax relief to low-income workers and families, the government has been putting more money into people’s pockets.

In these challenging times, the government is providing additional relief on the cost of living and prioritizing those who need the most help.

Keeping Transportation Costs Down

Keeping costs down to travel and transport goods is essential for Ontario’s economy and making life more affordable for hardworking families.

Extending Tax Relief at the Pumps

In spring 2022, the Ontario government cut the gas tax by 5.7 cents per litre and the fuel tax by 5.3 cents per litre for six months, beginning July 1, 2022. Statistics Canada noted that the province’s rate cut was a contributor to the decline in gas prices in Ontario for the month of July, helping to lower consumer price inflation.

While inflation has begun to ease, the cost of living is still too high for many families.

This is why the government is proposing to extend the cuts to the gas tax and fuel tax rates so that the rate of tax on gasoline and fuel (diesel) would remain at 9 cents per litre until December 31, 2023. This would save Ontario households $195 on average between July 1, 2022, and December 31, 2023.

See Annex: Details of Tax Measures and Other Legislative Initiatives for further information about these changes.

Helping Those Who Need It Most

The impact of rising prices is felt first and hardest by the most vulnerable, including low‑income workers, families and seniors. This is why the government continues to keep costs down for those who need the most help.

Increasing Financial Support for Seniors

The government is helping keep costs down for low-income seniors.

During this period of rising prices, it is key that Ontario supports those who need it most. As an immediate step, the government plans to help vulnerable seniors by proposing to double the Guaranteed Annual Income System (GAINS) payment for all recipients for 12 months starting in January 2023.

This measure would increase the maximum payment to $166 per month for single seniors and to $332 per month for couples, a maximum increase of almost $1,000 per person in 2023. This would ensure that about 200,000 of the province’s lowest income seniors would have additional support during these times.

The government is also planning to introduce measures to expand the GAINS program eligibility in the coming months, to ensure that more seniors who need financial help get it.

Footnotes

[1] Statistics Canada, The Daily: Consumer Price Index, July 2022.

Chart Descriptions

Chart 1.3: Annual Ontario Tax Savings from Extending the Proposed Small Business Limit Phase-Out

The chart shows three examples of the annual Ontario income tax savings to a corporation.

In Example 1, the corporation’s taxable capital is $12 million. The corporation’s annual tax saving under the current phase-out of the small business limit is $24,900. The proposed phase-out of the small business limit would provide an additional annual Ontario income tax saving of $14,525. The total annual Ontario income tax saving to this corporation from the proposed small business limit phase-out would now be $39,425.

Examples 2 and 3 show the annual Ontario income tax saving to corporations with $15 million and $30 million of taxable capital. In both cases, the corporations do not receive a tax saving under the current small business limit phase-out. Under the proposed small business limit phase-out, the corporation with $15 million of taxable capital would receive a new tax saving of $36,312, and the corporation with taxable capital of $30 million would receive a new tax saving of $20,750.

Source: Ontario Ministry of Finance.