Ontario’s Economic and Fiscal Outlook in Brief

Ontario’s economy continued to grow in the first half of 2024, despite the challenges of high interest rates and geopolitical uncertainty. While inflation has moderated and the Bank of Canada has begun lowering its policy interest rates, these rates nevertheless remain at elevated levels, and are projected to weigh down economic growth in the near term. Ontario’s economic growth is forecast to pick up in 2025 and 2026 as interest rates continue to ease.

Ontario’s increasing population is both contributing to its economic growth and putting additional strain on public programs and services. Nevertheless, the government is continuing to invest in key public services without raising taxes or fees and aiming to keep costs down for people and businesses.

The government’s plan retains a path to balance the budget, even with uncertain global economic conditions and other headwinds beyond the government’s control, including the federal carbon tax. The 2024 Ontario Economic Outlook and Fiscal Review continues to take a fiscally responsible and targeted approach by investing in the economy and infrastructure, keeping costs down, and providing immediate relief to individuals and families. This balanced approach has resulted in meaningful fiscal improvement since the 2024 Budget, allowing the government to keep taxes low, make additional investments and reduce the debt burden for future generations.

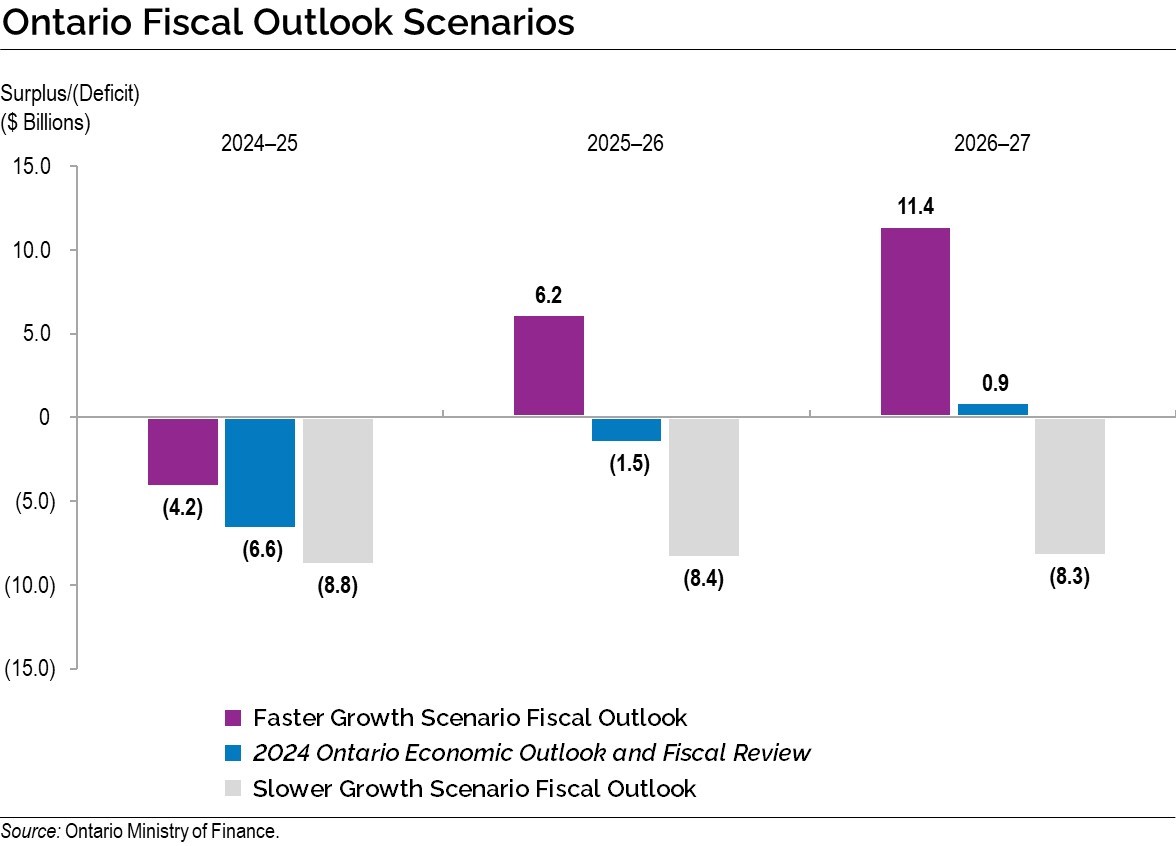

The government is projecting deficits of $6.6 billion in 2024–25 and $1.5 billion in 2025–26, followed by a surplus of $0.9 billion in 2026–27. This reflects stronger revenue and economic growth projections and includes additional contingencies to mitigate near-term risks in 2024–25.

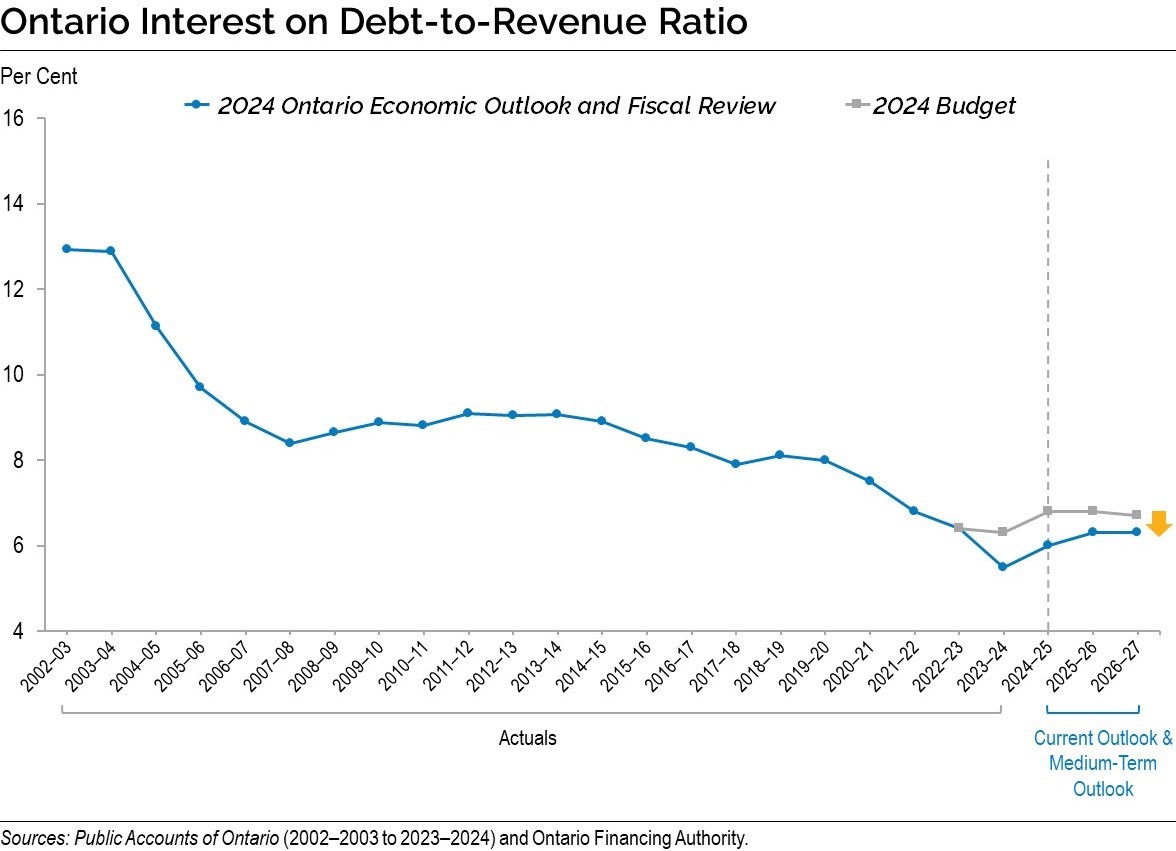

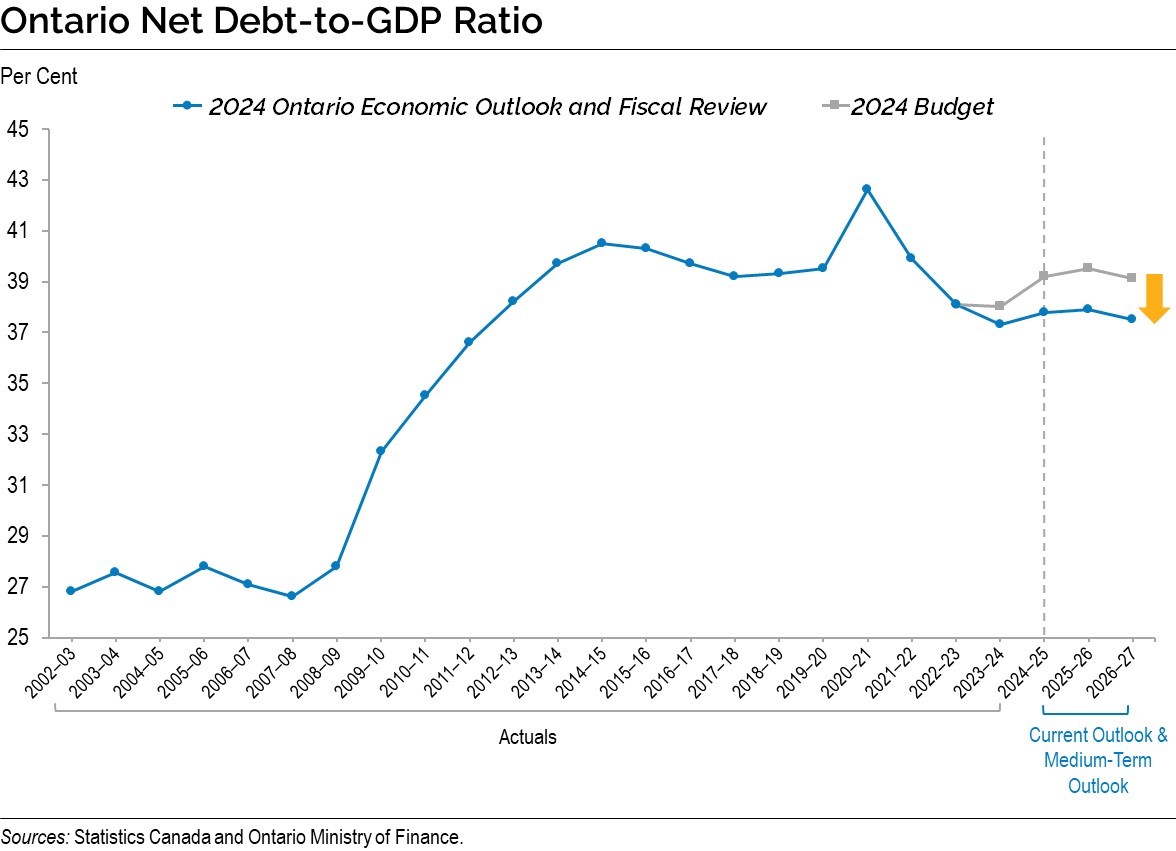

The net debt-to-GDP ratio is projected to be 37.8 per cent in 2024–25, compared with the forecast of 39.2 per cent projected in the 2024 Budget. This ratio fell to a 12-year low last year, and Ontario’s plan keeps it below levels seen since 2011–12. Further illustrating Ontario’s commitment to responsible fiscal management, the interest on debt-to-revenue ratio for 2024–25 is forecast to be 6.0 per cent and would be the second lowest since the 1980s, trailing only last year’s 5.5 per cent.

Ontario’s Economic Outlook

Ontario’s real gross domestic product (GDP) growth is projected to ease from 1.4 per cent in 2023 to 0.9 per cent in 2024. As interest rates continue to decline, real GDP growth is projected to strengthen to 1.7 per cent in 2025 and 2.3 per cent in both 2026 and 2027. Since the 2024 Budget, real GDP growth forecasts have been revised upwards for 2024, as well as for 2026 and 2027, and have been revised lower for 2025. For the purposes of prudent fiscal planning, these projections are set slightly below the average of private‐sector forecasts.

| 2023 | 2024p | 2025p | 2026p | 2027p | |

|---|---|---|---|---|---|

| Real GDP Growth | 1.4 | 0.9 | 1.7 | 2.3 | 2.3 |

| Nominal GDP Growth | 4.3 | 3.8 | 3.9 | 4.4 | 4.4 |

| Employment Growth | 2.4 | 1.4 | 1.5 | 1.4 | 1.2 |

| CPI Inflation | 3.8 | 2.5 | 2.1 | 2.0 | 2.0 |

Table footnotes:

p = Ontario Ministry of Finance planning projection based on external sources as of September 19, 2024.

Sources: Statistics Canada and Ontario Ministry of Finance.

Revisions to the Outlook Since the 2024 Budget

The outlook over the 2024 to 2027 period has been revised compared to the projections in the 2024 Budget. Key changes since the 2024 Budget include:

- Stronger growth in real GDP in 2024 followed by modestly weaker growth in 2025 and slightly stronger growth in both 2026 and 2027;

- Faster growth in nominal GDP in 2024 and in both 2026 and 2027;

- More robust employment growth in 2024, followed by softer gains in both 2025 and 2027; and

- Upward revisions to nominal household consumption — all years.

| 2024p 2024 Budget |

2024p 2024 FES |

2025p 2024 Budget |

2025p 2024 FES |

2026p 2024 Budget |

2026p 2024 FES |

2027p 2024 Budget |

2027p 2024 FES |

|

|---|---|---|---|---|---|---|---|---|

| Real Gross Domestic Product | 0.3 | 0.9 | 1.9 | 1.7 | 2.2 | 2.3 | 2.2 | 2.3 |

| Nominal Gross Domestic Product | 2.7 | 3.8 | 3.9 | 3.9 | 4.3 | 4.4 | 4.1 | 4.4 |

| Compensation of Employees | 4.3 | 5.5 | 4.4 | 4.8 | 4.1 | 4.4 | 4.1 | 4.1 |

| Net Operating Surplus — Corporations | (4.7) | (6.2) | 3.5 | 4.5 | 7.9 | 4.5 | 6.0 | 5.6 |

| Nominal Household Consumption | 3.5 | 5.0 | 4.1 | 4.2 | 4.3 | 4.5 | 4.2 | 4.3 |

| Other Economic Indicators — Employment | 0.8 | 1.4 | 1.7 | 1.5 | 1.4 | 1.4 | 1.4 | 1.2 |

| Other Economic Indicators — Job Creation (000s) | 63 | 111 | 136 | 120 | 114 | 114 | 115 | 99 |

| Other Economic Indicators — Unemployment Rate (Per Cent) | 6.7 | 6.9 | 6.6 | 6.9 | 6.4 | 6.3 | 6.2 | 6.0 |

| Other Economic Indicators — Consumer Price Index | 2.6 | 2.5 | 2.0 | 2.1 | 2.0 | 2.0 | 2.0 | 2.0 |

| Other Economic Indicators — Housing Starts (000s)1 | 87.9 | 81.3 | 92.3 | 86.5 | 94.4 | 93.2 | 95.8 | 95.3 |

| Other Economic Indicators — Home Resales | 4.0 | 2.0 | 16.0 | 13.4 | 1.2 | 5.5 | 1.2 | 1.2 |

| Other Economic Indicators — Home Resale Prices | (0.2) | 0.3 | 3.1 | 4.7 | 4.0 | 4.0 | 4.0 | 4.0 |

| Key External Variables — U.S. Real Gross Domestic Product | 2.1 | 2.7 | 1.7 | 2.0 | 2.1 | 2.1 | 1.9 | 2.0 |

| Key External Variables — WTI Crude Oil ($US per Barrel) | 79 | 77 | 78 | 76 | 77 | 78 | 78 | 78 |

| Key External Variables — Canadian Dollar (Cents US) | 74.6 | 73.3 | 77.6 | 74.4 | 78.2 | 75.2 | 77.0 | 75.9 |

| Key External Variables — Three-Month Treasury Bill Rate (Per Cent)2 | 4.4 | 4.5 | 3.0 | 3.0 | 2.6 | 2.6 | 2.6 | 2.6 |

| Key External Variables — 10-Year Government Bond Rate (Per Cent)3 | 3.2 | 3.3 | 3.1 | 3.1 | 3.3 | 3.2 | 3.5 | 3.4 |

Table footnotes:

p = Ontario Ministry of Finance planning projection based on external sources as of September 19, 2024.

[1] Housing starts projection based on private-sector average as of September 19, 2024.

[2], [3] Government of Canada interest rates.

Sources: Statistics Canada; Canada Mortgage and Housing Corporation; Canadian Real Estate Association; Bank of Canada; United States Bureau of Economic Analysis; Blue Chip Economic Indicators (October 2024); U.S. Energy Information Administration; and Ontario Ministry of Finance.

A Strong Foundation for the Next Generation

The government is providing the people of Ontario with a clear view into the province’s finances, outlining its strategy to build a strong and resilient province now and into the future.

The government’s plan is consistent with the Fiscal Sustainability, Transparency and Accountability Act, 2019 and its governing principles that guide Ontario’s fiscal policy.

- Transparent: The government continues to be transparent through the release of regular fiscal updates. For the seventh year in a row, the Auditor General of Ontario has provided a clean audit opinion on the government’s consolidated financial statements.

- Responsible: The government has developed a measured and responsible approach to managing Ontario’s finances, while investing in key public services and capital projects that will help improve economic productivity and create jobs.

- Flexible: The government’s plan has built in appropriate levels of prudence in the form of contingency funds and a reserve to ensure the necessary fiscal flexibility to respond to changing circumstances.

- Equitable: The government’s plan strengthens and invests in critical public services, such as health care and education, for the people of today and ensures they are maintained for the benefit of future generations.

- Sustainable: The government will continue to respond to ongoing economic uncertainty while ensuring the long-term sustainability of Ontario’s finances and debt burden.

The Public Accounts of Ontario 2023–2024 reported a $0.6 billion deficit for Ontario; an improvement over the $3.0 billion deficit projected in the 2024 Budget. The government remains focused on its efforts to eliminate Ontario’s structural deficit and bring Ontario’s finances back to balance.

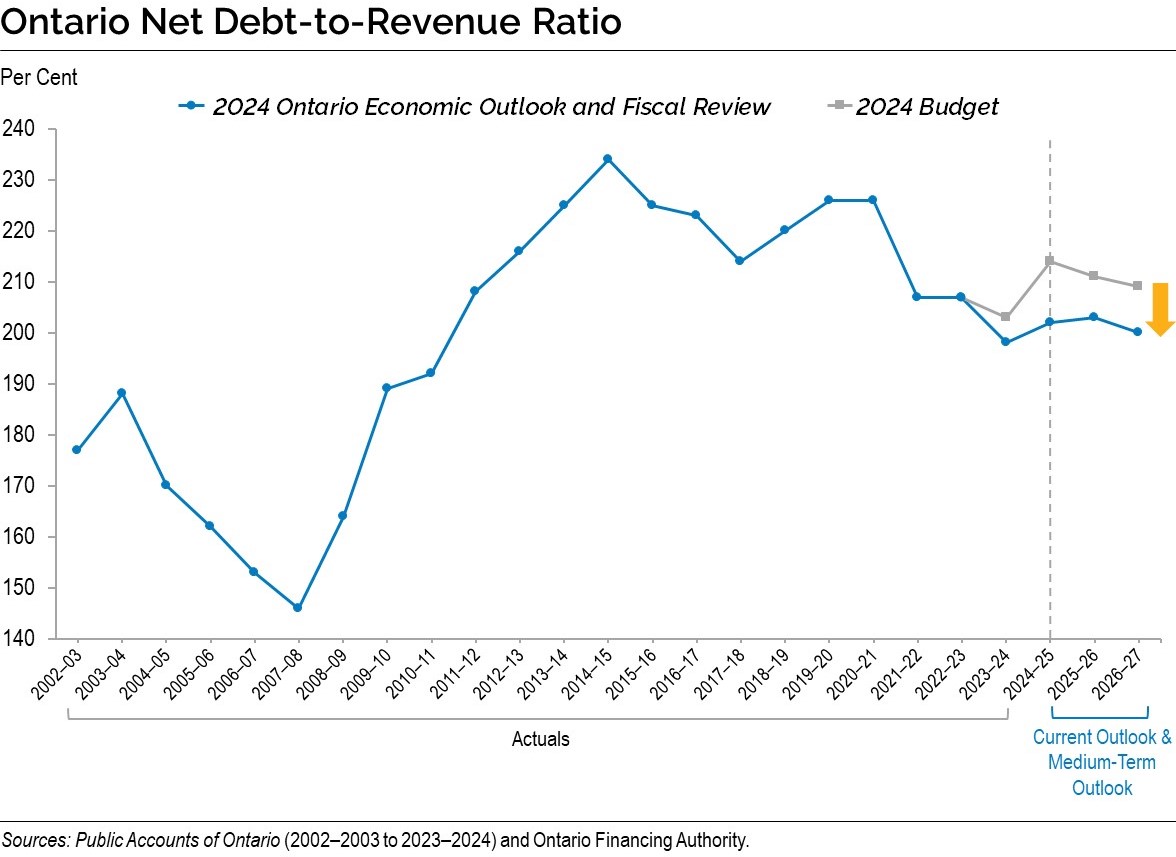

Over the past few years, higher economic growth and prudent expenditure management have strengthened Ontario’s fiscal position. In addition to strong performance in Ontario’s net debt-to-GDP and interest on debt-to-revenue ratios, program expenses as a share of GDP have fallen significantly from their pandemic peak. Net debt-to-revenue has been declining since 2020–21 and the forecast for this fiscal year would be the lowest since 2010–11 except for the last fiscal year.

Reflecting these improvements, Morningstar DBRS upgraded the province’s credit rating to AA from AA (low) on June 6, 2024. This was the province’s first upgrade since 2006. This reverses the trend of credit downgrades and shows that Ontario’s prudent and responsible fiscal plan is working. This will help lower the province’s borrowing costs and support more investment in Ontario, creating more jobs, and financing the province’s historic infrastructure plan. Moody’s and S&P Global ratings both have a positive outlook on their credit rating for Ontario.

Ontario’s Fiscal Plan

In 2024–25, the government is projecting a deficit of $6.6 billion. Over the medium term, the government is forecasting a deficit of $1.5 billion in 2025–26 and a surplus of $0.9 billion in 2026–27.

| Actual 2023–24 |

Current Outlook 2024–25 |

Medium-Term Outlook 2025–26 |

Medium-Term Outlook 2026–27 |

|

|---|---|---|---|---|

| Revenue — Personal Income Tax | 50.8 | 54.8 | 57.2 | 60.9 |

| Revenue — Sales Tax | 39.9 | 40.0 | 41.0 | 43.4 |

| Revenue — Corporations Tax | 23.1 | 27.9 | 27.6 | 28.8 |

| Revenue — Ontario Health Premium | 5.0 | 5.1 | 5.3 | 5.6 |

| Revenue — Education Property Tax | 5.8 | 5.8 | 5.8 | 5.9 |

| Revenue — All Other Taxes | 17.3 | 18.1 | 20.2 | 21.2 |

| Total Taxation Revenue | 141.9 | 151.7 | 157.2 | 165.6 |

| Government of Canada | 34.3 | 36.3 | 37.6 | 38.7 |

| Income from Government Business Enterprises | 7.4 | 6.7 | 7.5 | 7.5 |

| Other Non-Tax Revenue | 22.3 | 18.0 | 18.5 | 18.9 |

| Total Revenue | 205.9 | 212.6 | 220.8 | 230.7 |

| Programs — Health Sector | 85.5 | 86.0 | 88.1 | 90.0 |

| Programs — Education Sector2 | 37.2 | 37.6 | 38.8 | 39.5 |

| Programs — Postsecondary Education Sector | 13.2 | 12.2 | 12.5 | 13.1 |

| Programs — Children, Community and Social Services Sector | 19.4 | 20.0 | 20.1 | 20.1 |

| Programs — Justice Sector | 6.0 | 6.2 | 5.7 | 5.7 |

| Programs — Other Programs | 33.9 | 43.6 | 41.6 | 45.0 |

| Total Programs | 195.2 | 205.5 | 206.8 | 213.3 |

| Interest on Debt | 11.4 | 12.7 | 14.0 | 14.5 |

| Total Expense | 206.6 | 218.3 | 220.8 | 227.8 |

| Surplus/(Deficit) Before Reserve | (0.6) | (5.6) | (0.0) | 2.9 |

| Reserve | – | 1.0 | 1.5 | 2.0 |

| Surplus/(Deficit) | (0.6) | (6.6) | (1.5) | 0.9 |

| Net Debt as a Per Cent of GDP | 37.3% | 37.8% | 37.9% | 37.5% |

| Net Debt as a Per Cent of Revenue | 198.1% | 201.8% | 202.6% | 200.2% |

| Interest on Debt as a Per Cent of Revenue | 5.5% | 6.0% | 6.3% | 6.3% |

Table footnotes:

[1] For a fiscal summary, in the millions, of revenue, expense and the surplus/(deficit) over the medium-term outlook, see Table 3.1.

[2] Excludes Teachers’ Pension Plan. Teachers’ Pension Plan expense is included in Other Programs.

Notes: Numbers may not add due to rounding. Current and medium-term outlook primarily reflect information available as of September 30, 2024.

Sources: Ontario Treasury Board Secretariat and Ontario Ministry of Finance.

Revenue Outlook Over the Medium Term

Ontario’s revenue outlook is anchored by an economic projection based on private-sector forecasts and the best available information at the time of finalizing the planning projection. Between 2023–24 and 2026–27, revenues are expected to grow on average by 3.9 per cent a year. Details of the medium-term revenue outlook are outlined later in this document. See Chapter 3: Ontario’s Fiscal Plan and Outlook for more details.

Key inputs included in the revenue forecast are a prudent economic outlook based on private-sector forecasts; existing federal–provincial agreements and funding formulas; and the business plans of government ministries, business enterprises and service organizations.

Program Expense Outlook Over the Medium Term

The government is building a strong fiscal foundation while continuing to invest in critical public services. Between 2023–24 and 2026–27, program expense is projected to increase every year, growing at an average annual rate of 3.0 per cent. This growth reflects the government’s commitment to key areas such as health care, education, and infrastructure, which are facing increasing pressures due to Ontario’s growing population.

Despite these pressures, government revenues are projected to grow at a faster pace than program expenses over the medium term, as part of the government’s strategy for responsible fiscal management. To ensure fiscal stability and the ability to respond to unforeseen events, contingencies have been incorporated into the program expense outlook.

See Chapter 3: Ontario’s Fiscal Plan and Outlook for further details on the program expense outlook over the medium term.

Interest on Debt Outlook Over the Medium Term

Ontario is forecast to pay $12.7 billion in interest costs in 2024–25, $14.0 billion in 2025–26 and $14.5 billion in 2026–27. Over the four-year period from 2023–24 to 2026–27, the cumulative interest on debt expense is estimated to be $4.1 billion below the 2024 Budget forecast, and the interest on debt-to-revenue ratio is expected to remain near record lows.

See Chapter 4: Borrowing and Debt Management for further details on the interest on debt outlook over the medium term.

Other Fiscal Planning Assumptions

The reserve is set at $1.0 billion in 2024–25, $1.5 billion in 2025–26 and $2.0 billion in 2026–27. This is unchanged since the 2024 Budget.

Net debt-to-GDP for 2024–25 is projected to be 37.8 per cent. Over the medium term, the net debt-to-GDP ratio is forecast to be 37.9 per cent in 2025–26 and 37.5 per cent in 2026–27.

Economic and Fiscal Outlook Scenarios

To provide more transparency about the province’s economic outlook amid the elevated degree of economic uncertainty, the Ontario Ministry of Finance has developed Faster Growth and Slower Growth scenarios that the economy could take over the next few years. These alternative scenarios should not be considered the best case or the worst case, but reasonable possible outcomes in this period of uncertainty. See Chapter 2: Economic Performance and Outlook for more details.

| 2024p | 2025p | 2026p | 2027p | |

|---|---|---|---|---|

| Faster Growth Scenario | 1.5 | 3.3 | 2.6 | 2.6 |

| Planning Projection | 0.9 | 1.7 | 2.3 | 2.3 |

| Slower Growth Scenario | 0.5 | 0.3 | 2.2 | 2.2 |

Table footnotes:

p = Ontario Ministry of Finance planning projection based on external sources as of September 19, 2024, and alternative scenarios.

Source: Ontario Ministry of Finance.

| 2024p | 2025p | 2026p | 2027p | |

|---|---|---|---|---|

| Faster Growth Scenario | 4.7 | 6.3 | 4.9 | 4.9 |

| Planning Projection | 3.8 | 3.9 | 4.4 | 4.4 |

| Slower Growth Scenario | 3.1 | 1.7 | 4.1 | 4.1 |

Table footnotes:

p = Ontario Ministry of Finance planning projection based on external sources as of September 19, 2024, and alternative scenarios.

Source: Ontario Ministry of Finance.

In the event that the alternative economic scenarios materialize, as opposed to the Planning Projection, Ontario’s fiscal plan would also change as a result.

Under the Faster Growth scenario, the fiscal outlook may improve to a deficit of $4.2 billion in 2024–25 and reach surpluses of $6.2 billion in 2025–26 and $11.4 billion in 2026–27. However, under the Slower Growth scenario, the fiscal outlook may deteriorate to deficits of $8.8 billion in 2024–25, $8.4 billion in 2025–26 and $8.3 billion in 2026–27. In these alternative outlook scenarios, program expenditures are assumed to be unchanged compared to the medium-term expense outlook and only revenue and interest on debt are adjusted.

The heightened economic and geopolitical uncertainties facing Ontario underscore the need for a responsible and flexible fiscal plan. See Chapter 3: Ontario’s Fiscal Plan and Outlook, Economic and Fiscal Outlook Scenarios section for more details.

Borrowing and Debt Management

Ontario’s long-term borrowing requirement for 2024–25 is now forecast to be $37.5 billion. The improved deficit position and corresponding decrease in funding requirements allow the province to increase cash reserves, enhancing liquidity and flexibility for future years. As of October 15, 2024, Ontario had completed $31.4 billion, or 84 per cent, of its 2024–25 total long-term public borrowing program. Ontario’s borrowing program is partly driven by a historic capital plan. See the section titled A Capital Plan to Build a Better Ontario for more details.

| 2024 Budget | In-Year Change | Current Outlook 2024–25 |

Medium-Term Outlook 2025–26 |

Medium-Term Outlook 2026–27 |

|

|---|---|---|---|---|---|

| Deficit/(Surplus) | 9.8 | (3.2) | 6.6 | 1.5 | (0.9) |

| Investment in Capital Assets | 17.7 | – | 17.7 | 20.9 | 20.6 |

| Non-Cash and Cash Timing Adjustments | (11.0) | – | (11.0) | (12.0) | (13.9) |

| Net Loans and Investments | (0.3) | 1.1 | 0.8 | (0.2) | – |

| Debt Maturities and Redemptions | 28.0 | – | 28.0 | 33.1 | 26.9 |

| Total Funding Requirement | 44.2 | (2.1) | 42.2 | 43.3 | 32.6 |

| Decrease/(Increase) in Short-Term Borrowing | (5.0) | – | (5.0) | – | – |

| Increase/(Decrease) in Year-End Cash and Cash Equivalents | (1.0) | 1.3 | 0.3 | (8.3) | – |

| Total Long-Term Borrowing | 38.2 | (0.7) | 37.5 | 35.0 | 32.6 |

Table footnotes:

Note: Numbers may not add due to rounding.

Sources: Ontario Financing Authority and Ontario Ministry of Finance.

Ontario is forecast to pay $12.7 billion in interest costs in 2024–25, about $1.2 billion lower than the 2024 Budget forecast.

Interest on debt in 2025–26 and 2026–27 is forecast to be $14.0 billion and $14.5 billion, compared to the 2024 Budget forecast of $14.7 billion and $15.2 billion, respectively. As a share of revenue, interest on debt is projected to remain near record lows through 2026–27.

A one percentage point change in interest rates either up or down from the current interest rate forecast is estimated to have a corresponding change in Ontario’s borrowing costs by around $700 million in the first full year.

The net debt-to-GDP ratio in 2024–25 is now projected to be 37.8 per cent, or 1.4 percentage points lower than the 39.2 per cent forecast in the 2024 Budget, which is mainly due to lower than previously projected deficits. Over the medium-term outlook, the net debt-to-GDP ratio is projected to remain modestly lower than the forecasts in the 2024 Budget and at lows not seen since the early 2010s.

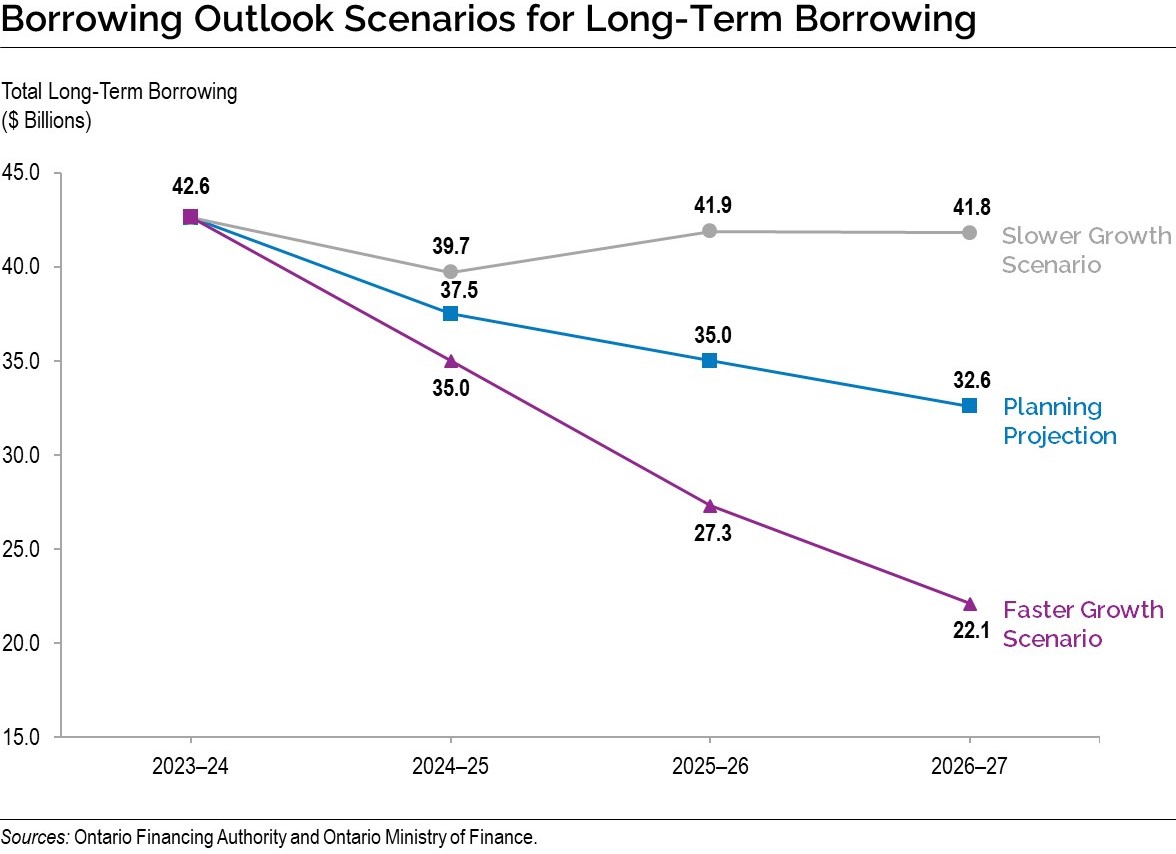

As described earlier in the Economic and Fiscal Outlook Scenarios section, in the event that alternative economic scenarios materialize, Ontario’s borrowing requirements in the next three years would also change as a result. Under the Faster Growth scenario, long-term borrowing would decrease by $20.7 billion over the three-year outlook period, while under the Slower Growth scenario, long-term borrowing would increase by $18.3 billion over the same period.

A Capital Plan to Build a Better Ontario

Ontario’s Plan to Build includes the most ambitious capital plan in Ontario’s history, with planned investments over the next 10 years totalling $191.3 billion, including $26.3 billion in 2024–25. To address the historic infrastructure deficit, this plan is getting shovels in the ground to build highways, hospitals and other critical assets, laying the foundation for a better Ontario.

Key highlights in the capital plan include the following:

Building Highways

A total of $27.8 billion over 10 years to support the planning and construction of highway expansion and rehabilitation projects across the province, including:

- Highway 413, a new 400-series highway and transportation corridor across Halton, Peel and York Regions that will bring relief to one of the busiest corridors in North America and save drivers up to 30 minutes each way on their commute during rush hour;

- Bradford Bypass, a new four-lane freeway connecting Highway 400 in Simcoe County and Highway 404 in York Region, which will save drivers an estimated 35 minutes in travel time compared to using local roads;

- Enabling the expansion of Highway 401 in Durham Region and bridge replacements in Port Hope to help relieve gridlock for tens of thousands of drivers per day and get goods moving faster;

- The Queen Elizabeth Way (QEW) Garden City Skyway Bridge Twinning project, which includes construction of a new bridge on the QEW over the Welland Canal connecting the City of

St. Catharines to the Town of Niagara‐on‐the‐Lake; - Advancing work to support the new Highway 7 between Kitchener and Guelph, which will alleviate gridlock on Highway 401 and help commuters save time;

- Widening Highway 3 between Essex and Leamington, and adding a new interchange connecting Highway 401 to the future Lauzon Parkway extension, to promote economic growth;

- Supporting construction to improve road safety and connect communities in the North through the replacement of the Little Current Swing Bridge on Highway 6;

- Planning construction of North America’s first 2+1 highway with a centre passing lane that changes direction at regular intervals, which increases safe passing opportunities on highways in Northeastern Ontario;

- Expanding Highway 11/17 from two to four lanes between Thunder Bay and Nipigon as part of a greater project to widen over 100 kilometres of the highway in this region;

- Widening Highway 17 from Kenora to the Manitoba border, which is part of a broader project to widen Highway 17 from two to four lanes for approximately 40 kilometres;

- Continuing construction of 10 new highway rest areas and rehabilitation of 14 existing rest areas to enhance road safety for travellers;

- Completing work to replace 11 bridges along Highway 417 in Ottawa;

- Improving Highway 401 near Kingston by resurfacing sections of eastbound and westbound lanes from Westbrook Road to Highway 15;

- Providing funding to the City of Toronto to accelerate construction on the Gardiner Expressway;

- Supporting the planning and design for a new interchange connecting Highway 401 to Lauzon Parkway in Windsor, which will support increased opportunities for trade and better access to the Windsor-Detroit border;

- Supporting the construction of a new interchange at Banwell Road and E.C. Row Expressway in the City of Windsor to keep people and goods moving and support development in the area; and

- Supporting the planning and design for a new interchange at Highway 416 and Barnsdale Road in Ottawa to support population growth and development planned by the City for the Barrhaven South area.

Building Transit

A total of $68.2 billion over 10 years for public transit, with a variety of projects underway, including:

- Construction is now underway across the entire Ontario Line, which will provide rapid transit from Exhibition/Ontario Place to Eglinton Avenue and Don Mills Road, as well as connect more than 40 other transit routes, including GO train lines, subway and streetcar lines and the Eglinton Crosstown Light Rail Transit (LRT);

- Transforming the GO Transit rail network to improve access and convenience across the Greater Golden Horseshoe by increasing service with two-way, all-day GO trains, every 15 minutes or less, across the core network with faster trains, more stations and better connections;

- Expanding service on the Milton GO Line by adding train trips and advancing the planning and design work for future two-way, all-day service;

- Continuing to increase the frequency of GO train service between Union Station and the Niagara Region, with more express service between Hamilton, Burlington and Toronto. This includes year-round weekend GO rail service between Union Station in Toronto and Niagara Falls;

- Extending the Hazel McCallion LRT by beginning the planning and design activities for the Mississauga loop and extension of the line into downtown Brampton;

- Completing all major construction on the Finch West LRT, including stations and stops, and undertaking testing for revenue service;

- Advancing work on the Yonge North Subway Extension by issuing a Request for Proposal (RFP) for the Advance Tunnel Contract that includes work to design, build and finance the construction of the tunnels;

- Constructing station and track improvements to restore the Northlander passenger rail service between Toronto and Northern Ontario. As part of its commitment, the government has purchased three new trainsets for the rail fleet for the reinstated service; and

- Continuing work on the Scarborough Subway Extension, including advancing design work under the Stations, Rail and Systems Contract.

Building Hospitals and Health Infrastructure

Investing nearly $50 billion over the next 10 years in health infrastructure, including over $36 billion in capital grants to support more than 50 hospital projects. These investments will add approximately 3,000 new bedsover the next decade, significantly increasing access to health care across the province. Key projects include:

- Sault Area Hospital — Percutaneous Coronary Intervention Project: This investment will provide patients in Northern Ontario with access to critical cardiac procedures, improving life-saving care in the region;

- The Ottawa Hospital — Civic Campus Redevelopment Project: Construction is expected to start in spring 2026. The new hospital will have 641 single patient rooms and the most advanced trauma centres in Eastern Ontario, and will provide highly specialized emergency and trauma services to treat complex injuries and illnesses;

- St. Joseph’s Continuing Care Centre, Sudbury: Renovations will increase rehabilitation bed capacity to 72, helping to ensure patients are relocated to appropriate care settings and facilitating reintegration into their local communities;

- Trillium Health Partners — Broader Redevelopment Project: This project will add over 600 hospital beds, enhancing system capacity and patient care. It involves expanding acute care services in Mississauga and consolidating complex continuing care and rehabilitation services at the Queensway site. Construction at Queensway has begun, with Mississauga set to start in March 2025;

- Canadian Mental Health Association — York and South Simcoe Community Care Hub: The province continues to support the design and construction of this project, building on an initial investment of $200,000 for early planning. This will expand access to mental health crisis and stabilization services, including additional withdrawal management beds, addressing critical mental health and addictions needs in the region;

- Grand River Hospital and St. Mary’s General Hospital, Kitchener-Waterloo: The province is supporting the planning of the joint St. Mary’s General Hospital–Grand River Hospital. This project will help people connect faster to care and meet the health services needs of the region’s growing population;

- Waypoint Centre for Mental Health Care, Penetanguishene: The transformation of the existing site will add 20 beds to improve mental health treatment, therapy and addictions counselling, increasing capacity to meet the rising demand for these services;

- St. Joseph’s Healthcare Hamilton Reactivation Care Centre: The province will invest over $16 million to support the construction of a new Reactivation Care Centre in Hamilton. Construction began in August 2024, and the centre will provide 57 transitional care beds, expanding local capacity for restorative and specialty care. This investment will enable smoother transitions for patients moving from hospital settings to home or community care; and

- Windsor Regional Hospital — Cardiac Catheterization Laboratory Renovation Project: Renovations began in summer 2024 to expand capacity for the hospital’s 24-hour cardiac catheterization services, which will provide more timely access to minimally invasive, life-saving cardiac procedures.

Building Long-Term Care Homes

Continuing planned investments that total a historic $6.4 billion since 2019 to build 58,000 new long-term care beds across the province, and upgrade existing beds to modern design standards, by 2028. As of September 2024, 18,439 beds (113 projects) are either completed, under construction, or have the approval to start construction, including:

- Advancing construction on 11,199 beds (67 projects) which started between April 2022 and August 2023 by providing a supplemental increase to the construction funding subsidy, to stimulate the start of construction for more long-term care homes across Ontario; and

- Helping to increase long-term care capacity in communities across the province by providing loan guarantees to select non-municipal, not-for-profit homes.

Building Schools and Child Care Spaces

- Investing approximately $23 billion over the next 10 years, including about $16 billion in capital grants, to build more schools and child care spaces, as well as support the renewal of existing schools. New schools include Tanya Khan Public School in Vaughan and Erie Migration District School in Kingsville, and school additions include École secondaire catholique Paul-Desmarais in Ottawa and St. Hilary Catholic School in Red Rock.

Building Postsecondary Education Infrastructure

- Investing $6.1 billion in the Postsecondary Education sector over the next 10 years, including over $2.3 billion in capital grants, to help colleges, universities and Indigenous Institutes modernize facilities by upgrading technology, supporting critical repairs and improving energy efficiency.

Building High-Speed Internet

- Nearly $4 billion, beginning in 2019–20, to ensure every community across the province has access to high-speed internet by the end of 2025. Multiple programs are underway to provide access to internet service and better cellular connectivity, such as Southwestern Integrated Fibre Technology and Eastern Ontario Regional Network initiatives. As of September 2024, over 100,000 homes and businesses have been connected to high-speed internet through these various programs.

Building Housing-Enabling Municipal Infrastructure

- Nearly $2 billion to help build municipal housing-enabling infrastructure projects through the Housing-Enabling Water Systems Fund (HEWSF) and Municipal Housing Infrastructure Program (MHIP). Under the first intake for the HEWSF, the province is investing in 54 water infrastructure projects across 60 municipalities that will help enable the construction of approximately 500,000 new homes across Ontario. In August 2024, the second intake for HEWSF and MHIP Housing-Enabling Core Servicing Stream were launched.

| Sector | Current Outlook2,3 2024–25 | Medium-Term Outlook 2025–26 | Medium-Term Outlook 2026–27 | 10-Year Total4 |

|---|---|---|---|---|

| Transportation — Transit | 10,695 | 12,567 | 8,579 | 68,156 |

| Transportation — Provincial Highways | 3,879 | 4,049 | 3,641 | 27,843 |

| Transportation — Other Transportation, Property and Planning | 219 | 229 | 127 | 1,246 |

| Health — Hospitals | 3,582 | 4,658 | 5,861 | 48,568 |

| Health — Other Health | 303 | 578 | 1,390 | 8,684 |

| Education | 3,350 | 3,173 | 3,025 | 23,095 |

| Postsecondary Education — Colleges and Other | 879 | 843 | 666 | 4,790 |

| Postsecondary Education — Universities | 130 | 136 | 141 | 1,346 |

| Social | 903 | 679 | 453 | 3,050 |

| Justice | 908 | 734 | 565 | 4,145 |

| Other Sectors5 | 4,388 | 4,669 | 4,434 | 22,967 |

| Total Infrastructure Expenditures | 29,235 | 32,315 | 28,882 | 213,890 |

| Less: Other Partner Funding6 | 2,972 | 1,996 | 1,900 | 22,543 |

| Total7 | 26,264 | 30,319 | 26,982 | 191,347 |

Table footnotes:

[1] Includes adjustments for the net book value of assets disposed during the year, as well as changes in valuation.

[2] Includes $865 million in interest capitalized during construction.

[3] Includes provincial investment in capital assets of $17.7 billion.

[4] Total reflects the planned infrastructure expenditures for years 2024–25 through 2033–34.

[5] Includes high-speed internet infrastructure, government administration, natural resources, and the culture and tourism industries.

[6] Other Partner Funding refers to third-party investments primarily in hospitals, colleges and schools.

[7] Includes federal–municipal contributions to provincial infrastructure investments.

Note: Numbers may not add due to rounding.

Source: Ontario Treasury Board Secretariat.

Chart Descriptions

Ontario Net Debt-to-Revenue Ratio

This line chart illustrates the Ontario net debt-to-revenue ratio from fiscal years 2002–03 to 2022–23 with separate lines showing the 2024 Budget projections, as well as the 2024 Ontario Economic Outlook and Fiscal Review (2024 FES), which is lower, for 2023–24 to 2026–27. There is an arrow pointing down between the 2024 Budget and 2024 FES lines to show that projections for the ratio have lowered since the 2024 Budget.

Sources: Public Accounts of Ontario (2002–2003 to 2023–2024) and Ontario Financing Authority.

Ontario Interest on Debt-to-Revenue Ratio

This line chart illustrates the Ontario interest on debt-to-revenue ratio from fiscal years 2002–03 to 2022–23 with separate lines showing the 2024 Budget projections, as well as the 2024 Ontario Economic Outlook and Fiscal Review (2024 FES), which is lower for 2023–24 to 2026–27. There is an arrow pointing down between the 2024 Budget and 2024 FES lines to show that projections for the ratio have lowered since the 2024 Budget.

Sources: Public Accounts of Ontario (2002–2003 to 2023–2024) and Ontario Financing Authority.

Ontario Fiscal Outlook Scenarios

The bar chart illustrates the range of Ontario deficit outlooks based on the two alternative economic scenarios presented in Chapter 2: Economic Performance and Outlook. The 2024 Ontario Economic Outlook and Fiscal Review fiscal outlook estimates the deficits to be $6.6 billion in 2024–25 and $1.5 billion in 2025–26, before reaching a surplus of $0.9 billion in 2026–27. Under the Faster Growth scenario, the deficit is estimated to be $4.2 billion in 2024–25, followed by surpluses of $6.2 billion in 2025–26 and $11.4 billion in 2026–27. Under the Slower Growth scenario, the deficits are estimated to be $8.8 billion in 2024–25, $8.4 billion in 2025–26 and $8.3 billion in 2026–27.

Source: Ontario Ministry of Finance.

Ontario Net Debt-to-GDP Ratio

This line chart illustrates the Ontario net debt-to-GDP ratio from fiscal years 2002–03 to 2022–23 with separate lines showing the 2024 Budget projections, as well as the 2024 Ontario Economic Outlook and Fiscal Review (2024 FES), which is lower for 2023–24 to 2026–27. There is an arrow pointing down between the 2024 Budget and 2024 FES lines to show that projections for the ratio have lowered since the 2024 Budget.

Sources: Statistics Canada and Ontario Ministry of Finance.

Borrowing Outlook Scenarios for Long-Term Borrowing

| Year | 2023–24 | 2024–25 | 2025–26 | 2026–27 |

|---|---|---|---|---|

| Planning Projection | 42.6 | 37.5 | 35.0 | 32.6 |

| Slower Growth Scenario | 42.6 | 39.7 | 41.9 | 41.8 |

| Faster Growth Scenario | 42.6 | 35.0 | 27.3 | 22.1 |