Ontario’s Economic and Fiscal Outlook in Brief

Protecting people’s health has been the government’s number one priority since the start of the pandemic. This is not just necessary to fight COVID‑19 and save lives. It is also the most sensible economic and fiscal policy. There simply cannot be a healthy economy without healthy people.

The 2021 Ontario Economic Outlook and Fiscal Review continues to make $51 billion in supports available to fight the COVID‑19 pandemic and promote economic recovery.

Ontario’s economy is recovering from the effects of the COVID‑19 pandemic and is poised to keep growing. For 2021–22, the government is projecting a deficit of $21.5 billion, $11.6 billion lower than the outlook published in the 2021 Budget. This improvement reflects a stronger economic growth outlook, as well as more recent information about the impact of COVID‑19 on the province’s finances. While there are reasons for optimism, the government continues to maintain fiscal flexibility given the continued uncertainty. This remains the prudent, responsible approach as Ontario moves cautiously towards fiscal recovery.

Over the medium term, the government is forecasting deficits of $19.6 billion in 2022–23 and $12.9 billion in 2023–24, an improvement of $8.1 billion and $7.2 billion, respectively, relative to the outlook presented in the 2021 Budget. While the current levels of government spending are necessary due to COVID‑19, long‐term prudent planning will help Ontario’s fiscal recovery and preserve the government’s ability to respond to future needs.

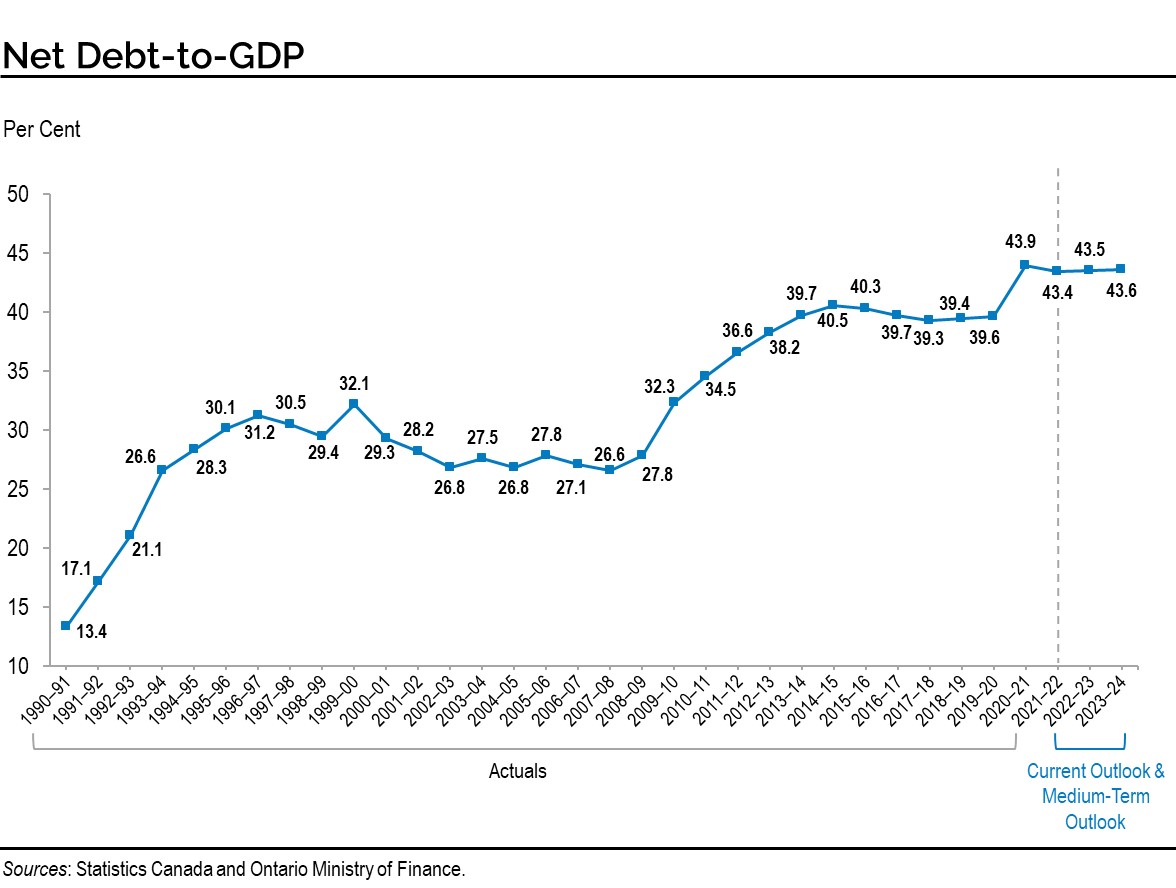

Ontario’s 2021–22 net debt-to-Gross Domestic Product (GDP) ratio is now forecast to be 43.4 per cent, 5.4 percentage points lower than the 48.8 per cent projected in the 2021 Budget. In addition, Ontario is projected to pay $13.0 billion in interest costs in 2021–22, down from the 2021 Budget forecast of $13.1 billion.

As with any forecast, there are numerous risks that are taken into consideration when determining the Province’s fiscal framework. The 2021 Ontario Economic Outlook and Fiscal Review is being released when global economic conditions remain highly uncertain, and there are a variety of factors beyond the Province’s control that may continue to impact the economic and fiscal outlook.

Acknowledging the continued uncertainty related to the global COVID‑19 pandemic, the government plans to provide an updated fiscal recovery plan in the 2022 Budget. Given the high degree of economic uncertainty, the Ontario Ministry of Finance has again developed Faster Growth and Slower Growth scenarios that the economy could take over the next several years, to provide people with more transparency about how alternative economic scenarios could impact the province’s finances.

Ontario’s Economic Outlook

Ontario’s real GDP is projected to rise 4.3 per cent in 2021, 4.5 per cent in 2022, 2.6 per cent in 2023 and 2.0 per cent in 2024. For the purposes of prudent fiscal planning, these projections were set slightly below the average of private‐sector forecasts.

| 2020 | 2021p | 2022p | 2023p | 2024p | |

|---|---|---|---|---|---|

| Real GDP Growth | (5.1) | 4.3 | 4.5 | 2.6 | 2.0 |

| Nominal GDP Growth | (4.6) | 9.0 | 6.6 | 4.6 | 4.1 |

| Employment Growth | (4.8) | 4.3 | 3.3 | 2.0 | 1.5 |

| CPI Inflation | 0.7 | 3.1 | 2.6 | 2.1 | 1.9 |

Table footnotes:

p = Ontario Ministry of Finance planning projection based on external sources.

Sources: Statistics Canada and Ontario Ministry of Finance.

Managing Ontario’s Finances Responsibly

The government is providing the people of Ontario with a transparent look into the province’s finances. Ontario’s prudent approach to fiscal planning helps to ensure that every necessary resource is available in the fight against COVID‑19 while recognizing that the future remains uncertain.

The government’s plan is consistent with the Fiscal Sustainability, Transparency and Accountability Act, 2019 and its governing principles that guide Ontario’s fiscal policy.

- Transparent: The government continues to demonstrate its commitment to transparency through the release of its seventh fiscal update since the beginning of the COVID‑19 pandemic. In addition, for the fourth year in a row, the Auditor General of Ontario has provided a clean audit opinion on the Province’s consolidated financial statements.

- Responsible: The government has developed a measured and responsible approach to managing Ontario’s finances that is driven by economic growth, not tax increases, while at the same time is strengthening critical programs and services. Additionally, the government continues to invest in Ontario’s progress in the fight against COVID‑19.

- Flexible: The government’s plan has built in appropriate levels of prudence in the form of contingency funds and a reserve to ensure it has the necessary fiscal flexibility to respond to changing circumstances.

- Equitable: The government’s plan strengthens critical public services, such as health care for the people of today, and ensures they are maintained for the benefit of future generations.

- Sustainable: The government is committed to employing a flexible approach to respond to the ongoing risks of COVID‑19, while balancing these needs with the long-term sustainability of Ontario’s finances, including the Province’s debt burden. This is reflected in the government’s prudent decision to establish dedicated contingency funds to provide targeted support for critical services and programs, address the extraordinary needs of the people of Ontario and create conditions for long-term growth.

Ontario’s Fiscal Plan

In 2021–22, the government is projecting a deficit of $21.5 billion, $11.6 billion lower than the deficit forecast at the time of the 2021 Budget. Over the medium term, the government is forecasting deficits of $19.6 billion in 2022–23 and $12.9 billion in 2023–24, an improvement of $8.1 billion and $7.2 billion, respectively, relative to the outlook presented in the 2021 Budget.

| Actual 2020–21 |

Current Outlook 2021–22 |

Medium-Term Outlook 2022–23 |

Medium-Term Outlook 2023–24 |

|

|---|---|---|---|---|

| Revenue — Personal Income Tax | 40.3 | 41.3 | 42.4 | 44.0 |

| Revenue — Sales Tax | 26.6 | 31.0 | 33.2 | 34.9 |

| Revenue — Corporations Tax | 17.8 | 17.0 | 17.3 | 17.4 |

| Revenue — Ontario Health Premium | 4.3 | 4.5 | 4.6 | 4.7 |

| Revenue — Education Property Tax | 6.0 | 5.8 | 5.7 | 5.8 |

| Revenue — All Other Taxes | 15.8 | 17.3 | 17.3 | 17.6 |

| Total Taxation Revenue | 110.9 | 116.9 | 120.5 | 124.4 |

| Government of Canada | 33.9 | 29.7 | 27.7 | 28.7 |

| Income from Government Business Enterprises | 5.0 | 4.7 | 5.5 | 6.6 |

| Other Non-Tax Revenue | 15.1 | 17.3 | 17.8 | 18.2 |

| Total Revenue | 164.9 | 168.6 | 171.5 | 178.0 |

| Base Programs1 — Health Sector | 64.4 | 69.9 | 71.6 | 73.2 |

| Base Programs2 — Education Sector3 | 28.4 | 30.8 | 31.3 | 31.5 |

| Base Programs4 — Postsecondary Education Sector | 9.5 | 10.7 | 11.0 | 11.2 |

| Base Programs5 — Children’s and Social Services Sector | 17.0 | 17.8 | 18.0 | 18.1 |

| Base Programs6 — Justice Sector | 4.7 | 4.8 | 4.8 | 4.8 |

| Base Programs7 — Other Programs | 26.0 | 31.5 | 36.3 | 36.8 |

| Total Base Programs | 150.0 | 165.5 | 173.0 | 175.6 |

| COVID‑19 Time-Limited Funding | 19.1 | 10.7 | 3.4 | – |

| Total Programs | 169.0 | 176.1 | 176.4 | 175.6 |

| Interest on Debt | 12.3 | 13.0 | 13.1 | 13.8 |

| Total Expense | 181.3 | 189.1 | 189.6 | 189.5 |

| Surplus/(Deficit) Before Reserve | (16.4) | (20.5) | (18.1) | (11.4) |

| Reserve | – | 1.0 | 1.5 | 1.5 |

| Surplus/(Deficit) | (16.4) | (21.5) | (19.6) | (12.9) |

| Net Debt as a Per Cent of GDP | 43.9% | 43.4% | 43.5% | 43.6% |

| Net Debt as a Per Cent of Revenue | 226.5% | 238.7% | 251.0% | 253.3% |

| Interest on Debt as Per Cent of Revenue | 7.4% | 7.7% | 7.7% | 7.8% |

Table footnotes:

[1], [2], [4], [5], [6], [7] In the 2021 Budget, the government made available COVID‑19 Time‐Limited Funding. This funding continues to be presented separately in order to transparently capture the temporary nature of these investments.

[3] Excludes Teachers’ Pension Plan. Teachers’ Pension Plan expense is included in Other Programs.

Note: Numbers may not add due to rounding.

Sources: Ontario Treasury Board Secretariat and Ontario Ministry of Finance.

Revenue Outlook Over the Medium Term

Key inputs included in the revenue forecast are:

- A prudent economic outlook;

- Existing federal–provincial agreements and funding formulas; and

- The business plans of government ministries, business enterprises and service organizations.

Details of the revenue outlook are outlined later in this document. See Chapter 3: Ontario’s Fiscal Plan and Outlook for more details.

Program Expense Outlook Over the Medium Term

Between 2021–22 and 2023–24, base program expense is projected to increase every year, growing at an average annual rate of 3.0 per cent as the government continues to invest in programs that serve the people of Ontario. The government is committed to ensuring a strong economic and fiscal recovery, while continuing to invest in critical public services.

At the same time, the Province continues to maintain flexibility to protect people’s health, while creating conditions for sustainable growth, investment and job creation. COVID‑19 Time-Limited Funding is projected to be phased out over the outlook, from $10.7 billion in 2021–22 to $3.4 billion in 2022–23, before being fully phased out in 2023–24. Given the unpredictability of the COVID‑19 pandemic, some of this funding continues to be available to deploy resources where they are needed most and to support further recovery initiatives.

See Chapter 3: Ontario’s Fiscal Plan and Outlook for further details on the program expense outlook over the medium term.

Other Fiscal Plan Assumptions

The reserve is set at $1.0 billion in 2021–22 and $1.5 billion each year over the medium term.

Net debt-to-GDP for 2021–22 is projected to be 43.4 per cent, 5.4 percentage points lower than the 48.8 per cent forecast in the 2021 Budget. Over the medium term, the net debt-to-GDP ratio is forecast to be 43.5 per cent in 2022–23 and 43.6 per cent in 2023–24, respectively.

Economic Outlook Scenarios

While the planning assumptions for economic growth are reasonable and prudent based on available private-sector forecasts, there are a broad range of factors that could result in economic growth being relatively stronger or weaker. For more details, see Chapter 2: Economic Performance and Outlook. In order to illustrate the high degree of economic uncertainty, the Ontario Ministry of Finance has developed Faster Growth and Slower Growth scenarios that the economy could take over the next several years. These alternative scenarios should not be considered the best case or the worst case. Rather, they represent possible outcomes in this period of heightened uncertainty.

| 2021p | 2022p | 2023p | 2024p | |

|---|---|---|---|---|

| Faster Growth Scenario | 4.9 | 6.0 | 2.9 | 2.3 |

| Planning Projection | 4.3 | 4.5 | 2.6 | 2.0 |

| Slower Growth Scenario | 4.0 | 3.2 | 2.5 | 1.9 |

Table footnotes:

p = Ontario Ministry of Finance planning projection and alternative scenarios.

Source: Ontario Ministry of Finance.

These economic scenarios illustrate a significant range of risk related to future economic growth. In the Planning Projection and the Slower Growth scenario, the level of real GDP surpasses its pre-pandemic level of the fourth quarter of 2019 by the first quarter of 2022. In the Faster Growth scenario, the pre-pandemic level of real GDP is reached by the fourth quarter of 2021. By the year 2024, the level of real GDP in the Faster Growth scenario is 2.6 per cent higher than in the Planning Projection, while in the Slower Growth scenario the level of real GDP is 1.7 per cent lower.

To reflect additional uncertainty related to the nominal GDP outlook, Faster Growth and Slower Growth scenarios are presented for nominal GDP growth in Chapter 2: Economic Performance and Outlook. Nominal GDP provides a broad measure of growth expected in the provincial tax base. In the event that the alternative economic scenarios materialize, as opposed to the Planning Projection, Ontario’s fiscal plan would also change as a result.

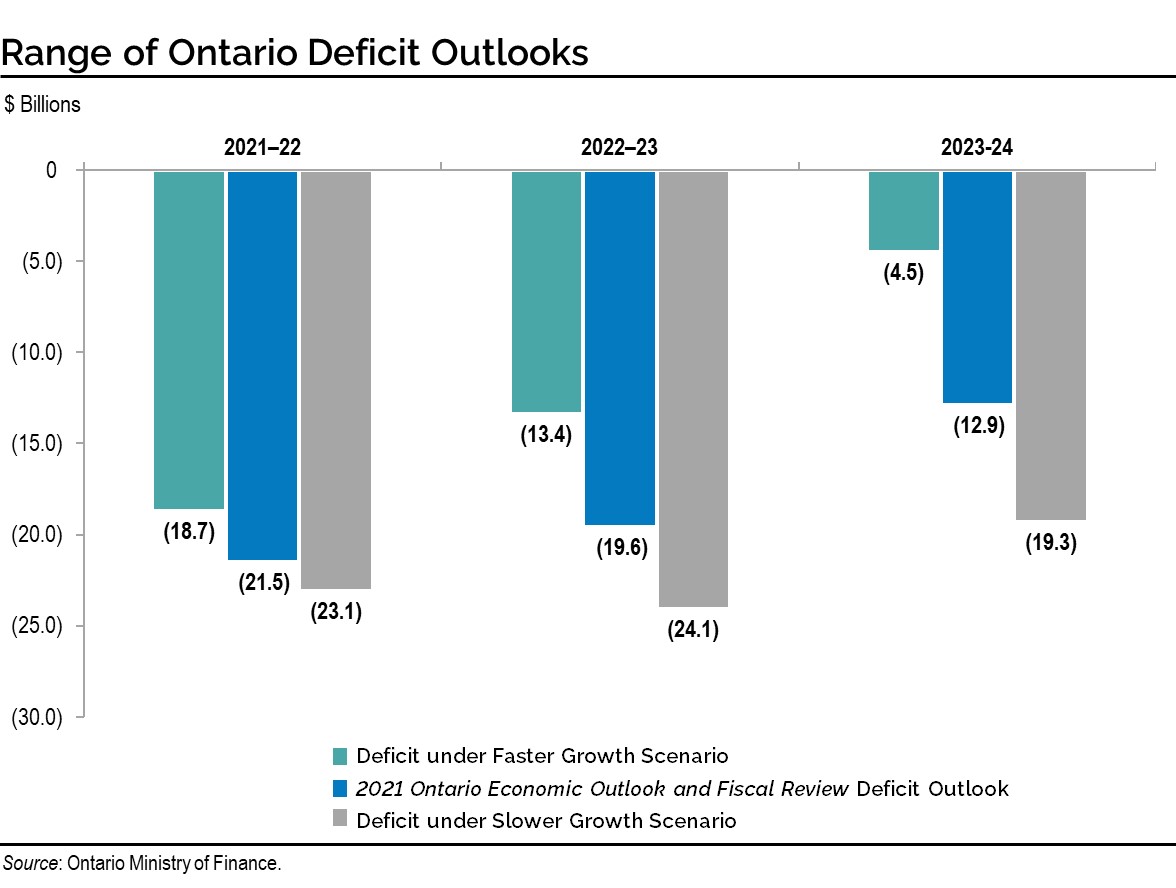

Under the Faster Growth scenario, the deficit outlook may improve to $18.7 billion in 2021–22, $13.4 billion in 2022–23, and $4.5 billion in 2023–24. However, under the Slower Growth scenario, the deficit outlook may deteriorate to $23.1 billion in 2021–22, $24.1 billion in 2022–23, and $19.3 billion in 2023–24.

Borrowing and Debt Management

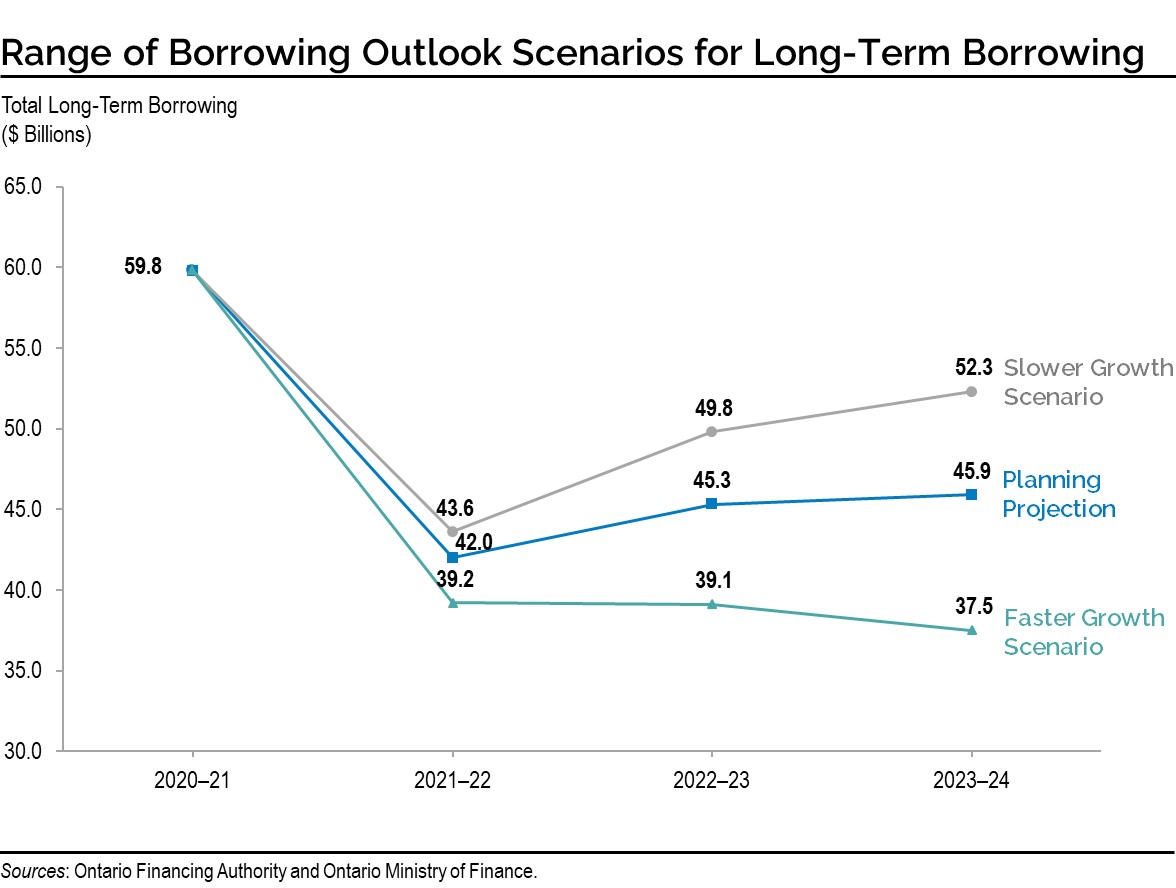

Ontario’s 2021–22 long-term public borrowing is now forecast to be $42.0 billion. This is

$12.7 billion lower than the 2021 Budget forecast due to lower funding requirements as a result of lower-than-projected deficits. As of October 19, 2021, the Province had completed $28.8 billion, or 69 per cent of its 2021–22 total long-term public borrowing program. Ontario is forecast to pay $13.0 billion in interest costs in 2021–22, down from the 2021 Budget forecast of $13.1 billion.

The net debt-to-GDP ratio in 2021–22 is now projected to be 43.4 per cent, or 5.4 percentage points lower than the 48.8 per cent forecast in the 2021 Budget. This was due to lower than previously projected deficits and higher nominal GDP growth. Over the medium-term outlook, the net debt-to-GDP ratio is projected to remain lower than the forecasts contained in the 2021 Budget.

Lower-than-forecast deficits and borrowing requirements have reduced Ontario’s interest costs. The interest on debt forecast for 2021–22 is $13.0 billion, down from the 2021 Budget forecast of $13.1 billion. Interest on debt in 2022–23 and 2023–24 is forecast to be $13.1 billion and $13.8 billion, respectively, lower than the forecast in the 2021 Budget by $0.5 billion and $0.8 billion.

A one percentage point change in interest rates from the current forecast, either up or down, would result in a corresponding change in Ontario’s interest costs by approximately $0.7 billion in the first full year.

| 2021 Budget | In-Year Change | Current Outlook 2021–22 |

Medium-Term Outlook 2022–23 |

Medium-Term Outlook 2023–24 |

|

|---|---|---|---|---|---|

| Deficit/(Surplus) | 33.1 | (11.6) | 21.5 | 19.6 | 12.9 |

| Investment in Capital Assets | 11.8 | 0.1 | 11.9 | 12.7 | 12.2 |

| Non-Cash Adjustments | (9.5) | – | (9.5) | (9.5) | (9.5) |

| Loans to Infrastructure Ontario | 0.2 | 0.0 | 0.2 | (0.1) | 0.0 |

| Other Net Loans/Investments | 1.3 | (0.3) | 1.0 | 0.3 | (1.0) |

| Debt Maturities/Redemptions | 25.0 | 0.0 | 25.0 | 30.5 | 31.2 |

| Total Funding Requirement | 61.9 | (11.8) | 50.1 | 53.3 | 45.9 |

| Decrease/(Increase) in Short-Term Borrowing | (6.0) | 4.0 | (2.0) | (2.0) | – |

| Decrease/(Increase) in Short-Term Borrowing | 4.0 | – | 4.0 | – | – |

| Pre-borrowing in 2020–21 for 2021–22 | (5.2) | (10.9) | (16.2) | – | – |

| Pre-borrowing for 2022–23 | – | 6.0 | 6.0 | (6.0) | – |

| Total Long-Term Public Borrowing | 54.7 | (12.7) | 42.0 | 45.3 | 45.9 |

Table footnotes:

Note: Numbers may not add due to rounding.

Source: Ontario Financing Authority.

As described earlier in the Economic Outlook Scenarios section, in the event that alternative economic scenarios materialize, Ontario’s borrowing requirements in the next three years would also change as a result. Under the Faster Growth scenario, long-term borrowing would decrease by a total of $17.4 billion over the three-year outlook period, while under the Slower Growth scenario, long-term borrowing would increase by $12.5 billion over the same period.

Ontario’s Capital Plan

A key element of the government’s plan is building Ontario’s future through investments in infrastructure, including strategic investments in transit, highways, schools, hospitals, long-term care and high-speed internet. Planned investments over the next 10 years total $148.1 billion, an increase of $2.7 billion since the 2021 Budget, including $17.2 billion in 2021–22. These investments are fundamental to the government’s made‐in‐Ontario plan for growth, jobs and long-term prosperity.

Key highlights in the capital plan include:

- As announced in the 2021 Budget, the Province continues to support hospital infrastructure projects with a historic investment of $30.2 billion over the next 10 years. Projects currently under construction or in various stages of planning include:

- Support for a new inpatient care tower in Etobicoke, and a complete rebuild of the Mississauga hospital in partnership with Trillium Health Partners;

- Transformation of the existing site and urgent care centre into a new 24/7 inpatient care hospital at Peel Memorial, in partnership with William Osler Health System. This will enable future development of an emergency department and meet the growth needs of one of Ontario’s fastest growing communities;

- Expansion of inpatient beds and ambulatory care at London Health Sciences Centre and to expand the Stem Cell Transplant Unit to double its current capacity;

- Planning for a new, modern hospital facility on the existing Uxbridge site at the Oak Valley Health – Uxbridge Hospital to replace the current aged building, and enable the expansion of specialized outpatient clinics as well as the creation of a community health hub with long-term care services;

- Support for continued planning to consolidate acute care services at the new Windsor-Essex acute care hospital, while retaining the existing Ouellette site for urgent care services;

- Regional planning for renovations to the Windsor Hôtel-Dieu Grace Healthcare, Tayfour Campus to expand access to mental health services in one location for patients;

- Support for a new hospital and a lodge in Moosonee as part of the Weeneebayko Area Health Authority – Health Campus of Care, as well as a new ambulatory care centre on Moose Factory Island;

- Continued support for the construction of the new South Niagara Hospital to replace aging facilities and provide additional inpatient beds, and emergency and ambulatory services to accommodate growth in demand; and

- Support for the new replacement hospital on the existing site of the West Lincoln Memorial Hospital to provide modern facilities for expanded emergency, maternal, surgical, ambulatory, and other services in Grimsby.

- Development of four new long‐term care homes in Mississauga, Ajax and Toronto under the Long‐Term Care Accelerated Build Pilot Program. Construction is underway at all of the sites, with completion dates starting in early 2022. These new long-term care homes will help Ontario meet its commitment of building 30,000 net new long-term care beds by 2028.

- Investing an additional $1.6 billion over the next six years to support large bridge rehabilitation projects and the advancement of highway expansion projects, including the Bradford Bypass and Highway 413.

- Investing an additional $1 billion over the next five years through the Ontario Community Infrastructure Fund to help 424 small, rural and Northern communities build and repair roads, bridges, water and wastewater infrastructure. This additional funding will help provide reliable and sustainable services and directly support public safety, job creation and economic growth. Combined with prior commitments, this new funding doubles the Ontario Community Infrastructure Fund to nearly $2 billion over five years.

- As announced in the 2021 Budget, a provincial investment of $2.8 billion for broadband infrastructure, to provide all regions of Ontario with access to reliable, high-speed internet by the end of 2025. This includes the province’s share of an equal provincial and federal investment totalling up to $1.2 billion to bring high-speed internet to up to 300,000 households and businesses through the Improving Connectivity for Ontario program and the federal Universal Broadband Fund program.

- Investing $21 billion, including about $14 billion in capital grants over the next 10 years, to support the renewal and expansion of school infrastructure, including new schools in Oshawa and Pickering and investments in ventilation to help ensure schools remain safe.

- More than $5 billion in the postsecondary sector, including over $2 billion in capital grants from the Province, to help colleges and universities modernize their facilities and renew instructional equipment and learning resources.

- Continuing to support the construction of new facilities at Grandview Children’s Centre in Ajax, the Children’s Treatment Centre at the Children’s Hospital of Eastern Ontario in Ottawa and the new Children’s Treatment Centre of Chatham-Kent to meet the increasing demand for critical services for children and youth with special needs.

| Sector | Current Outlook2,3 2021–22 |

Medium-Term Outlook–2022–23 | Medium-Term Outlook 2023–24 |

10-Year Total4 |

|---|---|---|---|---|

| Transportation — Transit | 5,642 | 6,801 | 6,736 | 61,622 |

| Transportation — Provincial Highways | 2,673 | 3,000 | 2,960 | 22,943 |

| Transportation — Other Transportation, Property and Planning | 182 | 181 | 196 | 1,513 |

| Health — Hospitals | 1,619 | 2,567 | 2,604 | 30,223 |

| Health — Other Health | 304 | 345 | 336 | 3,437 |

| Education | 3,295 | 2,773 | 2,415 | 21,162 |

| Postsecondary Education — Colleges and Other | 893 | 617 | 284 | 4,043 |

| Postsecondary Education — Universities | 93 | 135 | 122 | 1,285 |

| Social | 328 | 152 | 213 | 2,379 |

| Justice | 991 | 601 | 439 | 3,600 |

| Other Sectors5 | 2,911 | 3,253 | 3,314 | 17,504 |

| Total Infrastructure Expenditures | 18,932 | 20,426 | 19,619 | 169,710 |

| Less: Other Partner Funding6 | 1,765 | 2,684 | 1,951 | 21,584 |

| Total7 | 17,167 | 17,743 | 17,668 | 148,126 |

Table footnotes:

[1] Includes interest capitalized during construction; third-party investments in hospitals, colleges and schools; federal and municipal contributions to provincially owned infrastructure investments; and transfers to municipalities, universities and non-consolidated agencies.

[2] Includes $236 million in interest capitalized during construction.

[3] Includes provincial investment in capital assets of $11.9 billion.

[4] Total reflects the planned infrastructure expenditures for years 2021–22 through 2030–31.

[5] Includes broadband infrastructure, government administration, natural resources, and the culture and tourism industries.

[6] Other Partner Funding refers to third-party investments primarily in hospitals, colleges and schools.

[7] Includes federal–municipal contributions to provincial infrastructure investments.

Note: Numbers may not add due to rounding.

Source: Ontario Treasury Board Secretariat.

Footnotes

[1] Parliamentary Budget Officer, Fiscal Sustainability Report 2021, page 3;

https://www.pbo-dpb.gc.ca/en/blog/news/RP-2122-010-S--fiscal-sustainability-report-2021--rapport-viabilite-financiere-2021

Chart Descriptions

Chart: Range of Ontario Deficit Outlooks

The bar chart illustrates the range of Ontario deficit outlooks based on the two alternative economic scenarios presented in Chapter 2: Economic Performance and Outlook. The 2021 Ontario Economic Outlook and Fiscal Review deficit outlook estimates the deficit to be $21.5 billion in 2021–22, $19.6 billion in 2022–23 and $12.9 billion in 2023–24. Under the Faster Growth scenario, the deficit is estimated to be $18.7 billion in 2021–22, $13.4 billion in 2022–23 and $4.5 billion in 2023–24. Under the Slower Growth scenario, the deficit is estimated to be $23.1 billion in 2021–22, $24.1 billion in 2022–23 and $19.3 billion in 2023–24.

Source: Ontario Ministry of Finance.

Chart: Net Debt-to-GDP

Ontario’s net debt-to-GDP ratio is forecast at 43.4 per cent in 2021–22.

| Year | Net Debt-to-GDP (%) |

|---|---|

| 1990–91 | 13.4 |

| 1991–92 | 17.1 |

| 1992–93 | 21.1 |

| 1993–94 | 26.6 |

| 1994–95 | 28.3 |

| 1995–96 | 30.1 |

| 1996–97 | 31.2 |

| 1997–98 | 30.5 |

| 1998–99 | 29.4 |

| 1999–00 | 32.1 |

| 2000–01 | 29.3 |

| 2001–02 | 28.2 |

| 2002–03 | 26.8 |

| 2003–04 | 27.5 |

| 2004–05 | 26.8 |

| 2005–06 | 27.8 |

| 2006–07 | 27.1 |

| 2007–08 | 26.6 |

| 2008–09 | 27.8 |

| 2009–10 | 32.3 |

| 2010–11 | 34.5 |

| 2011–12 | 36.6 |

| 2012–13 | 38.2 |

| 2013–14 | 39.7 |

| 2014–15 | 40.5 |

| 2015–16 | 40.3 |

| 2016–17 | 39.7 |

| 2017–18 | 39.3 |

| 2018–19 | 39.4 |

| 2019–20 | 39.6 |

| 2020–21 | 43.9 |

| 2021–22 | 43.4 |

| 2022–23 | 43.5 |

| 2023–24 | 43.6 |

Sources: Statistics Canada and Ontario Ministry of Finance.

Chart: Range of Borrowing Outlook Scenarios for Long-Term Borrowing

($ Billions)

| Year | 2020–21 | 2021–22 | 2022–23 | 2023–24 |

|---|---|---|---|---|

| Planning Projection | $59.8 | $42.0 | $45.3 | $45.9 |

| Slower Growth Scenario | $59.8 | $43.6 | $49.8 | $52.3 |

| Faster Growth Scenario | $59.8 | $39.2 | $39.1 | $37.5 |

Sources: Ontario Financing Authority and Ontario Ministry of Finance.